Analyzing The Impact Of Clinton's Veto Threats On The 1% Budget

Table of Contents

Clinton's Budgetary Priorities and the 1%

Tax Policies and their Impact on High-Income Earners

Clinton's administration implemented several tax policies aimed at increasing revenue and reducing the deficit. These policies had a significant impact on high-income earners.

- Capital Gains Tax Increase: Clinton successfully pushed for an increase in the capital gains tax rate, affecting the investment income of the wealthiest Americans. This move aimed to generate more revenue for the government and reduce the perceived unfairness of lower tax rates on capital gains compared to ordinary income. Data from the Congressional Budget Office (CBO) showed a noticeable increase in tax revenue following this increase.

- Increased Income Tax Rates for Higher Brackets: The top marginal income tax rates were also increased during Clinton's presidency. This directly impacted the wealthiest 1%, leading to higher tax burdens for this demographic. The debate surrounding these increases involved significant political maneuvering and several instances where Clinton used the threat of a veto to secure his preferred policies. This resulted in significant legislative battles that shaped the final legislation.

Spending Cuts and Their Disproportionate Effect

While Clinton focused on increasing taxes on the wealthy, he also faced pressure to cut government spending. Some argue these cuts disproportionately impacted lower and middle-income individuals.

- Welfare Reform: The passage of the Personal Responsibility and Work Opportunity Act significantly reformed welfare programs, leading to decreased welfare payments. While the stated goal was to encourage self-sufficiency, critics argued this disproportionately harmed low-income families.

- Defense Spending: Clinton oversaw some reductions in defense spending, which were partially driven by the end of the Cold War. While these cuts could have had implications for various sectors of the economy, their disproportionate effect on the wealthiest 1% is less clear compared to other policy choices. The impact is likely to have been indirect and needs further investigation.

The Political Landscape and Veto Power

The Role of Congressional Opposition

Clinton faced a Republican-controlled Congress for much of his presidency, creating a politically challenging environment for enacting his budgetary agenda.

- Gridlock and Compromise: This partisan divide often led to gridlock, necessitating compromises that sometimes diluted his initial proposals. The threat of a veto was crucial in these negotiations.

- Strategic Use of Veto Power: Clinton leveraged the threat of a veto to prevent the passage of legislation perceived as overly favorable to the wealthy, successfully blocking several tax cuts proposed by the Republicans which disproportionately benefited high-income individuals. This demonstrates his strategic use of the veto as a tool to shape budgetary decisions.

Public Opinion and the 1% Budget

Public opinion played a critical role in shaping the political context surrounding Clinton's budgetary policies.

- Public Support for Tax Increases: While there was not uniform public support, polling data indicated that a significant portion of the public favored increased taxes on the wealthy to reduce the deficit and fund social programs. This public support provided political cover for Clinton to pursue some of his policies.

- Media Coverage and Framing: Media coverage framed the debate in ways that sometimes highlighted the impacts on different segments of society. This played a role in influencing public perception and political pressure on Clinton.

Long-Term Consequences of Clinton's Budgetary Decisions

Impact on Income Inequality

The long-term impact of Clinton's budgetary decisions on income inequality is a complex issue with ongoing debate.

- Mixed Results: While some argue that his policies helped reduce the deficit and improve the overall economy, leading to improved conditions for many, others point to the continued growth of income inequality during and after his presidency as evidence of their limitations. Data on wealth distribution during and after his tenure require careful analysis to draw definitive conclusions.

- Need for Further Research: A comprehensive study on the lasting impact on inequality requires a deep dive into the economic data of the era and an exploration of other social and economic factors.

Legacy of Veto Threats in Budgetary Politics

Clinton's use of veto threats set a precedent for subsequent presidential administrations.

- Presidential Power: His actions demonstrated the power of the presidency in shaping budgetary decisions and influencing fiscal policy.

- Political Strategy: His approach became a model for future presidents in navigating political gridlock and pursuing their agendas.

Conclusion: Summarizing the Impact of Clinton's Veto Threats on the 1% Budget

Clinton's presidency saw significant budgetary debates where his use of veto threats significantly influenced the final outcomes, particularly regarding tax policies and spending cuts. While his policies aimed to reduce the deficit and address wealth inequality to some degree, the long-term impact remains a complex subject open to various interpretations. Analyzing data on income distribution during and after his presidency reveals a nuanced picture. To fully understand the impact of Clinton's veto threats on the 1% budget and its influence on income inequality, further research into the specifics of Clinton-era legislation and its socio-economic consequences is highly recommended. Investigating the interplay between public opinion, political maneuvering, and presidential power remains vital for comprehending the complexities of shaping economic policy.

Featured Posts

-

Dylan Dreyer And Today Show Colleagues A Mishap And Its Aftermath

May 23, 2025

Dylan Dreyer And Today Show Colleagues A Mishap And Its Aftermath

May 23, 2025 -

The Nfls War On Butts A Look At The Tush Push Ruling

May 23, 2025

The Nfls War On Butts A Look At The Tush Push Ruling

May 23, 2025 -

Analyzing The Alleged Connection Between Kieran Culkin And The Leaving Neverland Accusations

May 23, 2025

Analyzing The Alleged Connection Between Kieran Culkin And The Leaving Neverland Accusations

May 23, 2025 -

Currans Concerns Bd Implementation Will Be Difficult

May 23, 2025

Currans Concerns Bd Implementation Will Be Difficult

May 23, 2025 -

Disney Presents The Hollywood Legends Early Film And Iconic Oscar Win

May 23, 2025

Disney Presents The Hollywood Legends Early Film And Iconic Oscar Win

May 23, 2025

Latest Posts

-

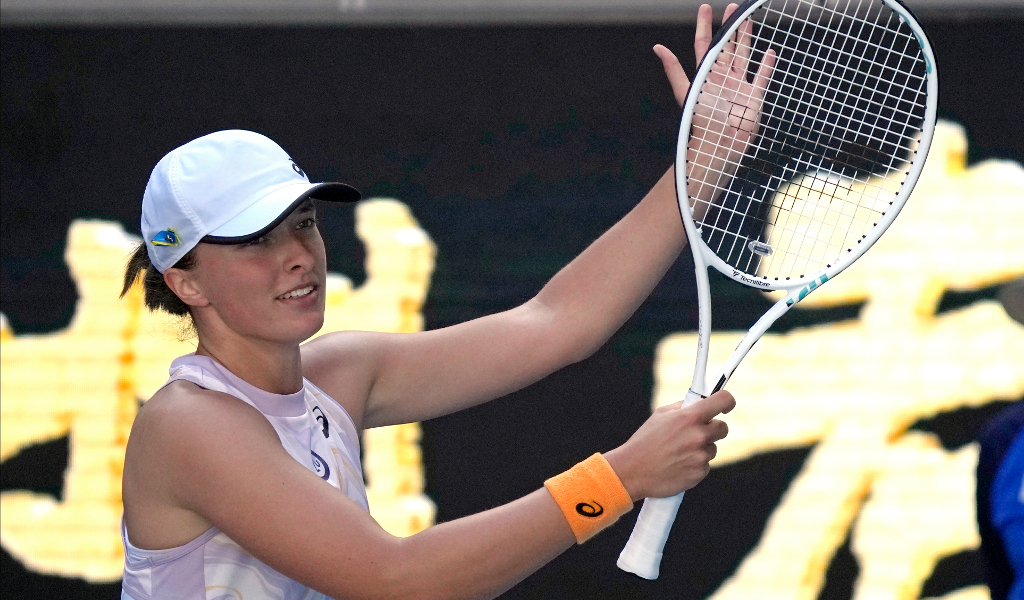

Pragativadi Swiatek And Rybakinas Fourth Round Berth At Indian Wells 2025

May 23, 2025

Pragativadi Swiatek And Rybakinas Fourth Round Berth At Indian Wells 2025

May 23, 2025 -

Programma Podderzhki Eleny Rybakinoy Dlya Devushek Sportsmenok Kazakhstana

May 23, 2025

Programma Podderzhki Eleny Rybakinoy Dlya Devushek Sportsmenok Kazakhstana

May 23, 2025 -

Odisha News Swiatek And Rybakina Shine At Indian Wells 2025

May 23, 2025

Odisha News Swiatek And Rybakina Shine At Indian Wells 2025

May 23, 2025 -

Elena Rybakina Investitsii V Buduschee Kazakhstanskogo Sporta

May 23, 2025

Elena Rybakina Investitsii V Buduschee Kazakhstanskogo Sporta

May 23, 2025 -

Indian Wells 2025 Swiatek And Rybakina Reach Fourth Round

May 23, 2025

Indian Wells 2025 Swiatek And Rybakina Reach Fourth Round

May 23, 2025