Analysis: Sasol (SOL) And The Investor Questions Following Its Strategy Update

Table of Contents

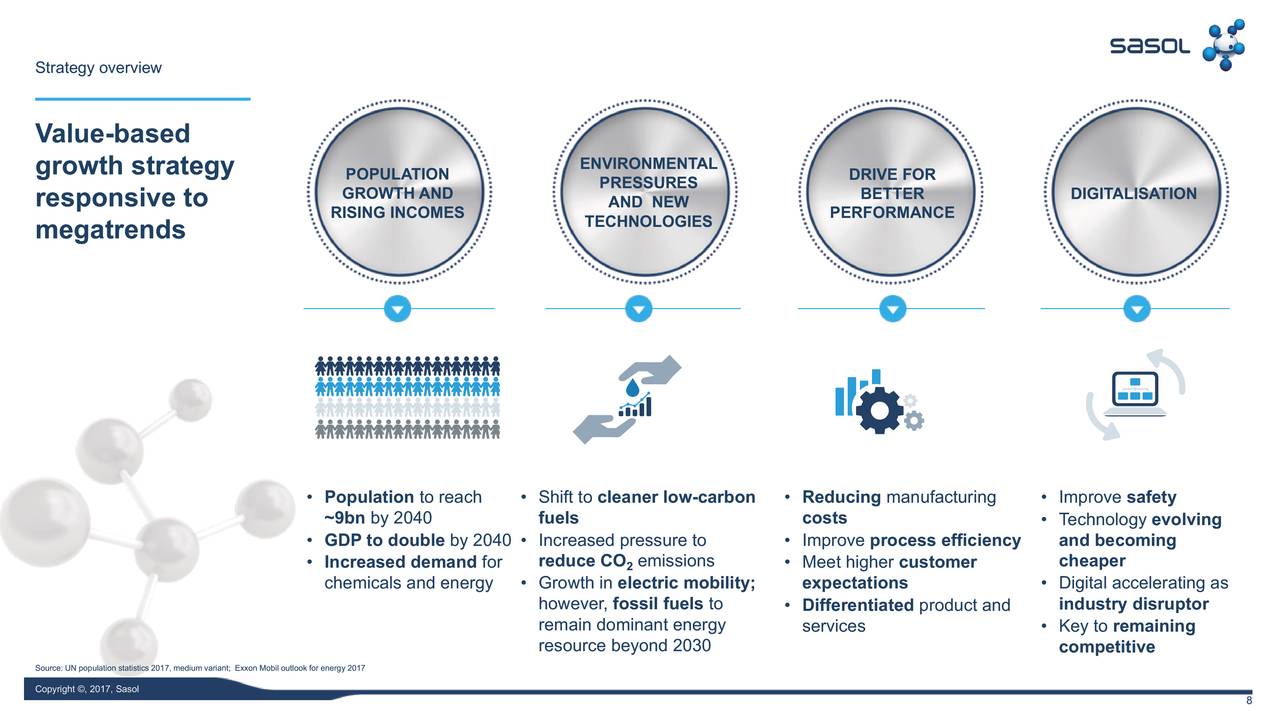

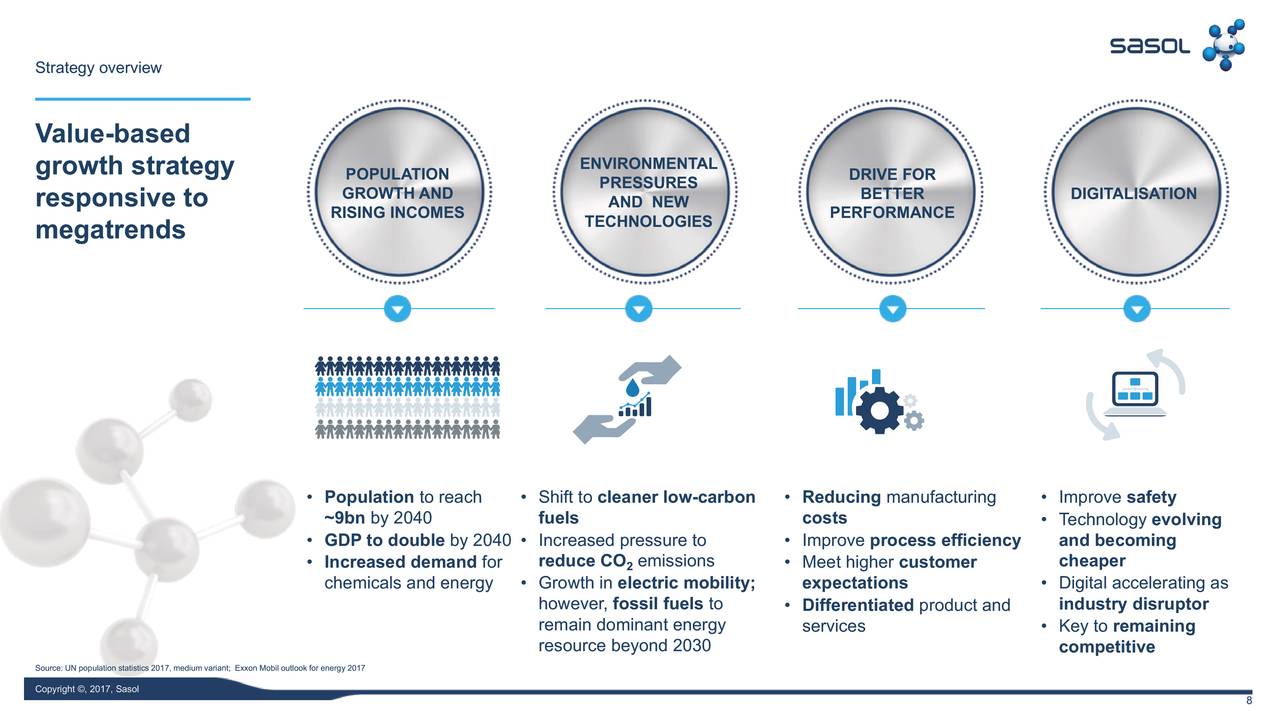

Sasol's Revised Growth Strategy and its Impact on SOL Stock

Sasol's revised growth strategy represents a significant shift in its approach to capital allocation and business focus. The key changes involve a sharper focus on specific high-margin business segments and a more disciplined approach to capital expenditure. This new strategy aims to enhance Sasol's profitability and boost shareholder value.

The projected impact on profitability and revenue streams remains a key concern for investors. While the strategy promises improved margins, the transition period might entail short-term challenges. Long-term shareholder value hinges on the successful execution of this plan, which faces numerous hurdles and risks.

- Changes in capital allocation priorities: Emphasis is shifting away from certain expansion projects to prioritize debt reduction and investments in core, high-return businesses.

- Focus on specific business segments: The strategy highlights a greater focus on chemicals and select energy segments where Sasol possesses a competitive advantage. This implies divestments or reduced investment in less profitable areas.

- Revised growth targets and timelines: While Sasol has set ambitious growth targets, realistic timelines and potential delays due to unforeseen circumstances need careful consideration.

- Potential risks and challenges: Execution risks, competition, commodity price volatility, and geopolitical factors all pose significant challenges to the success of the new strategy. A thorough Sasol growth strategy analysis is essential for understanding these risks. The SOL stock forecast remains uncertain until the plan's effectiveness can be empirically determined.

Debt Reduction and Financial Stability: A Critical Assessment

Sasol's substantial debt burden has been a major concern for investors. The company's progress on debt reduction initiatives is crucial for its financial stability and long-term viability. The company's overall financial health is intricately linked to its ability to successfully manage its debt levels while navigating fluctuating energy prices and commodity markets.

- Debt-to-equity ratio analysis: Analyzing Sasol's debt-to-equity ratio over time is critical to gauge its financial leverage and risk profile. A decreasing ratio indicates positive progress.

- Cash flow projections and forecasts: Sustainable cash flow generation is vital for debt repayment. Forecasting cash flows considering various scenarios (e.g., commodity price fluctuations) is essential.

- Credit rating outlook: Credit rating agencies closely monitor Sasol's financial performance and debt levels. Positive changes to Sasol's credit rating would signal improved financial health and reduced risk.

- Potential risks related to debt servicing: Interest rate hikes and unforeseen economic downturns can significantly increase the burden of debt servicing, potentially hindering the company's growth plans. A thorough understanding of Sasol debt and its management is essential for investors.

The Energy Transition and Sasol's Adaptability

The global energy transition presents both challenges and opportunities for Sasol. The company's approach to this transition, including investments in renewable energy and sustainable technologies, will play a significant role in shaping its future. The impact of environmental regulations and carbon emission targets will greatly influence Sasol's operational strategy.

- Investments in low-carbon technologies: Sasol's investments in carbon capture and storage, renewable energy sources, and other low-carbon technologies will be crucial for its long-term sustainability and compliance with environmental regulations.

- Carbon emission reduction strategies: Analyzing Sasol's progress in reducing carbon emissions is essential for assessing its commitment to environmental sustainability and its alignment with ESG investing trends.

- Alignment with ESG (Environmental, Social, and Governance) investing trends: Increasingly, investors are considering ESG factors when making investment decisions. Sasol's commitment to ESG principles will influence its attractiveness to environmentally conscious investors.

- Potential risks and opportunities: The energy transition presents both substantial risks (e.g., stranded assets, regulatory changes) and opportunities (e.g., new markets for low-carbon products and services). A thorough understanding of Sasol sustainability and its Sasol ESG initiatives is key for investors.

Operational Efficiency and Cost Reduction Measures

Improving operational efficiency and implementing cost reduction measures are essential for enhancing Sasol's profitability and competitiveness. The effectiveness of these initiatives will directly impact the company's bottom line.

- Process optimization projects: Identifying and implementing process improvements across the value chain can significantly enhance operational efficiency.

- Supply chain management improvements: Streamlining the supply chain through better procurement, logistics, and inventory management can lead to cost savings.

- Technology adoption for efficiency gains: Investing in advanced technologies such as digitalization and automation can improve productivity and reduce operational costs.

- Impact on labor costs and workforce adjustments: Optimizing labor costs through workforce adjustments and improved productivity will be crucial for maintaining profitability. Any Sasol cost reduction strategy must be carefully assessed for its human impact.

Conclusion: The Future of Sasol (SOL) and Informed Investment Decisions

Sasol's revised strategy presents a mixed outlook. While the focus on debt reduction and high-margin businesses offers potential for improved profitability and shareholder value, the execution risks and challenges associated with the energy transition and global economic uncertainties remain significant. Key investor concerns revolve around debt levels, the pace of the energy transition, and the successful execution of the revised growth strategy.

To address these concerns, careful monitoring of Sasol's financial performance, its progress on debt reduction, and its investments in sustainable technologies is vital. While the SOL stock outlook remains somewhat uncertain, a balanced assessment of the risks and rewards is necessary for making informed investment decisions.

Continue your Sasol (SOL) analysis by thoroughly investigating Sasol's growth strategy, assessing the risks and rewards of investing in Sasol, and staying informed on Sasol's financial performance. Only through diligent research can you make informed investment decisions regarding Sasol (SOL) stock and its Sasol future prospects.

Featured Posts

-

Naissance D Une Petite Fille Pour Michael Schumacher

May 20, 2025

Naissance D Une Petite Fille Pour Michael Schumacher

May 20, 2025 -

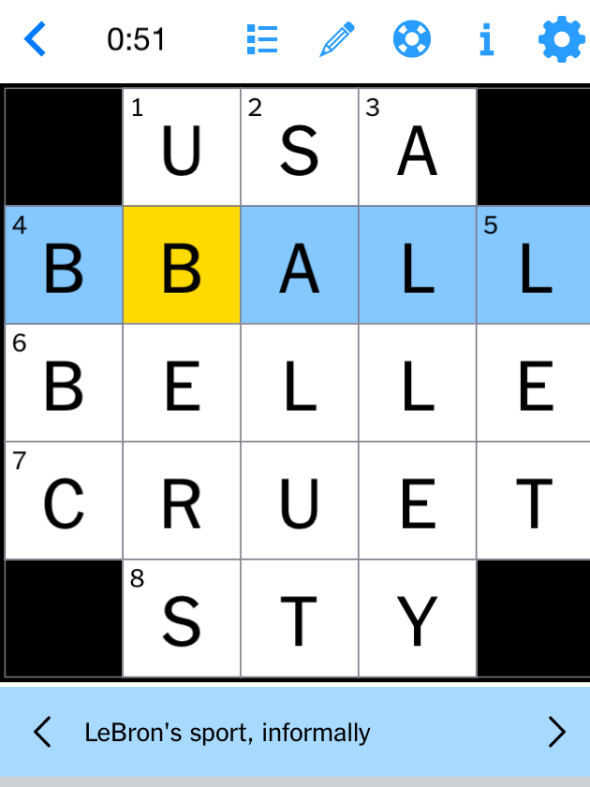

Find The Answers Nyt Mini Crossword March 15

May 20, 2025

Find The Answers Nyt Mini Crossword March 15

May 20, 2025 -

New Burnham And Highbridge History Photo Archive Opens Today

May 20, 2025

New Burnham And Highbridge History Photo Archive Opens Today

May 20, 2025 -

Fenerbahce Nin Yeni Transfer Hedefi Tadic Talisca Olayinin Etkisi

May 20, 2025

Fenerbahce Nin Yeni Transfer Hedefi Tadic Talisca Olayinin Etkisi

May 20, 2025 -

The Impact Of Shrinking Enrollment On College Town Economies

May 20, 2025

The Impact Of Shrinking Enrollment On College Town Economies

May 20, 2025

Latest Posts

-

Analyzing The Controversy Wayne Gretzkys Loyalty And His Relationship With Trump

May 20, 2025

Analyzing The Controversy Wayne Gretzkys Loyalty And His Relationship With Trump

May 20, 2025 -

The Wayne Gretzky Loyalty Debate Examining The Impact Of Trumps Policies On Canada Us Relations

May 20, 2025

The Wayne Gretzky Loyalty Debate Examining The Impact Of Trumps Policies On Canada Us Relations

May 20, 2025 -

Trumps Tariffs Gretzkys Loyalty A Canada Us Hockey Debate

May 20, 2025

Trumps Tariffs Gretzkys Loyalty A Canada Us Hockey Debate

May 20, 2025 -

Wayne Gretzky Fast Facts A Quick Look At The Great Ones Life And Career

May 20, 2025

Wayne Gretzky Fast Facts A Quick Look At The Great Ones Life And Career

May 20, 2025 -

Trumps Trade Policies And Gretzkys Allegiance A Look At The Stirred Debate

May 20, 2025

Trumps Trade Policies And Gretzkys Allegiance A Look At The Stirred Debate

May 20, 2025