Analyzing QBTS Stock Performance After The Next Earnings Release

Table of Contents

Understanding QBTS's Current Financial Position

Before predicting QBTS stock's post-earnings movement, it's vital to understand the company's current financial health. A thorough analysis requires reviewing recent financial statements and understanding the broader industry landscape.

Reviewing Recent Financial Statements

To establish a baseline, we need to examine QBTS's recent quarterly and annual reports. Key financial metrics to consider include:

- Revenue: Has revenue shown consistent growth or decline? Are there any significant shifts in revenue streams?

- Earnings Per Share (EPS): What is the trend in EPS? Are profits increasing or decreasing?

- Net Income: What is the overall profitability of QBTS? Are there any unusual expenses impacting net income?

- Debt-to-Equity Ratio: How leveraged is the company? A high debt-to-equity ratio can indicate higher risk.

Analyzing these metrics reveals trends and potential weaknesses that could impact future performance. Any press releases or announcements impacting investor sentiment should also be considered. For instance, a recent product launch or strategic partnership could boost future earnings and positively influence QBTS stock price.

Analyzing QBTS's Industry Landscape

QBTS operates within a specific industry, and understanding the competitive landscape and industry trends is critical. Factors to consider include:

- Major Competitors: Who are QBTS's main competitors? How does QBTS compare in terms of market share, innovation, and profitability?

- Industry Growth Rate: Is the industry experiencing growth or decline? A declining industry could negatively impact QBTS's future performance.

- Regulatory Changes: Are there any impending regulations that could impact QBTS's operations or profitability?

- Economic Factors: What are the broader economic factors (e.g., inflation, interest rates) that could influence consumer spending and, consequently, QBTS's revenue?

These industry-specific factors can significantly influence investor confidence and affect QBTS stock performance post-earnings.

Assessing Analyst Expectations

Consensus analyst forecasts provide valuable insight into market expectations for QBTS's upcoming earnings report. Consider the following:

- Range of Analyst Estimates: What is the range of EPS and revenue projections from different analysts? A wide range suggests uncertainty.

- Potential Upside/Downside Surprises: What is the probability of QBTS exceeding or missing expectations? This helps assess the potential volatility of the stock price.

- Historical Accuracy of Analyst Forecasts: How accurate have analyst forecasts been for QBTS in the past? This indicates the reliability of current projections.

Understanding analyst expectations allows for a more nuanced assessment of the potential impact of the earnings release on QBTS stock price. Exceeding expectations usually leads to a positive stock price reaction, while missing them often results in a decline.

Potential Scenarios Following the Earnings Release

The actual outcome of the QBTS earnings release can significantly influence its stock price. Let's explore three potential scenarios:

Positive Earnings Surprise

Exceeding analyst expectations can lead to a positive stock price reaction. Factors contributing to a positive surprise could include:

- Stronger-than-anticipated sales growth.

- Improved margins.

- Successful new product launches.

- Cost-cutting initiatives.

In such a scenario, we could expect increased trading volume and a substantial rise in the QBTS stock price. Investors might adopt aggressive buying strategies, driving up demand.

Negative Earnings Surprise

Missing analyst expectations can lead to a significant stock price decline. Factors contributing to a negative surprise could include:

- Lower-than-expected sales.

- Increased expenses.

- Supply chain disruptions.

- Increased competition.

In this scenario, increased volatility is expected, and investors might adopt risk-averse strategies, potentially leading to a sell-off. Risk management strategies, such as stop-loss orders, become crucial.

Meeting Expectations

If QBTS meets analysts' forecasts, the stock price reaction might be less dramatic. However, factors such as future guidance (the company's outlook for future performance) can still significantly influence the price. Positive guidance can create positive momentum, while negative guidance could lead to a price decline. Monitoring investor sentiment and news releases following the earnings announcement is crucial in this scenario.

Strategies for Investing in QBTS After Earnings

Investing in QBTS after the earnings release requires careful consideration of pre- and post-earnings strategies and sound risk management.

Pre-Earnings Strategies

Before the earnings release, investors might consider:

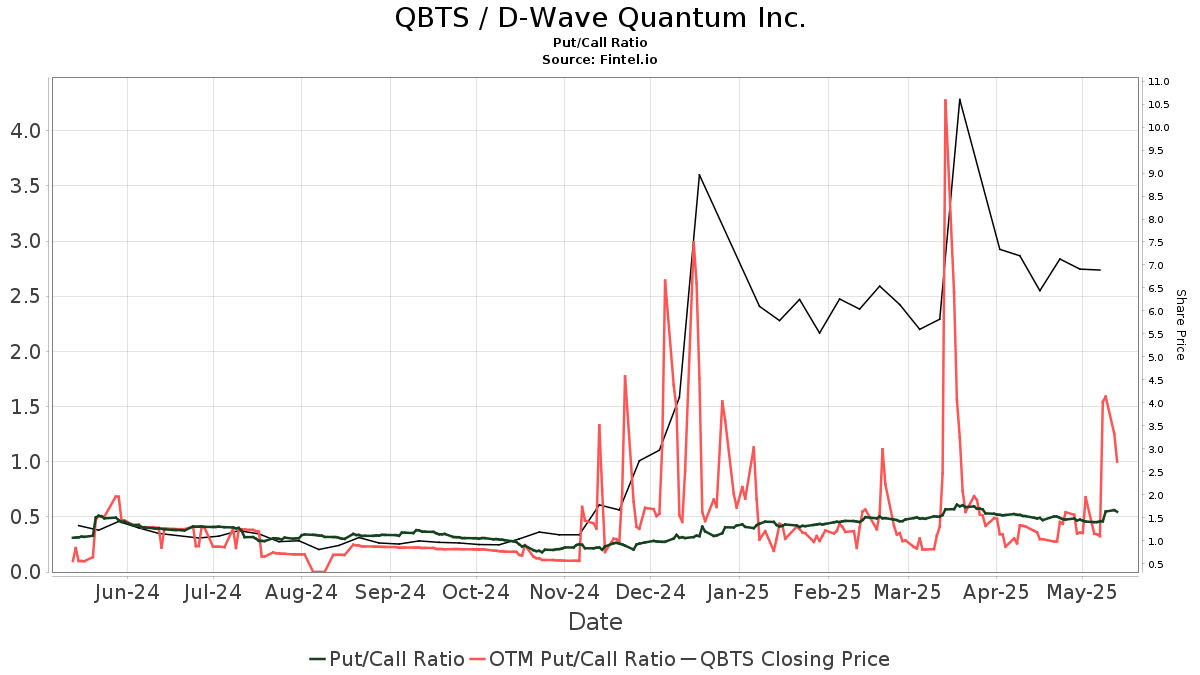

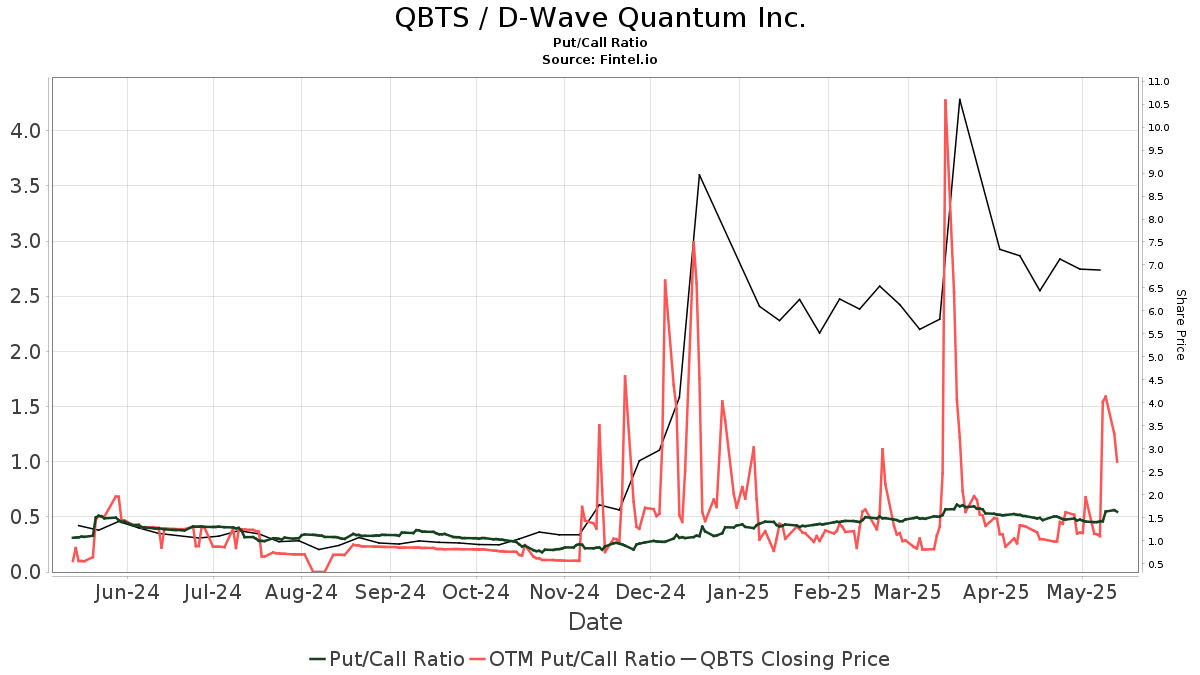

- Hedging: Using options or other derivatives to protect against potential losses.

- Adjusting Positions: Reducing exposure to QBTS if concerned about potential downside risk.

Post-Earnings Strategies

The appropriate post-earnings strategy depends on the actual results. Options include:

- Buying the Dip: Purchasing shares if the price declines following a negative surprise, believing the market has overreacted.

- Taking Profits: Selling shares if the price rises significantly following a positive surprise.

- Holding: Maintaining existing positions based on long-term investment goals and belief in the company's future prospects.

Risk Management

Regardless of the chosen strategy, risk management is paramount. Investors should:

- Diversify their portfolio to mitigate risk.

- Only invest what they can afford to lose.

- Consider their individual risk tolerance before making investment decisions.

Conclusion: Making Informed Decisions on QBTS Stock Post-Earnings

Predicting QBTS stock performance after the next earnings release requires a thorough analysis of its current financial position, the industry landscape, and analyst expectations. Understanding potential scenarios and developing a well-defined investment strategy, including risk management, is crucial for making informed investment decisions. Analyze QBTS stock performance carefully, monitor QBTS earnings reports diligently, and invest in QBTS strategically. Remember to conduct thorough due diligence and continue monitoring QBTS stock performance and related news for optimal investment outcomes. By following these steps, you can significantly improve your chances of successful investing in QBTS.

Featured Posts

-

Jalkapallo Avauskokoonpano Paljastui Kamara Ja Pukki Sivussa

May 20, 2025

Jalkapallo Avauskokoonpano Paljastui Kamara Ja Pukki Sivussa

May 20, 2025 -

Eurovision 2024 Louanes Song Unveiled

May 20, 2025

Eurovision 2024 Louanes Song Unveiled

May 20, 2025 -

D Wave Quantum Inc Qbts Explaining The Stocks Thursday Price Movement

May 20, 2025

D Wave Quantum Inc Qbts Explaining The Stocks Thursday Price Movement

May 20, 2025 -

Moodys 30 Year Yield At 5 Implications For Selling In America

May 20, 2025

Moodys 30 Year Yield At 5 Implications For Selling In America

May 20, 2025 -

Crisis En La Familia Schumacher Mick Se Separa Y Busca El Amor En App De Citas

May 20, 2025

Crisis En La Familia Schumacher Mick Se Separa Y Busca El Amor En App De Citas

May 20, 2025

Latest Posts

-

Yllaetyksiae Avauskokoonpanossa Kamaran Ja Pukin Tilanne

May 20, 2025

Yllaetyksiae Avauskokoonpanossa Kamaran Ja Pukin Tilanne

May 20, 2025 -

Huuhkajat Kaellmanin Maalit Ja Kehitys

May 20, 2025

Huuhkajat Kaellmanin Maalit Ja Kehitys

May 20, 2025 -

Huuhkajat Saavat Vahvistusta Benjamin Kaellmanin Maalivire

May 20, 2025

Huuhkajat Saavat Vahvistusta Benjamin Kaellmanin Maalivire

May 20, 2025 -

Jalkapallo Avauskokoonpano Paljastui Kamara Ja Pukki Sivussa

May 20, 2025

Jalkapallo Avauskokoonpano Paljastui Kamara Ja Pukki Sivussa

May 20, 2025 -

Benjamin Kaellman Maalivire Huuhkajien Avuksi

May 20, 2025

Benjamin Kaellman Maalivire Huuhkajien Avuksi

May 20, 2025