Amundi MSCI World II UCITS ETF USD Hedged Dist: A Guide To NAV And Its Implications

Table of Contents

What is Net Asset Value (NAV) and how is it calculated?

Net Asset Value (NAV) represents the net worth of an ETF's underlying assets. It's calculated by subtracting the ETF's liabilities from the total value of its assets. For the AMUNDI MSCI WORLD II, this involves several steps:

- Asset Valuation: The ETF holds a basket of global equities, mirroring the MSCI World Index. Each holding's market value is determined daily based on closing prices. This contributes the majority to the total asset value.

- Liabilities: These include expenses such as management fees, operating costs, and any outstanding payable amounts. These are deducted from the total asset value.

- Currency Hedging Impact: The "USD Hedged" designation means the ETF employs currency hedging strategies to minimize the impact of fluctuations between the USD and the currencies of the underlying assets. The effectiveness of this hedging and any associated costs affect the NAV calculation. A strong USD might increase NAV, while hedging costs might slightly reduce it.

Simplified Example:

Let's say the AMUNDI MSCI WORLD II holds $100 million in assets and has $1 million in liabilities. If currency hedging neither adds nor subtracts value on a given day, the NAV would be $99 million ($100 million - $1 million). This is then divided by the total number of outstanding shares to determine the NAV per share. This calculation is performed daily, providing a snapshot of the fund's value.

Understanding the Impact of Currency Hedging on NAV

Currency hedging is a strategy that aims to reduce the risk of currency fluctuations impacting the ETF's returns. For the AMUNDI MSCI WORLD II, it means protecting the investment from adverse movements between the USD and the currencies of the companies held within the index.

- Benefits: Hedging minimizes the impact of exchange rate volatility. If the USD strengthens against other currencies, an unhedged ETF would see a reduction in the value of its international holdings. Hedging mitigates this risk.

- Drawbacks: Hedging strategies are not costless. The expenses involved in implementing these strategies will slightly lower the NAV compared to an unhedged counterpart.

The presence of hedging affects NAV fluctuations. An unhedged ETF would experience larger NAV swings reflecting the movements in both asset prices and exchange rates. The AMUNDI MSCI WORLD II's NAV will be less volatile due to the hedging strategy, though potentially slightly lower due to the hedging costs.

How NAV Affects Your Investment in the Amundi MSCI World II UCITS ETF USD Hedged Dist

The daily NAV changes directly influence the AMUNDI MSCI WORLD II's share price. While there might be minor discrepancies due to market trading, the NAV is the primary driver of price.

- Investment Decisions: Monitoring the NAV helps inform your investment strategy. A rising NAV suggests strong performance, whereas a falling NAV might signal a need to reassess your position.

- ETF Returns: Your returns on the AMUNDI MSCI WORLD II are directly tied to the changes in its NAV. Tracking NAV movements lets you gauge the success of your investment.

- Dividend Distributions: While not directly determined by the NAV, the dividend distribution amount is usually calculated based on the fund's performance and profits, which are reflected in the NAV.

Understanding NAV is crucial for successful portfolio management.

Finding and Interpreting the Amundi MSCI World II UCITS ETF USD Hedged Dist NAV

Finding the daily NAV for the AMUNDI MSCI WORLD II is straightforward. You can access this information through:

- Amundi's Website: The ETF provider's website is the official source for accurate and up-to-date NAV data.

- Financial News Sites: Many reputable financial news and data providers (like Yahoo Finance, Google Finance, Bloomberg) list ETF NAVs.

- Brokerage Account Platforms: Your brokerage account will display the NAV of your holdings.

Interpreting the NAV involves comparing it to previous periods to assess performance trends. Consistent monitoring helps you identify potential risks and opportunities.

Conclusion: Making Informed Decisions with Amundi MSCI World II UCITS ETF USD Hedged Dist NAV Data

Understanding the Net Asset Value (NAV) of the Amundi MSCI World II UCITS ETF USD Hedged Dist is essential for making informed investment decisions. By understanding its calculation, the impact of currency hedging, and how it reflects the ETF's performance, you can better manage your portfolio. Continuous monitoring of the daily NAV allows you to track your investment's progress, identify potential risks, and react accordingly. Stay informed about the daily NAV of the Amundi MSCI World II UCITS ETF USD Hedged Dist and make smarter investment decisions today!

Featured Posts

-

Ferrari Challenge In South Florida Immersive Racing Days

May 25, 2025

Ferrari Challenge In South Florida Immersive Racing Days

May 25, 2025 -

Net Asset Value Nav Of Amundi Msci World Ii Ucits Etf Usd Hedged Dist What You Need To Know

May 25, 2025

Net Asset Value Nav Of Amundi Msci World Ii Ucits Etf Usd Hedged Dist What You Need To Know

May 25, 2025 -

Aubrey Wurst Leads Maryland Softball To Victory Over Delaware

May 25, 2025

Aubrey Wurst Leads Maryland Softball To Victory Over Delaware

May 25, 2025 -

Is Kyle Walker Peters Heading To West Ham Transfer News

May 25, 2025

Is Kyle Walker Peters Heading To West Ham Transfer News

May 25, 2025 -

Escape To The Country Making The Most Of Rural Living

May 25, 2025

Escape To The Country Making The Most Of Rural Living

May 25, 2025

Latest Posts

-

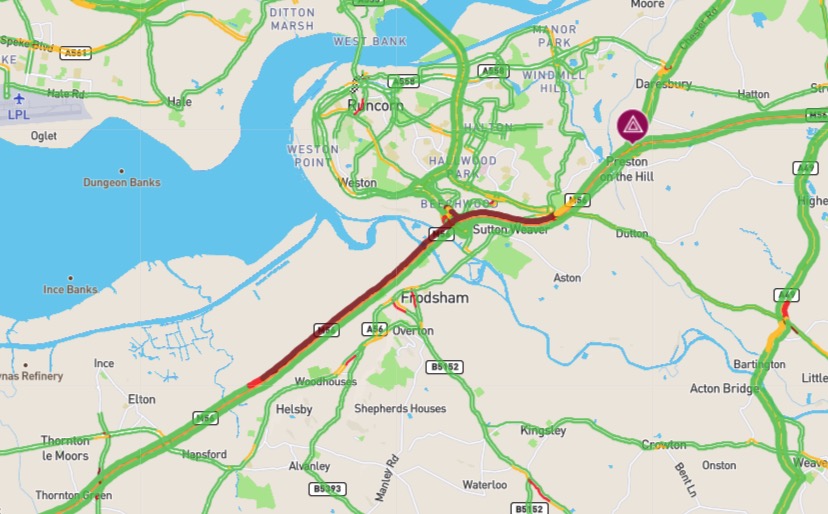

M56 Collision Cheshire Deeside Border Delays

May 25, 2025

M56 Collision Cheshire Deeside Border Delays

May 25, 2025 -

Severe Congestion On M6 Due To Van Crash

May 25, 2025

Severe Congestion On M6 Due To Van Crash

May 25, 2025 -

M6 Closed Van Overturn Causes Long Queues

May 25, 2025

M6 Closed Van Overturn Causes Long Queues

May 25, 2025 -

Major Delays On M6 After Van Crash

May 25, 2025

Major Delays On M6 After Van Crash

May 25, 2025 -

Live Emergency Services At Princess Road Following Pedestrian Collision

May 25, 2025

Live Emergency Services At Princess Road Following Pedestrian Collision

May 25, 2025