Analyzing The Economic Risks: A Look At The Possible Resumption Of Trump Tariffs On Europe

Table of Contents

Impact on Key European Sectors

The re-imposition of Trump tariffs on Europe would disproportionately affect several key economic sectors. The consequences could be far-reaching and long-lasting, necessitating swift and decisive action from both the EU and individual member states.

Automotive Industry

The European automotive industry, a cornerstone of many EU economies, would be particularly vulnerable to increased tariffs. The US is a significant export market for European car manufacturers, and higher tariffs would severely restrict market access.

- Job losses: Thousands of jobs across the automotive sector could be lost due to reduced production and exports.

- Reduced exports: A decline in exports to the US would impact profitability and investment in the industry.

- Price increases: Higher tariffs would lead to increased prices for European cars in the US, reducing competitiveness and consumer demand.

Germany, France, and Italy, home to major car manufacturers like Volkswagen, Renault, and Fiat Chrysler Automobiles, would be especially hard hit. The industry's reliance on global supply chains also makes it particularly vulnerable to disruptions caused by trade tensions.

Agricultural Products

The agricultural sector faces a similarly dire situation. European agricultural exports, including wine, cheese, and other specialty food products, are heavily reliant on the US market. Increased tariffs could severely curtail market access.

- Reduced market access: Higher tariffs would make European agricultural products less competitive in the US market.

- Farm income losses: Farmers would experience a significant drop in income due to reduced exports and potentially lower domestic prices.

- EU support measures: The EU might implement support measures to mitigate the impact on farmers, but these might not fully compensate for the losses.

Data from Eurostat and the OECD indicate significant trade volumes between the EU and the US in agricultural products. The loss of this trade would have a profound impact on rural economies and employment.

Manufacturing and Other Industries

The impact extends beyond the automotive and agricultural sectors. Many other manufacturing industries, including steel and machinery, would experience increased production costs and supply chain disruptions.

- Supply chain disruptions: Tariffs could disrupt established supply chains, leading to delays and increased costs.

- Increased production costs: Higher tariffs on imported materials would increase the cost of production for many European manufacturers.

- Ripple effect: The impact on manufacturing would ripple through related industries and services, impacting employment and economic growth across the board. The steel industry, for example, is already facing headwinds, and additional tariffs would exacerbate existing challenges.

Potential for Retaliatory Measures by the EU

The EU is unlikely to stand idly by if Trump tariffs on Europe are reinstated. Retaliatory measures would almost certainly be implemented, escalating trade tensions and potentially triggering a broader trade war.

EU's Response Options

The EU possesses several options for retaliatory action, mirroring the protectionist tactics employed by the US.

- Tariffs on US goods: The EU could impose tariffs on a range of US goods, including agricultural products and technology, to offset the impact of Trump tariffs.

- Trade disputes: The re-imposition of tariffs would likely lead to formal trade disputes through the WTO, further prolonging the conflict.

- Diplomatic tensions: Increased trade tensions would inevitably strain the transatlantic relationship, potentially impacting cooperation on other issues. The effectiveness of any retaliatory measure depends on multiple factors, including the scale of tariffs imposed and the response of the US.

Geopolitical Implications

Escalating trade tensions between the US and the EU carry significant geopolitical ramifications, potentially reshaping global trade patterns and alliances.

- Impact on transatlantic relationship: Renewed trade wars would severely damage the already strained relationship between the US and the EU.

- Global trade shifts: Countries might seek to diversify their trade relationships, reducing reliance on both the US and the EU.

- New alliances: The trade conflict could lead to the formation of new trade alliances and partnerships among countries seeking to counter US protectionism.

Economic Modeling and Forecasts

Predicting the precise economic consequences of renewed Trump tariffs on Europe is challenging, but existing economic models and forecasts offer some insights.

Economic Impact Assessments

Several reputable institutions, including the IMF and OECD, have published reports analyzing the potential impact of trade wars. These assessments typically present various scenarios, ranging from optimistic to pessimistic.

- IMF and OECD forecasts: These institutions have warned of significant economic losses if trade tensions escalate.

- Different scenarios: Models often present best-case, worst-case, and most likely scenarios, acknowledging the inherent uncertainties.

- Limitations of modeling: Economic models are inherently complex and rely on assumptions that may not perfectly reflect reality.

Consumer Impact

Ultimately, the costs of a renewed trade war would be borne by consumers.

- Increased prices: Higher tariffs would lead to increased prices for many goods and services.

- Reduced choice: Tariffs could limit the availability of certain products, reducing consumer choice.

- Social and political consequences: Increased prices and reduced choice could have significant social and political consequences, potentially leading to public discontent.

Conclusion: Analyzing the Economic Risks: A Look at the Possible Resumption of Trump Tariffs on Europe

The potential resumption of Trump tariffs on Europe presents significant economic risks. Our analysis has highlighted the vulnerability of key European sectors, the potential for retaliatory measures, and the broader geopolitical implications. The impact on the automotive, agricultural, and manufacturing industries could be severe, leading to job losses, reduced exports, and price increases. The EU's response, while likely robust, carries its own uncertainties and potential for escalating conflict. Economic models offer insights but are limited by inherent complexities and assumptions. Ultimately, consumers across Europe would bear the brunt of any trade war, experiencing higher prices and reduced choice. Stay informed about the ongoing discussion surrounding Trump tariffs on Europe and their potential impact on the global economy. Continue to follow the latest updates and participate in the conversation to better understand the potential economic risks. The implications of such a scenario necessitate continued vigilance and proactive engagement in mitigating the potential negative consequences of renewed Trump tariffs on Europe.

Featured Posts

-

Lin Tsan Ting A Golden Horse Awards Winners Life And Legacy

May 13, 2025

Lin Tsan Ting A Golden Horse Awards Winners Life And Legacy

May 13, 2025 -

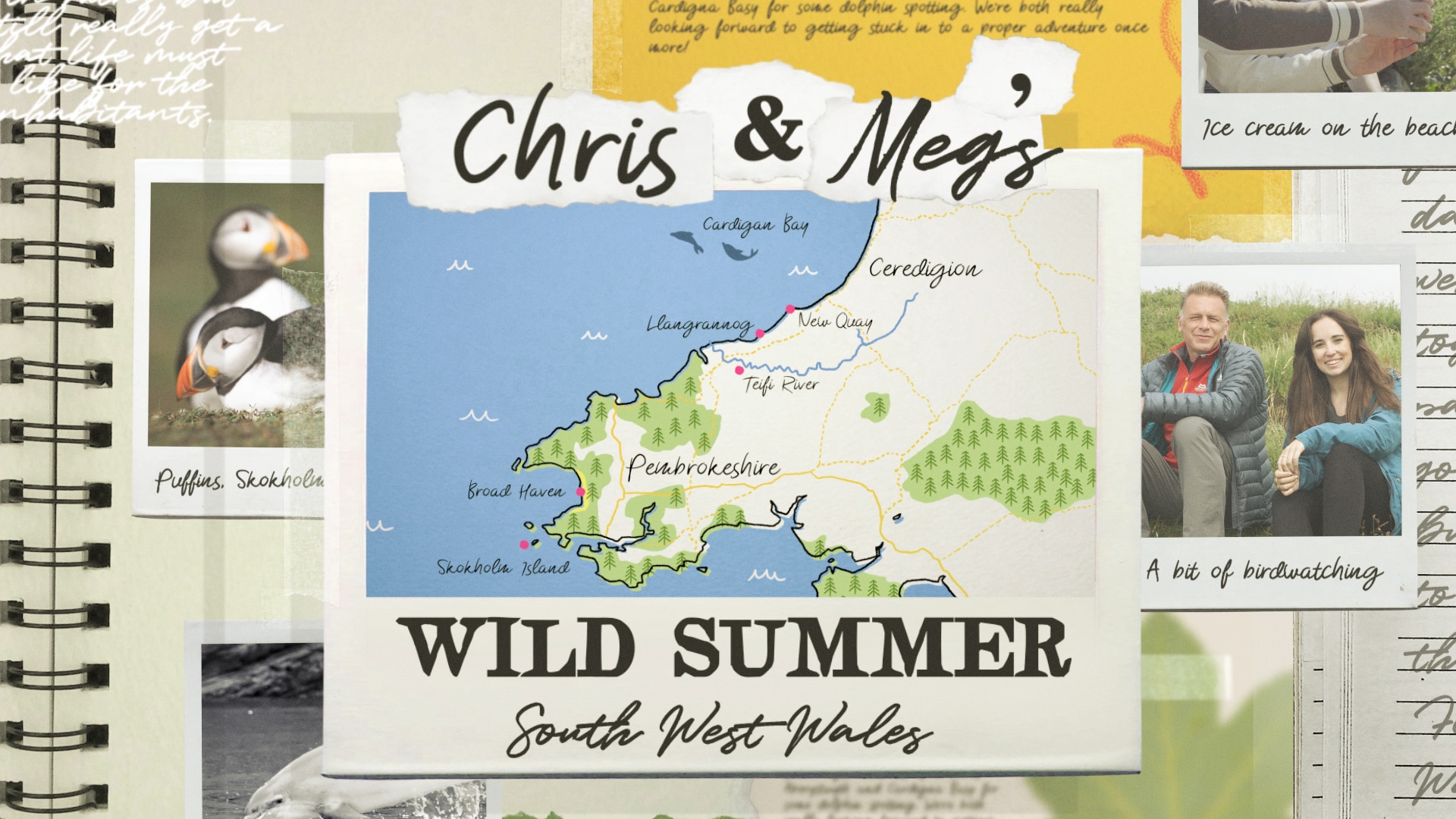

Their Wild Summer Chris And Megs Journey

May 13, 2025

Their Wild Summer Chris And Megs Journey

May 13, 2025 -

Quiz Test Your Knowledge Of Nba Draft Lottery Winners Since 2000

May 13, 2025

Quiz Test Your Knowledge Of Nba Draft Lottery Winners Since 2000

May 13, 2025 -

Dodgers Vs Cubs Prediction Home Field Advantage For Los Angeles

May 13, 2025

Dodgers Vs Cubs Prediction Home Field Advantage For Los Angeles

May 13, 2025 -

Is The Byd Seal Right For You A Complete Buyers Guide

May 13, 2025

Is The Byd Seal Right For You A Complete Buyers Guide

May 13, 2025