Analysis: PBOC's Reduced Yuan Support And Market Response

Table of Contents

The PBOC's Shift in Monetary Policy

For years, the PBOC actively managed the Yuan's exchange rate, often intervening to prevent significant fluctuations. These interventions, primarily through buying or selling US dollars in the foreign exchange market, aimed to maintain stability and support export competitiveness. The reasons behind these interventions included managing capital flows, mitigating the impact of external shocks, and supporting economic growth.

However, the PBOC's approach has subtly shifted. While the central bank hasn't explicitly abandoned its management of the Yuan, the level of direct intervention has demonstrably decreased. This change isn't necessarily a complete hands-off approach but rather a move towards greater exchange rate flexibility.

- Specific policy changes implemented by the PBOC: The PBOC has subtly altered its daily fixing mechanism, allowing for greater fluctuation in the Yuan's value against the US dollar. There has also been a noticeable reduction in the frequency and scale of forex interventions.

- Quantitative data showing the reduction in Yuan support: While precise figures on forex intervention are often kept confidential, observable data like the increased volatility in the Yuan's exchange rate and the reduced frequency of publicized PBOC announcements indirectly support this assessment.

- Potential motivations behind the policy change: Several factors may be driving this shift. These include a desire to allow market forces to play a more significant role in determining the Yuan's value, concerns about depleting foreign exchange reserves, and a response to evolving global economic conditions. The PBOC may also be seeking to foster a more market-determined exchange rate to encourage greater participation in the international financial system.

Impact on the Yuan Exchange Rate

Since the reduction in PBOC support, the Yuan has experienced increased volatility against major currencies. While the overall trend might show a gradual weakening or strengthening depending on the period analyzed, the daily fluctuations have become more pronounced.

- Charts showing Yuan exchange rate fluctuations: [Insert charts showing Yuan/USD, Yuan/EUR, Yuan/JPY exchange rates over a relevant period. Clearly label axes and highlight periods of significant volatility].

- Percentage changes in Yuan value against major currencies: [Provide data showing percentage changes against major currencies since the shift in PBOC policy. Clearly state the time period analyzed.]

- Analysis of volatility indicators: [Analyze volatility indicators such as the standard deviation of daily exchange rate changes to quantify the increase in volatility.]

The increased volatility reflects the greater influence of market forces on the Yuan's value. Factors such as global economic growth, trade balances, interest rate differentials, and investor sentiment now play a larger role in shaping the exchange rate.

Market Reactions and Investor Sentiment

The PBOC's reduced Yuan support has elicited mixed reactions from investors. While some view the move as a positive step towards greater market efficiency and transparency, others express concerns about the increased uncertainty.

- Analysis of capital flows into and out of China: [Discuss observed capital flows. Has there been a significant increase in capital outflow? How have foreign direct investments been affected?]

- Impact on Chinese trade balance: [Analyze the impact on Chinese exports and imports. A weaker Yuan can boost exports but might increase the cost of imports.]

- Quotes from market analysts and investors: [Include quotes from reputable sources reflecting diverse perspectives on the policy change.]

Overall, market sentiment remains somewhat cautious. While the long-term implications are still unfolding, the reduced support reflects a more nuanced approach to managing the Yuan's value.

Potential Long-Term Implications

The long-term implications of the PBOC's reduced Yuan support are complex and multifaceted. A more flexible exchange rate could, in theory, improve the efficiency of the Chinese economy by allowing market mechanisms to allocate resources more effectively. However, there are also potential risks, including increased volatility and potential disruptions to trade and investment.

- Long-term economic growth forecasts: [Discuss how the shift might impact China's long-term economic growth trajectory. Consider potential benefits and drawbacks.]

- Potential risks associated with exchange rate flexibility: [Discuss risks such as increased volatility, speculative attacks, and potential disruptions to economic stability.]

- Predictions for future PBOC actions: [Speculate on whether the PBOC might further adjust its monetary policy in response to market developments.]

The move towards greater exchange rate flexibility aligns with China's broader efforts to integrate more deeply into the global economy and improve the efficiency of its financial markets. However, careful monitoring and management will be crucial to navigate the challenges associated with this shift.

Conclusion: Understanding the Implications of PBOC's Reduced Yuan Support

The PBOC's reduction in Yuan support represents a notable shift in its monetary policy. This move has led to increased volatility in the Yuan's exchange rate and mixed reactions from market participants. While the long-term consequences remain uncertain, the change signals a potential move towards greater exchange rate flexibility and market-based pricing. Understanding the implications of PBOC's reduced Yuan support is crucial for investors, businesses, and policymakers alike. Stay informed about further developments by subscribing to our newsletter [link to newsletter] or following us on social media [links to social media]. Continued analysis of PBOC's actions and their impact on the Yuan and global markets will be essential for navigating this evolving landscape.

Featured Posts

-

16 Billion Revenue Cut Analyzing The Impact Of Trumps Tariffs On California

May 16, 2025

16 Billion Revenue Cut Analyzing The Impact Of Trumps Tariffs On California

May 16, 2025 -

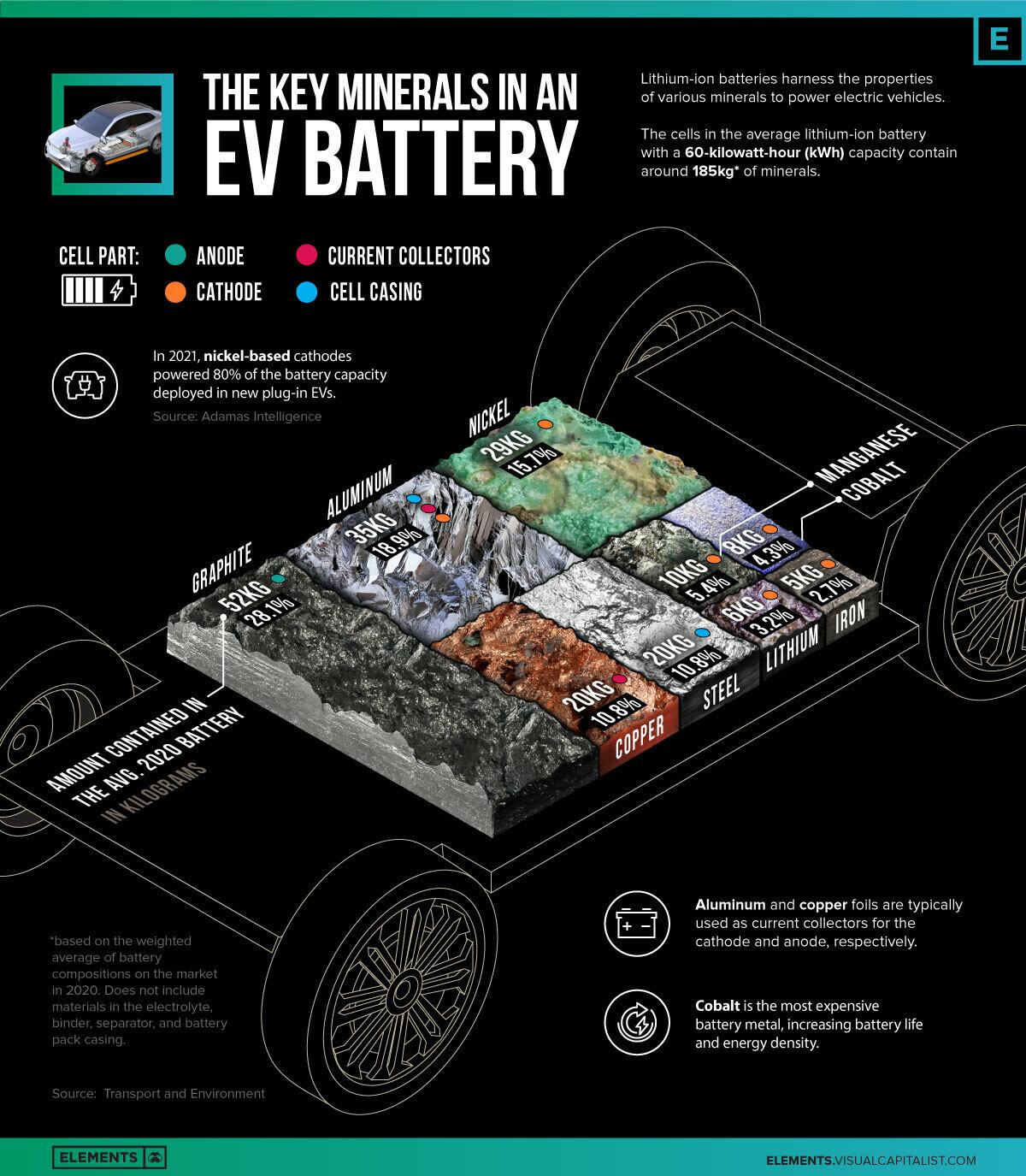

Congos Cobalt Export Ban A Market Analysis And Prediction Of Quota Impact

May 16, 2025

Congos Cobalt Export Ban A Market Analysis And Prediction Of Quota Impact

May 16, 2025 -

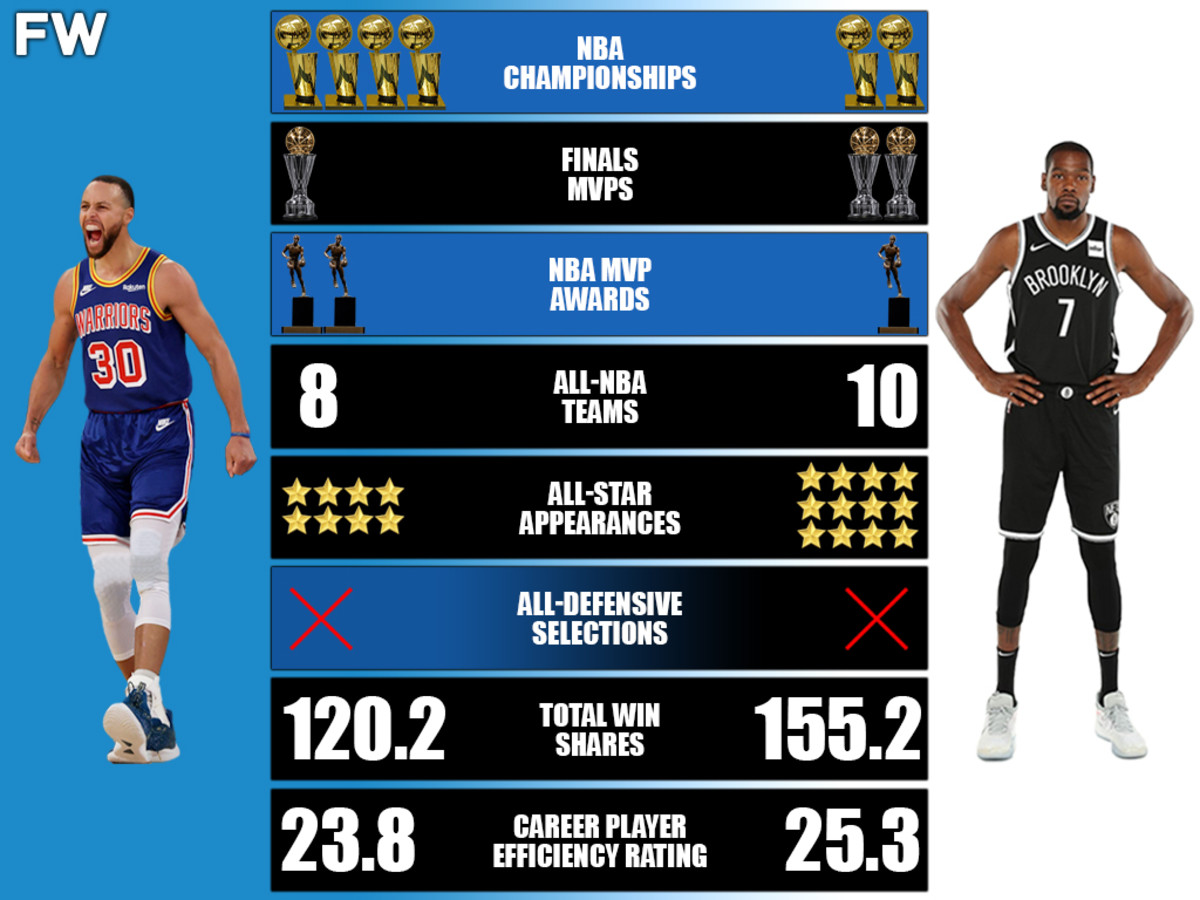

Jimmy Butler Vs Kevin Durant Why Butler Is A Better Option For The Warriors

May 16, 2025

Jimmy Butler Vs Kevin Durant Why Butler Is A Better Option For The Warriors

May 16, 2025 -

Ohio Man Dies In Police Custody I Dont Hear A Heartbeat Video

May 16, 2025

Ohio Man Dies In Police Custody I Dont Hear A Heartbeat Video

May 16, 2025 -

Taiwanese Regulator Cracks Down On Unethical Etf Sales Practices

May 16, 2025

Taiwanese Regulator Cracks Down On Unethical Etf Sales Practices

May 16, 2025

Latest Posts

-

Giants Vs Padres Game Prediction Analyzing A Potential Padres Victory

May 16, 2025

Giants Vs Padres Game Prediction Analyzing A Potential Padres Victory

May 16, 2025 -

Mlb Prediction Braves Vs Padres Atlantas Winning Strategy

May 16, 2025

Mlb Prediction Braves Vs Padres Atlantas Winning Strategy

May 16, 2025 -

Padres Vs Giants Prediction Will San Diego Win Or Lose Closely

May 16, 2025

Padres Vs Giants Prediction Will San Diego Win Or Lose Closely

May 16, 2025 -

Predicting The Padres Performance In Their 2025 Home Opener

May 16, 2025

Predicting The Padres Performance In Their 2025 Home Opener

May 16, 2025 -

Giants Vs Padres Prediction Outright Padres Win Or 1 Run Loss

May 16, 2025

Giants Vs Padres Prediction Outright Padres Win Or 1 Run Loss

May 16, 2025