Analyzing The D-Wave Quantum (QBTS) Stock Drop: Monday's Market Events

Table of Contents

Market-Wide Downturn and its Impact on QBTS

Monday's market saw a broad-based decline, particularly impacting the technology sector. This overall negative sentiment significantly influenced QBTS's performance. Several factors contributed to this broader market downturn:

-

Correlation between QBTS performance and major market indices (e.g., NASDAQ, S&P 500): The QBTS stock price moved in tandem with the NASDAQ and S&P 500, reflecting the general market negativity. This suggests that the D-Wave Quantum stock drop wasn't solely company-specific but also a consequence of broader economic anxieties. A strong negative correlation was observed, indicating a significant susceptibility to the overall market trend.

-

Analysis of investor sentiment towards the tech sector as a whole: Investor sentiment towards the tech sector was notably pessimistic on Monday. Concerns about interest rate hikes, inflation, and a potential recession led to widespread selling across the tech sector, dragging down even relatively strong performers like QBTS. This negative sentiment amplified the impact of any company-specific news.

-

Significant economic news released on Monday that might have influenced the market: The release of unexpectedly high inflation figures or a hawkish statement from a central bank could have triggered a sell-off across the board, impacting QBTS along with other growth stocks. This underscores the importance of monitoring macroeconomic factors when analyzing QBTS stock performance.

Specific News or Announcements Affecting D-Wave Quantum

While the market downturn played a significant role, it's crucial to investigate whether any company-specific news contributed to the D-Wave Quantum stock drop.

-

Review any press releases or news articles related to D-Wave Quantum from Monday: A thorough review of any press releases or news articles published on Monday concerning D-Wave Quantum is essential. Any negative news, even seemingly minor, could have triggered a sell-off. This includes examining social media sentiment and analyst reports.

-

Analyze the potential impact of any negative announcements on investor confidence: Even a minor delay in product development or a partnership cancellation could significantly impact investor confidence, particularly in a volatile market. Analyzing the narrative surrounding any negative news is critical in understanding its impact on the QBTS stock price.

-

Discuss any analyst downgrades or changes in ratings: Any downgrades from financial analysts could have exacerbated the selling pressure on QBTS. Analyst ratings heavily influence investor decisions, and negative revisions can lead to substantial price drops.

Technical Analysis of the QBTS Stock Chart

Analyzing the QBTS stock chart using technical indicators offers valuable insights into the price movement.

-

Identify key support and resistance levels: Identifying key support and resistance levels on the QBTS chart can help determine potential price reversal points. A break below a key support level often signals further downward pressure.

-

Discuss trading volume and its implications: High trading volume accompanying the price drop suggests strong selling pressure, reinforcing the significance of the downturn. Conversely, low volume could indicate a more temporary and less significant event.

-

Mention any notable candlestick patterns observed on the chart: Technical analysis identifies candlestick patterns that could predict future price movements. For example, a bearish engulfing pattern might indicate further downside potential for QBTS.

Short-Selling and Its Role in the Drop

Investigating the role of short-selling is crucial for a complete understanding of the D-Wave Quantum stock drop.

-

Analysis of short interest data: Analyzing short interest data provides insights into the number of investors betting against QBTS. A significant increase in short interest preceding the drop could indicate a coordinated effort to drive the price down.

-

Discuss the potential for coordinated short-selling: Coordinated short-selling, often referred to as a "short squeeze," can amplify price volatility and contribute to sharp declines.

-

Examine the impact of short-selling on price volatility: Short-selling can exacerbate price volatility, making the market more susceptible to rapid price swings.

Long-Term Implications for D-Wave Quantum and Quantum Computing

The D-Wave Quantum stock drop has significant implications for both the company and the broader quantum computing industry.

-

Impact on future funding rounds or acquisitions: The drop could make it more challenging for D-Wave Quantum to secure future funding rounds or attract potential acquirers. This highlights the risk inherent in investing in early-stage quantum computing companies.

-

Potential shift in investor perception of the quantum computing sector: While the long-term potential of quantum computing remains substantial, the QBTS stock drop could temporarily dampen investor enthusiasm for the sector. The industry needs to demonstrate resilience and sustained progress to counter this negative sentiment.

-

Discussion on the resilience of the quantum computing industry in the face of market fluctuations: The overall resilience of the quantum computing industry will depend on several factors, including continued technological advancements, government support, and successful commercial applications.

Conclusion

The D-Wave Quantum (QBTS) stock drop on Monday resulted from a confluence of factors. The broad market downturn, fueled by macroeconomic concerns, created a negative environment for technology stocks. This was compounded by any company-specific news, and potentially amplified by short-selling activity. Technical analysis of the QBTS chart further supports the observation of significant selling pressure. While the immediate implications are concerning, the long-term prospects of D-Wave Quantum and the quantum computing sector remain dependent on sustained technological advancement and investor confidence.

Call to Action: Stay informed on the evolving situation surrounding the D-Wave Quantum (QBTS) stock. Continue to analyze the market and understand the factors driving the fluctuations in D-Wave Quantum stock performance to make informed investment decisions. Further research into the D-Wave Quantum (QBTS) stock drop is crucial for navigating the complexities of the quantum computing investment landscape. Understanding the interplay between macroeconomic factors and company-specific news is vital for successful investment in QBTS and other quantum computing stocks.

Featured Posts

-

Wwe Raw Complete Results And Grades For May 19 2025

May 20, 2025

Wwe Raw Complete Results And Grades For May 19 2025

May 20, 2025 -

Wwe Raw Results And Winners May 19th 2025 Match Grades

May 20, 2025

Wwe Raw Results And Winners May 19th 2025 Match Grades

May 20, 2025 -

Journees Parcours De Femmes Celebration Du 8 Mars A Biarritz

May 20, 2025

Journees Parcours De Femmes Celebration Du 8 Mars A Biarritz

May 20, 2025 -

Thousands No Longer Need To File Hmrc Tax Returns

May 20, 2025

Thousands No Longer Need To File Hmrc Tax Returns

May 20, 2025 -

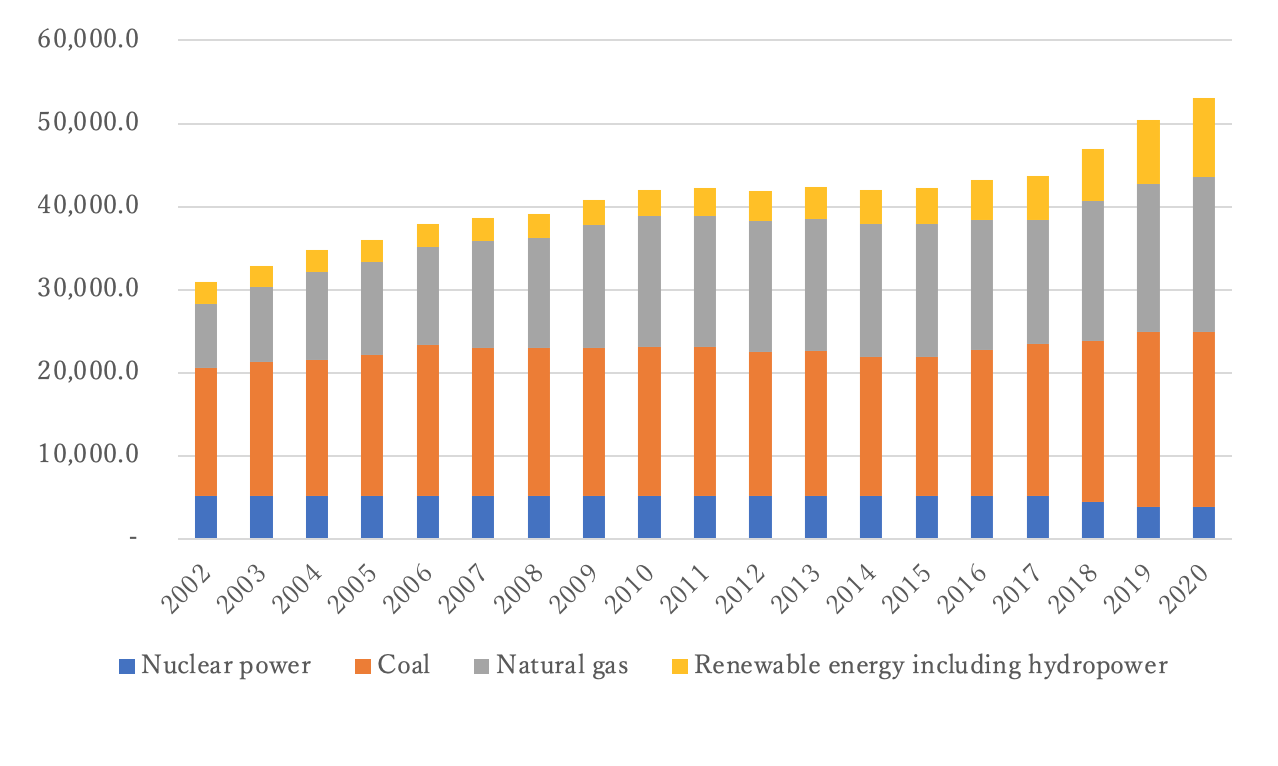

Taiwans Energy Transition Lng Takes Center Stage After Nuclear Closure

May 20, 2025

Taiwans Energy Transition Lng Takes Center Stage After Nuclear Closure

May 20, 2025

Latest Posts

-

Possible Dexter Resurrection Trailer Release Date Revealed

May 21, 2025

Possible Dexter Resurrection Trailer Release Date Revealed

May 21, 2025 -

Dexter Original Sin Steelbook Is It Worth The Buy Before Dexter New Blood

May 21, 2025

Dexter Original Sin Steelbook Is It Worth The Buy Before Dexter New Blood

May 21, 2025 -

The Original Sin Finale And Dexters Biggest Regret Debra Morgans Fate

May 21, 2025

The Original Sin Finale And Dexters Biggest Regret Debra Morgans Fate

May 21, 2025 -

Dexter Resurrection Trailer Release Date Hints Emerge

May 21, 2025

Dexter Resurrection Trailer Release Date Hints Emerge

May 21, 2025 -

Dexter Original Sin Steelbook Blu Ray Review Prepare For Dexter Resurrection

May 21, 2025

Dexter Original Sin Steelbook Blu Ray Review Prepare For Dexter Resurrection

May 21, 2025