Analyzing Riot Platforms (RIOT) Stock's Recent Decline

Table of Contents

Riot Platforms (RIOT) stock has experienced a recent decline, leaving investors questioning the underlying causes. This article delves into the key factors contributing to this downturn, examining market conditions, company performance, and future prospects for RIOT stock. We will explore the interplay between Bitcoin's price, energy costs, and the overall profitability of Bitcoin mining operations to provide a comprehensive understanding of RIOT's current situation. This analysis will help investors navigate the complexities of the cryptocurrency mining sector and make informed decisions regarding RIOT stock.

The Impact of Bitcoin's Price Volatility on RIOT Stock

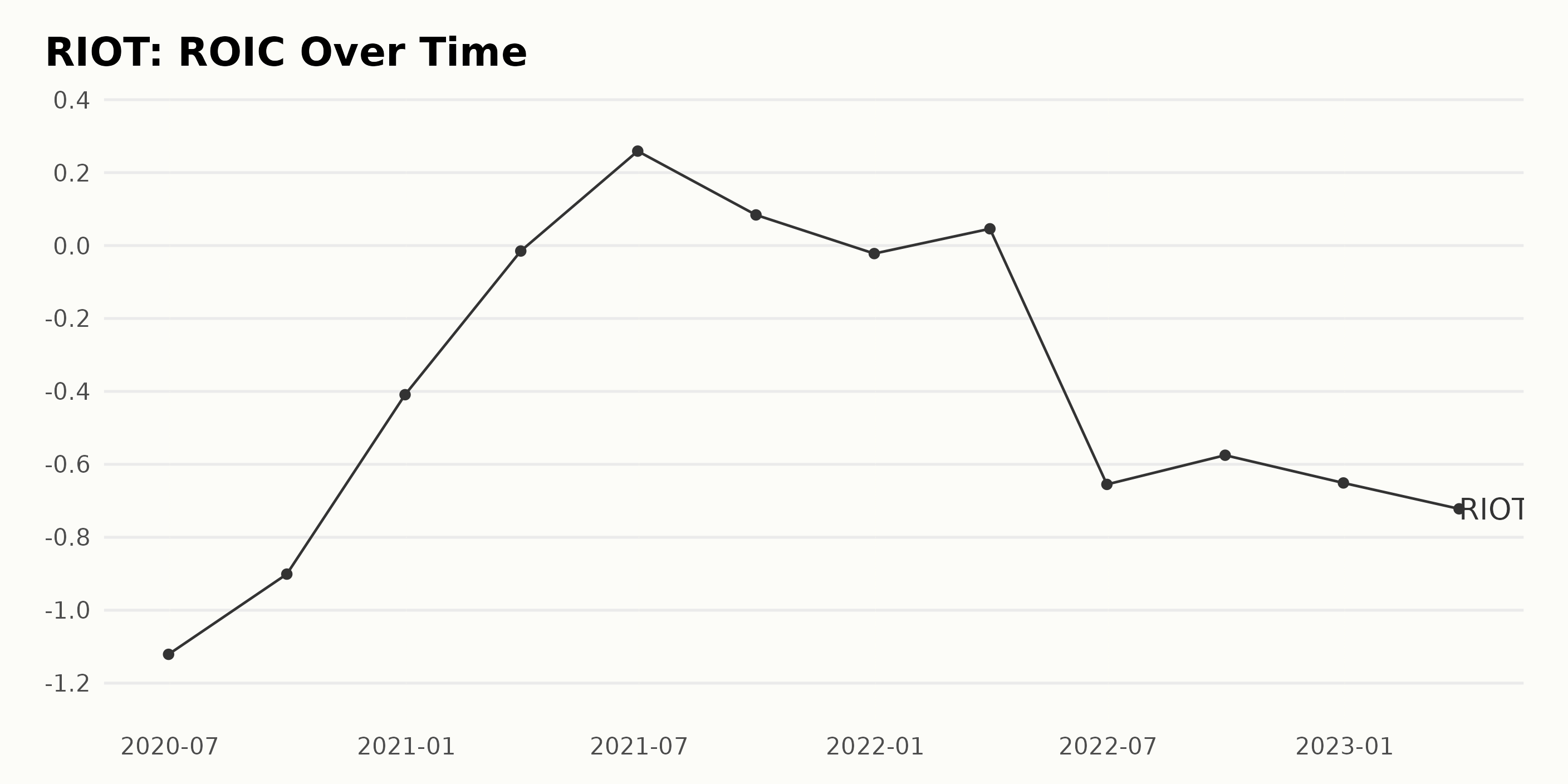

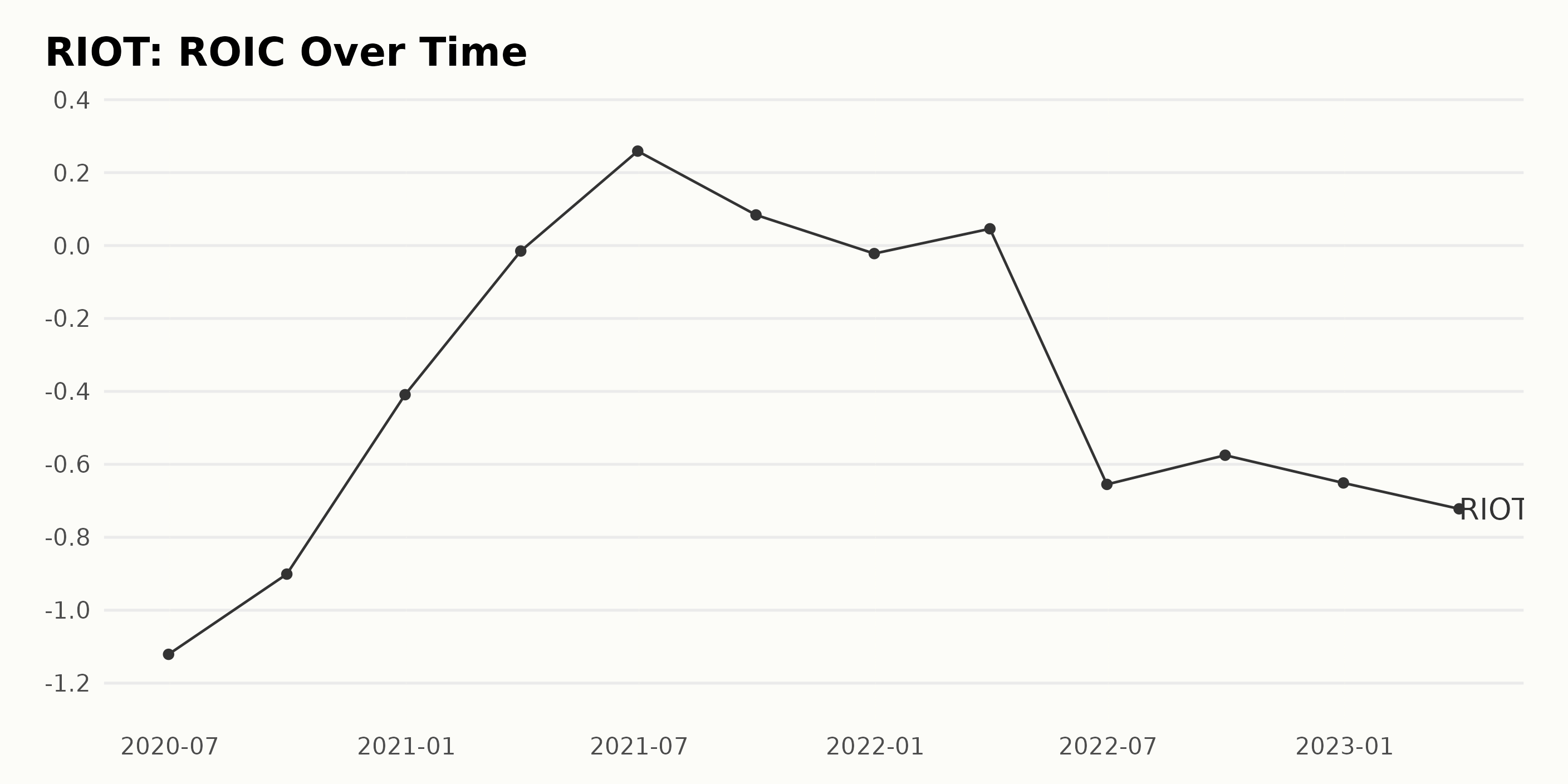

The price of Bitcoin (BTC) and the performance of RIOT stock are inextricably linked. This strong correlation is a crucial factor in understanding RIOT's recent decline. Bitcoin's price volatility directly impacts the profitability of Bitcoin mining, which in turn significantly affects RIOT's revenue and, consequently, its stock valuation.

-

How Bitcoin Price Drops Affect RIOT's Revenue: A decrease in Bitcoin's price reduces the revenue generated from mining operations. This is because the value of the mined Bitcoin is directly tied to the market price. Lower Bitcoin prices mean less revenue, even if the mining operation's hash rate remains consistent.

-

Historical Correlation: Analyzing historical data clearly demonstrates a strong positive correlation between the Bitcoin price and RIOT's stock price. When the Bitcoin price rises, RIOT's stock price generally follows suit, and vice versa. This correlation highlights the significant influence of the cryptocurrency market on RIOT's stock performance.

-

Investor Sentiment and Bitcoin Price Drops: Investor sentiment plays a crucial role. During periods of Bitcoin price decline, investor confidence in the cryptocurrency market, and consequently in Bitcoin mining stocks like RIOT, tends to decrease. This negative sentiment often leads to sell-offs, further driving down the RIOT stock price.

Rising Energy Costs and Their Effect on RIOT's Profitability

Rising energy costs pose a significant challenge to Bitcoin mining operations, including Riot Platforms. The energy-intensive nature of Bitcoin mining means that electricity prices directly impact the profitability of these operations. Increased energy costs reduce profit margins, making Bitcoin mining less attractive and potentially impacting the valuation of companies like RIOT.

-

Energy Costs as a Percentage of Operating Expenses: A substantial portion of RIOT's operating expenses is attributed to energy consumption. Fluctuations in electricity prices directly impact their bottom line. Understanding this percentage is vital for assessing the company's vulnerability to energy price increases.

-

Mitigation Strategies: RIOT, like other Bitcoin mining companies, is exploring strategies to mitigate the impact of rising energy costs. This includes investigating the adoption of renewable energy sources such as solar and wind power to reduce reliance on traditional, more expensive energy grids. This transition to sustainable energy can significantly improve long-term profitability.

-

Competitive Comparison: Comparing RIOT's energy costs and efficiency to its competitors provides valuable context. Companies with lower energy costs or more efficient mining operations have a competitive advantage in a market sensitive to energy price fluctuations.

Market Sentiment and Investor Confidence in the Cryptocurrency Sector

The overall sentiment towards the cryptocurrency market significantly influences RIOT's stock price. Investor confidence is impacted by various factors, including regulatory changes, macroeconomic conditions, and general market volatility. Negative market sentiment can lead to a decline in investor confidence, triggering sell-offs in cryptocurrency-related stocks like RIOT.

-

News and Events: Major news events impacting the cryptocurrency market, such as regulatory announcements or significant price swings in Bitcoin, immediately influence investor sentiment and consequently affect RIOT stock.

-

Regulatory Uncertainty: Regulatory uncertainty surrounding cryptocurrencies remains a significant concern for investors. Changes in regulations could impact the operations of Bitcoin mining companies, affecting their profitability and investor confidence.

-

Investor Sentiment Indicators: Several indicators, such as trading volume, social media sentiment, and analyst ratings, offer valuable insights into investor sentiment towards RIOT stock. Monitoring these indicators provides a broader understanding of market sentiment.

RIOT's Strategic Initiatives and Future Outlook

Analyzing RIOT's strategic initiatives and future plans is crucial for assessing its long-term potential. Expansion plans, technological upgrades, and diversification strategies play a significant role in determining the company's ability to navigate market challenges and enhance profitability.

-

Strategic Announcements: Keeping abreast of RIOT's recent announcements concerning its strategic direction, including new mining facilities, technological investments, or diversification efforts, is essential for gauging future growth potential.

-

Long-Term Impact: Evaluating the potential long-term impact of RIOT's initiatives on its stock price requires careful analysis. Successful execution of these strategies could lead to increased profitability and improved investor confidence.

-

Competitive Advantage: RIOT's competitive advantages in the Bitcoin mining industry, such as access to cheap energy, efficient mining technology, or strategic partnerships, are crucial factors in assessing its future outlook and potential for stock price growth.

Conclusion

This analysis reveals that the recent decline in Riot Platforms (RIOT) stock is multifaceted, influenced by Bitcoin price volatility, rising energy costs, and broader market sentiment. Understanding these interconnected factors is crucial for investors evaluating RIOT's potential. While the current market conditions present challenges for RIOT, investors should carefully monitor these key indicators and consider RIOT's long-term strategies before making any investment decisions regarding RIOT stock. Further research into RIOT's financial reports and market analysis is recommended before investing in Riot Platforms stock.

Featured Posts

-

Daily Lotto Draw Wednesday April 16th 2025 Winning Numbers

May 03, 2025

Daily Lotto Draw Wednesday April 16th 2025 Winning Numbers

May 03, 2025 -

High Public Confidence In Sc Elections 93 Approval Rating

May 03, 2025

High Public Confidence In Sc Elections 93 Approval Rating

May 03, 2025 -

Lottoergebnisse 6aus49 Ziehung Am 19 April 2025

May 03, 2025

Lottoergebnisse 6aus49 Ziehung Am 19 April 2025

May 03, 2025 -

Rumeurs De Complot Macron Vatican Influence Sur L Election Papale

May 03, 2025

Rumeurs De Complot Macron Vatican Influence Sur L Election Papale

May 03, 2025 -

The Increasing Homeless Population In Tulsa Challenges And Responses At The Tulsa Day Center

May 03, 2025

The Increasing Homeless Population In Tulsa Challenges And Responses At The Tulsa Day Center

May 03, 2025