Analyzing BigBear.ai Stock: A Potential Investment Opportunity

Table of Contents

BigBear.ai's Business Model and Revenue Streams

BigBear.ai offers a suite of AI-powered solutions primarily targeting the defense, intelligence, and commercial sectors. Their core services focus on data analytics, AI-driven decision support, and cybersecurity. Understanding BigBear.ai's revenue streams is crucial for assessing the BigBear.ai investment potential.

Core Services and Target Markets

BigBear.ai's services cater to the growing need for advanced data analysis and AI-driven insights across various sectors. The defense and intelligence communities are major clients, relying on BigBear.ai's solutions for mission-critical applications. The commercial sector, encompassing industries like finance and healthcare, also represents a significant and expanding market. The growth potential within these sectors is substantial, fueling BigBear.ai's expansion.

- Defense & Intelligence: Providing advanced analytics for threat detection, predictive modeling, and operational optimization.

- Commercial: Offering AI-driven solutions for fraud detection, risk management, and improved operational efficiency.

- Cybersecurity: Developing and implementing cutting-edge cybersecurity solutions to protect sensitive data.

Key Revenue Streams

BigBear.ai's revenue is generated through a mix of government contracts and commercial agreements. Recurring revenue streams are increasingly important, showcasing the company's ability to establish long-term partnerships.

- Government Contracts: A significant portion of BigBear.ai's revenue comes from long-term contracts with government agencies. These contracts often involve substantial sums and provide revenue stability.

- Commercial Partnerships: BigBear.ai is actively expanding its commercial client base, generating recurring revenue through software licenses and service agreements.

- Research and Development: Investing in R&D generates intellectual property and strengthens BigBear.ai's competitive advantage, contributing to future revenue growth.

Financial Performance and Future Outlook

Analyzing BigBear.ai's financial performance provides insights into its past successes and potential for future growth. A thorough review of BigBear.ai's financial statements is essential for any serious BigBear.ai investment consideration.

Recent Financial Results

Recent quarterly and annual reports should be carefully examined to assess key performance indicators (KPIs). This includes reviewing revenue growth, profitability (or lack thereof), and debt levels. Positive trends in these areas suggest a healthy and growing business, while negative trends may indicate potential risks. Pay close attention to the reported Earnings Per Share (EPS), revenue growth rate, and debt-to-equity ratio to gauge the financial health of BigBear.ai.

Growth Projections and Analyst Ratings

Analyst forecasts and ratings offer valuable insight into the future outlook for BigBear.ai stock. However, remember that these predictions are not guarantees and should be considered alongside your own analysis. Consulting various reputable financial sources will give a more holistic perspective on analyst sentiment regarding BigBear.ai's stock forecast and future earnings.

- Revenue Growth: Examine the projected growth rate in revenue, considering factors like market demand and BigBear.ai’s ability to secure new contracts.

- Profitability: Evaluate BigBear.ai's path towards profitability, considering operating margins and net income.

- Analyst Ratings: Review the consensus rating from multiple reputable financial analysts, bearing in mind that ratings can be subjective.

Competitive Landscape and Market Position

Understanding BigBear.ai's position within the competitive landscape is crucial for evaluating its long-term prospects. The AI market is competitive, with numerous established players and emerging startups vying for market share.

Key Competitors and Market Share

BigBear.ai competes with several large technology companies and specialized AI firms. Identifying these competitors and assessing their relative strengths and weaknesses allows for a better understanding of BigBear.ai's market share and potential for future growth within the competitive landscape.

- Direct Competitors: Identify companies offering similar AI-powered solutions in the defense, intelligence, and commercial sectors.

- Indirect Competitors: Consider other companies offering alternative solutions that address similar customer needs.

- Market Share Analysis: Evaluate BigBear.ai’s current market share and its potential for capturing a larger portion of the market.

Competitive Advantages and Differentiation

BigBear.ai's competitive advantage lies in its proprietary technology, experienced management team, and strong partnerships. These factors distinguish it from competitors and contribute to its ability to secure contracts and expand its market reach. Highlighting these USPs is key to understanding BigBear.ai's long-term viability.

- Proprietary Technology: Analyze the uniqueness and effectiveness of BigBear.ai's AI algorithms and platforms.

- Experienced Management: Assess the leadership team's track record and expertise in the AI and defense sectors.

- Strategic Partnerships: Evaluate the strength and value of BigBear.ai's partnerships with other companies and government agencies.

Risks and Potential Downsides

Like any investment, BigBear.ai stock carries inherent risks. A thorough understanding of these risks is crucial for making an informed investment decision.

Financial Risks

BigBear.ai faces several financial risks, including reliance on government contracts, potential challenges in achieving profitability, and fluctuations in revenue streams. Analyzing these risks provides a more realistic view of the investment's potential downsides.

- Government Contract Dependence: BigBear.ai's significant reliance on government contracts exposes it to budgetary constraints and changes in government priorities.

- Profitability Challenges: Assess BigBear.ai's historical profitability and its projected path to consistent profitability.

- Debt Levels: Analyze BigBear.ai’s debt levels and the potential impact on its financial flexibility and stability.

Market Risks

Macroeconomic factors, industry-specific risks, and technological disruptions could all impact BigBear.ai's performance. Thorough consideration of these market risks allows for a more balanced assessment of potential investment outcomes.

- Geopolitical Instability: Evaluate the potential impact of international conflicts or political uncertainty on BigBear.ai's operations and contracts.

- Technological Disruption: Analyze the risk of new technologies rendering BigBear.ai's solutions obsolete.

- Competitive Pressures: Assess the competitive landscape and the potential for increased competition to erode BigBear.ai's market share.

Conclusion

Analyzing BigBear.ai stock requires a careful consideration of its business model, financial performance, competitive landscape, and inherent risks. While the company operates in a high-growth sector with significant potential, investors should be aware of the financial and market risks involved. The information presented in this article should be viewed as an initial assessment. Remember to conduct thorough due diligence before making any investment decisions. Start your own thorough analysis of BigBear.ai stock today! Learn more about investing in BigBear.ai stock by consulting reputable financial sources and seeking professional financial advice.

Featured Posts

-

The Billionaire Boys World Luxury Lifestyle And Responsibilities

May 20, 2025

The Billionaire Boys World Luxury Lifestyle And Responsibilities

May 20, 2025 -

Canadas Stance On Us Tariffs Countering Oxford Study Findings

May 20, 2025

Canadas Stance On Us Tariffs Countering Oxford Study Findings

May 20, 2025 -

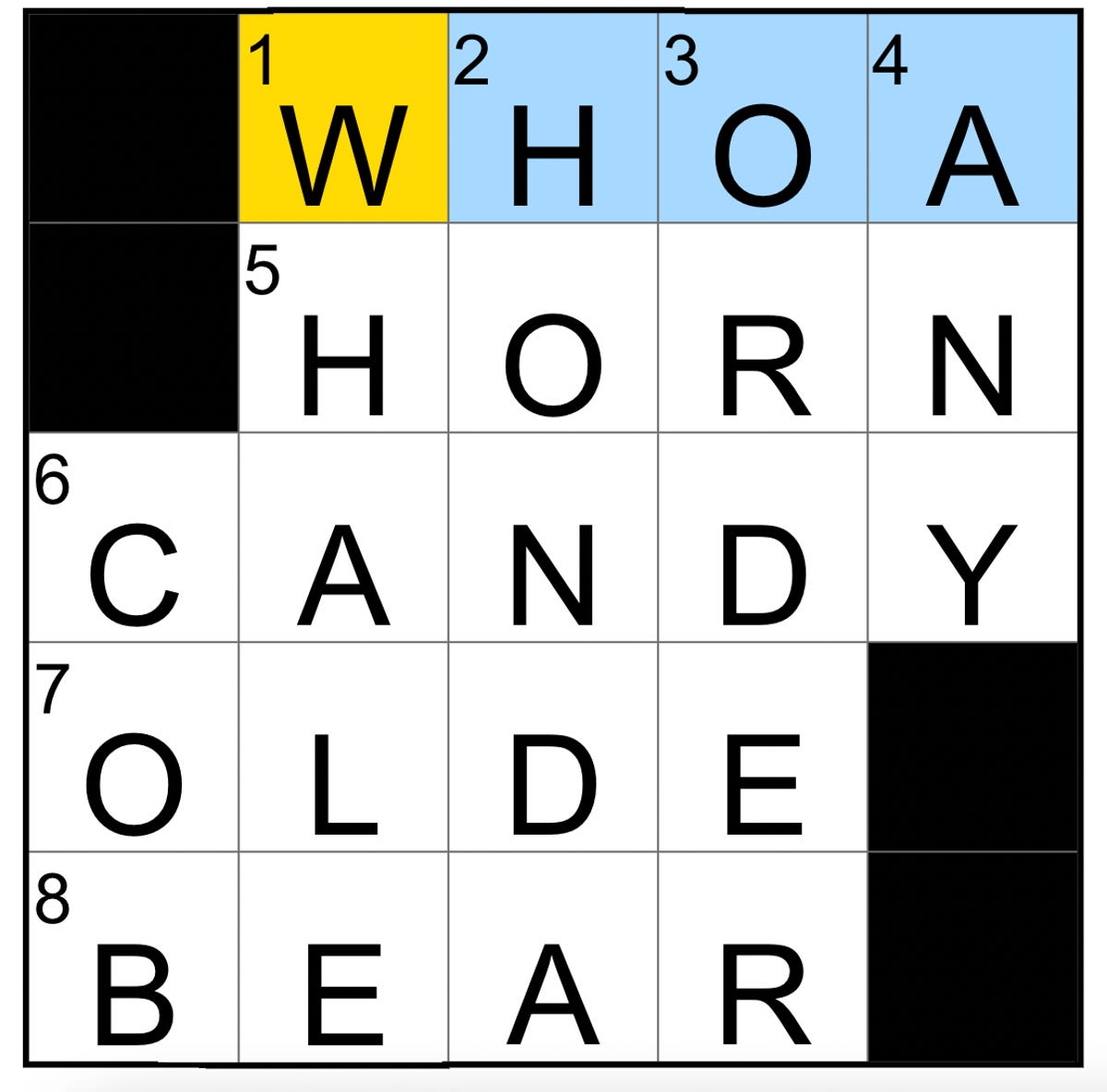

Get Help With The Nyt Mini Crossword April 26 2025

May 20, 2025

Get Help With The Nyt Mini Crossword April 26 2025

May 20, 2025 -

Apples Llm Siri Overcoming The Competition

May 20, 2025

Apples Llm Siri Overcoming The Competition

May 20, 2025 -

Tarihe Gecen Bir Yildiz Dusan Tadic In Basari Hikayesi

May 20, 2025

Tarihe Gecen Bir Yildiz Dusan Tadic In Basari Hikayesi

May 20, 2025

Latest Posts

-

Ex Tory Councillors Wife Faces Delay In Racial Hatred Tweet Appeal

May 21, 2025

Ex Tory Councillors Wife Faces Delay In Racial Hatred Tweet Appeal

May 21, 2025 -

Mother Imprisoned For Social Media Post After Southport Stabbing Incident

May 21, 2025

Mother Imprisoned For Social Media Post After Southport Stabbing Incident

May 21, 2025 -

Ex Tory Councillors Wifes Racial Hatred Tweet Appeal Awaiting Verdict

May 21, 2025

Ex Tory Councillors Wifes Racial Hatred Tweet Appeal Awaiting Verdict

May 21, 2025 -

Jail Sentence For Mother After Southport Stabbing Tweet Home Detention Appeal Fails

May 21, 2025

Jail Sentence For Mother After Southport Stabbing Tweet Home Detention Appeal Fails

May 21, 2025 -

Racial Hatred Tweet Former Tory Councillors Wifes Appeal Delayed

May 21, 2025

Racial Hatred Tweet Former Tory Councillors Wifes Appeal Delayed

May 21, 2025