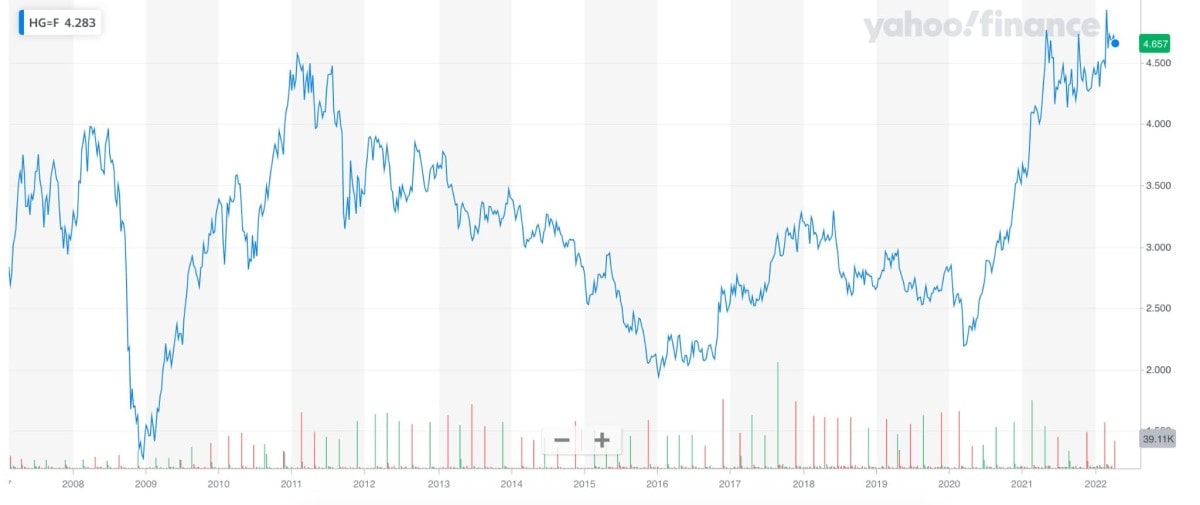

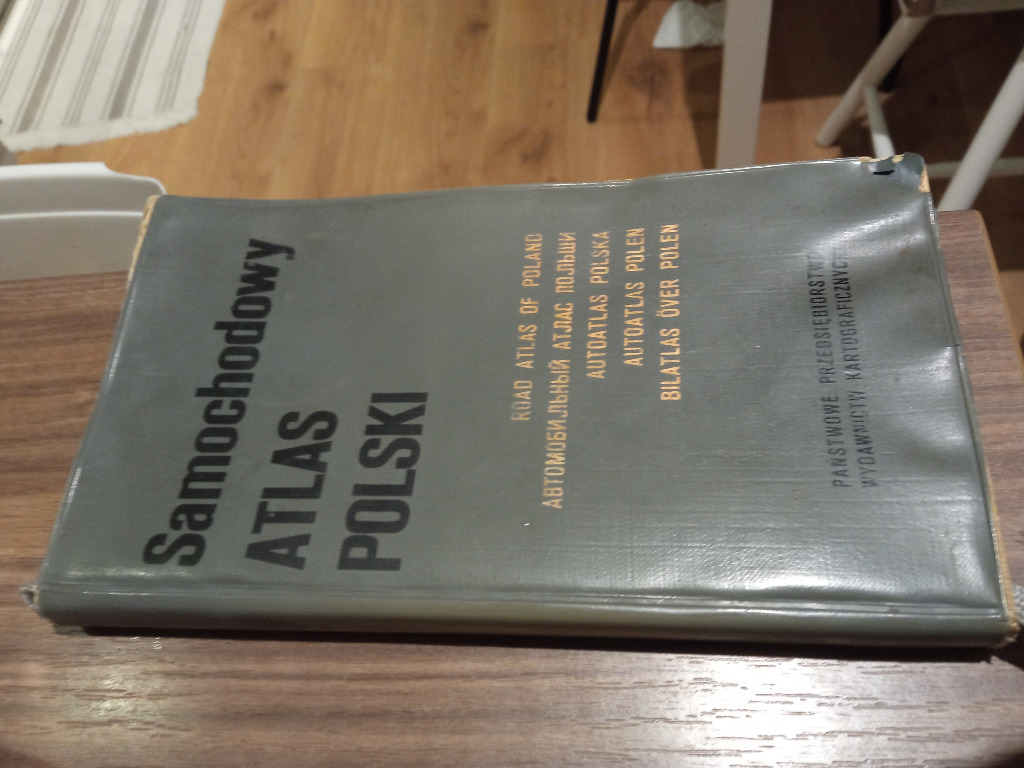

Analysis: Copper Price Hike Linked To China-US Trade

Table of Contents

China's Role in the Copper Market

China's influence on the global copper market is undeniable. Its massive economy and ambitious infrastructure projects are key drivers of the current copper price hike.

Increased Demand from China

China's booming construction sector and continued investment in infrastructure projects significantly boost global copper demand. This insatiable appetite for copper is a major contributor to the recent price surge.

- Massive infrastructure projects (e.g., Belt and Road Initiative): These large-scale projects require vast quantities of copper for wiring, plumbing, and other applications, directly impacting the copper price.

- Growth in renewable energy infrastructure (solar, wind): The transition to cleaner energy sources relies heavily on copper, driving up demand and contributing to the copper price hike. This increased demand for copper in green technologies is a long-term trend expected to continue.

- Rising urbanization and increased consumer spending: As China's population continues to urbanize and consumer spending rises, the demand for copper-containing products, from appliances to electronics, increases, further fueling the copper price.

Impact of Trade Tensions on Copper Supply Chains

Trade disputes between China and the US can significantly disrupt copper supply chains, limiting availability and pushing prices higher. This geopolitical instability directly affects the copper price hike.

- Tariffs and trade restrictions create uncertainty and volatility: The imposition of tariffs and trade restrictions introduces uncertainty into the market, making it difficult for businesses to accurately predict costs and impacting the overall copper price.

- Disruptions in copper mining and processing operations due to trade sanctions: Sanctions can directly impact the supply of copper from certain regions, creating shortages and increasing the copper price.

- Increased transportation costs and logistical challenges add to the price: Trade tensions often lead to increased shipping costs and logistical complexities, further contributing to the upward pressure on the copper price.

US Economic Policies and their Influence

US economic policies also play a significant role in the global copper market and the current copper price hike.

Stimulus Packages and Infrastructure Spending

Government spending initiatives in the US, such as stimulus packages and infrastructure investments, significantly increase copper demand, putting upward pressure on prices.

- Increased demand for copper in construction and manufacturing projects: Large-scale infrastructure projects, spurred by government spending, lead to increased demand for copper in construction and various manufacturing processes, affecting the copper price.

- Government investments in electric vehicle infrastructure further inflate demand: The push towards electric vehicles requires substantial amounts of copper for batteries and wiring, driving up demand and impacting the copper price hike.

- Ripple effects on related industries requiring copper components: Increased demand in one sector creates ripple effects throughout the economy, impacting various industries that rely on copper components.

Impact of US Sanctions on Global Copper Markets

US sanctions on specific countries or companies can disrupt the global supply of copper, leading to price increases. This geopolitical element is a key factor in the copper price hike.

- Reduced copper exports from sanctioned nations: Sanctions can severely limit or halt copper exports from targeted countries, creating supply shortages and boosting the copper price.

- Uncertainty in global supply chains due to geopolitical factors: Geopolitical uncertainty discourages investment and disrupts supply chains, adding to the volatility of the copper price.

- Potential for market manipulation and speculation: The uncertainty caused by sanctions can create opportunities for market manipulation and speculation, further driving up the copper price.

Other Contributing Factors to the Copper Price Hike

Beyond US-China relations, several other factors contribute to the current copper price hike.

Global Supply Chain Disruptions

Broader supply chain issues, independent of US-China trade tensions, contribute significantly to price volatility.

- Pandemic-related factory closures and logistical bottlenecks: The COVID-19 pandemic disrupted global supply chains, impacting copper production and transportation, contributing to the copper price hike.

- Extreme weather events impacting mining operations: Natural disasters and extreme weather can severely disrupt copper mining operations, creating supply shortages and driving up prices.

- Labor shortages in mining and processing industries: Labor shortages in the mining and processing industries further restrict copper production and add to the price increase.

Speculation and Investor Sentiment

Market speculation and investor sentiment play a vital role in driving up copper prices.

- Increased investment in commodities due to inflation concerns: Investors often turn to commodities like copper as a hedge against inflation, increasing demand and driving up prices.

- Market speculation leading to price fluctuations: Speculative trading can create significant price fluctuations in the copper market, further exacerbating the copper price hike.

- Investor sentiment influenced by geopolitical events and economic forecasts: Investor confidence and sentiment are heavily influenced by geopolitical events and economic forecasts, directly impacting the demand for and price of copper.

Conclusion

The dramatic copper price hike is a multifaceted issue with several interwoven factors. While China's surging demand and its trade relationship with the US are major drivers, other elements, such as global supply chain disruptions, investor sentiment, and US economic policies, all contribute to the price increase. Understanding these interconnected factors is crucial for businesses and investors navigating this volatile market. Further analysis of the copper price hike and its underlying causes will be essential for predicting future market trends and mitigating risks associated with this vital commodity. Stay informed about the ongoing developments in the copper price to make informed decisions.

Featured Posts

-

Relacionamento De Mindy Kaling Com Ex Colega De The Office A Declaracao De Amor

May 06, 2025

Relacionamento De Mindy Kaling Com Ex Colega De The Office A Declaracao De Amor

May 06, 2025 -

Produkcja Trotylu W Polsce Eksport Do Usa Dla Wojska

May 06, 2025

Produkcja Trotylu W Polsce Eksport Do Usa Dla Wojska

May 06, 2025 -

Celtics Vs Suns April 4th Game Time Tv Broadcast And Live Stream Info

May 06, 2025

Celtics Vs Suns April 4th Game Time Tv Broadcast And Live Stream Info

May 06, 2025 -

Understanding Westpacs Wbc Profit Decrease The Role Of Margin Squeezes

May 06, 2025

Understanding Westpacs Wbc Profit Decrease The Role Of Margin Squeezes

May 06, 2025 -

Zamowienie Na Trotyl Z Polski Analiza Rynkowa I Geopolityczne Implikacje

May 06, 2025

Zamowienie Na Trotyl Z Polski Analiza Rynkowa I Geopolityczne Implikacje

May 06, 2025

Latest Posts

-

Trotyl Z Polski Duze Zamowienie I Jego Wplyw Na Przemysl Zbrojeniowy

May 06, 2025

Trotyl Z Polski Duze Zamowienie I Jego Wplyw Na Przemysl Zbrojeniowy

May 06, 2025 -

Analyzing The Appeal Of Leon Thomas And Halle Baileys Rather Be Alone

May 06, 2025

Analyzing The Appeal Of Leon Thomas And Halle Baileys Rather Be Alone

May 06, 2025 -

Eksport Trotylu Z Polski Skala I Znaczenie Zamowienia

May 06, 2025

Eksport Trotylu Z Polski Skala I Znaczenie Zamowienia

May 06, 2025 -

Rather Be Alone Exploring The Success Of Leon Thomas And Halle Baileys Collaboration

May 06, 2025

Rather Be Alone Exploring The Success Of Leon Thomas And Halle Baileys Collaboration

May 06, 2025 -

Zamowienie Na Trotyl Z Polski Analiza Rynkowa I Geopolityczne Implikacje

May 06, 2025

Zamowienie Na Trotyl Z Polski Analiza Rynkowa I Geopolityczne Implikacje

May 06, 2025