Analysis: Gold (XAUUSD) Recovers After Weak US Economic Data

Table of Contents

Weak US Economic Data Triggers Gold Rally

Recent US economic indicators painted a less-than-rosy picture, triggering a rally in the XAUUSD market. Several key factors contributed to this gold price surge:

- Disappointing GDP Growth: Lower-than-anticipated GDP growth figures signaled a potential slowdown in the US economy, increasing investor anxiety. This fueled a flight to safety, boosting demand for gold as a safe haven.

- Rising Unemployment Claims: A surge in unemployment claims further fueled concerns about the health of the US economy. This negative economic sentiment strengthened the appeal of gold as a stable investment.

- Weakening US Dollar: The disappointing economic data led to a weakening of the US dollar (USD). Since gold is priced in USD, a weaker dollar generally translates to a higher XAUUSD price, making gold more affordable for international buyers and increasing demand. This inverse relationship between the USD and gold prices is a key driver of XAUUSD price action.

- Lower Interest Rate Expectations: The weak economic data reduced expectations for future interest rate hikes by the Federal Reserve. Lower interest rates typically make gold more attractive, as it doesn't yield interest and becomes more competitive against interest-bearing assets.

Safe-Haven Demand Drives Gold Investment

Gold's recent price increase is largely attributed to its status as a premier safe-haven asset. During periods of economic turmoil and uncertainty, investors flock to gold as a store of value:

- Protection Against Market Volatility: Investors view gold as a hedge against market volatility. When stock markets decline or other assets lose value, gold often holds its value or even increases, offering portfolio diversification and risk mitigation.

- Geopolitical Uncertainty: Global geopolitical instability often drives investors towards gold as a safe haven. Concerns about international conflicts, political instability, and other unpredictable events fuel demand for this reliable asset.

- Inflation Hedge: Gold is often seen as a hedge against inflation. During periods of rising inflation, the purchasing power of fiat currencies decreases, while the value of gold tends to hold steady or even increase, making it an attractive investment to protect against inflation erosion. This is particularly important in considering long-term gold investment strategies.

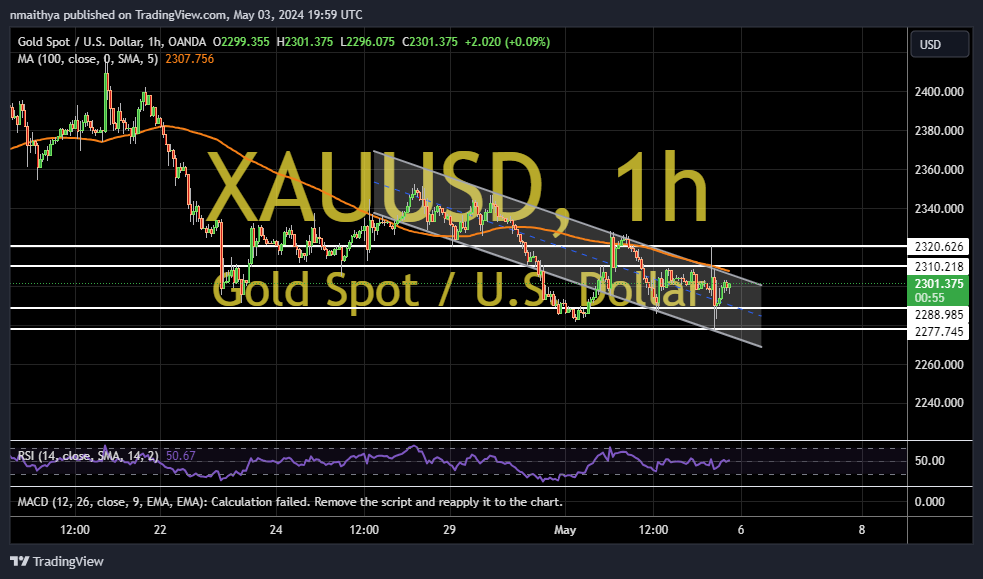

Technical Analysis of the XAUUSD Price Movement

Analyzing the XAUUSD chart reveals several key technical aspects that supported the recent price rally:

- Support Levels: The price action showed strong support at key technical levels, indicating buying pressure and preventing further declines.

- Resistance Levels: Breaking through significant resistance levels confirmed the strength of the upward trend and signaled further potential for growth in the XAUUSD price.

- Technical Indicators: Technical indicators such as moving averages and the Relative Strength Index (RSI) provided signals suggesting a bullish trend, supporting the price increase. These indicators offer valuable insights for those engaged in XAUUSD trading strategies.

Future Outlook for Gold (XAUUSD)

The future outlook for gold prices remains somewhat uncertain, depending on various factors:

- Further Economic Data Releases: Upcoming US economic data releases will significantly influence investor sentiment and consequently, the XAUUSD price. Positive data could dampen gold's appeal, while negative data could fuel further price increases.

- Central Bank Actions: Actions taken by central banks around the world, including interest rate decisions and other monetary policy adjustments, will also impact gold prices.

- Geopolitical Events: Unforeseen geopolitical events could significantly impact the safe-haven demand for gold, leading to price fluctuations.

Developing a robust investment strategy should consider these factors. For example, a conservative approach might involve gradually accumulating gold as a long-term investment to benefit from potential future price appreciation, while more active traders might leverage technical analysis for short-term XAUUSD trading opportunities.

Conclusion

The recent surge in gold (XAUUSD) prices following the release of weak US economic data underscores its role as a vital safe-haven asset. This recovery is driven by increased investor demand amid economic uncertainty and a weaker dollar. Technical analysis further supports the observed price action. Understanding the interplay of economic indicators, geopolitical factors, and technical analysis is crucial for navigating the XAUUSD market effectively.

Call to Action: Stay informed about the latest developments in the US economy and the XAUUSD market. Monitor key economic indicators and technical analysis to make informed decisions regarding your gold (XAUUSD) investments and trading strategies. Consider diversifying your portfolio with gold to mitigate risk and capitalize on potential opportunities within the XAUUSD market.

Featured Posts

-

The Landry Shamet Question A Dilemma For The New York Knicks

May 17, 2025

The Landry Shamet Question A Dilemma For The New York Knicks

May 17, 2025 -

At And T Sounds Alarm On Broadcoms V Mware Deal A 1 050 Price Hike

May 17, 2025

At And T Sounds Alarm On Broadcoms V Mware Deal A 1 050 Price Hike

May 17, 2025 -

China Open To Canada Trade Deal Ambassadors Statement

May 17, 2025

China Open To Canada Trade Deal Ambassadors Statement

May 17, 2025 -

Blue Origins Rocket Launch Abruptly Halted By Technical Glitch

May 17, 2025

Blue Origins Rocket Launch Abruptly Halted By Technical Glitch

May 17, 2025 -

Update Valerio Therapeutics S A And The Approval Of Its Financial Statements

May 17, 2025

Update Valerio Therapeutics S A And The Approval Of Its Financial Statements

May 17, 2025

Latest Posts

-

Review Of Jackbit Is It The Best Crypto Casino For 2025

May 17, 2025

Review Of Jackbit Is It The Best Crypto Casino For 2025

May 17, 2025 -

Jackbit Your Guide To The Best Bitcoin Casino Experience In 2025

May 17, 2025

Jackbit Your Guide To The Best Bitcoin Casino Experience In 2025

May 17, 2025 -

Choosing The Best Crypto Casino In 2025 Jackbits Advantages

May 17, 2025

Choosing The Best Crypto Casino In 2025 Jackbits Advantages

May 17, 2025 -

2025s Top Crypto Casinos A Guide To Easy Withdrawals And Exclusive Bonuses

May 17, 2025

2025s Top Crypto Casinos A Guide To Easy Withdrawals And Exclusive Bonuses

May 17, 2025 -

Exclusive Bonuses Find The Best Crypto Casinos With Easy Withdrawals In 2025

May 17, 2025

Exclusive Bonuses Find The Best Crypto Casinos With Easy Withdrawals In 2025

May 17, 2025