Analysis Of Sinograin's Auction Of Imported Soybeans In China

Table of Contents

Sinograin's soybean auctions are pivotal events shaping China's agricultural landscape and global soybean markets. These auctions, conducted by China's largest grain reserve operator, significantly influence domestic soybean prices and import strategies. This article analyzes a recent Sinograin soybean auction, examining its details, market impact, and strategic implications for Sinograin, the Chinese government, and global soybean trade. We will delve into the specifics to understand the auction's ripple effects on the Chinese economy and international agricultural relations.

H2: Auction Details and Results

The recent Sinograin soybean auction showcased several key aspects impacting the market. Understanding these details is crucial for comprehensive market analysis.

H3: Volume and Price of Soybeans Auctioned:

The auction involved a significant volume of imported soybeans, totaling approximately [Insert Actual Volume - e.g., 1 million metric tons]. The average price achieved was [Insert Actual Price - e.g., $550 per metric ton], which represents a [Insert Percentage Change - e.g., 5%] increase/decrease compared to the previous auction. This fluctuation can be attributed to various factors, including global supply and demand dynamics.

| Metric | Value |

|---|---|

| Total Volume (MT) | [Insert Actual Volume] |

| Average Price ($/MT) | [Insert Actual Price] |

| Price Change (%) | [Insert Percentage Change] |

H3: Participating Companies and Winning Bids:

Major Chinese agricultural companies, including [Insert Company Names - e.g., COFCO, Shandong Port Group], actively participated in the bidding process. [Insert Winning Bidder Information - e.g., COFCO secured the largest share of the soybeans, winning bids for approximately 400,000 metric tons]. The distribution of winning bids suggests a continued consolidation within the Chinese soybean processing industry. This concentration of purchases has implications for market competitiveness and pricing power.

H3: Geographic Origin of Soybeans:

The imported soybeans originated primarily from [Insert Countries of Origin - e.g., Brazil and the United States], reflecting China's diverse sourcing strategies. The reliance on Brazilian soybeans [Explain reason – e.g., due to their competitive pricing and consistent supply] highlights the importance of the Brazil-China trade relationship in global soybean markets. The inclusion of US soybeans, however, signals a degree of diversification in sourcing, potentially mitigating risks associated with reliance on a single supplier. The specific mix of Brazilian soybeans and US soybeans is significant in gauging geopolitical influences on the market.

- [Specific data point 1 - e.g., 60% of soybeans originated from Brazil]

- [Specific data point 2 - e.g., The average price for Brazilian soybeans was slightly lower than that of US soybeans]

- [Specific data point 3 - e.g., The inclusion of US soybeans indicates a potential easing of trade tensions]

H2: Market Impact and Analysis

The Sinograin soybean auction had a significant and multifaceted impact on the Chinese and global soybean markets.

H3: Influence on Domestic Soybean Prices:

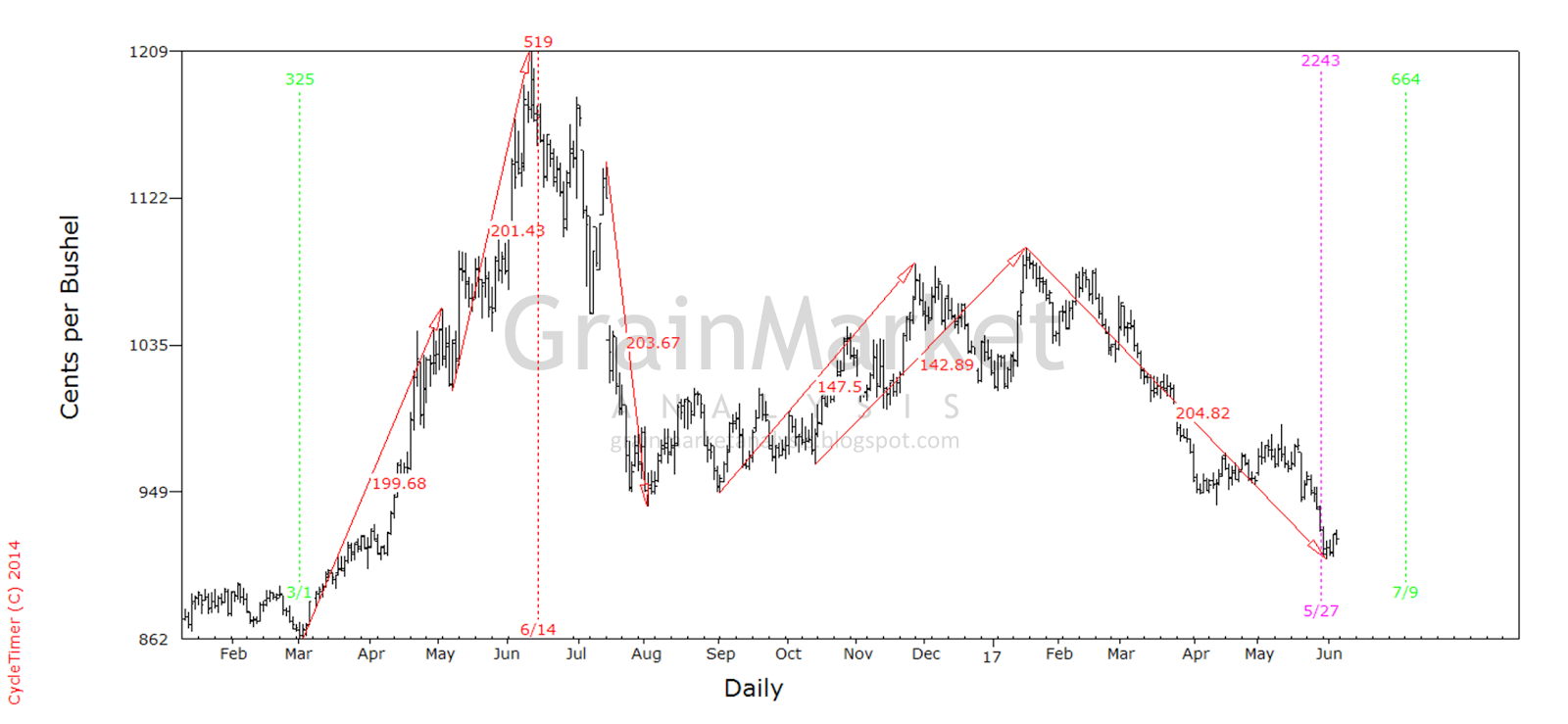

The auction results immediately impacted domestic soybean prices in China. [Insert description of price movement with supporting data and charts. E.g., Following the auction, domestic soybean prices experienced a slight dip, reflecting the increased supply.] [Include a graph showing price trends]. This illustrates the direct influence Sinograin auctions have on market equilibrium.

H3: Implications for Soybean Imports:

The auction provides insight into future soybean import strategies. The volume and price achieved suggest a continued strong demand for imported soybeans in China. [Discuss potential shifts – e.g., China may adjust its import volumes based on global prices and domestic supply.] This necessitates a close monitoring of global soybean production and weather patterns.

H3: Impact on Chinese Feed Industry:

The availability of soybeans at auctioned prices significantly impacts the cost of feed for livestock, poultry, and aquaculture. Lower prices reduce feed costs, potentially leading to lower food prices for consumers. Conversely, higher prices could increase the cost of animal products. The price volatility directly influences profitability and production decisions within the Chinese feed industry.

- [Factor 1: Demand from the pig farming sector]

- [Factor 2: Poultry feed prices]

- [Factor 3: Aquaculture feed costs]

H2: Strategic Implications for Sinograin and the Chinese Government

Sinograin's role and the government's policies are integral to understanding the implications of this auction.

H3: Sinograin's Role in Market Stabilization:

Sinograin plays a vital role in stabilizing the soybean market in China. By releasing soybeans into the market through auctions, Sinograin can mitigate price spikes caused by supply shortages or speculation. This demonstrates the importance of state intervention in managing crucial agricultural commodities.

H3: Government Policy and Food Security:

The auction aligns with the Chinese government's overarching goals of ensuring food security and achieving self-sufficiency in agricultural production. However, the dependence on imported soybeans highlights the challenges in meeting these objectives fully. The government likely uses these auctions as a tool to balance domestic production with import needs.

H3: Geopolitical Considerations:

The sourcing of soybeans from various countries has geopolitical implications. Maintaining strong trade relationships with major soybean exporters is crucial for ensuring a stable supply of this essential commodity. The auction's outcome may influence China's diplomatic efforts and trade negotiations with these nations.

- [Policy objective 1: Reducing reliance on imports]

- [Policy objective 2: Supporting domestic soybean farmers]

- [Policy objective 3: Maintaining stable food prices]

Conclusion:

The Sinograin soybean auction provides valuable insights into China's agricultural market dynamics. The auction's volume, price, and implications for domestic prices, import strategies, and the feed industry underscore the importance of monitoring these events. Understanding the strategic role of Sinograin and the interplay of government policies, market forces, and geopolitical factors are key to navigating the complexities of China's soybean market. Stay informed about future Sinograin soybean auctions and their impact on the Chinese agricultural market by following reputable agricultural news sources and market analysis reports.

Featured Posts

-

El Clasico Frenzy Immediate Reactions To Barcelonas 4 3 Victory

May 29, 2025

El Clasico Frenzy Immediate Reactions To Barcelonas 4 3 Victory

May 29, 2025 -

Game Stop Limits Pokemon Tcg Sales One Per Customer

May 29, 2025

Game Stop Limits Pokemon Tcg Sales One Per Customer

May 29, 2025 -

State Library Of Queensland Fellowship Controversy Gaza Post Sparks Outrage

May 29, 2025

State Library Of Queensland Fellowship Controversy Gaza Post Sparks Outrage

May 29, 2025 -

Ipa O Captain America Xairetaei Stratiotika Ton Tramp

May 29, 2025

Ipa O Captain America Xairetaei Stratiotika Ton Tramp

May 29, 2025 -

Kellys Child Sale Accusation Key Testimony From Joshlins Aunt

May 29, 2025

Kellys Child Sale Accusation Key Testimony From Joshlins Aunt

May 29, 2025

Latest Posts

-

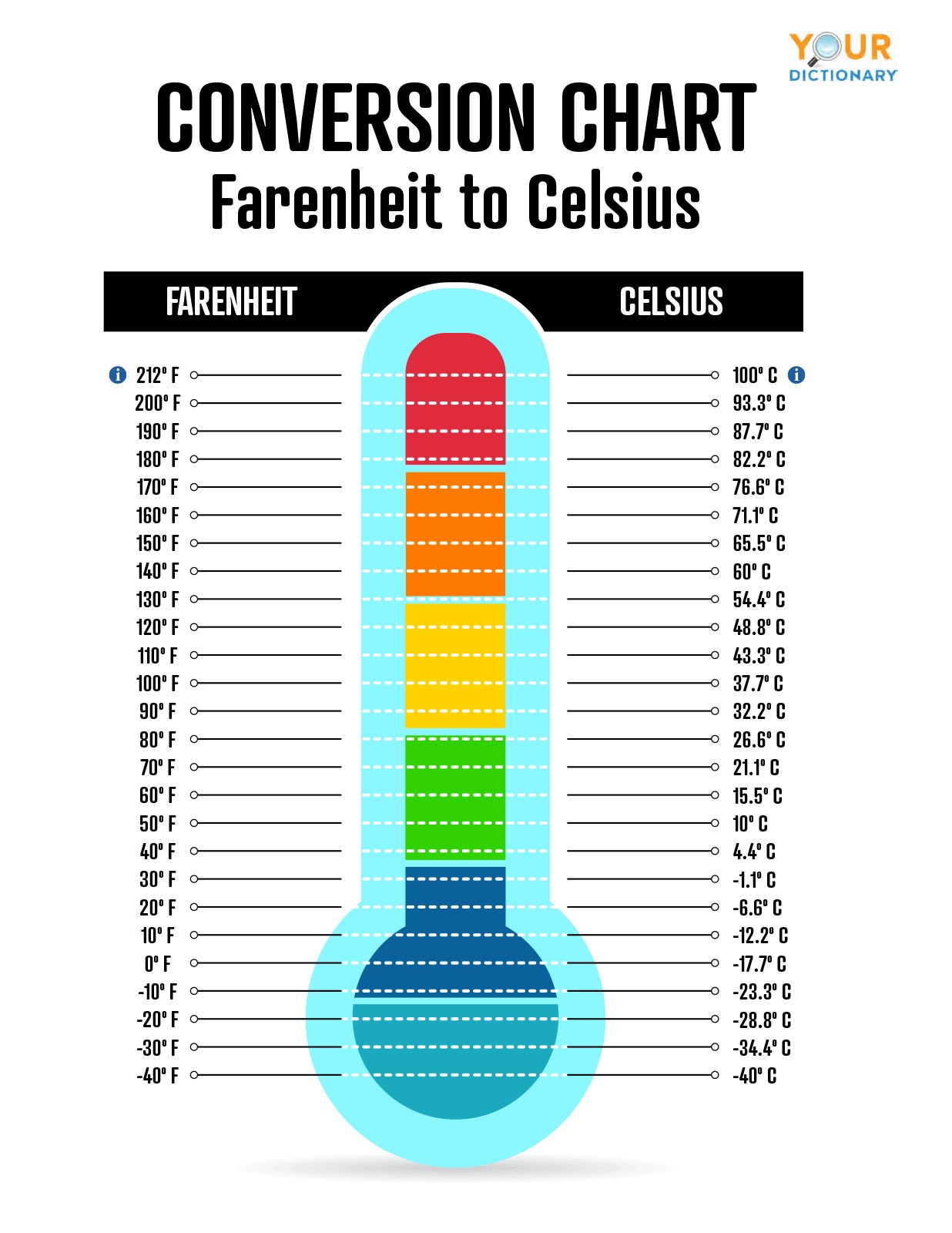

Texas Heat Advisory Temperatures To Hit 111 Degrees Fahrenheit

May 30, 2025

Texas Heat Advisory Temperatures To Hit 111 Degrees Fahrenheit

May 30, 2025 -

Bajas Temperaturas En Lima Advertencia Del Senamhi Por Frio Extremo

May 30, 2025

Bajas Temperaturas En Lima Advertencia Del Senamhi Por Frio Extremo

May 30, 2025 -

Mada Preduprezhdaet Opasnaya Pogoda V Izraile

May 30, 2025

Mada Preduprezhdaet Opasnaya Pogoda V Izraile

May 30, 2025 -

Preduprezhdenie Politsii Izrailya Ostavaytes Doma

May 30, 2025

Preduprezhdenie Politsii Izrailya Ostavaytes Doma

May 30, 2025 -

Izrail Mada Prognoziruet Ekstremalnye Pogodnye Usloviya Zharu Kholod I Shtorm

May 30, 2025

Izrail Mada Prognoziruet Ekstremalnye Pogodnye Usloviya Zharu Kholod I Shtorm

May 30, 2025