Analyst Predicts Apple Stock To Hit $254: Should You Buy Now?

Table of Contents

The Analyst's Prediction: A Deep Dive

The prediction of Apple stock reaching $254 originates from renowned tech analyst, Sarah Chen, of the reputable firm, TechVision Insights. Chen, with over 15 years of experience in the tech sector and a proven track record of accurate predictions, bases her forecast on several key factors:

-

New product launches: The upcoming iPhone 15, Apple Watch Series 9, and the highly anticipated Vision Pro headset are expected to drive significant sales growth and boost Apple's revenue streams. These innovative products represent a continuation of Apple's history of successful product launches and market dominance.

-

Strong financial performance and projected growth: Apple's consistent profitability and strong financial performance in recent quarters indicate a healthy company poised for continued expansion. Analysts project impressive year-over-year growth in key areas like services and wearables.

-

Market share and competitive advantage: Apple maintains a dominant market share in several key sectors, including smartphones and tablets. Its strong brand loyalty and ecosystem lock-in provide a significant competitive advantage. This entrenched position helps shield it from some of the market volatility seen in other tech companies.

-

Macroeconomic factors influencing the prediction: While global economic uncertainty exists, Chen's prediction accounts for potential headwinds. She believes Apple's resilience and premium pricing strategy will allow it to weather potential economic downturns better than many competitors.

[Insert a supporting chart or graph here illustrating the predicted price trajectory from the current price to $254, clearly labeled and sourced.]

Assessing the Risks: Potential Downsides of Investing in Apple Stock

While the $254 Apple stock prediction is enticing, it's crucial to acknowledge potential downsides:

-

Increased competition: Samsung, Google, and other tech giants pose increasing competition, especially in the smartphone and wearable markets. Innovative products from these rivals could erode Apple's market share and impact profitability.

-

Supply chain disruptions: Global supply chain issues could impact Apple's ability to produce and deliver its products, leading to potential revenue shortfalls. Geopolitical instability and unforeseen events can significantly affect their supply chains.

-

Global economic slowdown or recession: A significant global economic downturn could negatively impact consumer spending, reducing demand for Apple's premium-priced products. This risk applies to all sectors but especially luxury goods.

-

Negative regulatory changes: Increased regulatory scrutiny or unfavorable legislative changes could impact Apple's operations and profitability. Antitrust concerns and data privacy regulations represent potential challenges.

Diversification is vital for mitigating risk. Don't put all your eggs in one basket. Spreading your investments across different asset classes and companies reduces your overall portfolio volatility.

Current Market Analysis: Apple Stock's Current Standing

As of [Insert Date], Apple stock is trading at [Insert Current Price]. This represents a [Percentage Change] increase/decrease compared to [Specific Time Period, e.g., the last year, quarter]. Compared to its historical performance, the current price is [High/Low/Average] relative to its long-term trends. Key financial metrics, like the P/E ratio of [Insert P/E Ratio] and dividend yield of [Insert Dividend Yield], provide further insights into the stock's valuation and potential returns. Comparing these metrics to industry benchmarks is crucial for a comprehensive analysis.

Alternative Investment Strategies: Beyond Buying Apple Stock

If the $254 Apple stock prediction feels too risky, consider alternative strategies:

-

Dollar-cost averaging (DCA): Instead of investing a lump sum, DCA involves regularly investing smaller amounts over time. This reduces the impact of market volatility.

-

Other tech stocks: Explore other promising tech companies with strong growth potential but potentially lower valuations than Apple.

-

Diversification into other asset classes: Consider diversifying your portfolio beyond tech stocks by investing in real estate, bonds, or other asset classes to further mitigate risk.

Conclusion: Should You Buy Apple Stock Now? A Final Verdict

The $254 Apple stock prediction presents both exciting opportunities and significant risks. While Chen's analysis highlights compelling reasons for optimism, potential downsides cannot be ignored. Before buying Apple stock, carefully weigh the potential gains against the inherent risks. Conduct thorough due diligence, research Apple's financials and future prospects, and consider your personal risk tolerance. Consulting a qualified financial advisor is highly recommended. While the $254 Apple stock prediction is exciting, remember to carefully evaluate your investment strategy. Thoroughly research Apple stock and consult a financial advisor before making any purchase decisions.

Featured Posts

-

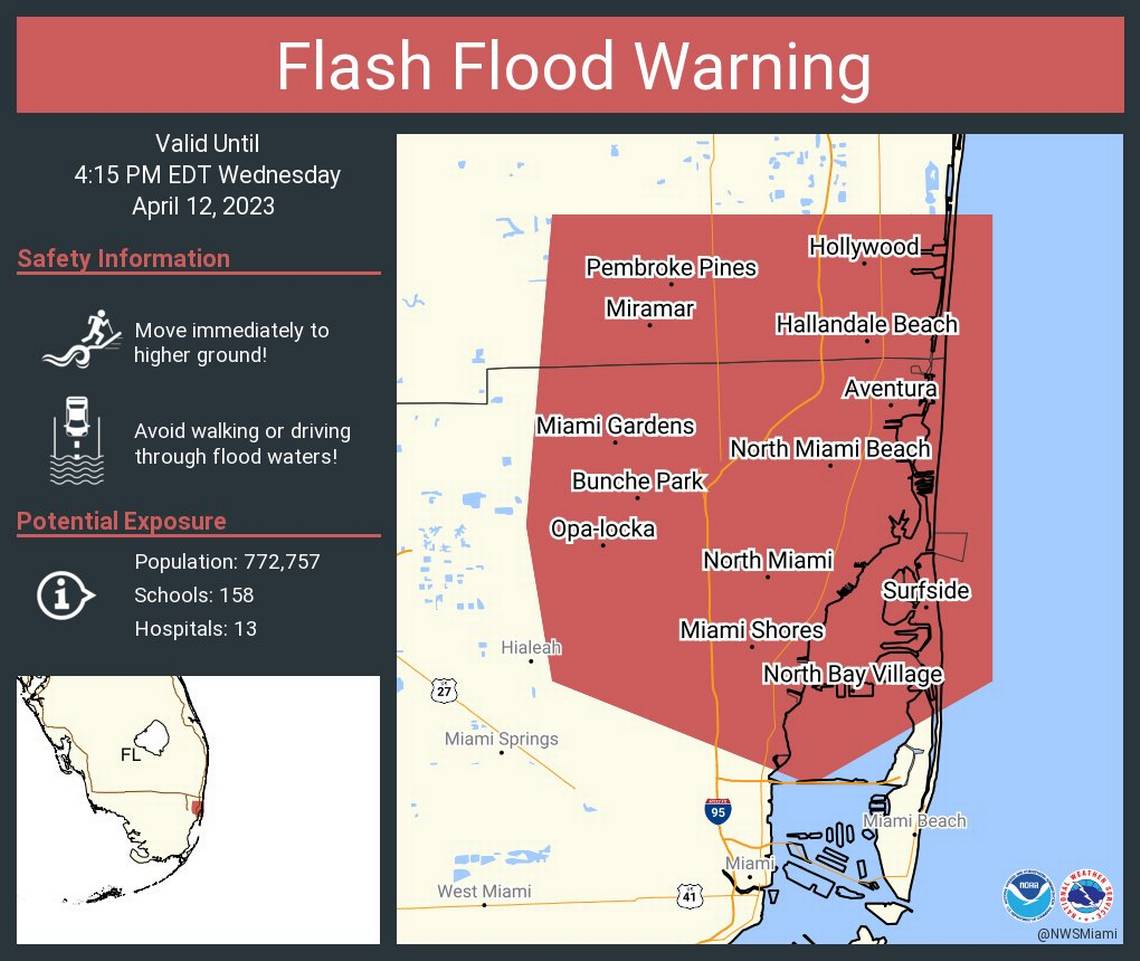

Severe Weather Alert Flash Flood Warning For Parts Of Pennsylvania

May 25, 2025

Severe Weather Alert Flash Flood Warning For Parts Of Pennsylvania

May 25, 2025 -

Massive Rubber Duck Installation In Myrtle Beach Whats The Message

May 25, 2025

Massive Rubber Duck Installation In Myrtle Beach Whats The Message

May 25, 2025 -

Canada Post Strike How It Could Alienate Customers

May 25, 2025

Canada Post Strike How It Could Alienate Customers

May 25, 2025 -

Footballer Kyle Walker Faces Backlash Following Annie Kilners Claims

May 25, 2025

Footballer Kyle Walker Faces Backlash Following Annie Kilners Claims

May 25, 2025 -

Heineken Revenue Surpasses Expectations Outlook Remains Strong Despite Trade Headwinds

May 25, 2025

Heineken Revenue Surpasses Expectations Outlook Remains Strong Despite Trade Headwinds

May 25, 2025

Latest Posts

-

F1 Wolffs Response To Russells Underrated Comment Sparks Debate

May 25, 2025

F1 Wolffs Response To Russells Underrated Comment Sparks Debate

May 25, 2025 -

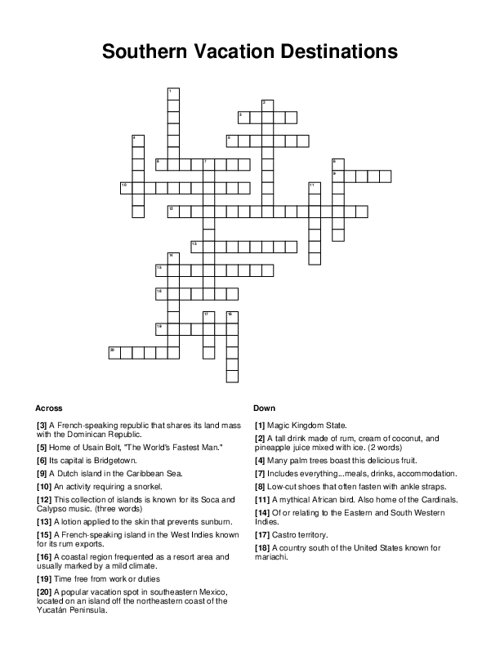

Shooting At Popular Southern Vacation Spot Prompts Safety Review

May 25, 2025

Shooting At Popular Southern Vacation Spot Prompts Safety Review

May 25, 2025 -

Southern Vacation Destination Addresses Safety Concerns Following Shooting Incident

May 25, 2025

Southern Vacation Destination Addresses Safety Concerns Following Shooting Incident

May 25, 2025 -

Toto Wolff Responds To George Russells Underrated Claims

May 25, 2025

Toto Wolff Responds To George Russells Underrated Claims

May 25, 2025 -

Formula 1 Mertsedes So Kazni Pred Trkata Vo Bakhrein

May 25, 2025

Formula 1 Mertsedes So Kazni Pred Trkata Vo Bakhrein

May 25, 2025