Amundi DJIA UCITS ETF: NAV Explained & Analysis

Table of Contents

What is the Amundi DJIA UCITS ETF?

The Amundi DJIA UCITS ETF is designed to track the performance of the Dow Jones Industrial Average, a widely followed benchmark of 30 large, publicly-owned companies in the United States. This ETF aims to replicate the DJIA's composition, offering investors exposure to a basket of leading American companies across various sectors.

- Investment Objective: To provide investors with a cost-effective way to gain exposure to the performance of the DJIA.

- Replication Method: The ETF likely utilizes a full replication strategy, meaning it holds all 30 components of the DJIA in proportion to their weighting in the index. (Note: This should be verified with the ETF's official documentation).

- Expense Ratio: The expense ratio represents the annual cost of owning the ETF. A lower expense ratio is generally preferred as it directly impacts the NAV. (The specific expense ratio should be obtained from the provider's fact sheet). This cost, expressed as a percentage of the assets under management, is deducted from the ETF's assets and therefore affects the NAV.

- UCITS Structure: The "UCITS" designation (Undertakings for Collective Investment in Transferable Securities) means the ETF complies with EU regulations, making it a suitable investment option for European investors. This structure offers certain investor protections and regulatory oversight. Keywords: UCITS, ETF investment, Dow Jones, expense ratio.

Understanding NAV Calculation for the Amundi DJIA UCITS ETF

The Net Asset Value (NAV) of the Amundi DJIA UCITS ETF represents the net value of its assets minus its liabilities, per share. It's calculated daily, typically at the close of the market.

- Asset Valuation: The value of the ETF's underlying assets (the 30 DJIA stocks) is determined using their closing market prices.

- Liabilities: These include expenses such as management fees and any other outstanding obligations.

- Total Net Assets: The total value of assets minus liabilities is divided by the total number of outstanding ETF shares to arrive at the NAV per share. Keywords: NAV calculation, ETF valuation, asset valuation, daily NAV.

Factors Affecting Amundi DJIA UCITS ETF NAV

Several factors influence the daily fluctuations of the Amundi DJIA UCITS ETF's NAV:

- Market Movements: Changes in the prices of the 30 DJIA components directly impact the ETF's NAV. Positive market sentiment generally leads to a higher NAV, while negative sentiment leads to a lower NAV.

- Economic News: Major economic announcements (e.g., interest rate changes, employment data) can significantly influence the DJIA and, consequently, the ETF's NAV.

- Individual Stock Performance: Strong performance by one or more DJIA components can positively affect the NAV, while underperformance can have the opposite effect.

- Dividend Payouts: When underlying companies pay dividends, the ETF receives these dividends, which are then typically distributed to ETF shareholders. This can slightly reduce the NAV on the ex-dividend date, but the overall effect depends on the dividend's size and reinvestment strategy. Keywords: Market volatility, DJIA performance, dividend impact, NAV fluctuation.

Analyzing Amundi DJIA UCITS ETF NAV Trends

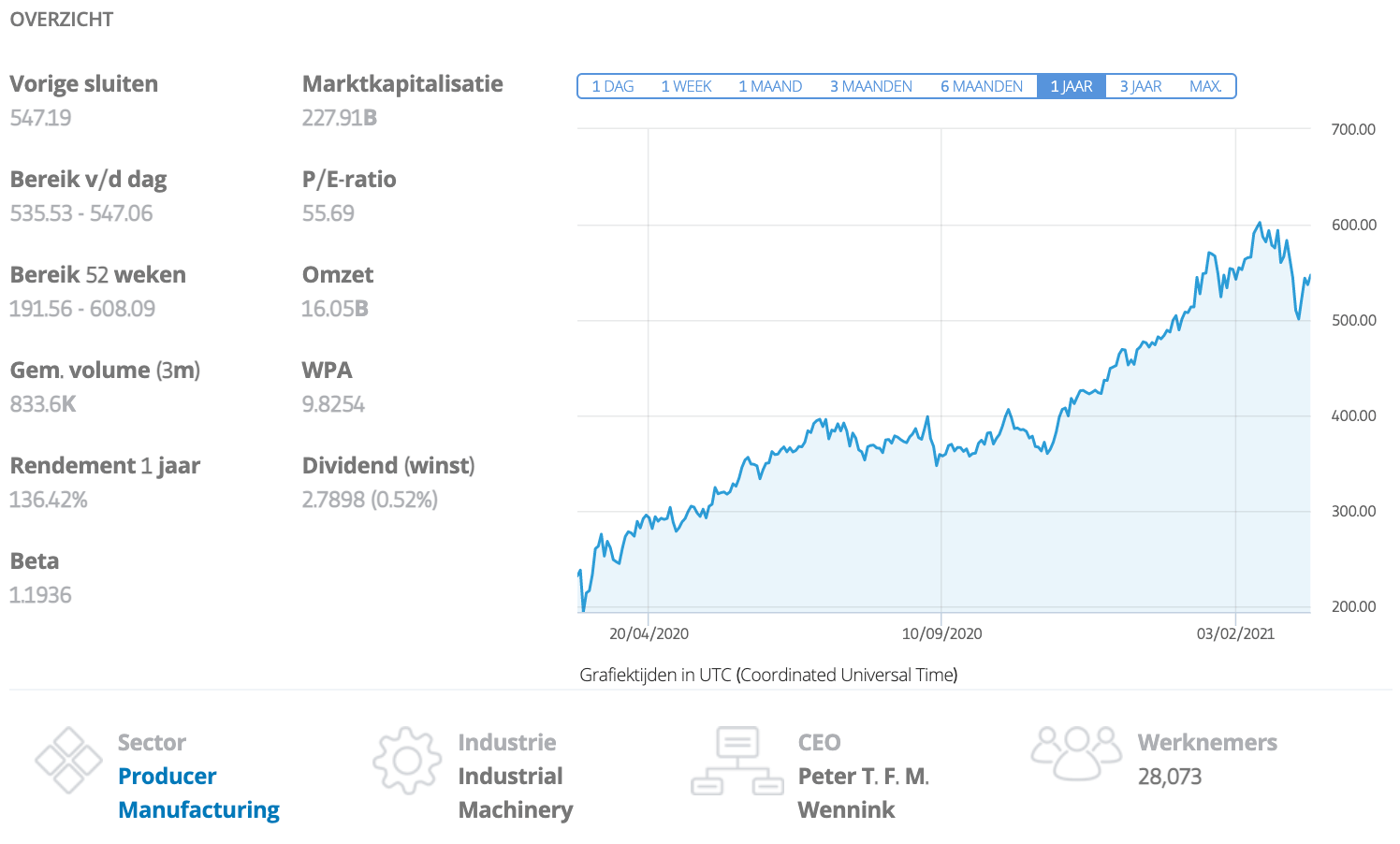

Analyzing historical NAV data provides valuable insights into the ETF's performance. (Note: Historical data should be sourced from a reliable financial data provider and presented visually using charts and graphs).

- NAV Performance: Tracking the NAV over time reveals its growth or decline, reflecting the overall performance of the DJIA.

- Comparison to DJIA: Comparing the ETF's NAV performance to the DJIA index itself highlights the ETF's tracking ability. Minor discrepancies are expected due to factors like expense ratios.

- NAV and Market Price Relationship: The ETF's market price should closely track its NAV. Significant deviations can indicate arbitrage opportunities.

- Tracking Error: Tracking error measures the difference between the ETF's performance and the performance of its benchmark index (the DJIA). A lower tracking error is generally preferred. Keywords: NAV performance, historical data, DJIA tracking, tracking error, ETF performance.

Using NAV Information for Investment Decisions

Understanding the NAV is essential for making informed investment decisions.

- Performance Assessment: Monitoring NAV trends helps assess the ETF's long-term performance and its alignment with investment goals.

- Arbitrage Opportunities: Comparing the ETF's market price to its NAV can reveal potential arbitrage opportunities—buying low and selling high—though this requires precise timing and market knowledge.

- Buy/Sell Signals: While not a sole indicator, NAV movements can inform investment strategies. Consistent upward trends might suggest a favorable investment environment, while sustained declines could prompt reevaluation. Keywords: Investment strategy, buy/sell signals, arbitrage opportunities, performance analysis.

Conclusion: Investing Wisely with the Amundi DJIA UCITS ETF NAV

Understanding the Amundi DJIA UCITS ETF's NAV is crucial for investors seeking exposure to the Dow Jones Industrial Average. By analyzing NAV trends, understanding the factors influencing it, and comparing it to the market price, investors can make more informed decisions. Regularly reviewing the NAV, along with other relevant financial indicators, helps in assessing the ETF's performance and aligning it with your investment goals. To stay informed about the Amundi DJIA UCITS ETF NAV and other vital information, refer to the official provider's website or reputable financial data sources. Remember that past performance is not indicative of future results. Conduct thorough research and consider consulting a financial advisor before making any investment decisions. Keywords: Amundi DJIA UCITS ETF, NAV analysis, investment decision, informed investing.

Featured Posts

-

M62 Westbound Resurfacing Manchester To Warrington Road Closure

May 25, 2025

M62 Westbound Resurfacing Manchester To Warrington Road Closure

May 25, 2025 -

Amundi Djia Ucits Etf A Detailed Look At Net Asset Value Nav

May 25, 2025

Amundi Djia Ucits Etf A Detailed Look At Net Asset Value Nav

May 25, 2025 -

Indonesia Classic Art Week 2025 Perpaduan Seni Dan Porsche

May 25, 2025

Indonesia Classic Art Week 2025 Perpaduan Seni Dan Porsche

May 25, 2025 -

How To Interpret The Net Asset Value Of The Amundi Dow Jones Industrial Average Ucits Etf

May 25, 2025

How To Interpret The Net Asset Value Of The Amundi Dow Jones Industrial Average Ucits Etf

May 25, 2025 -

Aex Stijgt Na Uitstel Trump Analyse Van De Winsten

May 25, 2025

Aex Stijgt Na Uitstel Trump Analyse Van De Winsten

May 25, 2025

Latest Posts

-

Amsterdam Stock Market 7 Initial Plunge Reflects Trade War Anxiety

May 25, 2025

Amsterdam Stock Market 7 Initial Plunge Reflects Trade War Anxiety

May 25, 2025 -

Voorspelling Toekomst Van Europese Aandelen Versus Wall Street

May 25, 2025

Voorspelling Toekomst Van Europese Aandelen Versus Wall Street

May 25, 2025 -

Gryozy Lyubvi Ili Ilicha V Gazete Trud Analiz Syuzheta

May 25, 2025

Gryozy Lyubvi Ili Ilicha V Gazete Trud Analiz Syuzheta

May 25, 2025 -

7 Drop In Amsterdam Stock Market Trade War Uncertainty

May 25, 2025

7 Drop In Amsterdam Stock Market Trade War Uncertainty

May 25, 2025 -

Krijgt De Recente Marktdraai Tussen Europese En Amerikaanse Aandelen Een Vervolg

May 25, 2025

Krijgt De Recente Marktdraai Tussen Europese En Amerikaanse Aandelen Een Vervolg

May 25, 2025