Analyzing Gibraltar Industries (ROCK) Upcoming Earnings Report

Table of Contents

Key Metrics to Watch in the Gibraltar Industries (ROCK) Earnings Report

The upcoming Gibraltar Industries (ROCK) Earnings Report will be scrutinized for several key performance indicators. Understanding these metrics is essential for assessing the company's financial health and future prospects.

Revenue Growth: ROCK Revenue and Sales Performance

Analyzing historical revenue trends is crucial for predicting future performance. Gibraltar Industries’ revenue growth will be a primary focus.

- Past Performance: Examining past quarters and years reveals trends in ROCK revenue and identifies periods of growth or decline.

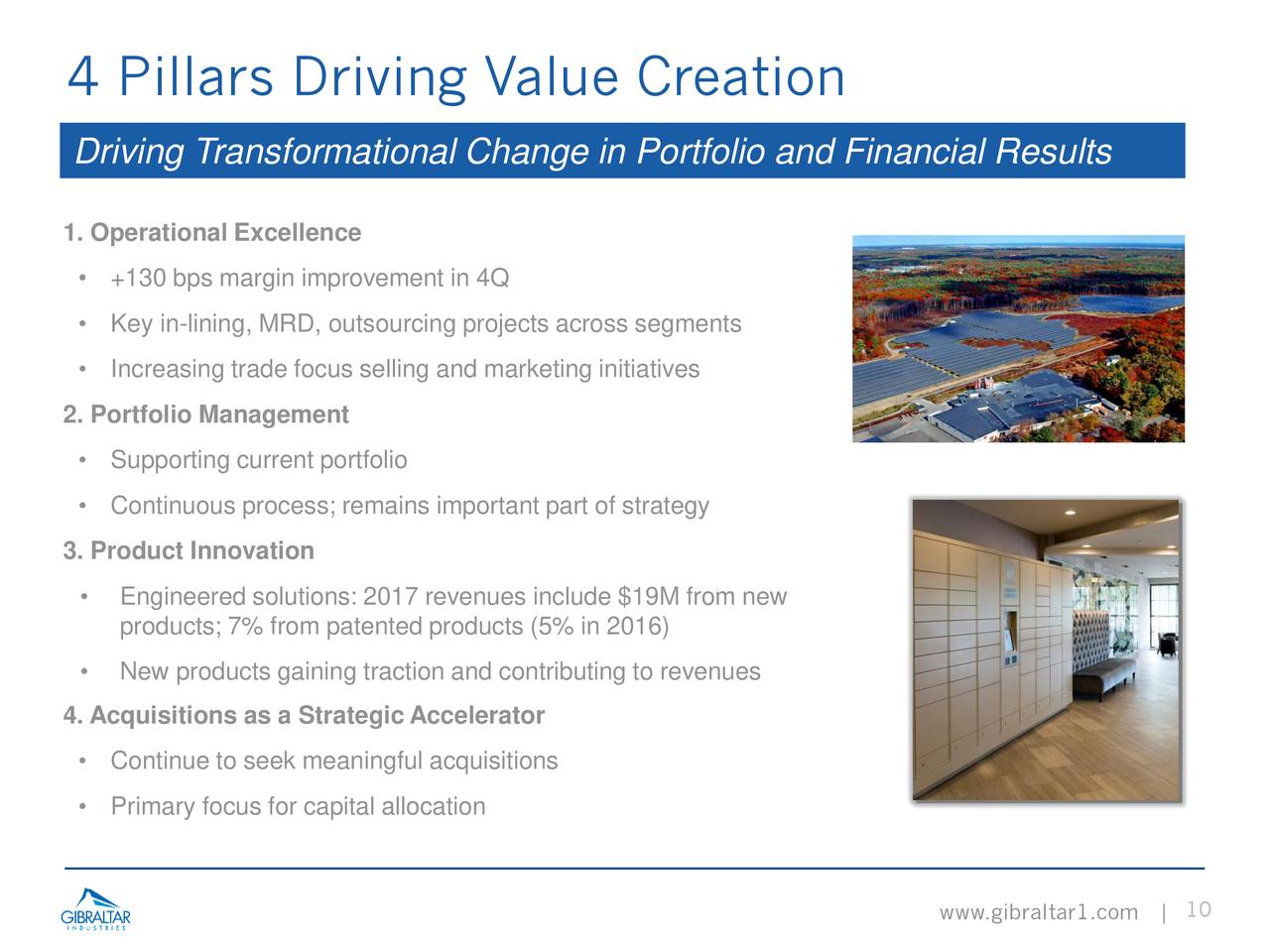

- New Product Launches: The success of new product introductions will significantly impact Gibraltar Industries sales. Strong sales of new items indicate market acceptance and potential for future growth.

- Market Expansion: Expansion into new geographic markets or customer segments will directly influence ROCK revenue.

- Acquisitions: Any recent acquisitions should be considered, as they may boost Gibraltar Industries sales immediately or in the near future.

Comparing projected ROCK revenue against analyst estimates and previous quarters will provide a clearer picture of the company's performance trajectory. Positive surprises could lead to upward pressure on the stock price.

Profitability Analysis: ROCK Profit Margin and Earnings per Share (EPS)

Profitability is a key indicator of a company's financial health. For Gibraltar Industries, this means examining gross margin, operating margin, and net income.

- Raw Material Costs: Fluctuations in raw material prices directly impact Gibraltar Industries profitability. Increased costs can squeeze margins, while cost-cutting measures can boost profitability.

- Manufacturing Efficiency: Improvements in manufacturing efficiency translate to higher profit margins. Analyzing efficiency gains will provide insight into the company's operational effectiveness.

- Pricing Strategies: The company's pricing strategies will play a crucial role in determining ROCK profit margin. Competitive pricing can boost volume but might reduce margins, while premium pricing can enhance profitability but might limit volume.

A comparison of profitability metrics to previous periods and industry benchmarks will provide context and help investors gauge Gibraltar Industries’ performance relative to its competitors. Analyzing earnings per share (EPS) will show the profitability on a per-share basis.

Cash Flow and Balance Sheet: Assessing ROCK Cash Flow and Financial Strength

Analyzing Gibraltar Industries’ cash flow statement and balance sheet reveals its financial health and ability to meet its obligations.

- Cash Flow from Operations: Strong positive cash flow from operations indicates a healthy business model capable of generating cash.

- Capital Expenditures: Investments in capital expenditures, like new equipment, show long-term investment in growth but might temporarily reduce short-term cash flow.

- Debt Levels: High debt levels can indicate financial risk, while low debt levels suggest a strong financial position. Analyzing Gibraltar Industries debt and its ability to service that debt is critical.

The company's liquidity position—its ability to meet short-term obligations—and its overall financial strength are key factors to consider. Analyzing ROCK cash flow provides insights into the company's financial stability.

Analyzing the Impact of External Factors on Gibraltar Industries (ROCK) Earnings

External factors significantly impact Gibraltar Industries’ performance. Understanding these factors is essential for a complete analysis.

Macroeconomic Conditions: Macroeconomic Impact on ROCK and Gibraltar Industries and Inflation

Macroeconomic conditions significantly influence Gibraltar Industries (ROCK).

- Inflation: High inflation can increase raw material costs, impacting margins and potentially reducing consumer demand for building products.

- Interest Rates: Rising interest rates can increase borrowing costs for both Gibraltar Industries and its customers, potentially slowing down construction projects and impacting demand.

- Recessionary Fears: Concerns about a recession can lead to decreased consumer and business spending, affecting demand for Gibraltar Industries' products.

Analyzing how these factors might affect demand for Gibraltar Industries' products and services is critical for predicting the company’s performance.

Industry Trends and Competition: ROCK Competitors and Gibraltar Industries Industry Trends

The building products industry is dynamic, with several trends and competitive pressures impacting Gibraltar Industries.

- Key Competitors: Identifying key competitors and analyzing their market share provides insight into Gibraltar Industries' competitive position. Understanding competitive strategies and market dynamics is crucial.

- Sustainability: Growing emphasis on sustainable building materials presents both opportunities and challenges for Gibraltar Industries. The company's commitment to sustainable practices will be an important factor.

- Technological Advancements: Technological advancements in building materials and construction methods can disrupt the market. Gibraltar Industries’ ability to adapt to and leverage these advancements is important.

- Regulatory Changes: Changes in building codes and environmental regulations can influence demand for specific products and impact Gibraltar Industries’ operations.

Investor Sentiment and Stock Price Implications

Understanding investor sentiment and expectations surrounding the Gibraltar Industries (ROCK) Earnings Report is crucial.

Pre-Earnings Expectations: ROCK Stock Price and Gibraltar Industries Investor Sentiment

Analyst forecasts and investor sentiment play a significant role in shaping the market's reaction to the earnings report.

- Analyst Estimates: Comparing the actual results to analyst expectations will be key. Beating expectations often leads to positive market reactions, while missing expectations can lead to negative reactions.

- Market Reaction Scenarios: Consider various scenarios: a positive surprise (beating expectations), meeting expectations, and a negative surprise (missing expectations). Each scenario will have different implications for the ROCK stock price.

Post-Earnings Trading Strategy: ROCK Trading Strategy and Gibraltar Industries Stock Outlook

Based on the earnings report results, investors may develop various trading strategies.

- Buy: Strong results exceeding expectations could trigger a buy signal.

- Hold: Meeting expectations might lead to a hold strategy.

- Sell: Disappointing results could prompt a sell signal.

Disclaimer: This is not financial advice. Always consult with a financial professional before making any investment decisions.

Conclusion: Preparing for the Gibraltar Industries (ROCK) Earnings Release

The upcoming Gibraltar Industries (ROCK) Earnings Report will be influenced by key metrics like revenue growth, profitability, and cash flow, as well as external factors including macroeconomic conditions and industry trends. Monitoring these factors is critical for making informed investment decisions. Understanding the interplay of these factors will allow you to assess the Gibraltar Industries (ROCK) financial results accurately. Stay updated on the Gibraltar Industries (ROCK) earnings report and conduct thorough research before making any investment decisions. Analyze the Gibraltar Industries (ROCK) performance carefully, considering the insights provided in this analysis of the ROCK earnings analysis and understanding Gibraltar Industries’ (ROCK) performance relative to its peers.

Featured Posts

-

The Big Issues Childrens Competition And The Winner Is

May 13, 2025

The Big Issues Childrens Competition And The Winner Is

May 13, 2025 -

Schoduvel 2025 Braunschweig Karneval Im Tv Und Live Stream

May 13, 2025

Schoduvel 2025 Braunschweig Karneval Im Tv Und Live Stream

May 13, 2025 -

Dispute Over Epic City Development Abbotts Warning Vs Developers Denial

May 13, 2025

Dispute Over Epic City Development Abbotts Warning Vs Developers Denial

May 13, 2025 -

Analyzing The Da Vinci Code Literary Techniques And Narrative Structure

May 13, 2025

Analyzing The Da Vinci Code Literary Techniques And Narrative Structure

May 13, 2025 -

Sabalenka Defeats Paolini Reaches Porsche Grand Prix Final

May 13, 2025

Sabalenka Defeats Paolini Reaches Porsche Grand Prix Final

May 13, 2025