Analyzing The GOP Tax Plan: The Reality Of Deficit Reduction

Table of Contents

Projected Revenue Changes Under the GOP Tax Plan

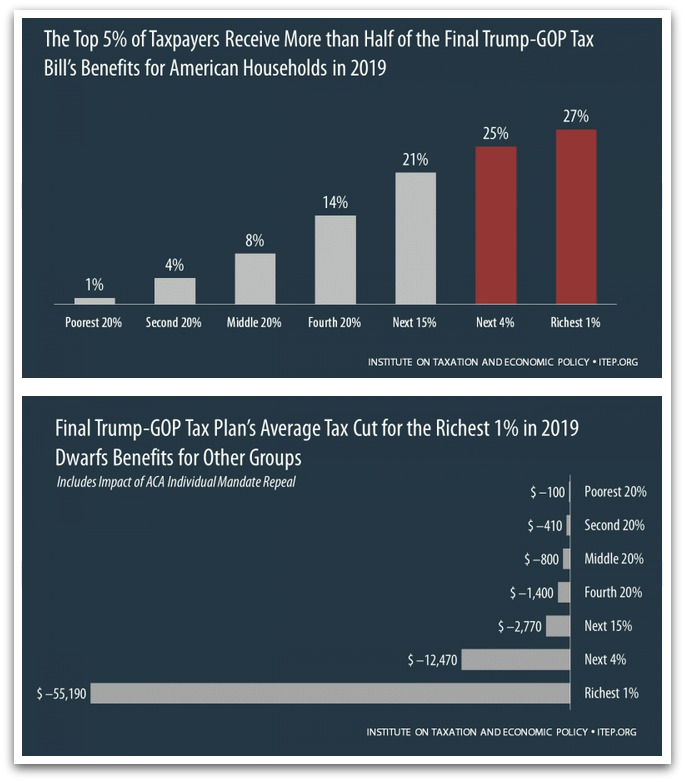

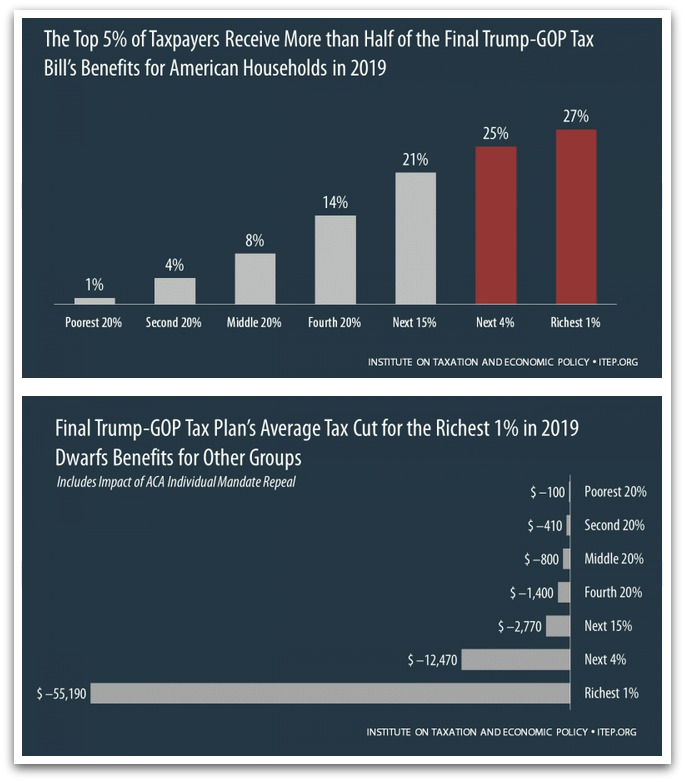

The GOP tax plan significantly lowered both individual and corporate tax rates. Corporate taxes were slashed from 35% to 21%, while individual tax brackets were also reduced. However, these cuts dramatically altered projected federal revenue. Official government estimates, alongside independent analyses from organizations like the Congressional Budget Office (CBO) and the Tax Policy Center, consistently projected substantial revenue losses.

- Specific Tax Cuts and Their Estimated Revenue Impacts: The reduction in the corporate tax rate alone was estimated to decrease federal revenue by hundreds of billions of dollars annually. Individual tax cuts, particularly the standardized deduction increases, further contributed to these revenue losses.

- Comparison of Projected Revenue Losses with the Administration's Forecasts: The administration's forecasts consistently underestimated the actual revenue losses, often citing anticipated economic growth to offset the tax cuts. These optimistic projections proved significantly less accurate than independent analyses.

- Discrepancies Between Different Analyses: While all analyses predicted significant revenue loss, there were some discrepancies in the exact figures, largely stemming from differing assumptions about economic growth and taxpayer behavior. These variations highlight the inherent uncertainties in economic modeling.

Economic Growth Projections and Their Impact on the Deficit

The GOP argued that the tax cuts would stimulate significant economic growth through supply-side economics – the theory that lower taxes incentivize investment, job creation, and ultimately higher GDP growth. This increased economic activity, they claimed, would offset the revenue losses from the tax cuts. However, the magnitude and likelihood of this growth remain highly debated.

- Explanation of Supply-Side Economics and Its Relevance to the Plan: Supply-side economics suggests that tax cuts, by increasing the after-tax return on investment, encourage businesses to expand, leading to higher employment and output. The GOP plan heavily relied on this theory to justify its deficit-reduction claims.

- Citations of Economic Models Supporting and Opposing the Predicted Growth: Some economic models, often those employed by the administration, predicted substantial GDP growth following the tax cuts. However, other models, including those from the CBO, suggested much more modest growth, often insufficient to offset the revenue losses.

- Discussion of Potential Unintended Consequences Hindering Economic Growth: Critics pointed to potential unintended consequences such as increased income inequality, a widening trade deficit, and a surge in the national debt, which could negatively impact economic growth and ultimately worsen the deficit.

The Role of Increased Spending and Its Influence on the Deficit

The GOP tax plan was implemented alongside increased government spending in several areas, including military spending and certain social programs. This simultaneous reduction in revenue and increase in spending significantly exacerbated the deficit. The combination of tax cuts and increased spending created a potent fiscal stimulus, dramatically expanding the national debt.

- Examples of Increased Government Spending: Increased military spending, coupled with continued spending on various social programs, contributed to a significant rise in government expenditure during the period following the implementation of the tax plan.

- Analysis of the Interplay Between Tax Cuts and Spending Increases: The synergistic effect of simultaneous tax cuts and spending increases created a significant fiscal imbalance, leading to a rapid increase in the national debt. This combination proved far more detrimental to deficit reduction than either factor alone.

- Potential Long-Term Consequences of This Combined Fiscal Policy: The long-term consequences of this combined fiscal policy include a higher national debt, potentially leading to increased interest payments and a reduced capacity for future government spending.

Long-Term Implications and Sustainability of the GOP Tax Plan

The long-term effects of the GOP tax plan on the federal budget and national debt are deeply concerning. The projected revenue losses, coupled with increased spending, suggest a trajectory of increasing national debt. The sustainability of the tax plan's core components over time is questionable.

- Analysis of Long-Term Projections of Debt-to-GDP Ratio: Projections indicate a steadily rising debt-to-GDP ratio, raising concerns about the nation's long-term fiscal health and its ability to service its debt.

- Discussion of Potential Future Tax Increases to Offset Revenue Losses: To address the long-term fiscal implications, future tax increases may be necessary to offset the ongoing revenue losses. This could lead to political gridlock and potentially stifle economic growth.

- Assessment of the Plan's Overall Long-Term Fiscal Impact: The overall long-term fiscal impact of the GOP tax plan is expected to be significantly negative, leading to a substantial increase in the national debt and potentially jeopardizing the nation's long-term financial stability.

Analyzing the GOP Tax Plan: A Final Assessment of Deficit Reduction

In conclusion, the GOP tax plan's impact on deficit reduction has fallen far short of its proponents' claims. While the plan did lead to some economic growth, the revenue losses from the tax cuts, coupled with increased government spending, resulted in a significant expansion of the national debt. The long-term fiscal consequences remain a serious concern, highlighting the challenges of implementing large-scale tax cuts without corresponding spending reductions or offsetting revenue increases. Further analysis of the GOP tax plan and its long-term fiscal implications is crucial to inform future economic policy decisions. Continue the conversation on the GOP tax plan and its impact on deficit reduction.

Featured Posts

-

Nintendos Action Against Ryujinx Emulator Development Ceases

May 21, 2025

Nintendos Action Against Ryujinx Emulator Development Ceases

May 21, 2025 -

Analisis Kesuksesan Liverpool Kontribusi Pelatih Dalam Menjuarai Liga Inggris 2024 2025

May 21, 2025

Analisis Kesuksesan Liverpool Kontribusi Pelatih Dalam Menjuarai Liga Inggris 2024 2025

May 21, 2025 -

Sabalenkas Powerful Performance Propels Her To Madrid Open Last 16

May 21, 2025

Sabalenkas Powerful Performance Propels Her To Madrid Open Last 16

May 21, 2025 -

De Kwetsbaarheid Van De Voedingsindustrie Abn Amro Over Arbeidsmigranten

May 21, 2025

De Kwetsbaarheid Van De Voedingsindustrie Abn Amro Over Arbeidsmigranten

May 21, 2025 -

Big Bear Ai Stock Weighing The Risks And Rewards Before You Buy

May 21, 2025

Big Bear Ai Stock Weighing The Risks And Rewards Before You Buy

May 21, 2025

Latest Posts

-

Planning For Drier Weather Tips And Advice

May 21, 2025

Planning For Drier Weather Tips And Advice

May 21, 2025 -

Drier Weather Ahead Your Guide To Dry Conditions

May 21, 2025

Drier Weather Ahead Your Guide To Dry Conditions

May 21, 2025 -

Is Drier Weather In Sight What To Expect This Season

May 21, 2025

Is Drier Weather In Sight What To Expect This Season

May 21, 2025 -

Big Bear Ai Is This Ai Stock Worth Buying

May 21, 2025

Big Bear Ai Is This Ai Stock Worth Buying

May 21, 2025 -

Analyzing Big Bear Ai Stock Should You Invest Today

May 21, 2025

Analyzing Big Bear Ai Stock Should You Invest Today

May 21, 2025