Analyzing The Bank Of Canada's Response To Trump Tariffs In April

Table of Contents

The Economic Impact of Trump Tariffs on Canada

The Trump tariffs delivered a considerable blow to the Canadian economy, significantly impacting various sectors and creating widespread economic uncertainty.

Impact on Canadian Exports

The tariffs primarily targeted key Canadian exports, leading to a decline in Canadian export volumes and revenues. The lumber and aluminum industries were particularly hard hit, facing substantial tariff barriers in the US market. Keywords like "Canadian export decline," "tariff impact on trade," and "bilateral trade disruption" aptly describe the situation.

- Lumber: The US imposed significant duties on Canadian softwood lumber, leading to a sharp decrease in exports and impacting Canadian forestry companies. Reports from Statistics Canada showed a [insert percentage]% drop in lumber exports to the US in [Month, Year]. [Insert citation/link to Statistics Canada report].

- Aluminum: Similar disruptions occurred in the aluminum sector. The tariffs increased production costs and reduced competitiveness in the US market, resulting in job losses and reduced production. [Insert quantifiable data and citation showcasing economic impact].

- Other Sectors: Beyond lumber and aluminum, other sectors experienced varying degrees of negative impact. The automotive industry, for instance, faced indirect effects due to supply chain disruptions and increased input costs.

Increased Uncertainty and Investor Sentiment

The imposition of tariffs created significant economic uncertainty, negatively impacting investor confidence and consumer spending. This uncertainty stemmed from the unpredictable nature of US trade policy and the potential for further tariff escalations. Keywords such as "investor confidence Canada," "economic uncertainty," and "market volatility" accurately reflect this period.

- Decreased Investment: Businesses postponed or cancelled investment projects due to the heightened uncertainty, fearing further trade disruptions and reduced profitability. [Insert evidence of decreased investment, citing relevant financial reports and indices like the TSX].

- Consumer Spending: Consumer confidence decreased, leading to a slowdown in consumer spending. Uncertainty about job security and future economic prospects caused consumers to become more cautious with their expenditures. [Insert data on consumer spending patterns during this period, citing relevant economic reports].

The Bank of Canada's Monetary Policy Response

Faced with the economic challenges posed by the Trump tariffs, the Bank of Canada implemented a range of monetary policy measures aimed at mitigating the negative impacts and stabilizing the economy.

Interest Rate Decisions

The Bank of Canada's response involved careful consideration of interest rate adjustments. The primary goal was to maintain price stability and support economic growth in the face of external shocks. Keywords such as "monetary policy," "interest rate adjustments," and "Bank of Canada rate announcement" are relevant here.

- [Date]: The Bank of Canada [lowered/maintained/raised] its key interest rate to [percentage] citing [reason, e.g., concerns about slowing economic growth due to trade uncertainty]. [Insert link to official Bank of Canada press release].

- [Date]: Subsequent decisions reflected the evolving economic situation and the Bank's assessment of the impact of the tariffs. [Details of subsequent interest rate changes and justifications].

- Proactive vs. Reactive: Analysis of whether the Bank's initial response was proactive (anticipating the negative effects) or reactive (responding to already visible impacts) is crucial for a complete assessment.

Quantitative Easing (QE) and Other Measures

While the Bank of Canada primarily relied on interest rate adjustments, it also considered and potentially implemented other monetary policy tools to support the economy. Keywords such as "quantitative easing," "liquidity measures," and "monetary policy tools" are important for this section.

- Quantitative Easing (QE): Did the Bank of Canada consider or implement QE to increase liquidity in the financial system? If so, details about the scale and implementation should be provided. [Include details and rationale].

- Other Measures: Were there any other unconventional monetary policy tools utilized? For example, did the Bank implement any targeted lending programs or liquidity facilities for specific sectors affected by the tariffs? [Provide specifics and assessment].

- Effectiveness Assessment: Evaluating the effectiveness of these measures requires analyzing their impact on key economic indicators such as inflation, employment, and economic growth.

Assessing the Effectiveness of the Bank of Canada's Response

Evaluating the Bank of Canada's response requires considering both its short-term and long-term impacts.

Short-Term Impacts

The immediate effects of the Bank of Canada's actions were crucial in mitigating the most severe negative impacts of the tariffs. Keywords like "economic stabilization," "inflation control," and "currency fluctuations" are crucial here.

- Mitigation of Negative Impacts: To what extent did the Bank's policies prevent a sharper decline in economic growth and employment? [Provide evidence and analysis].

- Inflation Control: Did the monetary policy actions succeed in preventing significant inflationary pressures? [Data on inflation rates and analysis of its impact on consumer prices].

- Canadian Dollar Impact: How did the Bank's response affect the Canadian dollar's exchange rate? [Analysis of currency fluctuations and the role of monetary policy in influencing the exchange rate].

Long-Term Implications

The long-term effects of both the tariffs and the Bank's response are complex and require ongoing analysis. Keywords such as "long-term economic growth," "trade negotiations," and "structural economic changes" are pertinent.

- Impact on Industries: How did the tariffs and the Bank's response shape the long-term trajectory of affected Canadian industries? [Long-term economic data and analysis on industry performance].

- Policy Adjustments: What lessons were learned from this experience that may inform future monetary policy adjustments in the face of similar economic shocks? [Analysis of future policy adjustments based on the experience].

- Trade Negotiations: How did the Bank's actions influence the broader context of Canada-US trade negotiations? [Analysis of the interplay between monetary policy and trade relations].

Conclusion: Understanding the Bank of Canada's Response to Trump Tariffs in April

The Bank of Canada's response to Trump tariffs in April 2018 involved a multifaceted approach, primarily focusing on interest rate adjustments and careful monitoring of the economic situation. While the immediate impacts of the tariffs were significant, the Bank's actions likely played a role in mitigating the severity of the economic downturn. The long-term consequences, however, are still unfolding and require further analysis. To gain a deeper understanding of the nuances of the Bank of Canada's response to Trump Tariffs in April, further research into the Bank's official publications and economic data is recommended. Explore the Bank of Canada's website for detailed reports and analyses of this crucial period in Canadian economic history.

Featured Posts

-

Fortnite Server Status Is Fortnite Down Update 34 20 Patch Notes And Downtime

May 02, 2025

Fortnite Server Status Is Fortnite Down Update 34 20 Patch Notes And Downtime

May 02, 2025 -

Addressing The Urgent Mental Health Crisis Among Canadian Youth Lessons Learned Globally

May 02, 2025

Addressing The Urgent Mental Health Crisis Among Canadian Youth Lessons Learned Globally

May 02, 2025 -

Kocaeli 1 Mayis Arbede Olaylarin Ardindaki Sebepler Ve Sonuclari

May 02, 2025

Kocaeli 1 Mayis Arbede Olaylarin Ardindaki Sebepler Ve Sonuclari

May 02, 2025 -

Abu Jinapor Reflects On The Npps Unexpected 2024 Election Result

May 02, 2025

Abu Jinapor Reflects On The Npps Unexpected 2024 Election Result

May 02, 2025 -

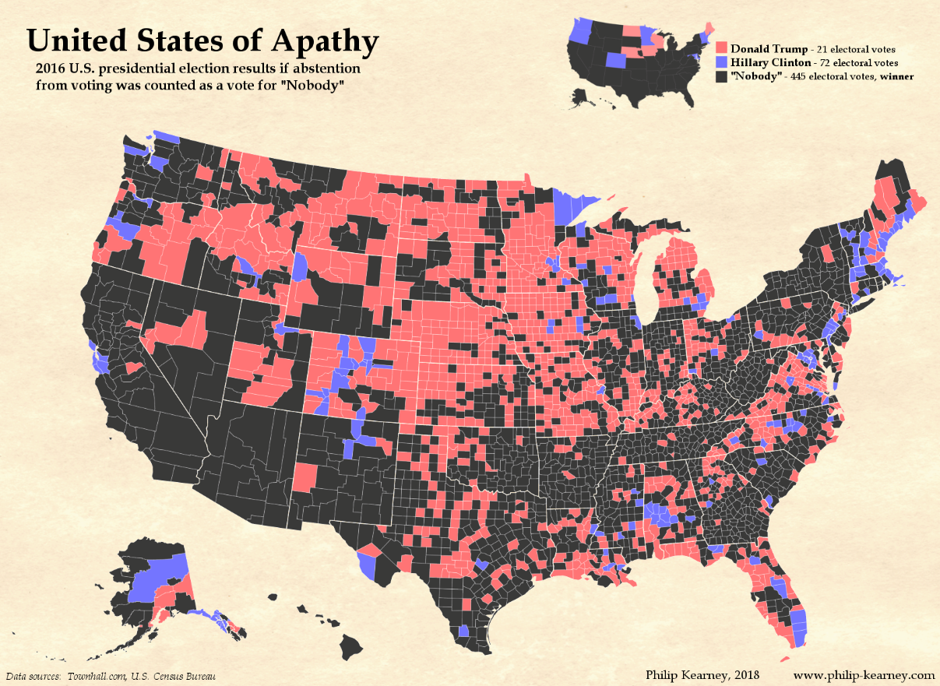

Voter Turnout In Florida And Wisconsin Implications For The Future Of Politics

May 02, 2025

Voter Turnout In Florida And Wisconsin Implications For The Future Of Politics

May 02, 2025

Latest Posts

-

Remembering A Young Life Georgia Stanways Tribute In Kendal

May 03, 2025

Remembering A Young Life Georgia Stanways Tribute In Kendal

May 03, 2025 -

Footballer Georgia Stanway Mourns Young Fan Killed On Pitch In Kendal

May 03, 2025

Footballer Georgia Stanway Mourns Young Fan Killed On Pitch In Kendal

May 03, 2025 -

Stanways Emotional Tribute After Tragic Pitchside Death In Kendal

May 03, 2025

Stanways Emotional Tribute After Tragic Pitchside Death In Kendal

May 03, 2025 -

Georgia Stanways Condolences Following Tragic Kendal Pitch Death

May 03, 2025

Georgia Stanways Condolences Following Tragic Kendal Pitch Death

May 03, 2025 -

10 Year Old Girl Dies On Rugby Pitch A Communitys Grief

May 03, 2025

10 Year Old Girl Dies On Rugby Pitch A Communitys Grief

May 03, 2025