Analyzing Riot Platforms (RIOT) And Coinbase Global (COIN) Stock Performance

Table of Contents

Understanding Riot Platforms (RIOT): A Deep Dive into Bitcoin Mining

Riot Platforms Business Model:

Riot Platforms' core business revolves around Bitcoin mining. They operate large-scale mining facilities, utilizing powerful hardware to solve complex computational problems and earn Bitcoin rewards. This process, known as Bitcoin mining, is crucial to securing the Bitcoin blockchain. Their success hinges on several key factors:

- Mining Capacity: The total amount of computational power (measured in hash rate) Riot Platforms dedicates to Bitcoin mining directly impacts their Bitcoin earning potential. A higher hash rate generally translates to more Bitcoins mined.

- Energy Consumption: Bitcoin mining is energy-intensive. Riot Platforms' operational efficiency in managing energy costs significantly impacts its profitability. Strategies to secure low-cost, sustainable energy sources are critical for long-term success.

- Geographic Diversification: Diversifying mining operations across various geographical locations mitigates risks associated with regional power outages, regulatory changes, and climate-related disruptions.

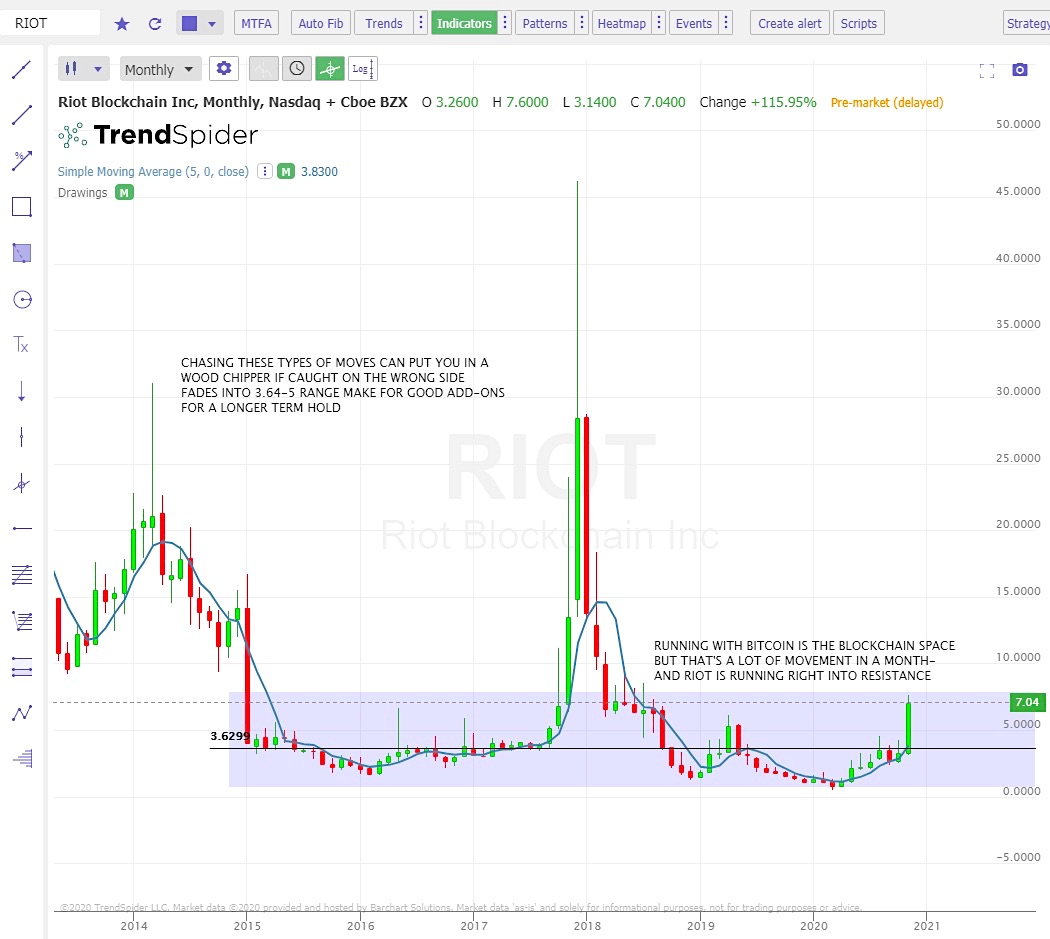

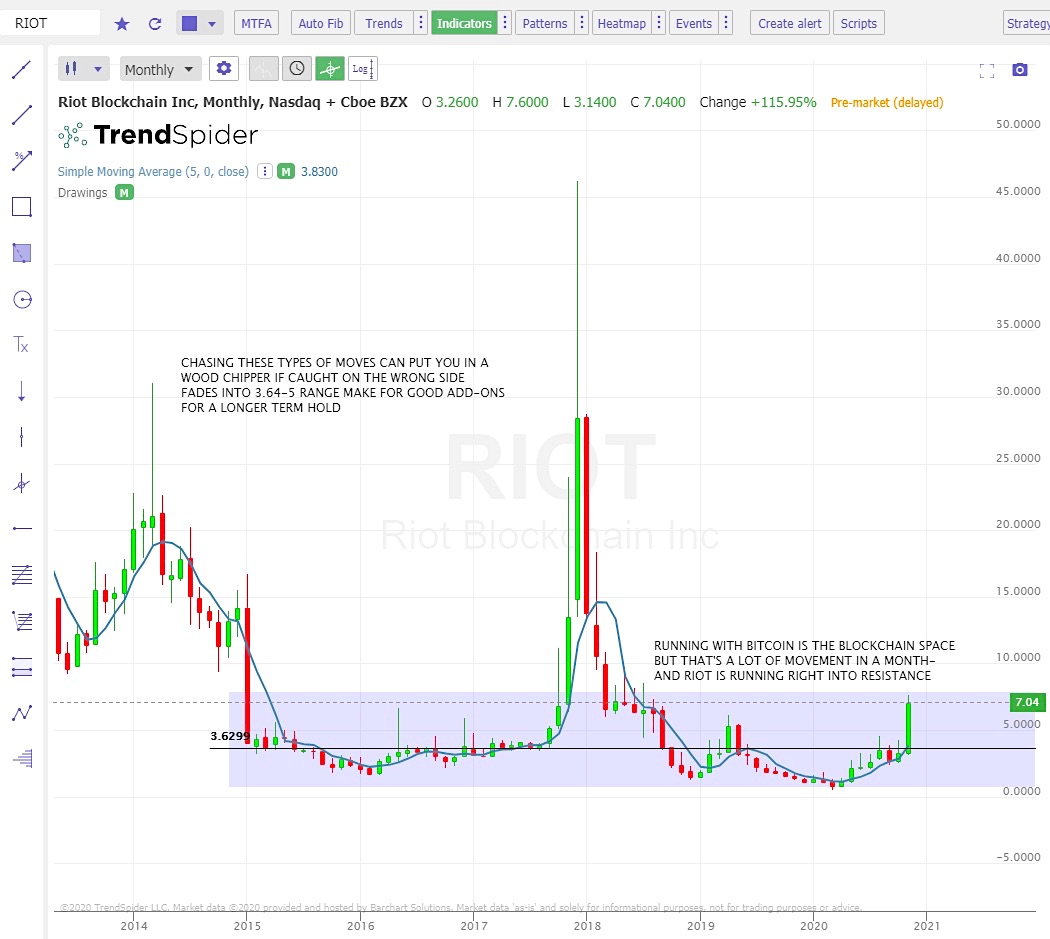

Analyzing RIOT Stock Performance:

Riot Platforms' stock price is intrinsically linked to the price of Bitcoin. However, other factors also influence its performance:

- Bitcoin Price Fluctuations: The most significant driver of RIOT's stock price is the price of Bitcoin. A rising Bitcoin price generally leads to higher revenue and profitability for Riot Platforms, boosting investor confidence and stock price.

- Regulatory Changes: Government regulations concerning cryptocurrency mining can significantly impact Riot Platforms' operations and profitability. Favorable regulations can boost investor confidence, while stringent regulations can negatively affect the stock price.

- Market Sentiment: Overall market sentiment towards cryptocurrency mining and Bitcoin's long-term prospects plays a significant role. Positive sentiment often translates to higher stock prices, while negative sentiment can lead to declines.

Key financial indicators to watch include revenue, earnings per share (EPS), and price-to-earnings ratio (P/E). Analyzing historical price trends reveals significant price movements correlated with Bitcoin's price and major regulatory announcements.

RIOT Stock Valuation and Future Outlook:

Valuing RIOT stock requires considering its current mining capacity, projected expansion plans, and the anticipated price of Bitcoin. Several factors could influence its future performance:

- Potential Catalysts for Growth: Increased Bitcoin adoption, technological advancements in mining hardware, and strategic partnerships could propel Riot Platforms' growth and increase its stock valuation.

- Potential Risks: Regulatory uncertainty, energy price volatility, and competition from other Bitcoin miners pose significant risks to Riot Platforms and its stock price.

Deconstructing Coinbase Global (COIN): The Cryptocurrency Exchange Giant

Coinbase's Business Model and Revenue Streams:

Coinbase is a leading cryptocurrency exchange, facilitating the buying, selling, and trading of various cryptocurrencies. Its revenue streams primarily include:

- Trading Fees: Coinbase generates revenue by charging fees on cryptocurrency transactions conducted on its platform. Trading volume directly impacts this revenue stream.

- Staking Rewards: Coinbase offers staking services, allowing users to earn rewards by locking up their crypto assets. This contributes to their overall revenue.

- Subscription Fees: Coinbase offers subscription-based services for institutional investors and other high-volume traders.

Coinbase's market share, user base, and competitive landscape are constantly evolving, influencing its overall financial performance.

Analyzing COIN Stock Performance:

Coinbase's stock price is influenced by a multitude of factors:

- Cryptocurrency Market Trends: The overall performance of the cryptocurrency market significantly impacts Coinbase's trading volume and, subsequently, its revenue and stock price.

- Regulatory Landscape: Changes in cryptocurrency regulations worldwide directly affect Coinbase's operations and investor confidence.

- Competition: The cryptocurrency exchange market is competitive. Coinbase's ability to maintain its market share and attract new users is crucial for its stock price performance.

Key financial indicators include trading volume, user growth, and net income. Analyzing historical price trends reveals correlations with cryptocurrency market cycles and major regulatory events.

COIN Stock Valuation and Future Outlook:

Valuing COIN stock requires assessing its market share, user growth, and the potential impact of regulatory changes and technological advancements. Several factors could shape its future:

- Potential Catalysts for Growth: Expanding into new markets, introducing new services (like decentralized finance offerings), and strategic partnerships can drive future growth.

- Potential Risks: Security breaches, regulatory crackdowns, and increasing competition present significant risks to Coinbase's long-term prospects.

Comparative Analysis: RIOT vs. COIN

Direct Comparison of Financial Performance:

Comparing RIOT and COIN requires analyzing their respective financial metrics:

- Revenue Growth: Comparing the revenue growth rates of both companies reveals which is experiencing faster expansion.

- Profitability: Analyzing profitability metrics (like net income margins) helps assess the efficiency and sustainability of each business model.

- Valuation Multiples: Comparing valuation multiples (like P/E ratios) offers insights into market expectations for future growth.

Investment Strategies and Risk Assessment:

Investment strategies for RIOT and COIN should consider:

- Risk Tolerance: Investors with higher risk tolerance might be more inclined towards RIOT, given its direct exposure to Bitcoin's price volatility. COIN presents a comparatively less volatile, albeit still risky, investment.

- Investment Horizon: A long-term investment horizon might be more suitable for both stocks, given the inherent volatility of the cryptocurrency market.

- Diversification Strategies: Diversifying investments across multiple asset classes is crucial to mitigate risks associated with cryptocurrency investments.

Investing in the Future of Cryptocurrency: A Recap of RIOT and COIN

This analysis has highlighted the key factors influencing the performance of Riot Platforms (RIOT) and Coinbase Global (COIN) stocks. Understanding their respective business models, revenue streams, and the broader cryptocurrency market dynamics is crucial for making informed investment decisions. Key takeaways emphasize the importance of considering Bitcoin price volatility for RIOT and the regulatory landscape for COIN.

Remember, investing in cryptocurrency-related stocks involves substantial risk. Conduct thorough due diligence and consider your risk tolerance before making any investment decisions. Stay informed on Riot Platforms (RIOT) and Coinbase Global (COIN) stock performance by continuing your research and monitoring market trends.

Featured Posts

-

The Merrie Monarch Festival A Deep Dive Into Hoikes Cultural Performances

May 02, 2025

The Merrie Monarch Festival A Deep Dive Into Hoikes Cultural Performances

May 02, 2025 -

Orta Afrika Cumhuriyeti Nin Bae Ile Yeni Ticaret Anlasmasi Gelecege Bakis

May 02, 2025

Orta Afrika Cumhuriyeti Nin Bae Ile Yeni Ticaret Anlasmasi Gelecege Bakis

May 02, 2025 -

2 6 1

May 02, 2025

2 6 1

May 02, 2025 -

Tuesday April 15 2025 Daily Lotto Results

May 02, 2025

Tuesday April 15 2025 Daily Lotto Results

May 02, 2025 -

Wachtlijsten Tbs De Gevolgen Van Overvolle Klinieken

May 02, 2025

Wachtlijsten Tbs De Gevolgen Van Overvolle Klinieken

May 02, 2025

Latest Posts

-

Tensions Accrues Macron Prepare De Nouvelles Sanctions Contre La Russie

May 03, 2025

Tensions Accrues Macron Prepare De Nouvelles Sanctions Contre La Russie

May 03, 2025 -

France Russie Macron Annonce Une Intensification De La Pression Sur Moscou

May 03, 2025

France Russie Macron Annonce Une Intensification De La Pression Sur Moscou

May 03, 2025 -

La Russie Face A La Pression De Macron Developpements Attendus

May 03, 2025

La Russie Face A La Pression De Macron Developpements Attendus

May 03, 2025 -

Macron Intensifie La Pression Sur La Russie Les Prochains Jours Seront Decisifs

May 03, 2025

Macron Intensifie La Pression Sur La Russie Les Prochains Jours Seront Decisifs

May 03, 2025 -

Emmanuel Macron Pression Accrue Sur Moscou Prevue Prochainement

May 03, 2025

Emmanuel Macron Pression Accrue Sur Moscou Prevue Prochainement

May 03, 2025