Analyzing BigBear.ai (BBAI): A Penny Stock Deep Dive.

Table of Contents

Understanding BigBear.ai's (BBAI) Business Model and Financial Performance

Revenue Streams and Growth Prospects

BigBear.ai's primary revenue streams stem from government contracts and commercial clients. The government sector, particularly defense and intelligence agencies, has historically been a significant contributor to BBAI's revenue. Commercial clients, encompassing various industries that require advanced data analytics and AI solutions, represent a growing segment of their business.

Analyzing BBAI revenue growth requires careful review of financial statements. While historical growth might indicate trends, future growth projections are inherently uncertain. Factors influencing future revenue include:

- Securing new government contracts: The competitive bidding process for government contracts presents a significant challenge. Success depends on the company's ability to demonstrate its expertise and cost-effectiveness.

- Expansion into new commercial markets: Success in penetrating new commercial markets requires targeted marketing, strategic partnerships, and strong sales execution.

- Maintaining existing contracts: Renewal of existing government contracts is crucial for sustained revenue streams. Failure to renew contracts could significantly impact financial performance.

The availability of reliable, up-to-date financial data for BBAI is vital for accurate assessment. Investors should consult official company filings and reputable financial news sources for the most recent information regarding BBAI revenue, BigBear.ai growth, and its performance in the government contracts and commercial clients segments.

Profitability and Key Financial Metrics

BigBear.ai's profitability has historically been inconsistent, a common characteristic of growth-stage companies. Investors should carefully scrutinize key financial metrics, including:

- Gross margins: These reveal the profitability of BBAI's core products and services, indicating efficiency in operations.

- Operating income: This shows the company's operating profitability after deducting operating expenses.

- Net income: This represents the company's overall profit after all expenses, including taxes and interest, are considered.

- Debt-to-equity ratio: This ratio provides insight into BBAI's financial leverage and risk profile. A high ratio might suggest a greater risk of financial instability.

- Current ratio: This assesses the company's ability to meet its short-term obligations.

Analyzing BBAI profitability and these key financial ratios is crucial for understanding the financial health of the company and its ability to sustain operations and fund future growth. Investors must carefully weigh the company's financial performance and risks before committing capital. Understanding BBAI profitability is paramount for evaluating its long-term viability.

Risk Assessment for BBAI Investors

Investing in BBAI, like any penny stock, entails significant risks. These risks include:

- Penny stock volatility: BBAI's share price can experience dramatic swings due to market sentiment, news events, and overall market conditions.

- Dependence on government contracts: Heavy reliance on government contracts exposes the company to potential budget cuts, changes in government priorities, and the inherent risks associated with government procurement processes.

- Competition in the AI market: The AI and big data market is highly competitive. BBAI faces competition from established players and new entrants, potentially affecting its market share and profitability.

- Financial instability: As a penny stock, BBAI's financial stability is potentially more precarious compared to larger, more established companies.

Understanding these BBAI risks is paramount before considering an investment. A thorough due diligence process is essential to mitigate potential losses. Assessing the level of risk that you're comfortable with is crucial before investing.

Analyzing BigBear.ai (BBAI) Stock Performance and Valuation

Historical Stock Price Analysis

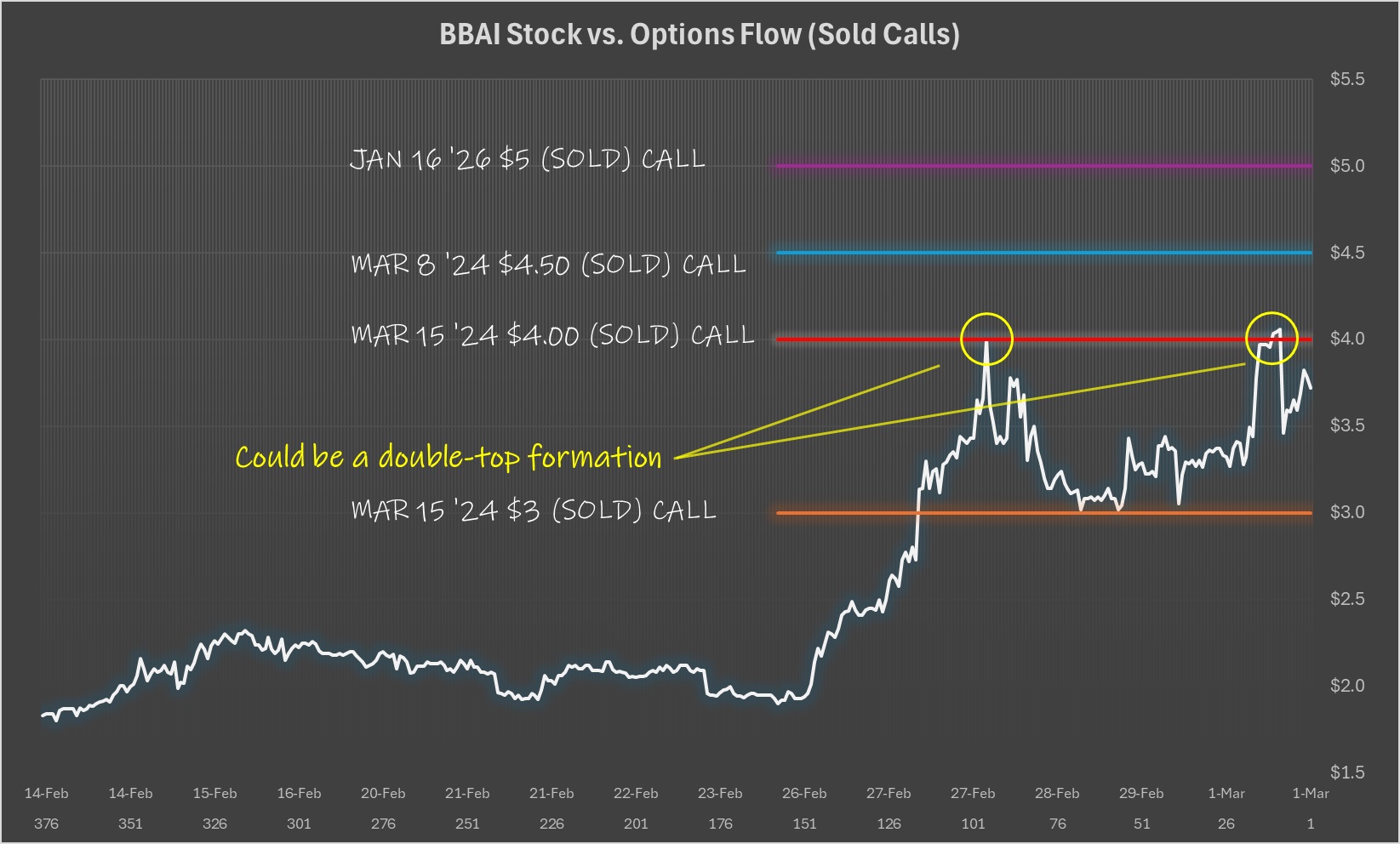

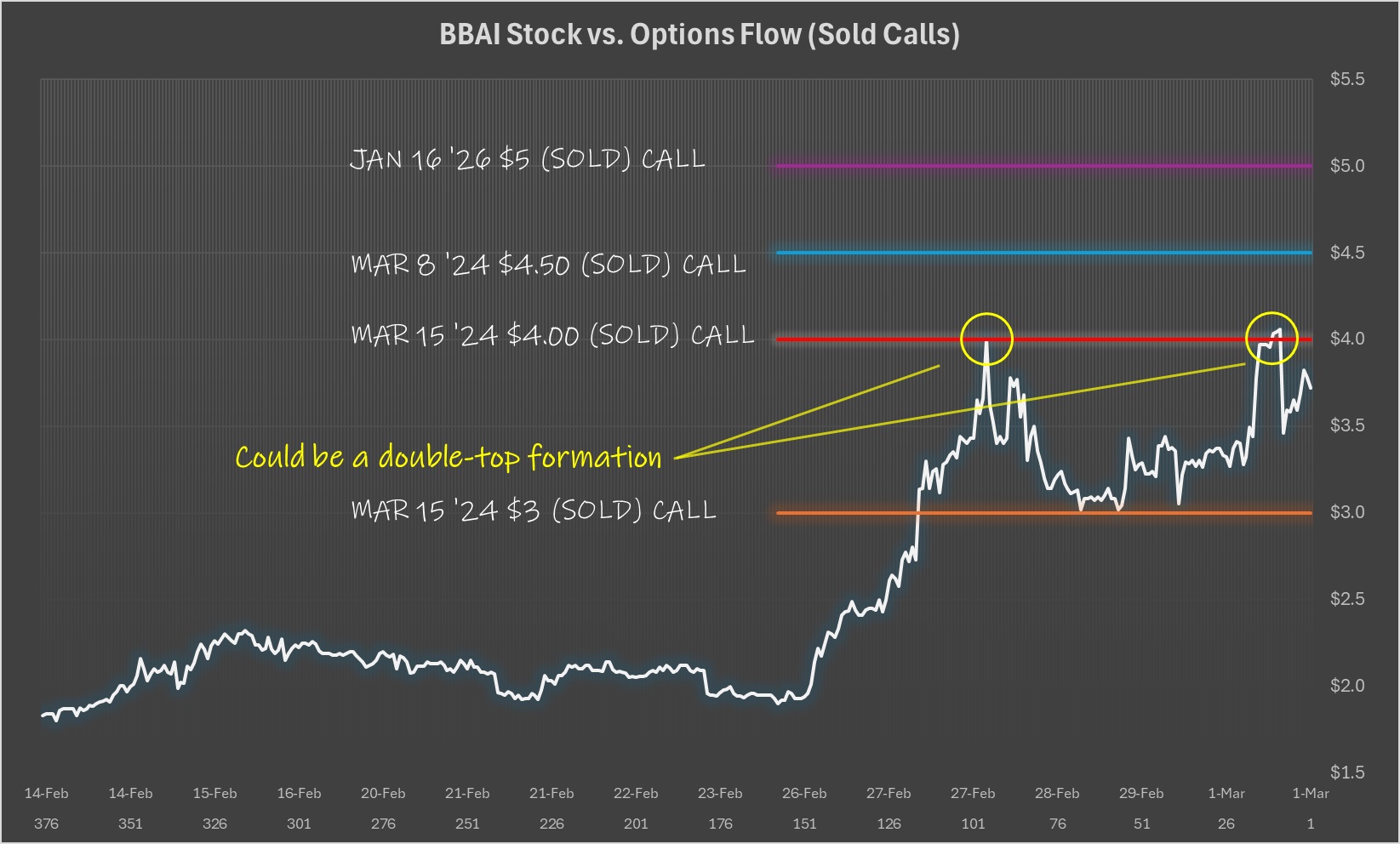

Analyzing BBAI's historical stock price performance is crucial for understanding its volatility and potential for future price movements. Charting the stock's price over time can reveal important trends and patterns. While past performance is not indicative of future results, it provides context for assessing risk and potential returns. Identify key price movements and try to correlate them with relevant news or events. Remember to consult reliable financial data sources for accurate information on BBAI stock price.

Valuation Metrics and Comparison to Competitors

Evaluating BBAI's valuation requires examining metrics such as:

- Price-to-Earnings (P/E) ratio: Compares the stock price to the company's earnings per share, offering insights into market expectations regarding future growth.

- Price-to-Sales (P/S) ratio: Relates the stock price to the company's revenue, useful for valuing companies that are not yet profitable.

Comparing BBAI's valuation to competitors in the AI and big data market provides valuable context. A higher valuation might suggest that the market anticipates greater future growth from BBAI compared to its rivals. Conversely, a lower valuation might suggest that the market is less optimistic about BBAI's future prospects.

BigBear.ai (BBAI) Future Outlook and Investment Considerations

Growth Potential and Future Opportunities

BigBear.ai's future growth potential hinges on several factors:

- New product launches: The development and successful launch of innovative AI and big data solutions can drive revenue growth and attract new clients.

- Expansion into new markets: Diversification into new geographic regions or industry sectors can reduce dependence on existing markets and expand the company's customer base.

- Strategic partnerships: Collaborating with other technology companies or industry leaders can enhance BBAI's capabilities and market reach.

However, BBAI's future growth is also subject to challenges, including intense competition, the need for continuous innovation, and the potential for economic downturns to affect government spending and commercial investment in AI and big data solutions.

Investment Strategy Recommendations

Investing in BBAI demands a cautious approach. Penny stocks are inherently risky, and BBAI is no exception. Potential strategies include:

- Buy-and-hold: This long-term strategy requires patience and confidence in BBAI's long-term prospects.

- Short-term trading: This more aggressive strategy aims to profit from short-term price fluctuations, but it carries significantly greater risk.

Disclaimer: This analysis is for informational purposes only and does not constitute financial advice. Investing in penny stocks, including BBAI, involves significant risk, and investors could lose their entire investment. Thorough due diligence is essential before making any investment decisions.

Conclusion: Making Informed Decisions about BigBear.ai (BBAI) Penny Stock

This analysis has explored various facets of BigBear.ai (BBAI), highlighting its potential for growth alongside the considerable risks associated with penny stock investing. BBAI's reliance on government contracts, competition in the AI sector, and historical financial performance need careful consideration. While the company's focus on AI and big data presents promising opportunities, the volatility inherent in its stock price necessitates a well-informed investment approach.

Before investing in BigBear.ai (BBAI) or any other penny stock, conducting your own comprehensive research is crucial. Analyzing BigBear.ai (BBAI) investments requires careful assessment of financial statements, competitor analysis, and a thorough understanding of the inherent risks involved. Remember that past performance is not indicative of future results. Investing in BigBear.ai (BBAI) should be part of a well-diversified investment portfolio that aligns with your risk tolerance and financial goals.

Featured Posts

-

Dexter Resurrections Villain A Deeper Look At Villains Name

May 21, 2025

Dexter Resurrections Villain A Deeper Look At Villains Name

May 21, 2025 -

Saskatchewan Political Panel Reacts To Federal Leaders Redneck Comments

May 21, 2025

Saskatchewan Political Panel Reacts To Federal Leaders Redneck Comments

May 21, 2025 -

Fratii Tate Baie De Multime In Bucuresti Cu Masina De Lux Video

May 21, 2025

Fratii Tate Baie De Multime In Bucuresti Cu Masina De Lux Video

May 21, 2025 -

British Runners Australian Adventure Battling Adversity

May 21, 2025

British Runners Australian Adventure Battling Adversity

May 21, 2025 -

Is Qbts The Leading Quantum Computing Stock In 2024

May 21, 2025

Is Qbts The Leading Quantum Computing Stock In 2024

May 21, 2025

Latest Posts

-

Sound Perimeter Understanding Musics Social Impact

May 22, 2025

Sound Perimeter Understanding Musics Social Impact

May 22, 2025 -

Arne Slots Perspective Liverpools Victory Psgs Shortcomings And Alisson Beckers Excellence

May 22, 2025

Arne Slots Perspective Liverpools Victory Psgs Shortcomings And Alisson Beckers Excellence

May 22, 2025 -

Within The Sound Perimeter Music And Shared Experience

May 22, 2025

Within The Sound Perimeter Music And Shared Experience

May 22, 2025 -

Liverpool Vs Psg Arne Slots Tactical Analysis And Alissons Stellar Performance

May 22, 2025

Liverpool Vs Psg Arne Slots Tactical Analysis And Alissons Stellar Performance

May 22, 2025 -

Musics Embrace Defining The Sound Perimeter Of Belonging

May 22, 2025

Musics Embrace Defining The Sound Perimeter Of Belonging

May 22, 2025