Analysis: US Sanctions And The Disruption Of Chinese Plastics Imports From Iran

Table of Contents

The Impact of US Sanctions on Iranian Petrochemical Exports

The US sanctions on Iran, targeting its oil and gas sector, have severely curtailed the country's ability to export petrochemicals, vital raw materials for plastics manufacturing. This has had a devastating knock-on effect on the global supply chain.

Restrictions on Iranian Oil and Gas

The sanctions directly target Iran's energy sector, restricting its access to international financial systems and limiting its ability to export oil and gas.

- Sanctioned Entities: Numerous Iranian oil and gas companies, including those involved in petrochemical production, have been subjected to sanctions.

- Types of Sanctions: These sanctions encompass financial restrictions, trade embargoes, and limitations on accessing international banking systems, effectively isolating Iran from the global financial market.

- Impact on Feedstock: The restrictions on oil and gas exports directly impact the availability of naphtha and ethane, crucial feedstocks for producing the ethylene and propylene needed to manufacture polyethylene and polypropylene – fundamental components of numerous plastic products.

The Knock-on Effect on Petrochemical Derivatives

These sanctions on raw materials have dramatically reduced Iran's capacity to produce and export finished petrochemicals, such as polyethylene (PE) and polypropylene (PP).

- Specific Petrochemicals Affected: The sanctions have significantly impacted the export of PE and PP, essential for packaging, construction, and consumer goods. Other derivatives, including polystyrene and polyvinyl chloride (PVC), have also been affected.

- Impact on Pricing and Availability: The decreased supply has led to price volatility and scarcity in the global market, forcing buyers to seek alternative suppliers, often at a higher cost.

- Challenges for Iranian Companies: Iranian petrochemical companies face immense difficulties navigating the complex sanctions regime, with limited access to international markets and financing.

The Disruption of Chinese Plastics Imports

China has been heavily reliant on Iranian petrochemical imports to fuel its massive plastics industry. The US sanctions have severely disrupted this relationship, causing significant challenges for Chinese companies.

China's Reliance on Iranian Petrochemicals

Prior to the sanctions, China was a major importer of Iranian petrochemicals, particularly PE and PP.

- Import Volumes: Data indicates a significant drop in the volume of Iranian petrochemicals imported by China following the imposition of sanctions. (Specific data, if available, would strengthen this section).

- Key Chinese Companies: Several large Chinese plastics manufacturers relied heavily on Iranian imports, creating vulnerabilities in their supply chains.

- Types of Plastics Affected: The impact has been felt across a range of plastic products, impacting various sectors within the Chinese economy.

Supply Chain Disruptions and Increased Costs

The reduced supply of Iranian petrochemicals has created significant disruptions in Chinese plastics supply chains.

- Challenges Faced by Manufacturers: Chinese manufacturers experienced increased costs, production delays, and difficulties sourcing alternative materials.

- Price Increases for Alternatives: The need to source petrochemicals from other countries, such as Saudi Arabia or the US, led to increased input costs, impacting profitability.

- Sourcing Difficulties: Finding reliable and cost-effective alternative suppliers has been a significant challenge for many Chinese companies.

Adaptation Strategies of Chinese Companies

Facing these challenges, Chinese companies have implemented several adaptation strategies.

- Diversification of Import Sources: Many companies have diversified their import sources, turning to countries like Saudi Arabia, Russia, and the United States.

- Investments in Domestic Production: Significant investments have been made in expanding domestic petrochemical production capacity to reduce reliance on imports.

- Technological Advancements: Companies are also investing in technology to improve efficiency and reduce their dependence on specific raw materials.

Geopolitical Implications and Broader Market Impacts

The disruption of Chinese plastics imports from Iran has far-reaching geopolitical and economic implications.

Impact on Global Plastics Market Dynamics

The sanctions and subsequent disruption have created significant volatility in the global plastics market.

- Price Fluctuations: Price fluctuations in key petrochemicals have become more frequent and pronounced, impacting manufacturers and consumers worldwide.

- Impact on Competition: The shift in supply sources has altered the competitive landscape, potentially leading to increased market concentration.

- Regional Imbalances: The disruption could exacerbate existing regional imbalances in the plastics market, concentrating production and supply in specific geographic areas.

Implications for US-China Relations

The sanctions and their impact on Chinese plastics imports add another layer of complexity to the already strained US-China relationship.

- Potential Trade Tensions: The situation could fuel further trade tensions between the two countries, particularly regarding access to vital resources and the stability of global supply chains.

- Implications for Future Trade Agreements: The situation underscores the challenges of navigating geopolitical tensions in the context of global trade agreements and economic interdependence.

- Broader Geopolitical Context: The events highlight the interconnected nature of global politics and economics, emphasizing the far-reaching implications of unilateral sanctions.

Conclusion

US sanctions on Iran have significantly disrupted the flow of Iranian petrochemicals to China, profoundly impacting the Chinese plastics industry and the global plastics market. Chinese companies have responded with diversification strategies, domestic production increases, and technological improvements. However, the long-term consequences remain uncertain, with implications for global supply chains, market dynamics, and US-China relations. Further research is needed to fully understand the long-term consequences of these sanctions on the Chinese plastics industry's reliance on Iranian petrochemicals. Continued monitoring of US sanctions and their impact on Chinese plastics imports from Iran, along with analysis of petrochemical sanctions and their effect on the global supply chain, is crucial for navigating the complexities of the global plastics market and for businesses and policymakers alike.

Featured Posts

-

White Lotus Season 3 Oscar Winning Guest Star Appears

May 07, 2025

White Lotus Season 3 Oscar Winning Guest Star Appears

May 07, 2025 -

Rihannas Heavenly Designs The New Savage X Fenty Bridal Line

May 07, 2025

Rihannas Heavenly Designs The New Savage X Fenty Bridal Line

May 07, 2025 -

Rihannas Savage X Fenty Bridal Collection A Heavenly New Line

May 07, 2025

Rihannas Savage X Fenty Bridal Collection A Heavenly New Line

May 07, 2025 -

Shooting At Arizona Restaurant Results In Multiple Injuries

May 07, 2025

Shooting At Arizona Restaurant Results In Multiple Injuries

May 07, 2025 -

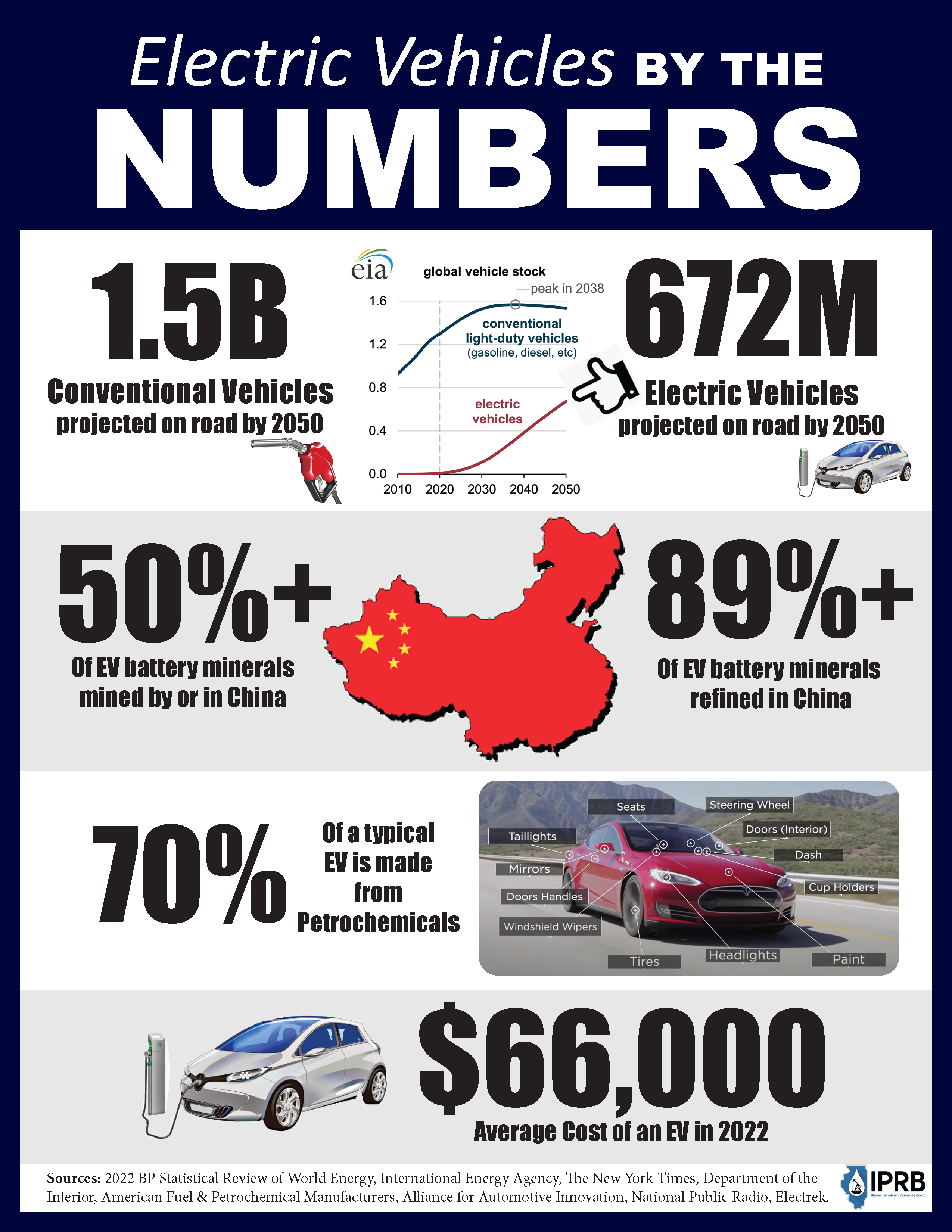

Car Dealers Continued Opposition To Electric Vehicle Mandates

May 07, 2025

Car Dealers Continued Opposition To Electric Vehicle Mandates

May 07, 2025

Latest Posts

-

Celtics Vs Cavs 4 Takeaways From A Stunning Upset

May 07, 2025

Celtics Vs Cavs 4 Takeaways From A Stunning Upset

May 07, 2025 -

The White Lotus Season 3 Uncovering The Truth About Ke Huy Quans Appearance

May 07, 2025

The White Lotus Season 3 Uncovering The Truth About Ke Huy Quans Appearance

May 07, 2025 -

Cavs Shock Celtics 4 Post Game Analysis Points

May 07, 2025

Cavs Shock Celtics 4 Post Game Analysis Points

May 07, 2025 -

Exploring A Potential Ke Huy Quan Cameo In The White Lotus Season 3

May 07, 2025

Exploring A Potential Ke Huy Quan Cameo In The White Lotus Season 3

May 07, 2025 -

Boston Celtics Blown Lead 4 Crucial Takeaways From Cavs Victory

May 07, 2025

Boston Celtics Blown Lead 4 Crucial Takeaways From Cavs Victory

May 07, 2025