Amundi MSCI World II UCITS ETF USD Hedged Dist: Daily NAV Updates And Performance

Table of Contents

Understanding Daily NAV Updates for the Amundi MSCI World II UCITS ETF USD Hedged Dist

What is NAV and Why is it Important?

Net Asset Value (NAV) represents the per-share value of an ETF's underlying assets. For the Amundi MSCI World II UCITS ETF USD Hedged Dist, this reflects the combined value of the numerous global companies it holds, adjusted for the USD hedging strategy. Daily NAV updates are vital for several reasons:

- Performance Tracking: Monitoring daily NAV allows investors to track the ETF's performance and understand its short-term and long-term growth trajectory.

- Return Calculation: Daily NAV data is essential for calculating your investment returns, whether you're looking at daily, weekly, monthly, or annual performance.

- Informed Decision-Making: Changes in NAV provide insights into market sentiment and can guide your investment strategies.

You can typically find daily NAV updates on the official Amundi website, major financial news websites (like Yahoo Finance or Google Finance), and through your brokerage account.

Factors Affecting the Daily NAV of the ETF

Several factors contribute to the daily fluctuations in the ETF's NAV:

- Market Movements of Underlying Assets: The primary driver is the performance of the companies within the MSCI World Index. Positive market sentiment generally leads to increased NAV, while negative sentiment leads to decreases.

- Currency Exchange Rate Fluctuations: The "USD Hedged" aspect minimizes exposure to currency risk. However, minor fluctuations in exchange rates can still impact the NAV, albeit to a lesser extent than an unhedged ETF.

- Dividend Distributions: When the underlying companies distribute dividends, the ETF's NAV typically adjusts to reflect this payout. This is a positive aspect as it contributes to overall returns.

- Expense Ratios: The ETF's expense ratio, which covers management and operational costs, slightly reduces the NAV over time.

Analyzing the Performance of the Amundi MSCI World II UCITS ETF USD Hedged Dist

Long-Term Performance and Historical Data

Analyzing the long-term performance of the Amundi MSCI World II UCITS ETF USD Hedged Dist is crucial for understanding its investment potential. (Insert chart or graph illustrating historical performance here). This data should be compared to relevant benchmarks, such as other global equity ETFs or the MSCI World Index itself, to assess its relative performance. Looking at long-term trends will provide a clearer picture of consistent growth or volatility.

Risk and Return Considerations

While the ETF offers global diversification, it's important to acknowledge its risk profile:

- Volatility: Like any equity investment, the ETF is subject to market volatility. However, diversification across numerous global companies helps mitigate this risk compared to investing in individual stocks.

- Currency Hedging: The USD hedging helps reduce the impact of currency exchange rate fluctuations, thereby protecting your investment from significant losses due to currency movements.

- Risk-Return Profile: The ETF aims for a balance between risk and return. While it seeks to generate capital appreciation through global market exposure, it's not a risk-free investment.

Understanding this risk-return profile is essential before incorporating the ETF into your investment strategy.

Accessing Daily NAV Updates and Performance Data

Reliable Sources for Information

For accurate and up-to-date NAV and performance data on the Amundi MSCI World II UCITS ETF USD Hedged Dist, consult these reputable sources:

- Amundi Website: The official Amundi website is the primary source for information on their ETFs.

- Major Financial Data Providers: Sites like Yahoo Finance, Google Finance, and Bloomberg provide real-time and historical data on many ETFs. (Include links if possible).

- Your Brokerage Account: Your brokerage platform will usually display the current NAV and performance history of ETFs you hold.

Conclusion: Making Informed Decisions with the Amundi MSCI World II UCITS ETF USD Hedged Dist

This article has highlighted the importance of monitoring daily NAV updates and analyzing the long-term performance of the Amundi MSCI World II UCITS ETF USD Hedged Dist. By understanding the factors influencing its NAV and its risk-return profile, you can make informed decisions about its suitability for your investment portfolio. Remember to utilize the reliable data sources outlined above to stay abreast of its performance. Conduct thorough research or consult with a qualified financial advisor to determine if the Amundi MSCI World II UCITS ETF USD Hedged Dist aligns with your individual investment goals and risk tolerance. Regularly reviewing the ETF's performance and adjusting your strategy as needed are key to successful investing in the Amundi MSCI World II UCITS ETF USD Hedged Dist and similar global equity ETFs.

Featured Posts

-

Hromadne Prepustanie V Nemecku Dosledky Pre Ekonomiku A Zamestnancov

May 25, 2025

Hromadne Prepustanie V Nemecku Dosledky Pre Ekonomiku A Zamestnancov

May 25, 2025 -

Aktien Frankfurt Eroeffnung Dax Rueckgang Am 21 Maerz 2025 Faelligkeitstermin An Den Terminmaerkten

May 25, 2025

Aktien Frankfurt Eroeffnung Dax Rueckgang Am 21 Maerz 2025 Faelligkeitstermin An Den Terminmaerkten

May 25, 2025 -

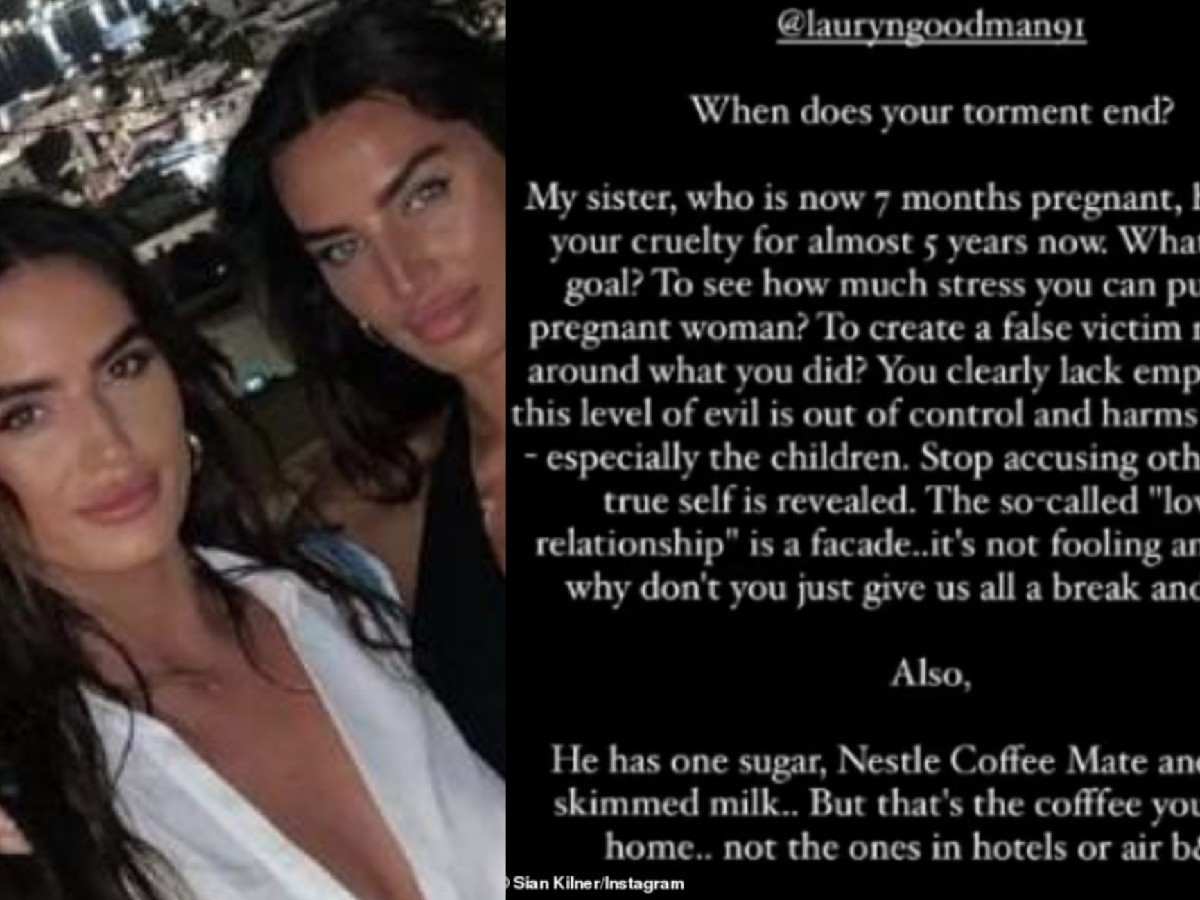

Following Kyle Walkers Night Out Annie Kilners Poisoning Allegations Explained

May 25, 2025

Following Kyle Walkers Night Out Annie Kilners Poisoning Allegations Explained

May 25, 2025 -

Bbc Radio 1 Big Weekend 2025 Tickets The Official Guide

May 25, 2025

Bbc Radio 1 Big Weekend 2025 Tickets The Official Guide

May 25, 2025 -

Kyle Walker Night Out Fallout Annie Kilners Public Accusations

May 25, 2025

Kyle Walker Night Out Fallout Annie Kilners Public Accusations

May 25, 2025

Latest Posts

-

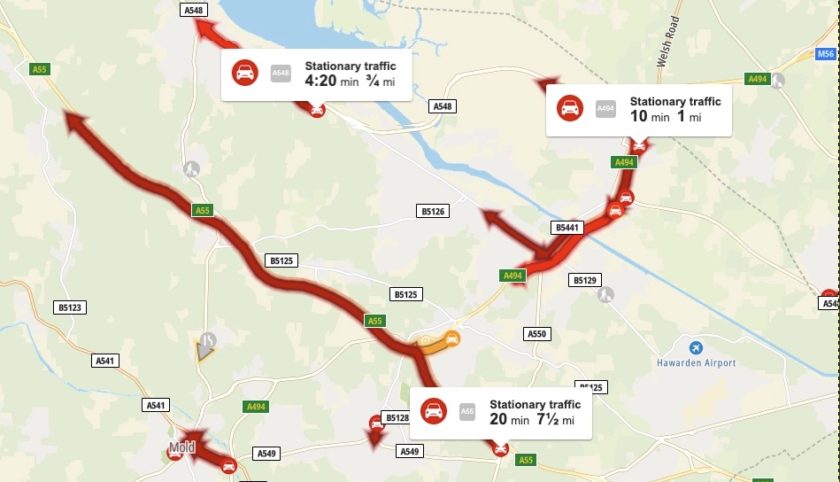

M56 Traffic Delays Cheshire And Deeside Border Collision

May 25, 2025

M56 Traffic Delays Cheshire And Deeside Border Collision

May 25, 2025 -

M56 Collision Cheshire Deeside Border Delays

May 25, 2025

M56 Collision Cheshire Deeside Border Delays

May 25, 2025 -

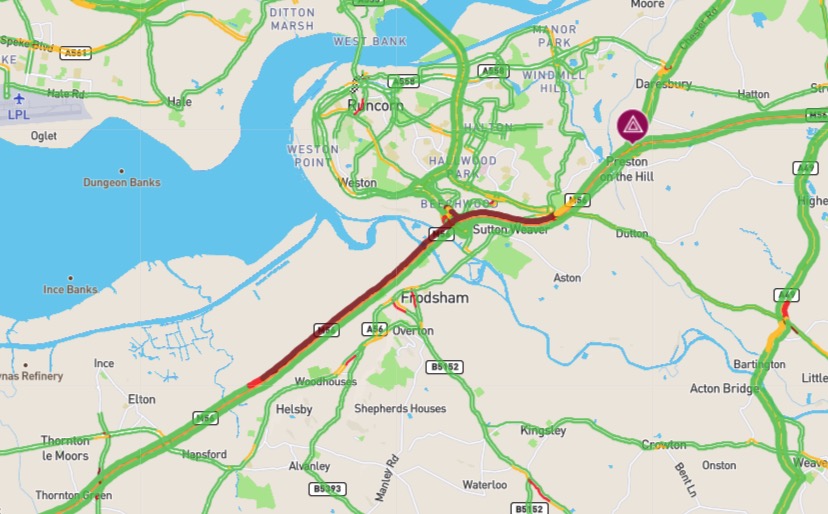

Severe Congestion On M6 Due To Van Crash

May 25, 2025

Severe Congestion On M6 Due To Van Crash

May 25, 2025 -

M6 Closed Van Overturn Causes Long Queues

May 25, 2025

M6 Closed Van Overturn Causes Long Queues

May 25, 2025 -

Major Delays On M6 After Van Crash

May 25, 2025

Major Delays On M6 After Van Crash

May 25, 2025