Analyst's Bullish Apple Prediction: $254 Target – Time To Invest?

Table of Contents

Strong Fundamentals Driving the Apple Stock Price Up

Apple's impressive stock performance isn't just based on hype; it's grounded in robust financial performance and a forward-looking strategy. Several key factors contribute to this bullish outlook, suggesting that the $254 target might be within reach.

Record iPhone Sales and Services Revenue Growth

Apple's latest financial reports paint a picture of remarkable success. iPhone sales remain remarkably strong, defying expectations in a potentially slowing smartphone market. This sustained demand, coupled with significant growth in Apple's services revenue, is a major catalyst for the upward trajectory of the stock price.

- Impressive iPhone sales figures: Recent quarters have shown consistent growth in iPhone sales, indicating strong consumer demand and brand loyalty. Specific sales figures should be inserted here, sourced from Apple's official financial reports.

- Booming Services Revenue: Apple's services sector, encompassing Apple Music, iCloud, Apple TV+, and more, continues to expand rapidly, generating a recurring revenue stream that adds stability and predictability to Apple's financial performance. Growth percentages should be included here, referencing official Apple reports.

- Synergy between Hardware and Services: The integration between Apple's hardware and services creates a powerful ecosystem that encourages users to stay within the Apple environment, leading to increased customer lifetime value.

Innovation and Future Product Launches

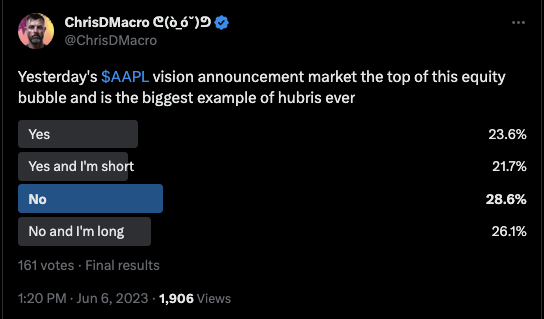

Apple’s continued investment in research and development (R&D) fuels its reputation for innovation. Upcoming product launches, including new iPhone models, Apple Watch iterations, and potential advancements in augmented reality (AR) and virtual reality (VR), are expected to further boost Apple's revenue and market share. These new products maintain Apple's position at the forefront of technological advancements, ensuring continuous customer interest and investment.

- Anticipation for new product releases: The buzz surrounding upcoming product releases generates significant media attention and consumer anticipation, positively impacting investor sentiment.

- Strategic investments in R&D: Apple's substantial R&D budget showcases its commitment to innovation and future growth, assuring investors of its long-term potential.

- Expanding into new markets: Apple's expansion into emerging markets represents a significant growth opportunity, with untapped potential for increased customer acquisition and revenue generation. Keywords: Apple innovation, new Apple products, Apple product releases, Apple R&D.

Expanding Ecosystem and Loyal Customer Base

The strength of Apple's ecosystem is a significant factor driving its stock price. The seamless integration between iPhones, iPads, Macs, and Apple Watches fosters a highly loyal customer base. This ecosystem locks in customers, increasing the likelihood of repeat purchases and subscription services.

- High customer retention rates: Apple boasts incredibly high customer retention rates, indicating strong brand loyalty and a reluctance to switch to competing platforms.

- Increased spending per customer: The Apple ecosystem encourages users to invest in multiple Apple devices and services, leading to increased spending per customer over time.

- Sticky ecosystem: The interconnected nature of Apple's products and services makes it difficult for customers to switch to other brands, ensuring long-term revenue streams. Keywords: Apple ecosystem, Apple customer loyalty, Apple market share.

Analyst Sentiment and Market Outlook for Apple

The bullish $254 price target isn't an isolated prediction. A significant number of analysts share a positive outlook on Apple's future, further supporting the investment case.

Positive Analyst Ratings and Price Targets

Many prominent investment firms have issued buy ratings and price targets for Apple stock, aligning with the optimistic outlook. These positive ratings reflect a shared belief in Apple's ability to maintain its strong performance and potentially exceed expectations.

- Summary of analyst ratings and price targets: Include a brief overview of the consensus among leading analysts, citing specific examples where possible.

- Investment firm endorsements: Mention specific investment firms that have publicly expressed bullish sentiment towards Apple stock, adding credibility to the prediction.

- Positive market sentiment: Highlight the generally positive market sentiment surrounding Apple, which is a significant factor in driving up the stock price. Keywords: Apple analyst rating, Apple stock rating, investment firm opinion, buy rating Apple.

Overall Market Conditions and Economic Factors

While the outlook is positive, it's crucial to acknowledge potential risks and headwinds. Overall market conditions and economic factors can influence Apple's stock price. Geopolitical uncertainty, inflation, and potential supply chain disruptions could impact Apple's performance.

- Potential risks and challenges: Discuss potential headwinds, such as macroeconomic uncertainties, competition, and regulatory challenges.

- Mitigation strategies: Mention how Apple might mitigate these risks through diversification, cost-cutting measures, and strategic partnerships.

- Long-term growth prospects: Reiterate the belief that Apple’s long-term growth prospects remain strong, despite short-term economic headwinds. Keywords: market outlook, economic factors, Apple stock risk, market volatility.

Conclusion: Should You Invest in Apple Stock Based on the $254 Prediction?

The $254 price target for Apple stock is supported by strong fundamentals, positive analyst sentiment, and the company's continued innovation. Apple’s robust financial performance, loyal customer base, and expanding ecosystem contribute to a compelling investment case. However, potential market risks should be considered.

While the $254 target holds significant potential, it's crucial to remember that stock markets are inherently unpredictable. Conduct thorough research, considering your risk tolerance and financial goals before making any investment decisions. Considering investing in Apple stock? Learn more about the potential of reaching the $254 target and make an informed decision. Keywords: Apple stock investment, Apple stock analysis, buy Apple stock.

Featured Posts

-

Unfair Comments Ferrari Boss Responds To Lewis Hamiltons Remarks

May 24, 2025

Unfair Comments Ferrari Boss Responds To Lewis Hamiltons Remarks

May 24, 2025 -

Crisi Dazi Ue Impatto Sulle Borse E Possibili Contromisure

May 24, 2025

Crisi Dazi Ue Impatto Sulle Borse E Possibili Contromisure

May 24, 2025 -

Long Delays On M56 Due To Serious Crash Real Time Updates

May 24, 2025

Long Delays On M56 Due To Serious Crash Real Time Updates

May 24, 2025 -

Trump Tax Bill House Vote And What It Means For You

May 24, 2025

Trump Tax Bill House Vote And What It Means For You

May 24, 2025 -

2002 Submarine Bribery Scandal French Investigation Incriminates Najib Razak

May 24, 2025

2002 Submarine Bribery Scandal French Investigation Incriminates Najib Razak

May 24, 2025

Latest Posts

-

Analiz Stati Gryozy Lyubvi Ili Ilicha V Gazete Trud

May 25, 2025

Analiz Stati Gryozy Lyubvi Ili Ilicha V Gazete Trud

May 25, 2025 -

Amsterdam Stock Market 7 Initial Plunge Reflects Trade War Anxiety

May 25, 2025

Amsterdam Stock Market 7 Initial Plunge Reflects Trade War Anxiety

May 25, 2025 -

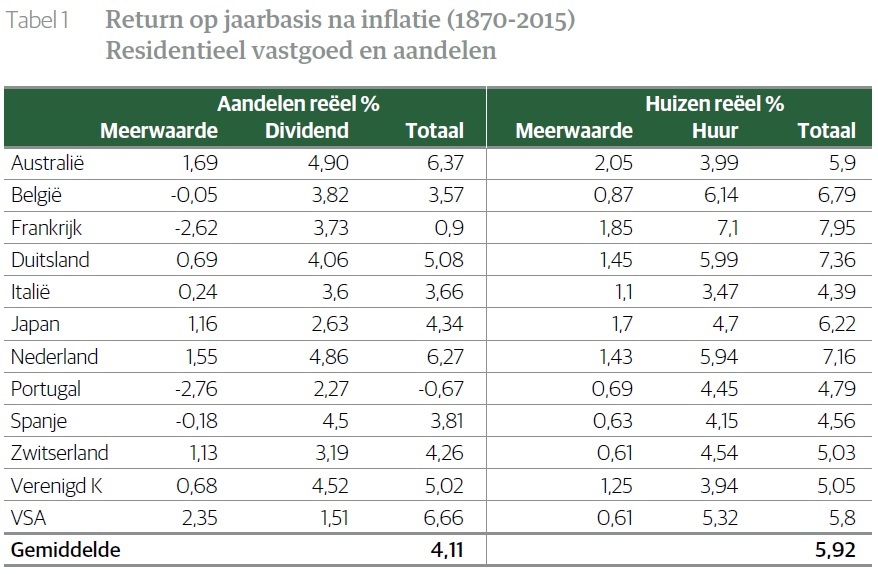

Voorspelling Toekomst Van Europese Aandelen Versus Wall Street

May 25, 2025

Voorspelling Toekomst Van Europese Aandelen Versus Wall Street

May 25, 2025 -

Gryozy Lyubvi Ili Ilicha V Gazete Trud Analiz Syuzheta

May 25, 2025

Gryozy Lyubvi Ili Ilicha V Gazete Trud Analiz Syuzheta

May 25, 2025 -

7 Drop In Amsterdam Stock Market Trade War Uncertainty

May 25, 2025

7 Drop In Amsterdam Stock Market Trade War Uncertainty

May 25, 2025