Analyzing Ripple's (XRP) 15,000% Increase: Investment Opportunities And Risks

Table of Contents

H2: Factors Contributing to XRP's 15,000% Rise

Several interconnected factors fueled XRP's remarkable price surge. Understanding these is crucial for any investor considering exposure to this cryptocurrency.

H3: Technological Advancements

Ripple's technology, particularly RippleNet, forms the bedrock of its success. RippleNet offers a scalable, efficient solution for cross-border payments, significantly improving upon traditional methods. Key advantages include:

- Cross-border payments: XRP facilitates swift and cost-effective international transactions, bypassing the complexities and delays of traditional banking systems.

- Transaction speed: Transactions using XRP are processed considerably faster than many other cryptocurrencies and traditional banking systems.

- Low fees: XRP's low transaction fees make it a financially attractive option for high-volume transfers.

- Scalability: RippleNet's architecture is designed to handle a large volume of transactions, a crucial factor for widespread adoption.

H3: Adoption by Financial Institutions

A pivotal factor in XRP's rise is its increasing adoption by major financial institutions. Ripple has strategically partnered with numerous banks and payment providers globally, leveraging XRP for their international payment needs. Examples include:

- Major banking partnerships: Several large banks have integrated XRP into their cross-border payment systems, demonstrating a significant shift towards cryptocurrency adoption in the traditional finance sector.

- Institutional adoption: This institutional adoption signifies a validation of XRP's utility and potential, boosting investor confidence and driving price appreciation.

- Global payments: The use of XRP for global payments reduces processing time and costs, making it a competitive solution compared to traditional SWIFT networks.

H3: Speculative Trading and Market Sentiment

Speculative trading and positive market sentiment significantly contributed to XRP's price increase. Social media buzz, news coverage, and the fear of missing out (FOMO) created a self-reinforcing cycle of price appreciation:

- Market sentiment: Positive news and increased media attention fueled a surge in demand, leading to significant price increases.

- Speculation: Speculative trading amplified price volatility, leading to substantial gains for early investors.

- FOMO: The rapid price increase further fueled speculative buying, as investors feared missing out on potential profits.

H2: Investment Opportunities in XRP

Despite the risks, XRP presents potential investment opportunities, though careful consideration is essential.

H3: Long-Term Growth Potential

XRP's long-term growth hinges on continued adoption by financial institutions and the expansion of RippleNet. Potential scenarios include:

- Future price prediction: Predicting future prices is inherently speculative, but continued adoption could lead to significant price appreciation in the long term.

- Growth potential: The ongoing development of RippleNet and increased institutional partnerships could drive sustained growth.

- Long-term investment: A long-term perspective is crucial when evaluating XRP, as short-term price fluctuations are common.

H3: Short-Term Trading Strategies

Short-term trading strategies can potentially yield profits, but involve considerable risk given XRP's high volatility. Investors should consider:

- Short-term trading: Day trading and swing trading can be employed, but require careful risk management.

- Volatility: The highly volatile nature of XRP necessitates careful monitoring of market conditions.

- Risk management: Implementing robust risk management strategies, such as stop-loss orders, is crucial.

- Cryptocurrency trading strategies: Thorough research and understanding of various trading strategies are vital before engaging in short-term trading.

H2: Risks Associated with Investing in XRP

Investing in XRP comes with significant risks that investors must carefully weigh.

H3: Regulatory Uncertainty

The ongoing legal battle between Ripple and the SEC casts a shadow over XRP's future. The outcome could significantly impact its price:

- SEC lawsuit: The lawsuit's outcome remains uncertain and could significantly affect XRP's price.

- Regulatory uncertainty: This regulatory uncertainty creates considerable risk for investors.

- Legal risk: Investors should be aware of the potential legal ramifications associated with investing in XRP during this period.

H3: Market Volatility

The cryptocurrency market is inherently volatile, and XRP is no exception. Price swings can be dramatic and unpredictable, driven by:

- Market volatility: Unexpected news events, market sentiment shifts, and regulatory changes can cause significant price fluctuations.

- Price fluctuation: Investors need to be prepared for substantial price drops as well as gains.

- Investment risk: High volatility increases the risk of significant financial losses.

H3: Competition from Other Cryptocurrencies

XRP faces competition from other cryptocurrencies offering similar functionalities. The competitive landscape includes:

- Cryptocurrency competition: Other cryptocurrencies are also vying for a share of the cross-border payments market.

- Market share: XRP's market share could be eroded by competitors with similar or superior technology.

- Alternative payment solutions: Investors need to be aware of alternative payment solutions that could reduce demand for XRP.

3. Conclusion

Analyzing Ripple's (XRP) 15,000% increase reveals a complex interplay of technological advancements, institutional adoption, and market speculation. While the potential for future growth is evident, the risks associated with regulatory uncertainty, market volatility, and competition are substantial. Key takeaways emphasize the need for thorough research and a prudent assessment of your risk tolerance before investing in XRP. Before making any decisions related to analyzing Ripple's XRP investment, or investing in XRP generally, conduct thorough research and consider consulting a financial advisor. Remember that understanding Ripple's (XRP) price analysis is only one piece of the puzzle. Careful consideration of the inherent risks is paramount before committing your capital.

Featured Posts

-

Juridische Strijd Kampen Dagvaardt Enexis Wegens Stroomnetaansluiting

May 01, 2025

Juridische Strijd Kampen Dagvaardt Enexis Wegens Stroomnetaansluiting

May 01, 2025 -

Duponts Masterful Performance A Key Factor In Frances Victory Against Italy

May 01, 2025

Duponts Masterful Performance A Key Factor In Frances Victory Against Italy

May 01, 2025 -

Dragons Den Peter Joness Savage Put Down Leaves Viewers Speechless

May 01, 2025

Dragons Den Peter Joness Savage Put Down Leaves Viewers Speechless

May 01, 2025 -

Dalys Late Try England Beats France In Tense Six Nations Encounter

May 01, 2025

Dalys Late Try England Beats France In Tense Six Nations Encounter

May 01, 2025 -

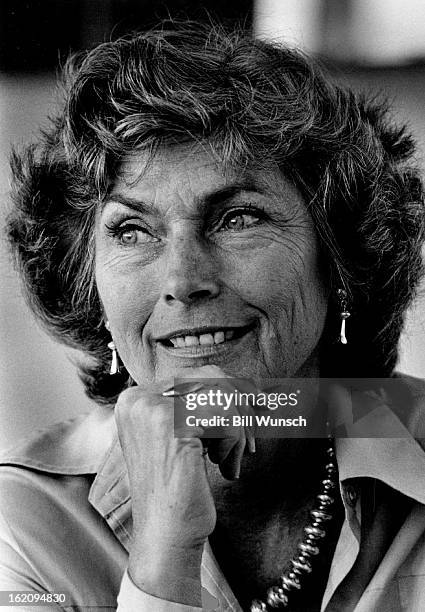

Actress Priscilla Pointer 100 Passes Away A Look Back At Her Career

May 01, 2025

Actress Priscilla Pointer 100 Passes Away A Look Back At Her Career

May 01, 2025

Latest Posts

-

100 Year Old Dallas Star Dies Remembering A Life Well Lived

May 01, 2025

100 Year Old Dallas Star Dies Remembering A Life Well Lived

May 01, 2025 -

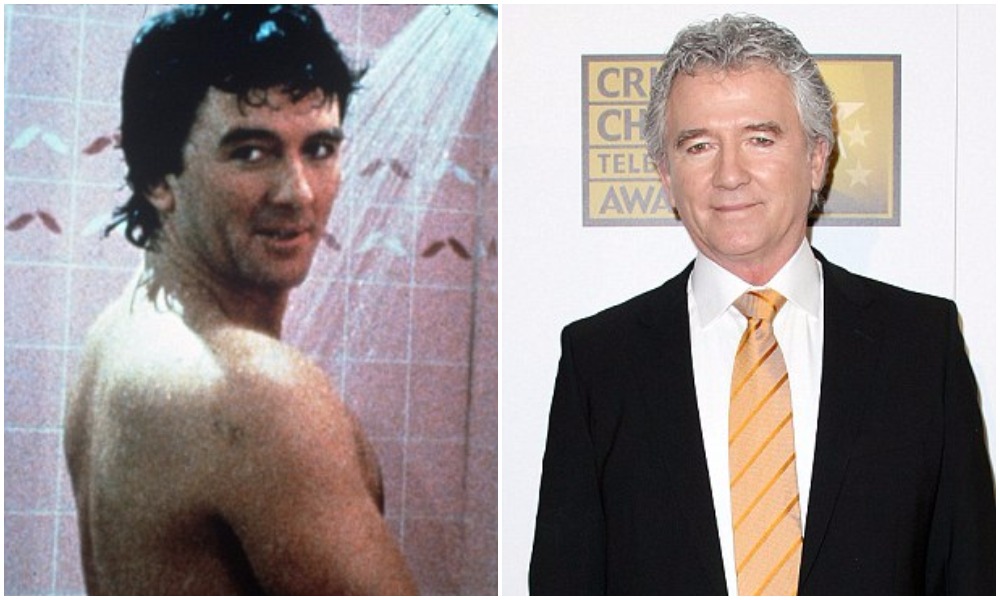

Death Of Beloved Dallas Star At 100

May 01, 2025

Death Of Beloved Dallas Star At 100

May 01, 2025 -

Centenarian Dallas Star Passes Away

May 01, 2025

Centenarian Dallas Star Passes Away

May 01, 2025 -

Dallas Icon Passes Away At Age 100

May 01, 2025

Dallas Icon Passes Away At Age 100

May 01, 2025 -

Tributes Pour In For Stage And Screen Icon Priscilla Pointer 100

May 01, 2025

Tributes Pour In For Stage And Screen Icon Priscilla Pointer 100

May 01, 2025