Amundi MSCI All Country World UCITS ETF USD Acc: NAV Calculation And Implications

Table of Contents

The Mechanics of Amundi MSCI All Country World UCITS ETF USD Acc NAV Calculation

The Amundi MSCI All Country World UCITS ETF USD Acc NAV, or Net Asset Value, represents the value of a single share in the ETF. Understanding its calculation is key to grasping your investment's worth.

Understanding the components of NAV:

The Amundi MSCI All Country World UCITS ETF USD Acc NAV calculation considers various components:

- Underlying Assets: The ETF invests in a globally diversified portfolio of stocks and potentially bonds, mirroring the MSCI All Country World Index. Each asset's weighting within the index directly impacts the NAV calculation.

- Market Values: The value of each asset is determined using its closing market price. Bid-ask spreads, representing the difference between the buying and selling prices, are also factored in for a more accurate valuation.

- Currency Conversions: Since the ETF is denominated in USD, any assets held in other currencies are converted to USD using the prevailing exchange rates at the end of the trading day. This conversion influences the final NAV figure.

- Expense Ratio: The ETF's expense ratio, representing the annual cost of managing the fund, is deducted from the total asset value before calculating the NAV per share. This reduces the NAV proportionally.

The daily NAV calculation process:

The Amundi MSCI All Country World UCITS ETF USD Acc NAV is calculated daily:

- Aggregation of Asset Values: The market value of each asset in the portfolio is determined and summed.

- Division by Outstanding Shares: The total asset value, net of expenses, is divided by the total number of outstanding ETF shares.

- Publication: The calculated NAV is then published by the fund provider at the end of the trading day, usually on their official website.

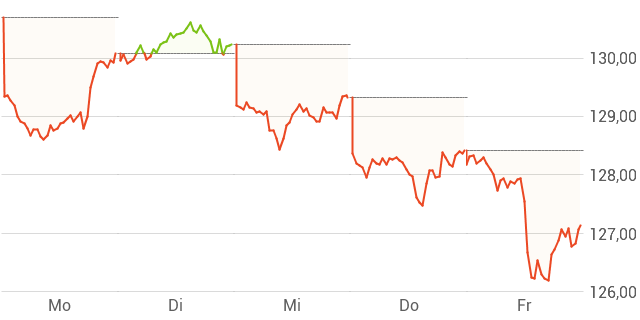

Factors influencing daily NAV fluctuations:

Several factors influence the daily fluctuations in the Amundi MSCI All Country World UCITS ETF USD Acc NAV:

- Market Movements: Changes in the overall market, reflecting the performance of the MSCI All Country World Index and the individual stocks within the ETF, directly impact the NAV. A positive market day typically results in a higher NAV.

- Currency Exchange Rate Fluctuations: Changes in exchange rates between the USD and other currencies influence the value of assets held in foreign currencies. Currency fluctuations can significantly impact the NAV.

- Corporate Actions: Corporate actions such as dividends paid by underlying companies or stock splits affect the NAV calculation. Dividends increase the NAV temporarily before they are reinvested or distributed, while splits adjust the number of shares.

Implications of NAV for Amundi MSCI All Country World UCITS ETF USD Acc Investors

Understanding the NAV is crucial for all Amundi MSCI All Country World UCITS ETF USD Acc investors.

Understanding your investment value:

- Share Value Reflection: The NAV directly reflects the value of each share you own in the ETF.

- NAV vs. Market Price: While the NAV is the theoretical value of a share, the market price may differ slightly due to supply and demand dynamics. These differences are usually minimal.

NAV's role in buy and sell transactions:

- Pricing Mechanism: The NAV is the basis for determining the price you pay when buying shares and receive when selling them.

- Transaction Costs: Brokerage fees and other transaction costs are added to the buying price and deducted from the selling price, resulting in the net amount received or paid.

Using NAV for performance analysis:

- Performance Tracking: Monitoring NAV changes over time provides a clear picture of the ETF's performance.

- Time Horizon Consideration: Analyzing NAV requires considering the investment timeframe. Short-term fluctuations are normal, while long-term trends provide a better indication of investment performance.

Accessing Amundi MSCI All Country World UCITS ETF USD Acc NAV Data

Staying informed about your investment requires knowing where to find the NAV.

Official sources for NAV information:

- Amundi Website: Check the official Amundi website for the daily NAV and other relevant information.

- Financial Data Providers: Reputable financial data providers like Bloomberg and Refinitiv also publish this data.

Interpreting NAV data:

- Effective Interpretation: Pay attention to the reporting currency (USD) and compare NAV changes over time, factoring in market conditions and the overall investment strategy.

Conclusion: Mastering Amundi MSCI All Country World UCITS ETF USD Acc NAV for Informed Investing

Understanding the Amundi MSCI All Country World UCITS ETF USD Acc NAV calculation is vital for making informed investment decisions. By grasping how the NAV is calculated and its implications, you can effectively track your investment's performance, understand its value, and make sound buy and sell decisions. Remember to regularly monitor the Amundi MSCI All Country World UCITS ETF USD Acc NAV using official sources and use this information to make well-informed choices regarding your portfolio. Further research into ETF investing and NAV analysis will enhance your investment capabilities.

Featured Posts

-

Dayamitra Telekomunikasi Mtel Dan Merdeka Battery Mbma Prospek Investasi Usai Masuk Msci

May 24, 2025

Dayamitra Telekomunikasi Mtel Dan Merdeka Battery Mbma Prospek Investasi Usai Masuk Msci

May 24, 2025 -

Picture This Prime Video Every Song Featured In The New Rom Com

May 24, 2025

Picture This Prime Video Every Song Featured In The New Rom Com

May 24, 2025 -

Kyle Walker Peters Transfer Leeds United Initiate Contact

May 24, 2025

Kyle Walker Peters Transfer Leeds United Initiate Contact

May 24, 2025 -

Nimi Muistiin Ferrarin 13 Vuotias Uutuus Ajaa Kohti F1 Uraa

May 24, 2025

Nimi Muistiin Ferrarin 13 Vuotias Uutuus Ajaa Kohti F1 Uraa

May 24, 2025 -

Artfae Daks Alalmany Tjawz Dhrwt Mars Welamat Ela Teafy Alswq Alawrwbyt

May 24, 2025

Artfae Daks Alalmany Tjawz Dhrwt Mars Welamat Ela Teafy Alswq Alawrwbyt

May 24, 2025

Latest Posts

-

Serious M56 Motorway Incident Car Overturn And Casualty Care

May 24, 2025

Serious M56 Motorway Incident Car Overturn And Casualty Care

May 24, 2025 -

The M62 Relief Road Burys Unrealized Transport Plan

May 24, 2025

The M62 Relief Road Burys Unrealized Transport Plan

May 24, 2025 -

Serious Car Crash Leads To Road Closure And Hospitalization

May 24, 2025

Serious Car Crash Leads To Road Closure And Hospitalization

May 24, 2025 -

Emergency Services Respond To M56 Crash Involving Overturned Car

May 24, 2025

Emergency Services Respond To M56 Crash Involving Overturned Car

May 24, 2025 -

M56 Car Crash Overturned Vehicle Casualty Treated On Motorway

May 24, 2025

M56 Car Crash Overturned Vehicle Casualty Treated On Motorway

May 24, 2025