Amundi MSCI World Ex-US UCITS ETF Acc: Understanding Net Asset Value (NAV)

Table of Contents

What is Net Asset Value (NAV) in the Context of ETFs?

The Net Asset Value (NAV) represents the intrinsic value of a single share or unit of an Exchange Traded Fund (ETF). For the Amundi MSCI World ex-US UCITS ETF Acc, the NAV reflects the total value of all the underlying assets held within the ETF, minus its liabilities. Understanding the Amundi MSCI World ex-US UCITS ETF Acc NAV is paramount because it essentially shows you the current market value of your investment.

The basic calculation is straightforward: Total Assets - Total Liabilities = NAV. The total assets include the market value of all the stocks, bonds, or other securities the ETF holds. Liabilities encompass any outstanding expenses or obligations of the fund.

Daily fluctuations in the NAV directly affect the ETF's unit price and, consequently, your returns. While the ETF's trading price might deviate slightly from the NAV due to market forces of supply and demand, the NAV provides a reliable indicator of the ETF's underlying worth.

- NAV represents the intrinsic value of the ETF's holdings.

- NAV is calculated at the end of each trading day.

- Investors buy and sell ETF units based on the NAV, though the actual trading price may differ slightly.

Factors Affecting the NAV of the Amundi MSCI World ex-US UCITS ETF Acc

Several factors significantly influence the Amundi MSCI World ex-US UCITS ETF Acc NAV. Understanding these factors is key to interpreting NAV changes and making informed investment choices.

Market Performance: The performance of the underlying assets—global equities excluding the US—directly impacts the ETF's NAV. Positive performance in the international equity markets generally leads to a higher NAV, while negative performance results in a lower NAV. This is because the ETF's holdings reflect the price movements of the MSCI World ex-US index.

Currency Fluctuations: Because the Amundi MSCI World ex-US UCITS ETF Acc invests in companies outside the US, currency exchange rates play a crucial role. Fluctuations in exchange rates between the base currency of the ETF (likely EUR) and the currencies of the underlying assets can significantly affect the NAV. A strengthening of the Euro against other currencies could increase the NAV, and vice versa.

Management Fees and Expenses: The ETF's operating expenses, including management fees and administrative costs, are deducted from the fund's assets. These expenses naturally reduce the NAV over time, although the impact is usually relatively small compared to market movements.

- Changes in the market capitalization of companies within the MSCI World ex-US index.

- Impact of dividends received from underlying holdings.

- Influence of interest rates on the value of fixed-income components (if any).

Where to Find the NAV of the Amundi MSCI World ex-US UCITS ETF Acc

Accessing the daily Amundi MSCI World ex-US UCITS ETF Acc NAV is relatively straightforward. Several reputable sources provide this crucial information.

Official Sources: You can find the daily NAV on Amundi's official website. Major financial data providers, such as Bloomberg and Refinitiv, also publish this data. Finally, your brokerage account will display the NAV alongside your portfolio holdings.

Data Frequency: The NAV is typically updated daily, reflecting the closing prices of the underlying assets.

Data Presentation: The NAV is usually presented in the ETF's base currency (likely Euros) per share or unit.

- Amundi's official website.

- Major financial data providers (e.g., Bloomberg, Refinitiv).

- Your brokerage account statement.

Understanding NAV and Investment Strategy

Monitoring the Amundi MSCI World ex-US UCITS ETF Acc NAV is essential for making informed investment decisions. Regularly checking the NAV allows you to track your investment's performance and identify potential trends.

NAV and Investment Decisions: While not the sole determinant, observing NAV trends can help you determine potential entry and exit points. A consistently rising NAV might indicate a strong investment, whereas a consistently declining NAV may warrant reevaluation.

Long-Term vs. Short-Term Perspective: It’s vital to adopt a long-term perspective when analyzing NAV fluctuations. Short-term volatility is common, and focusing solely on daily changes can lead to impulsive decisions.

Comparing to Benchmarks: Compare the ETF's NAV performance against its benchmark index (MSCI World ex-US) to gauge its relative performance. This comparison provides a clearer picture of the fund manager's skill in tracking the index.

- Regularly checking the NAV helps track investment performance.

- Using NAV trends to identify potential entry and exit points.

- Considering the NAV in context with other investment goals and risk tolerance.

Conclusion: Mastering the Amundi MSCI World ex-US UCITS ETF Acc NAV for Successful Investing

Understanding the Amundi MSCI World ex-US UCITS ETF Acc NAV is a cornerstone of successful investing in this ETF. By regularly monitoring the NAV, understanding the factors influencing it, and comparing its performance against its benchmark, you can make more informed decisions about buying, selling, or holding your investment. Learn to effectively track your Amundi MSCI World ex-US UCITS ETF Acc NAV and understand Amundi MSCI World ex-US UCITS ETF Acc NAV performance to optimize your investment strategy. Visit the Amundi website for more information and detailed resources on the fund.

Featured Posts

-

80 Millio Forintos Extrak Ezt Kapja Aki Megveszi Ezt A Porsche 911 Est

May 25, 2025

80 Millio Forintos Extrak Ezt Kapja Aki Megveszi Ezt A Porsche 911 Est

May 25, 2025 -

Complete Glastonbury 2025 Lineup Confirmed Artists After Leak

May 25, 2025

Complete Glastonbury 2025 Lineup Confirmed Artists After Leak

May 25, 2025 -

Sejarah Dan Evolusi Porsche 356 Di Zuffenhausen Jerman

May 25, 2025

Sejarah Dan Evolusi Porsche 356 Di Zuffenhausen Jerman

May 25, 2025 -

Seattles Green Spaces A Womans Refuge During The Early Pandemic

May 25, 2025

Seattles Green Spaces A Womans Refuge During The Early Pandemic

May 25, 2025 -

Auto Extrak Porsche 911 80 Millio Forintert

May 25, 2025

Auto Extrak Porsche 911 80 Millio Forintert

May 25, 2025

Latest Posts

-

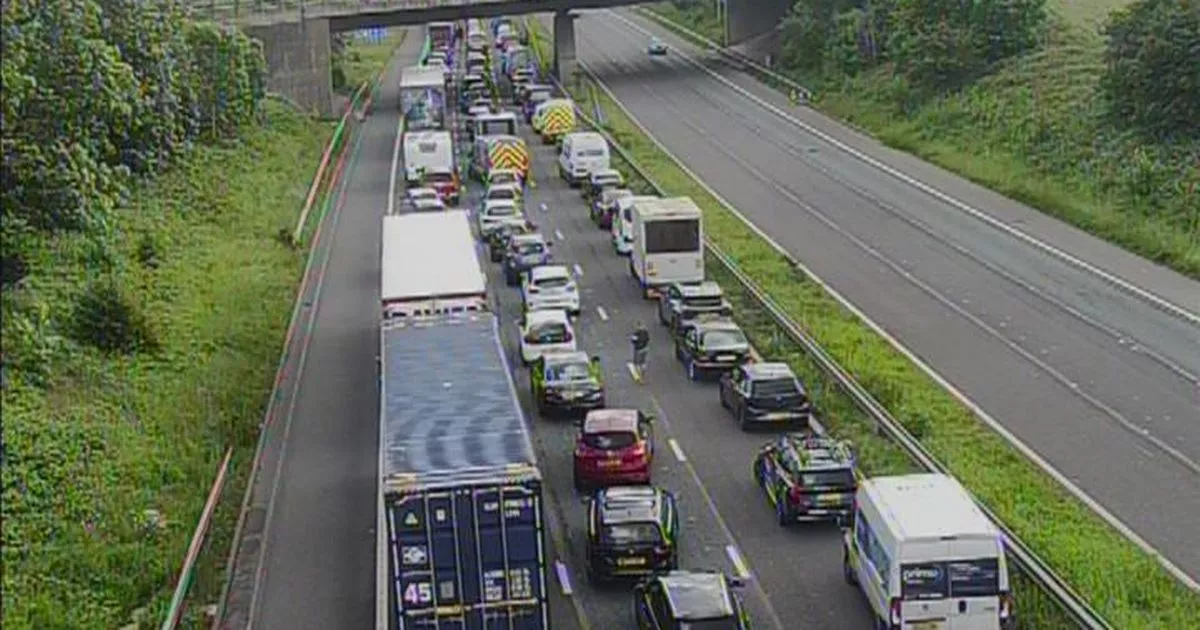

M56 Closed Live Traffic Updates Following Serious Crash

May 25, 2025

M56 Closed Live Traffic Updates Following Serious Crash

May 25, 2025 -

M56 Traffic Live Current Delays Following Crash

May 25, 2025

M56 Traffic Live Current Delays Following Crash

May 25, 2025 -

M56 Crash Live Traffic Updates And Long Delays

May 25, 2025

M56 Crash Live Traffic Updates And Long Delays

May 25, 2025 -

Large Diamond Ring Fuels Engagement Rumors For Annie Kilner And Kyle Walker

May 25, 2025

Large Diamond Ring Fuels Engagement Rumors For Annie Kilner And Kyle Walker

May 25, 2025 -

Kyle Walker And The Serbian Models A Night Out Following Wifes Departure

May 25, 2025

Kyle Walker And The Serbian Models A Night Out Following Wifes Departure

May 25, 2025