Analyzing Economic Trends: Trump's Impact, Or Lack Thereof

Table of Contents

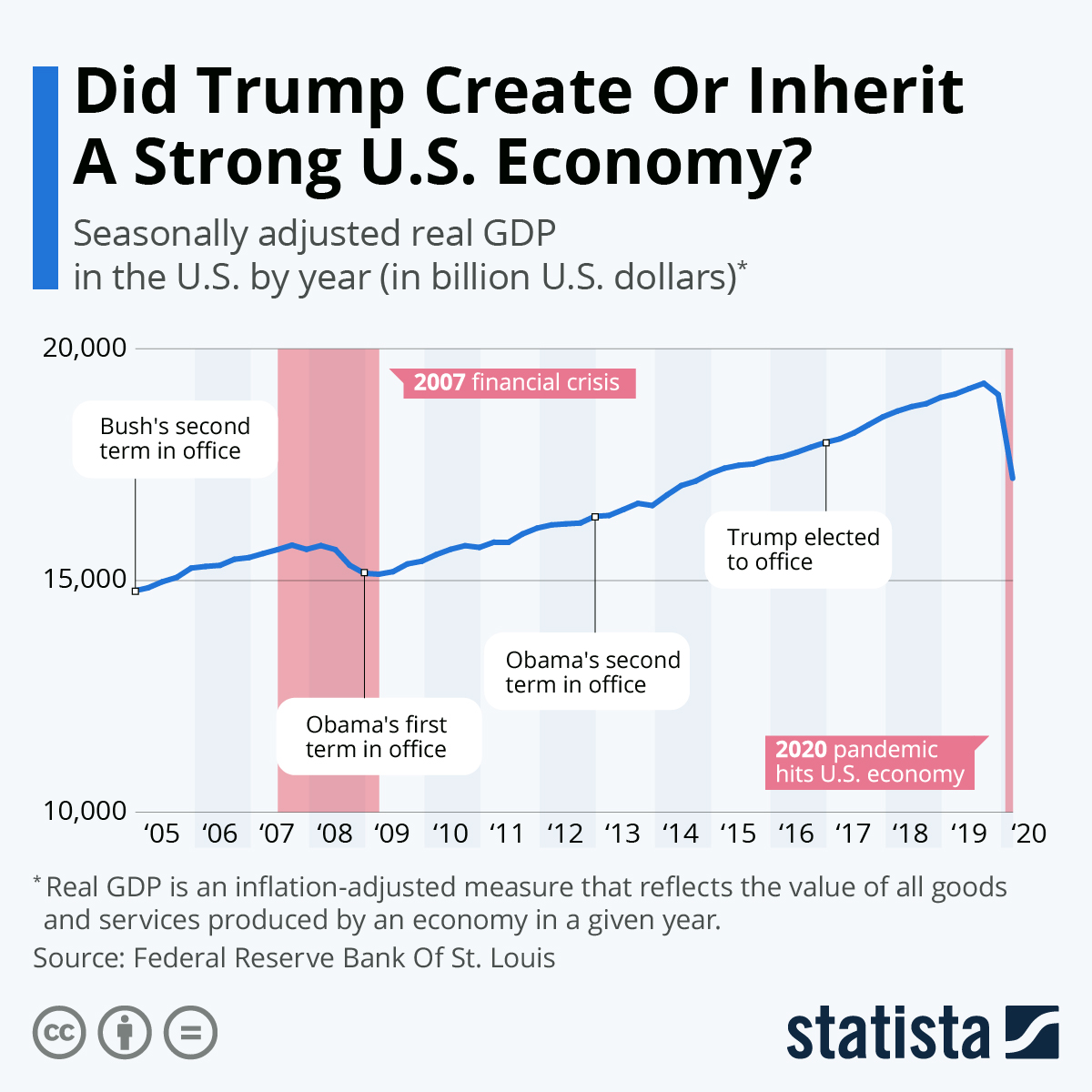

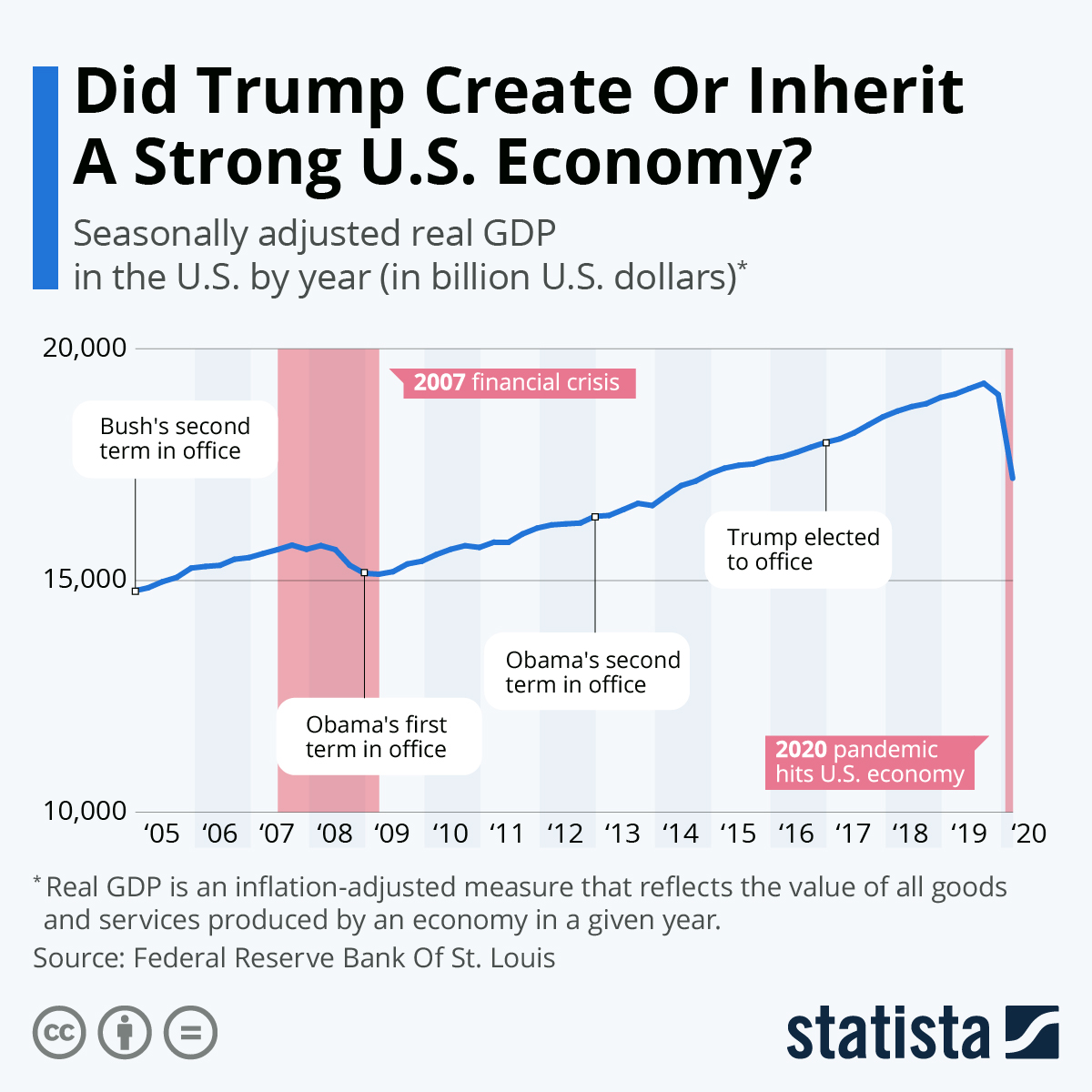

GDP Growth and Job Creation Under Trump

Initial Growth and the Tax Cuts and Jobs Act

The initial years of Trump's presidency saw a period of economic expansion. The Tax Cuts and Jobs Act of 2017, a significant piece of legislation, aimed to stimulate the economy through substantial corporate and individual tax cuts. Proponents argued this would boost investment, job creation, and overall GDP growth. However, critics countered that the tax cuts disproportionately benefited corporations and the wealthy, leading to increased national debt without generating sustainable long-term growth. The effectiveness of this legislation remains a subject of ongoing debate.

- GDP growth rates:

- 2017: 2.3%

- 2018: 2.9%

- 2019: 2.3%

- 2020: -3.5% (significantly impacted by the COVID-19 pandemic)

- Job creation: While job growth was positive during much of this period, analyzing sector-specific growth is crucial. The service sector continued its dominance, while manufacturing saw modest gains, often attributed to global factors rather than solely domestic policies.

- Comparison to pre-Trump growth: Comparing these figures to the economic growth rates of the Obama administration provides crucial context. While Trump's early years showed growth, it's vital to consider if this represented a continuation of pre-existing trends or a significant departure.

The Impact of Trade Wars and Tariffs

Trump's administration initiated a series of trade wars, most notably with China. These trade wars involved imposing tariffs on imported goods, aiming to protect American industries and reduce trade deficits. However, the impact was complex and controversial. Tariffs led to increased prices for consumers, negatively impacting purchasing power. American businesses faced increased costs, and some sectors experienced significant disruptions.

- Tariff impacts: Industries like agriculture and manufacturing faced substantial challenges due to retaliatory tariffs imposed by other countries.

- Trade deficits: While the initial goal was to reduce trade deficits, the impact of tariffs on the overall trade balance is debated. Some analyses show that the trade deficits persisted or even worsened in certain areas.

- Economic cost: The overall economic cost of the trade wars is difficult to quantify precisely, but studies suggest negative impacts on GDP growth and consumer welfare.

Inflation and Interest Rates During the Trump Administration

Inflationary Pressures and Monetary Policy

Inflation rates during Trump's presidency remained relatively low compared to historical levels. The Federal Reserve, responsible for monetary policy, maintained a low interest rate environment for much of this period. However, as the economy grew, there were concerns about potential inflationary pressures. The Federal Reserve's response involved gradual interest rate adjustments, a delicate balancing act aiming to maintain economic growth without triggering significant inflation.

- Inflation rates: Annual inflation rates remained consistently below the Federal Reserve's target rate throughout much of Trump's term.

- Interest rate changes: The Federal Reserve implemented several interest rate hikes and cuts throughout the period, reflecting their response to economic conditions.

- Impact on borrowing: These interest rate changes influenced borrowing costs for businesses and consumers, impacting investment and spending decisions.

The Role of the Energy Sector and Oil Prices

The energy sector experienced significant changes during Trump's presidency. Increased domestic oil production, fueled by policies promoting fossil fuel extraction, led to lower oil prices. This had a complex effect on the economy, benefiting consumers through lower gasoline prices but potentially harming the renewable energy sector.

- Oil prices: Oil prices fluctuated throughout the period, influenced by global supply and demand factors.

- Domestic oil production: Domestic oil production significantly increased during this time.

- Impact on GDP: The energy sector's contribution to GDP growth was noteworthy, but its overall impact on economic indicators remains a topic of ongoing analysis.

Long-Term Economic Trends and Trump's Legacy

Assessing the Sustainability of Economic Growth

The sustainability of economic growth under Trump is a key area of debate. Some argue that the growth was primarily driven by short-term stimulus measures, while others point to longer-term factors like technological advancements and demographic shifts. Determining the lasting impact requires further analysis.

- Comparison to other presidents: Comparing economic growth under Trump to previous administrations provides context for evaluating his economic legacy.

- Long-term indicators: Examining long-term indicators, such as productivity growth and infrastructure investment, helps evaluate the sustainability of the economic gains.

- Underlying factors: Understanding the underlying factors driving economic growth, like technological innovation and global economic conditions, is critical.

The Unforeseen Impact of the COVID-19 Pandemic

The COVID-19 pandemic dramatically disrupted the economy, making a clear assessment of Trump's economic legacy even more challenging. The pandemic's impact on GDP, employment, and inflation requires careful separation from the effects of policies implemented prior to the crisis.

- Pandemic's impact: The pandemic caused a sharp recession, widespread job losses, and significant shifts in economic activity.

- Government responses: Government responses, such as stimulus packages, had significant economic consequences.

- Long-term consequences: The long-term economic consequences of the pandemic are still unfolding and require further study.

Conclusion

This analysis of economic trends during Trump's presidency reveals a complex picture. While initial GDP growth and job creation were noteworthy, factors like trade wars and the COVID-19 pandemic complicate a straightforward assessment. Understanding these interwoven trends is crucial for informed policy decisions. Further research into the long-term effects of policies implemented during this period is needed to fully understand the legacy of economic trends during Trump's presidency. Continue your exploration by researching specific economic indicators and their correlations with policy decisions during this era.

Featured Posts

-

The Zuckerberg Trump Era Impact On Technology And Society

Apr 23, 2025

The Zuckerberg Trump Era Impact On Technology And Society

Apr 23, 2025 -

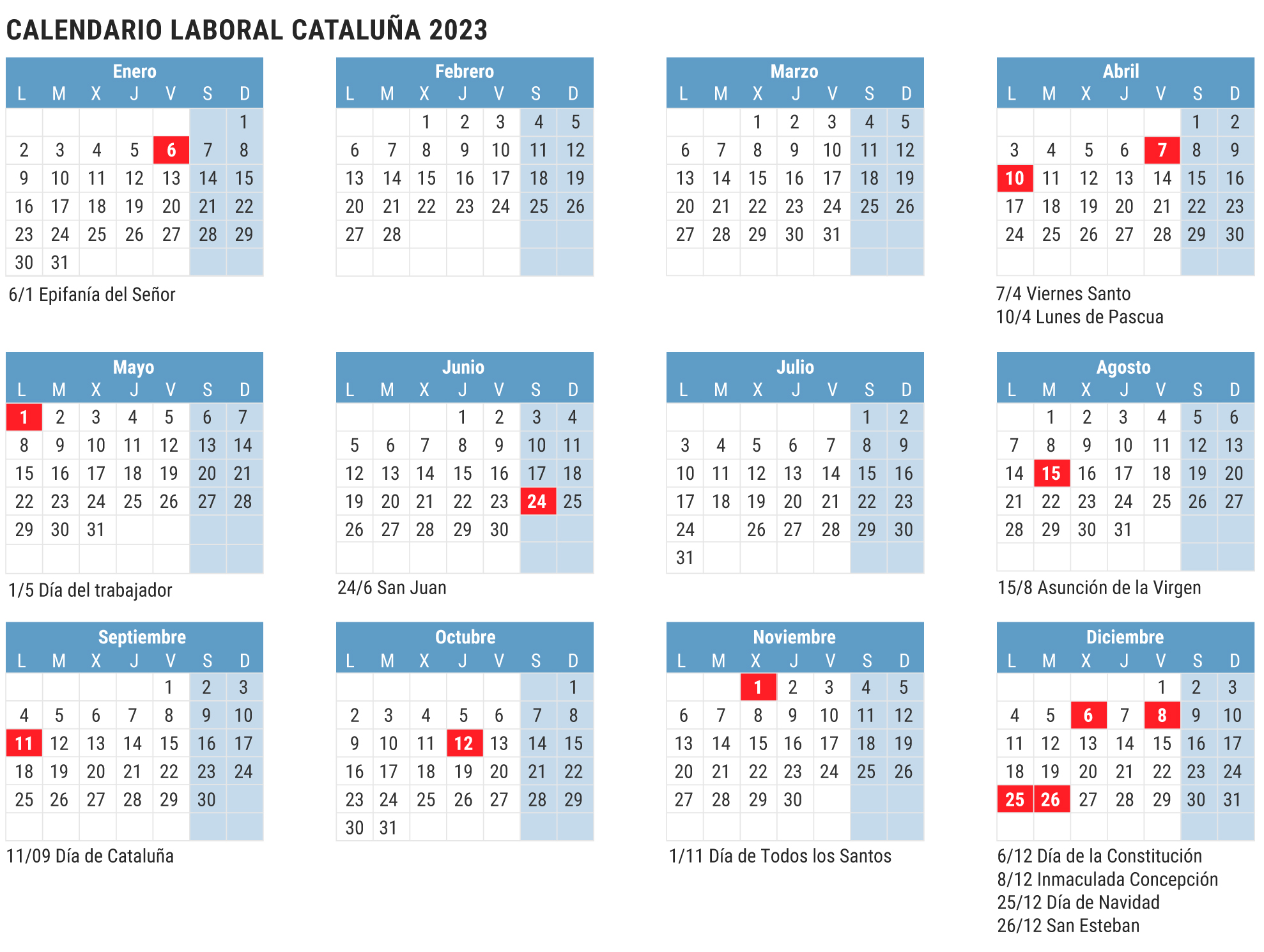

Calendario Laboral 21 De Abril Festivo Planifica Tu Puente

Apr 23, 2025

Calendario Laboral 21 De Abril Festivo Planifica Tu Puente

Apr 23, 2025 -

Cub Southpaw Shota Imanagas Mlb Best Splitter A Deep Dive

Apr 23, 2025

Cub Southpaw Shota Imanagas Mlb Best Splitter A Deep Dive

Apr 23, 2025 -

Diamondbacks Walk Off Win Stuns Brewers In Ninth Inning

Apr 23, 2025

Diamondbacks Walk Off Win Stuns Brewers In Ninth Inning

Apr 23, 2025 -

Legislatives Allemandes J 6 Enjeux Candidats Et Pronostics

Apr 23, 2025

Legislatives Allemandes J 6 Enjeux Candidats Et Pronostics

Apr 23, 2025