Analyzing The Bitcoin Rebound: Risks And Rewards For Investors

Table of Contents

The recent Bitcoin rebound has reignited interest among investors, presenting both exciting opportunities and significant risks. Understanding the factors driving this price surge and carefully weighing the potential rewards against the inherent volatility is crucial for making informed investment decisions. This article will delve into the complexities of the Bitcoin rebound, analyzing its potential, the associated dangers, and providing insights to help navigate this dynamic market.

Factors Driving the Bitcoin Rebound

Several interconnected factors contribute to the current Bitcoin rebound. Understanding these drivers is key to predicting future price movements and making informed investment choices.

Macroeconomic Factors

Global economic uncertainty plays a significant role in Bitcoin's price fluctuations. Many investors view Bitcoin as a hedge against inflation and economic instability.

- Increased institutional investment: Large financial institutions are increasingly allocating capital to Bitcoin, boosting demand and price.

- Inflation hedge narrative: As inflation rises globally, Bitcoin's limited supply and decentralized nature make it an attractive alternative store of value.

- Regulatory developments (positive and negative): Clearer regulatory frameworks in some jurisdictions can increase investor confidence, while negative news can trigger price drops. The impact of regulatory uncertainty on Bitcoin price prediction is significant.

Technological Advancements

Ongoing technological improvements enhance Bitcoin's functionality and appeal, driving further adoption and price appreciation.

- Lightning Network adoption: The Lightning Network, a layer-2 scaling solution, significantly improves transaction speed and reduces fees, making Bitcoin more practical for everyday use.

- Taproot upgrade impact: The Taproot upgrade enhanced Bitcoin's scalability and privacy, making it more attractive to both developers and users.

- Growing DeFi ecosystem on Bitcoin: The development of decentralized finance (DeFi) applications on the Bitcoin network is opening new possibilities and attracting investors.

Market Sentiment and Investor Behavior

Market psychology and investor behavior significantly influence Bitcoin's price. FOMO (fear of missing out) and media narratives play a crucial role.

- Social media sentiment analysis: Tracking social media sentiment provides valuable insights into investor sentiment and its impact on price volatility.

- Impact of news cycles on Bitcoin price: Positive news often leads to price increases, while negative news can trigger sell-offs. Understanding the news cycle is crucial for Bitcoin price prediction.

- Whale activity and its influence: Large Bitcoin holders ("whales") can significantly influence price movements through their buying and selling activities.

Assessing the Risks of Investing in Bitcoin During a Rebound

Despite the potential rewards, investing in Bitcoin during a rebound involves considerable risks. A comprehensive understanding of these risks is crucial for mitigating potential losses.

Volatility and Price Corrections

Bitcoin's price is notoriously volatile, susceptible to sharp and sudden price corrections.

- Historical price volatility data: Analyzing historical price data reveals the extent of Bitcoin's volatility and the potential for significant price swings.

- Risk of market manipulation: The relatively small market capitalization of cryptocurrencies makes them vulnerable to market manipulation.

- Impact of sudden regulatory changes: Unexpected regulatory actions can trigger significant price drops.

Security Risks and Scams

The cryptocurrency market is unfortunately susceptible to scams and security breaches.

- Importance of secure wallets: Using secure wallets and employing best security practices is essential to protect your Bitcoin holdings.

- Risks of phishing and other scams: Investors need to be vigilant against phishing attempts and other scams that target cryptocurrency users.

- Exchange security measures: Choosing reputable and secure cryptocurrency exchanges is paramount.

Regulatory Uncertainty

The regulatory landscape for Bitcoin varies significantly across jurisdictions, creating uncertainty and potential risks.

- Varying regulatory approaches globally: Different countries have adopted different approaches to regulating Bitcoin, leading to uncertainty and potential for conflicting regulations.

- Potential for future regulations: The regulatory environment for cryptocurrencies is constantly evolving, and future regulations could significantly impact Bitcoin's price.

- Impact of taxation on Bitcoin investments: Taxation rules for Bitcoin investments vary widely, and understanding these rules is crucial for minimizing tax liabilities.

Evaluating the Rewards of a Bitcoin Investment Strategy

While the risks are substantial, the potential rewards of a well-considered Bitcoin investment strategy can be significant.

Potential for High Returns

Bitcoin has historically demonstrated significant price appreciation, offering the potential for substantial returns on investment.

- Long-term price growth potential: Many analysts believe Bitcoin has long-term price growth potential, driven by increasing adoption and scarcity.

- Comparison with traditional investment assets: Compared to some traditional investments, Bitcoin has the potential for higher returns, albeit with higher risk.

- Potential for diversification benefits: Bitcoin's low correlation with traditional asset classes can enhance portfolio diversification.

Decentralization and Financial Freedom

Bitcoin's decentralized nature offers the potential for increased financial freedom and reduced reliance on traditional financial institutions.

- Reduced reliance on traditional financial institutions: Bitcoin allows for peer-to-peer transactions without intermediaries.

- Accessibility to global financial markets: Bitcoin provides access to global financial markets, regardless of geographic location.

- Potential for increased financial inclusion: Bitcoin can potentially provide financial services to underserved populations.

Portfolio Diversification

Bitcoin can serve as a valuable diversifying asset within a broader investment portfolio.

- Correlation with traditional assets: Bitcoin's low correlation with traditional assets such as stocks and bonds can help mitigate risk.

- Risk mitigation through diversification: Adding Bitcoin to a diversified portfolio can reduce overall portfolio risk.

- Building a balanced crypto portfolio: Consider diversifying within the crypto market itself by investing in other cryptocurrencies.

Conclusion

Analyzing the Bitcoin rebound requires a careful evaluation of both the potential rewards and inherent risks. While the prospect of significant returns is tempting, the volatility and regulatory uncertainty remain significant challenges. By understanding the factors driving the rebound, assessing the risks, and developing a well-informed investment strategy, investors can navigate this dynamic market more effectively. Remember to conduct thorough research and consider seeking advice from a qualified financial advisor before investing in Bitcoin or any other cryptocurrency. Don't miss out on the potential of the Bitcoin rebound—but approach it with caution and a well-defined plan. Learn more about managing your Bitcoin investment risk and capitalize on this exciting opportunity.

Featured Posts

-

Several Arrested In Shreveport Following Large Scale Vehicle Theft Investigation

May 08, 2025

Several Arrested In Shreveport Following Large Scale Vehicle Theft Investigation

May 08, 2025 -

Xrp Regulatory Status Latest News And Analysis Of Sec Decision

May 08, 2025

Xrp Regulatory Status Latest News And Analysis Of Sec Decision

May 08, 2025 -

Istori Ska Pobeda Segeda Nad Pariz Sent Zhermen U L Sh

May 08, 2025

Istori Ska Pobeda Segeda Nad Pariz Sent Zhermen U L Sh

May 08, 2025 -

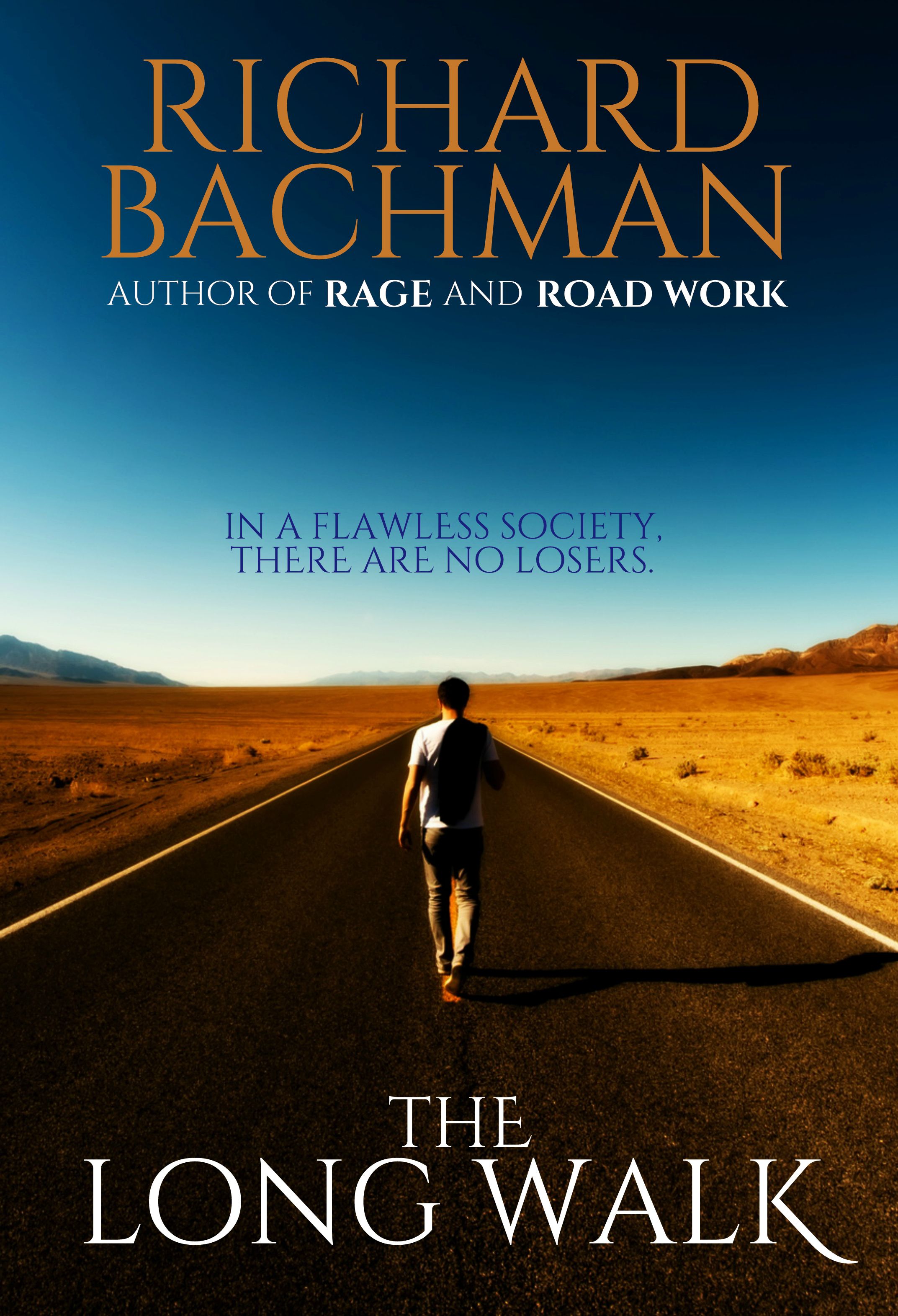

Stephen King Thinks The Long Walk Trailer Is Too Intense

May 08, 2025

Stephen King Thinks The Long Walk Trailer Is Too Intense

May 08, 2025 -

True Blue A Look At Play Station Podcast Episode 512

May 08, 2025

True Blue A Look At Play Station Podcast Episode 512

May 08, 2025