Analysis Of The Offer For InterRent REIT: Executive Chair And Sovereign Wealth Fund Proposal

Table of Contents

The Proposed Acquisition Offer: Details and Valuation

The acquisition offer for InterRent REIT involves a [Specific Offer Price] per share, totaling a transaction value of [Total Transaction Value]. The payment method is proposed as [Payment Method: e.g., a combination of cash and stock]. Several conditions are attached to the offer, including [mention key conditions, e.g., regulatory approvals, shareholder approval].

To assess the valuation, we must compare the offered price to InterRent REIT's current market value and recent trading history. At the time of writing, InterRent REIT's stock is trading at [Current Market Price], meaning the offer presents a [Premium Percentage]% premium. Analyzing key valuation metrics such as the Price-to-Earnings (P/E) ratio and Price-to-Book (P/B) ratio is crucial. A detailed comparison of these ratios against industry benchmarks and InterRent REIT's historical data will provide a clearer picture of the fairness of the offer.

- Offer price per share: [Specific Offer Price]

- Total value of the transaction: [Total Transaction Value]

- Premium offered compared to the market price: [Premium Percentage]%

- Key valuation ratios and their implications: [Detailed analysis of P/E and P/B ratios, comparing to industry averages and historical data for InterRent REIT]

The Executive Chair's Role and Potential Conflicts of Interest

The Executive Chair's involvement in this acquisition is significant. They hold a [Percentage]% stake in InterRent REIT and have a close relationship with the participating Sovereign Wealth Fund. This raises concerns about potential conflicts of interest. It's essential to examine whether the offer price fairly represents the value of InterRent REIT for all shareholders, especially considering the Executive Chair's vested interest. Independent valuation experts should assess if any bias exists in the offer.

Transparency is paramount. Detailed disclosure regarding the Executive Chair's negotiations and any potential benefits they might receive beyond the offer price is crucial. Furthermore, mechanisms to mitigate these conflicts of interest, such as independent board committees overseeing the transaction, should be in place.

- Executive Chair's ownership stake in InterRent REIT: [Percentage]%

- History of the Executive Chair's involvement with the company: [Brief history highlighting relevant past actions]

- Potential conflict of interest concerns: [Detailed explanation of potential conflicts]

- Measures to mitigate conflicts of interest (if any): [Description of any mitigating measures]

The Sovereign Wealth Fund's Involvement and Strategic Rationale

The participation of a Sovereign Wealth Fund adds another layer of complexity to the InterRent REIT acquisition. Understanding their investment strategy is vital. Sovereign Wealth Funds typically have a long-term investment horizon and often focus on stable, income-generating assets like real estate. Their investment criteria typically emphasize risk mitigation and long-term value creation.

The fund's motivation for acquiring InterRent REIT likely involves strategic synergies with their existing portfolio, diversification opportunities, or a belief in the long-term growth potential of the Canadian real estate market. Analyzing their past real estate investments and comparing them to InterRent REIT's profile can illuminate their strategic rationale.

- Sovereign Wealth Fund's investment track record in real estate: [Overview of the fund's past investments in the real estate sector]

- Potential synergies between the Sovereign Wealth Fund's portfolio and InterRent REIT: [Discussion of possible synergies]

- Strategic rationale behind the acquisition for the Sovereign Wealth Fund: [Analysis of the fund's likely motivations]

Potential Risks and Benefits of the Acquisition for InterRent REIT Shareholders

This acquisition presents both potential benefits and risks for InterRent REIT shareholders. The offer might bring increased liquidity, potential for higher returns if the offer price is indeed fair, and possibly improved financial stability under the new ownership structure.

However, risks include the dilution of ownership, potential loss of control over the company's strategic direction, and potential regulatory hurdles during the acquisition process. Furthermore, a detailed assessment of the post-acquisition management and strategic plans is necessary to gauge the long-term impact on growth and profitability.

- Potential benefits for InterRent REIT shareholders: [Detailed explanation of potential advantages]

- Potential risks associated with the acquisition: [Thorough explanation of potential drawbacks]

- Potential impact on the company's future growth and profitability: [Prediction of the potential impact on future performance]

Conclusion: Final Thoughts on the InterRent REIT Acquisition Offer

This analysis of the InterRent REIT acquisition offer reveals a complex situation. While the offer presents potential financial benefits and a strategic shift for the company, the involvement of the Executive Chair and the inherent conflicts of interest require careful scrutiny. Shareholders must weigh the premium offered against the potential risks and uncertainties associated with the deal. The Sovereign Wealth Fund's involvement adds another layer of complexity, necessitating a thorough understanding of their investment strategy and long-term goals.

Conduct your own due diligence before making investment decisions regarding the InterRent REIT offer. Consider seeking advice from financial professionals to assess the appropriateness of this offer based on your individual investment objectives and risk tolerance. Learn more about InterRent REIT and the proposed acquisition to make an informed investment choice. [Insert links to relevant financial news articles and InterRent REIT investor relations pages].

Featured Posts

-

Tate Mc Raes Collaboration With Morgan Wallen A Republican Controversy

May 29, 2025

Tate Mc Raes Collaboration With Morgan Wallen A Republican Controversy

May 29, 2025 -

Ertekes Magyar Penzermek 100 Forintos Ermek Gyujtemenybe

May 29, 2025

Ertekes Magyar Penzermek 100 Forintos Ermek Gyujtemenybe

May 29, 2025 -

Aj Odudu Responds To Mickey Rourkes Inappropriate Comment On Celebrity Big Brother

May 29, 2025

Aj Odudu Responds To Mickey Rourkes Inappropriate Comment On Celebrity Big Brother

May 29, 2025 -

100 Forintos Bankjegyek Gyujtemenyi Ertek Es Ritkasag

May 29, 2025

100 Forintos Bankjegyek Gyujtemenyi Ertek Es Ritkasag

May 29, 2025 -

Liverpool Southampton De Redenen Achter De Zes Wissels

May 29, 2025

Liverpool Southampton De Redenen Achter De Zes Wissels

May 29, 2025

Latest Posts

-

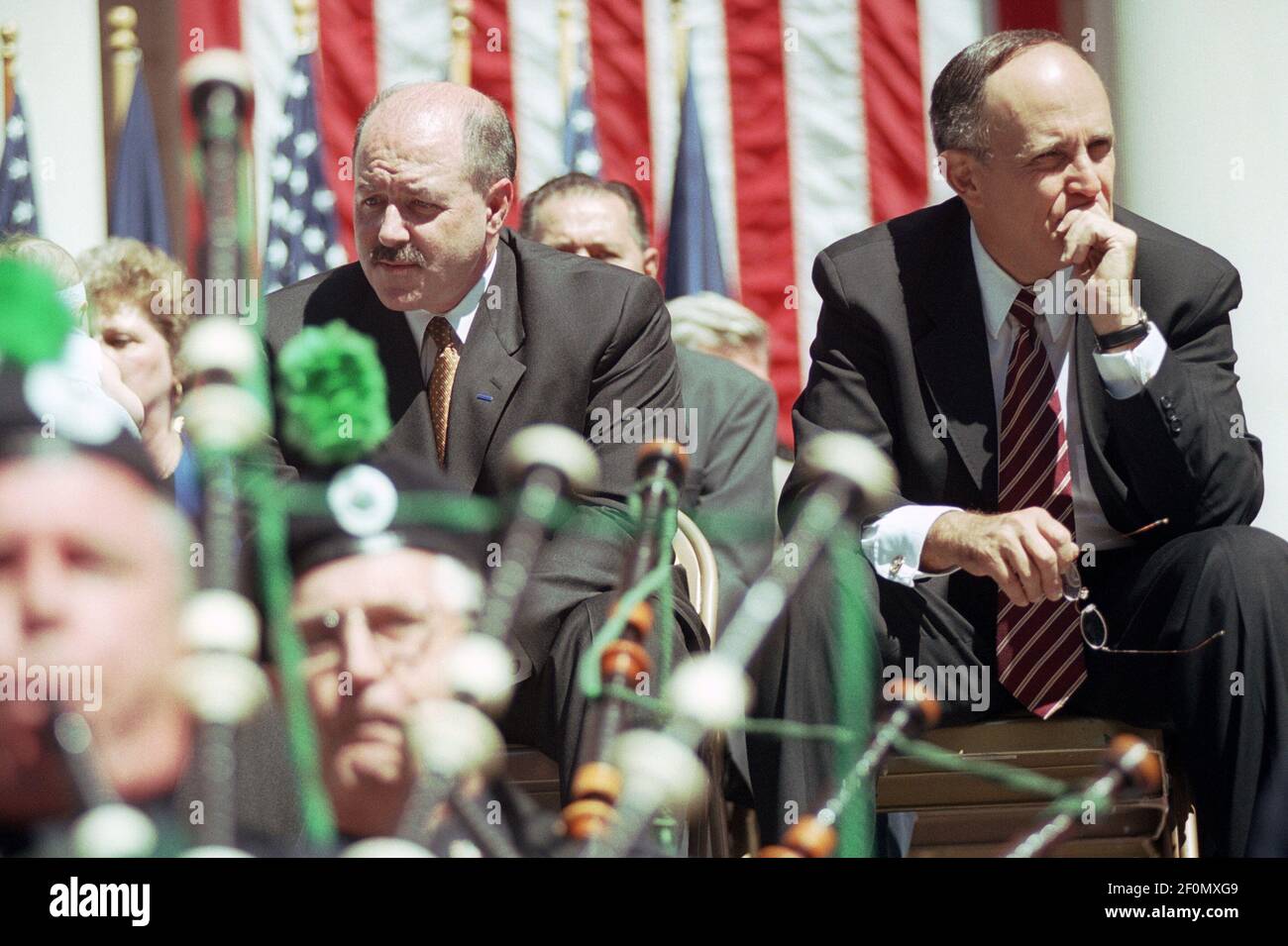

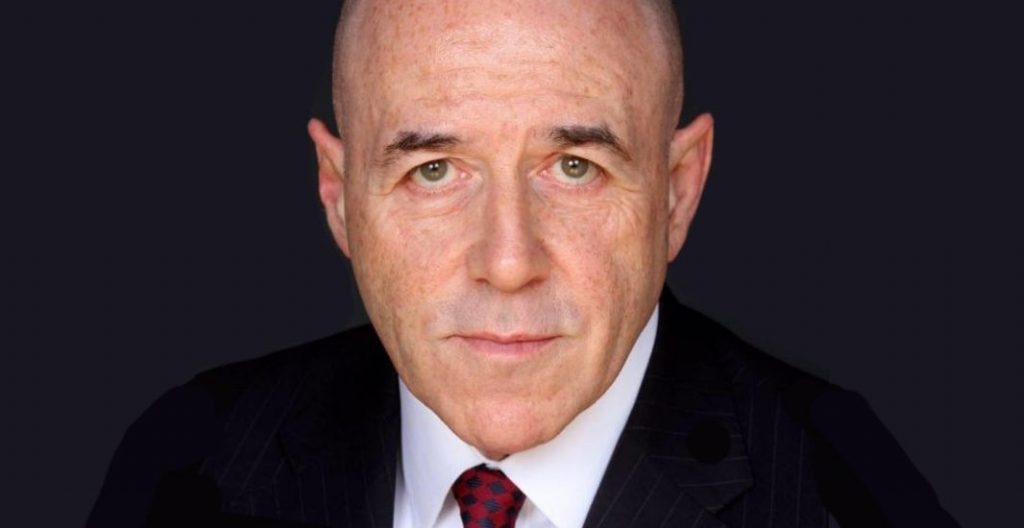

Bernard Kerik Former Nypd Commissioner Dies At 69

May 31, 2025

Bernard Kerik Former Nypd Commissioner Dies At 69

May 31, 2025 -

Hospitalization Of Former Nypd Commissioner Bernard Kerik A Health Update

May 31, 2025

Hospitalization Of Former Nypd Commissioner Bernard Kerik A Health Update

May 31, 2025 -

Understanding Bernard Keriks Family Wife Hala Matli And Children

May 31, 2025

Understanding Bernard Keriks Family Wife Hala Matli And Children

May 31, 2025 -

Hospitalized Former Nypd Commissioner Keriks Health Update

May 31, 2025

Hospitalized Former Nypd Commissioner Keriks Health Update

May 31, 2025 -

Bernard Kerik Ex Nypd Commissioner Undergoes Medical Treatment Expected Recovery

May 31, 2025

Bernard Kerik Ex Nypd Commissioner Undergoes Medical Treatment Expected Recovery

May 31, 2025