Analyzing The D-Wave Quantum (QBTS) Stock Dip On Monday

Table of Contents

Market-Wide Factors Influencing QBTS Stock Performance

Several market-wide factors could have contributed to the QBTS stock dip on Monday. Understanding the broader economic and technological landscape is crucial for analyzing the performance of a growth stock like D-Wave Quantum.

Overall Market Sentiment

Monday's market performance showed a generally negative sentiment across several key indices.

- The NASDAQ Composite, a technology-heavy index, experienced a [insert percentage]% decline.

- The S&P 500, a broader market indicator, also saw a [insert percentage]% drop.

This negative market sentiment often disproportionately affects growth stocks, such as those in the burgeoning quantum computing sector. Investors tend to be more risk-averse during periods of general market downturn, leading to selling pressure on companies with higher valuations and potentially less-established revenue streams. The broader economic concerns, such as [mention specific concerns like inflation, interest rate hikes, etc.], further exacerbated this negative sentiment, impacting investor confidence in high-growth, speculative investments like QBTS.

Sector-Specific Trends in Quantum Computing

While the overall market contributed to the decline, it's also important to analyze whether the dip was specific to quantum computing stocks or a broader trend within the technology sector.

- [Mention other quantum computing companies and their performance on Monday, e.g., "IonQ also experienced a slight decline, while Rigetti showed more resilience."]

- [Discuss any news or announcements that may have impacted the sector on Monday, e.g., "A lack of major breakthroughs or funding announcements in the quantum computing field might have dampened investor enthusiasm."]

The quantum computing market is still relatively nascent, making it susceptible to significant swings in investor sentiment. Negative news or a lack of substantial positive developments can easily trigger selling pressure, as investors might seek safer investments in more established sectors.

D-Wave Quantum-Specific News and Developments

Analyzing company-specific news and developments is crucial to fully understand the QBTS stock dip.

Absence of Positive Catalysts

The absence of positive news or announcements from D-Wave Quantum itself on Monday might have contributed to the decline.

- [List any expected announcements or events that did not materialize, e.g., "No significant contract wins were reported, and there were no major technological advancements publicized."]

The absence of positive catalysts can lead to selling pressure, as investors might interpret the silence as a lack of progress or future growth potential. Positive news often fuels investor optimism, while a lack thereof can lead to uncertainty and a decrease in the stock's value.

Potential for Negative News (Speculative)

While no concrete negative news was reported, speculation plays a role in stock market movements. It is crucial to approach this section with a disclaimer that the following is speculative.

- [Mention any unsubstantiated rumors or potential concerns affecting investor confidence, but clearly state this is speculation, e.g., "Unconfirmed rumors about potential delays in a key project may have contributed to some selling pressure."]

It is imperative to emphasize the importance of separating fact from speculation when analyzing stock movements. While rumors can influence short-term price fluctuations, long-term investment decisions should be based on concrete facts and thorough due diligence.

Technical Analysis of the QBTS Stock Dip

Technical analysis can provide additional insights into the QBTS stock dip.

Chart Patterns and Trading Volume

Analyzing the QBTS stock chart reveals [insert specific chart patterns observed, e.g., "a breakdown below a key support level"].

- [Mention specific chart patterns (e.g., head and shoulders, support/resistance levels). Include data on trading volume, e.g., "Trading volume increased significantly on Monday, suggesting heightened selling pressure."]

These patterns can offer valuable insights into the short-term trends and potential support/resistance levels for the QBTS stock. High trading volume during a price drop further reinforces the strength of the selling pressure.

Short-Term vs. Long-Term Implications

Determining whether the dip is a temporary correction or a signal of a larger trend requires a longer-term perspective.

- [Consider the historical performance of QBTS and the broader quantum computing market, e.g., "Historically, QBTS has shown volatility, but its long-term trajectory reflects the growing interest in quantum computing."]

It is crucial to consider both short-term and long-term perspectives when making investment decisions. While short-term fluctuations are common, a long-term outlook is necessary for evaluating the potential of companies in a developing sector like quantum computing.

Conclusion

The D-Wave Quantum (QBTS) stock dip on Monday resulted from a combination of factors. Market-wide negativity, a lack of positive company-specific news, and technical indicators all contributed to the downturn. While speculative concerns played a part, the overall market sentiment and the absence of positive catalysts from D-Wave Quantum likely exerted the most significant influence.

While the dip in D-Wave Quantum (QBTS) stock presents complexities, thorough analysis of market factors, company developments, and technical indicators is crucial before making investment decisions. Continue to monitor the D-Wave Quantum (QBTS) stock and the broader quantum computing sector for further insights. Conduct your own in-depth research before investing in QBTS or any other quantum computing stock. Remember that investing in growth stocks like QBTS carries inherent risks.

Featured Posts

-

Sabalenkas Powerful Performance Propels Her To Madrid Open Last 16

May 21, 2025

Sabalenkas Powerful Performance Propels Her To Madrid Open Last 16

May 21, 2025 -

Understanding The Love Monster A Guide To Healthy Relationships

May 21, 2025

Understanding The Love Monster A Guide To Healthy Relationships

May 21, 2025 -

Clisson Debat Sur Le Port De Symboles Religieux Au College

May 21, 2025

Clisson Debat Sur Le Port De Symboles Religieux Au College

May 21, 2025 -

Eyresi Efimereyontos Giatroy Stin Patra 10 11 5

May 21, 2025

Eyresi Efimereyontos Giatroy Stin Patra 10 11 5

May 21, 2025 -

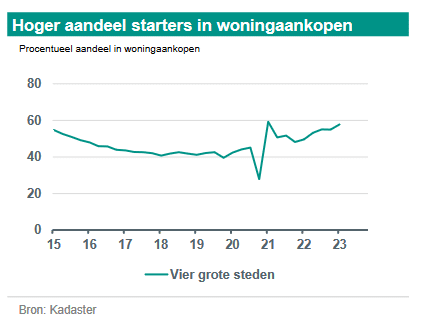

Abn Amro Voorspelt Stijgende Huizenprijzen Ondanks Renteverhogingen

May 21, 2025

Abn Amro Voorspelt Stijgende Huizenprijzen Ondanks Renteverhogingen

May 21, 2025

Latest Posts

-

Jail Sentence For Mother Following Southport Stabbing The Impact Of Social Media

May 22, 2025

Jail Sentence For Mother Following Southport Stabbing The Impact Of Social Media

May 22, 2025 -

Hotel Fire Tweet Leads To Jail Sentence For Tory Councillors Wife Appeal Update

May 22, 2025

Hotel Fire Tweet Leads To Jail Sentence For Tory Councillors Wife Appeal Update

May 22, 2025 -

Mothers Tweet Following Southport Stabbing Results In Jail Time And Loss Of Home

May 22, 2025

Mothers Tweet Following Southport Stabbing Results In Jail Time And Loss Of Home

May 22, 2025 -

Appeal Rejected Councillors Wifes Harsh Sentence Stands Following Migrant Rant

May 22, 2025

Appeal Rejected Councillors Wifes Harsh Sentence Stands Following Migrant Rant

May 22, 2025 -

Councillors Wifes Jail Sentence For Inflammatory Tweet Appeal Awaits

May 22, 2025

Councillors Wifes Jail Sentence For Inflammatory Tweet Appeal Awaits

May 22, 2025