Amundi DJIA UCITS ETF (Distributing): NAV Explained

Table of Contents

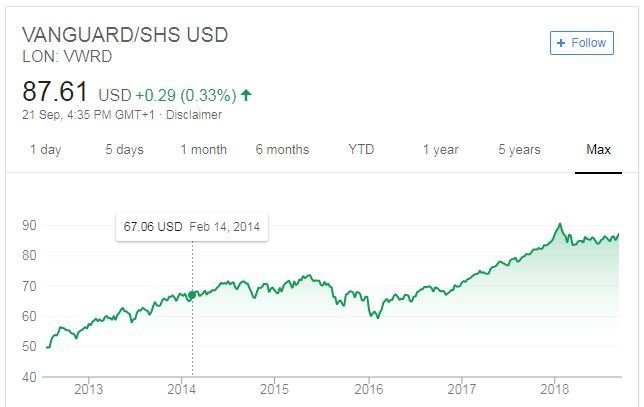

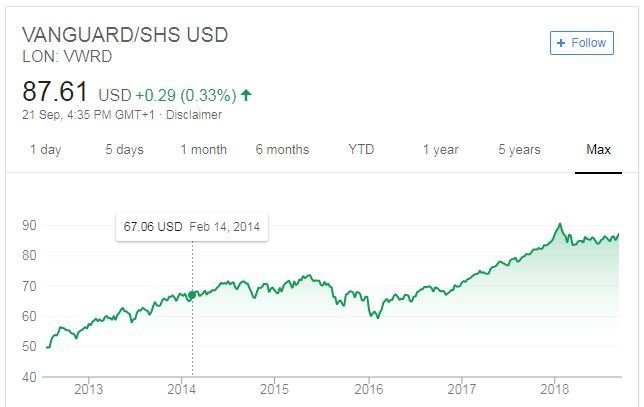

The Amundi DJIA UCITS ETF (Distributing) offers investors a straightforward way to gain exposure to the performance of the Dow Jones Industrial Average (DJIA), a benchmark index of 30 large, publicly-owned companies in the US. Understanding its Net Asset Value (NAV) is crucial for making sound investment choices and maximizing your return. This article will demystify NAV, explaining what it is, how it's calculated for this specific ETF, and why it matters for your investment strategy. We'll also explore how to track NAV and its implications for your portfolio.

What is Net Asset Value (NAV)?

Net Asset Value (NAV) represents the intrinsic value of a single share in an exchange-traded fund (ETF). Simply put, it's the value of the ETF's underlying assets minus its liabilities, divided by the number of outstanding shares. For the Amundi DJIA UCITS ETF (Distributing), this means the NAV reflects the total value of the ETF's holdings in the 30 companies that make up the DJIA, adjusted for any liabilities.

The calculation involves determining the current market value of each holding in the ETF's portfolio. This is then aggregated to arrive at the total asset value. Any liabilities, such as management fees or expenses, are subtracted from this total. Finally, this net asset figure is divided by the total number of outstanding ETF shares to arrive at the NAV per share.

It's important to distinguish between NAV and the market price of the ETF. While ideally, they should be very close, market price can fluctuate throughout the trading day due to supply and demand. The NAV, however, is calculated only once per day, usually at the close of the market.

- NAV represents the intrinsic value of the ETF's holdings. It reflects the true worth of the assets the ETF owns.

- Calculated daily by summing the market value of all assets, minus liabilities, divided by the number of outstanding shares. This ensures a daily snapshot of the ETF's value.

- Fluctuations in NAV reflect changes in the underlying DJIA components. If the DJIA goes up, the ETF's NAV generally increases, and vice versa.

Importance of NAV for the Amundi DJIA UCITS ETF (Distributing)

Understanding the NAV of the Amundi DJIA UCITS ETF (Distributing) is vital for several reasons. Firstly, it allows you to accurately assess the ETF's performance over time. By tracking the NAV changes, you can compare the ETF's growth against the performance of the DJIA itself, ensuring your investment aligns with your expectations.

Secondly, NAV facilitates a more precise comparison between the Amundi DJIA UCITS ETF (Distributing) and other investment options. While market price may fluctuate dramatically, NAV provides a consistent measure of the ETF's underlying value, enabling a fairer comparison to other ETFs tracking similar indices or other asset classes.

The relationship between the NAV and the ETF's share price is crucial. While small discrepancies are normal due to market forces, significant deviations can signal potential buying or selling opportunities. A persistently low market price relative to the NAV could indicate an undervalued ETF, while the opposite may suggest an overvalued one.

- Track performance relative to the DJIA. Compare your ETF's return against the benchmark index's performance.

- Identify potential buying or selling opportunities based on NAV discrepancies. Capitalize on market inefficiencies.

- Assess the ETF’s overall health and asset management. Significant and sustained differences between NAV and market price could raise concerns.

How to Find and Track the NAV of the Amundi DJIA UCITS ETF (Distributing)

Finding the NAV of the Amundi DJIA UCITS ETF (Distributing) is straightforward. Several reliable sources provide this data:

- Amundi's official website: The asset manager will usually publish daily NAV updates on their website, often within their ETF fact sheets or dedicated investor sections.

- Financial news websites: Reputable financial news sources (e.g., Bloomberg, Yahoo Finance, Google Finance) typically provide real-time or delayed NAV data for various ETFs.

- Online brokerage platforms: If you hold the ETF within a brokerage account, the platform will often display the NAV alongside the current market price.

NAV updates are usually daily, reflecting the closing market value of the underlying assets. Many charting and financial analysis platforms allow you to track the NAV of the Amundi DJIA UCITS ETF (Distributing) over time, visualizing its performance and identifying trends.

- Check the ETF's fact sheet or prospectus. This document contains important information about the ETF, including details about how the NAV is calculated.

- Utilize online brokerage platforms. Most platforms provide real-time or near real-time NAV data.

- Use financial data providers like Bloomberg or Refinitiv. These offer comprehensive financial data, including detailed historical NAV information.

Understanding the "Distributing" Aspect of the ETF

The "Distributing" designation in the Amundi DJIA UCITS ETF (Distributing) name signifies that the ETF distributes dividends to its shareholders. These dividends come from the dividends paid by the companies within the DJIA index. This distribution will affect the NAV. After a dividend payout, the NAV will be adjusted downwards to reflect the distribution of assets. This reduction in NAV is offset by the cash received by investors.

It's crucial to understand the tax implications of these dividend distributions. The dividends received are usually subject to tax in your jurisdiction. Always consult a qualified tax advisor for personalized advice regarding the tax implications of your investment.

- Regular dividend payments from the ETF's underlying assets. This provides a stream of income in addition to potential capital appreciation.

- NAV is adjusted after dividend distribution. This ensures the NAV accurately reflects the value of the remaining assets.

- Consult a tax professional for personalized advice. Understanding the tax implications of dividend distributions is crucial for effective tax planning.

Conclusion

Understanding the Net Asset Value (NAV) of the Amundi DJIA UCITS ETF (Distributing) is pivotal for making informed investment decisions. By tracking NAV and understanding its relationship to the ETF's share price and dividend distributions, investors can effectively monitor performance, identify potential opportunities, and manage their portfolios more efficiently.

Call to Action: Learn more about the Amundi DJIA UCITS ETF (Distributing) and its NAV by visiting [link to relevant resource]. Start making informed investment decisions today with a clear understanding of your Amundi DJIA UCITS ETF (Distributing) NAV.

Featured Posts

-

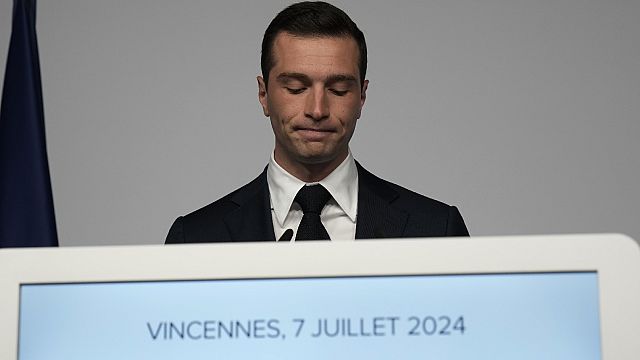

Jordan Bardella And The 2027 French Presidential Election

May 25, 2025

Jordan Bardella And The 2027 French Presidential Election

May 25, 2025 -

Amundi Djia Ucits Etf Dist Monitoring Net Asset Value For Investment Decisions

May 25, 2025

Amundi Djia Ucits Etf Dist Monitoring Net Asset Value For Investment Decisions

May 25, 2025 -

Apple Stock Prediction 254 Is Aapl A Buy Near 200

May 25, 2025

Apple Stock Prediction 254 Is Aapl A Buy Near 200

May 25, 2025 -

Stijgende Kapitaalmarktrentes En De Euro Analyse Van De Huidige Situatie

May 25, 2025

Stijgende Kapitaalmarktrentes En De Euro Analyse Van De Huidige Situatie

May 25, 2025 -

80 Millio Forintos Extrak Ezt Kapja Aki Megveszi Ezt A Porsche 911 Est

May 25, 2025

80 Millio Forintos Extrak Ezt Kapja Aki Megveszi Ezt A Porsche 911 Est

May 25, 2025

Latest Posts

-

Farrows Plea Hold Trump Accountable For Deporting Venezuelan Gang Members

May 25, 2025

Farrows Plea Hold Trump Accountable For Deporting Venezuelan Gang Members

May 25, 2025 -

Mia Farrows Plea Jail Trump For Handling Of Venezuelan Deportations

May 25, 2025

Mia Farrows Plea Jail Trump For Handling Of Venezuelan Deportations

May 25, 2025 -

Actress Mia Farrow Seeks Legal Action Against Trump Regarding Venezuelan Deportations

May 25, 2025

Actress Mia Farrow Seeks Legal Action Against Trump Regarding Venezuelan Deportations

May 25, 2025 -

Actress Mia Farrow Trump Should Face Charges For Venezuelan Deportation Actions

May 25, 2025

Actress Mia Farrow Trump Should Face Charges For Venezuelan Deportation Actions

May 25, 2025 -

The Fall From Grace 17 Celebrities Who Lost Everything Instantly

May 25, 2025

The Fall From Grace 17 Celebrities Who Lost Everything Instantly

May 25, 2025