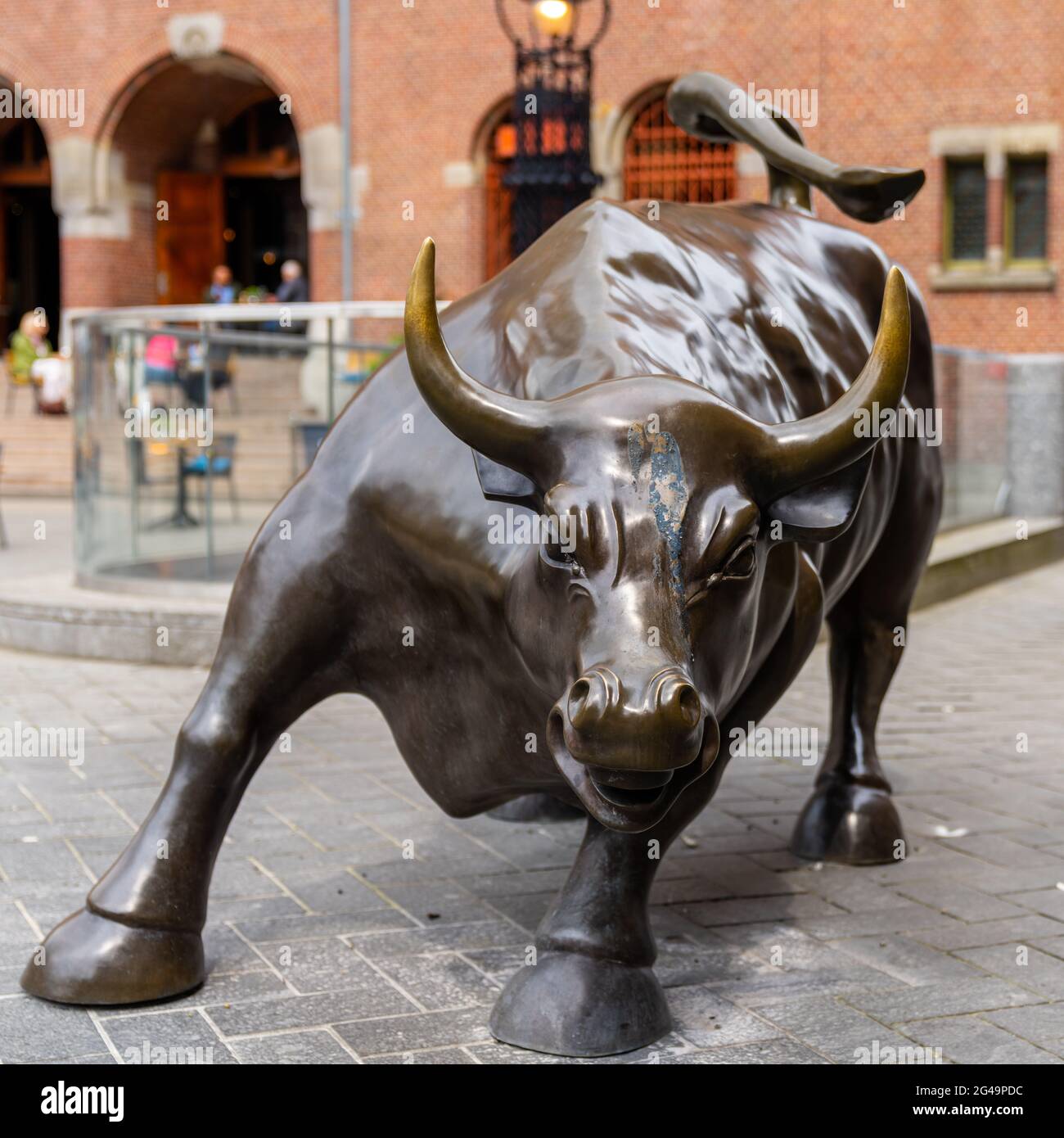

Amsterdam Exchange Suffers Third Consecutive Major Loss

Table of Contents

Analyzing the Scale of the Losses

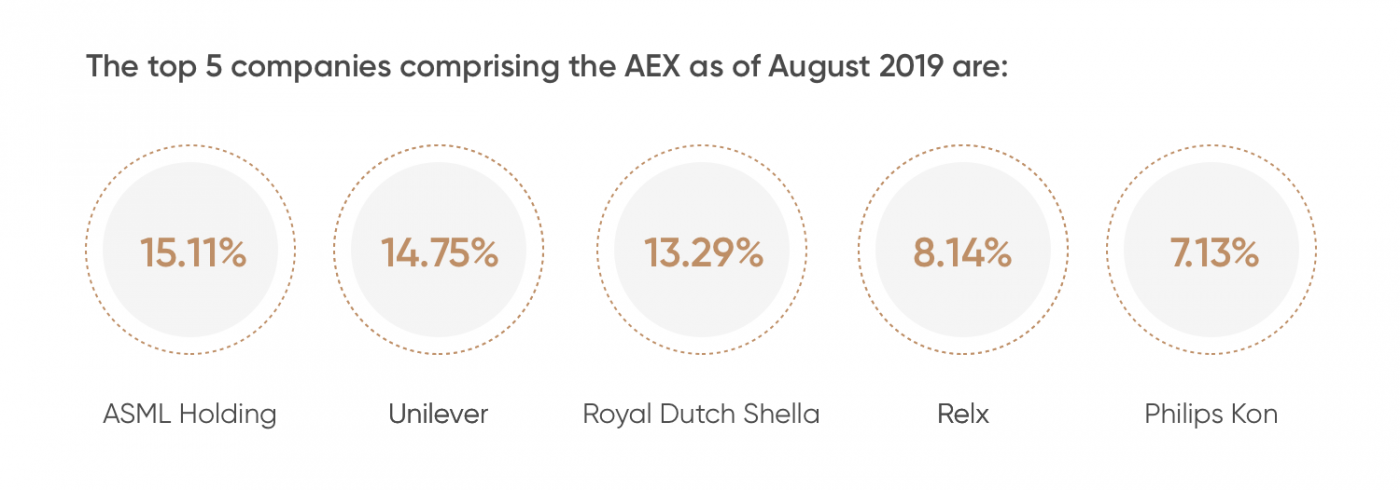

The magnitude of the losses suffered by the Amsterdam Exchange over the past three consecutive periods is alarming. In Q1 2024, the AEX index experienced a 15% decline, representing a significant drop in overall market capitalization. This followed a 10% loss in Q4 2023 and an 8% decline in Q3 2023. These figures represent the worst consecutive quarterly performance in the exchange's history, surpassing even the lows witnessed during the 2008 financial crisis.

Several sectors have been heavily impacted. The energy sector, heavily reliant on volatile global prices, has seen significant losses, with Royal Dutch Shell experiencing a 10% drop in share value during Q1 2024. Similarly, the technology sector, already facing global headwinds, has also suffered considerable setbacks. These Amsterdam Exchange losses have significantly affected the portfolios of both institutional and individual investors.

- Quantifiable data on the losses: A 15% decline in the AEX index in Q1 2024, following a 10% and 8% drop in the previous two quarters.

- Specific companies significantly impacted: Royal Dutch Shell (10% share value drop), alongside other significant players in the energy and technology sectors.

- Comparison to previous historical lows: The current losses represent the worst consecutive quarterly performance in the exchange’s history, exceeding even the 2008 financial crisis lows.

Identifying the Contributing Factors

Several interconnected factors have contributed to these sustained Amsterdam Exchange losses. The ongoing global economic uncertainty, fueled by high inflation and aggressive interest rate hikes by central banks, has created a risk-averse environment, impacting investor sentiment. The energy crisis in Europe, particularly impacting energy-reliant Dutch industries, has further exacerbated the situation. Furthermore, geopolitical instability and concerns about future energy supply have dampened investor confidence.

Internal factors might also play a role. While not yet confirmed, some analysts suggest that potential regulatory changes or internal management issues within the Amsterdam Exchange itself might have contributed to the downturn. A thorough independent review is crucial to address and mitigate any internal shortcomings.

- Impact of global inflation and interest rate hikes: Increased borrowing costs and reduced consumer spending have significantly impacted businesses.

- Effect of the ongoing energy crisis: Increased energy costs have placed immense pressure on Dutch industries, reducing profitability and investor confidence.

- Analysis of any significant policy changes: Potential regulatory changes affecting the exchange need careful evaluation to assess their impact on market performance.

- Potential internal management or structural issues: Internal reviews are necessary to identify and resolve any contributing factors within the exchange itself.

Consequences and Ripple Effects

The consequences of these substantial Amsterdam Exchange losses extend far beyond the exchange itself. Affected companies are likely to experience job losses and reduced investment opportunities. Decreased consumer confidence, a direct result of market instability, could lead to further economic slowdown. Pension funds and individual investors, already grappling with inflation, are facing significant losses, impacting retirement savings and financial security.

The Dutch government may need to intervene to mitigate the wider economic impact, potentially through financial support or regulatory adjustments. The magnitude of the problem may require substantial government intervention to prevent a further economic crisis.

- Potential job losses within affected companies: Reductions in workforce are likely within companies whose share values have dropped significantly.

- Decreased foreign investment in the Dutch market: The ongoing losses may deter international investors from putting money into the Dutch economy.

- Impact on pension funds and individual investors: Pension funds and individual investors are experiencing substantial losses in their portfolios.

- Government responses and potential bailout packages: The severity of the crisis may necessitate government intervention to stabilize the economy.

Long-Term Implications for the Amsterdam Exchange

The long-term implications for the Amsterdam Exchange are significant. The exchange faces a crucial period requiring a proactive and comprehensive recovery strategy. Restoring investor confidence will be paramount, potentially involving increased transparency and robust regulatory oversight. Attracting new investments will be critical to revitalize the market. Structural reforms within the exchange itself might also be necessary to improve efficiency and competitiveness.

The exchange needs to adapt to the evolving global landscape, focusing on technological advancements and attracting new listings. Failing to adapt could lead to a long-term decline in its market share and influence.

- Potential restructuring of the Amsterdam Exchange: Internal reforms are needed to enhance the exchange’s efficiency and attract investments.

- Attracting new investments to boost the exchange: Strategies to attract new investments and listings are critical to revitalize the exchange.

- Improving transparency and investor confidence: Increased transparency and clear communication are essential to regain trust from investors.

- Long-term predictions for the recovery of the Amsterdam Exchange: The recovery will depend on a multitude of factors, including global economic conditions and internal reforms.

Conclusion

This article has examined the severity of the Amsterdam Exchange's third consecutive major loss, detailing the scale of the downturn, its contributing factors, and the ensuing consequences. The long-term implications are significant, requiring proactive measures to restore investor confidence and the exchange's vitality. The Amsterdam Exchange losses represent a serious challenge requiring a multifaceted approach involving both internal reforms and external support.

Understanding the complexities behind these Amsterdam Exchange losses is crucial for investors and stakeholders alike. Stay informed about further developments and consider diversifying your portfolio to mitigate risks associated with continued Amsterdam Exchange losses. Continue following news and analysis regarding the Amsterdam Exchange Losses for the latest updates.

Featured Posts

-

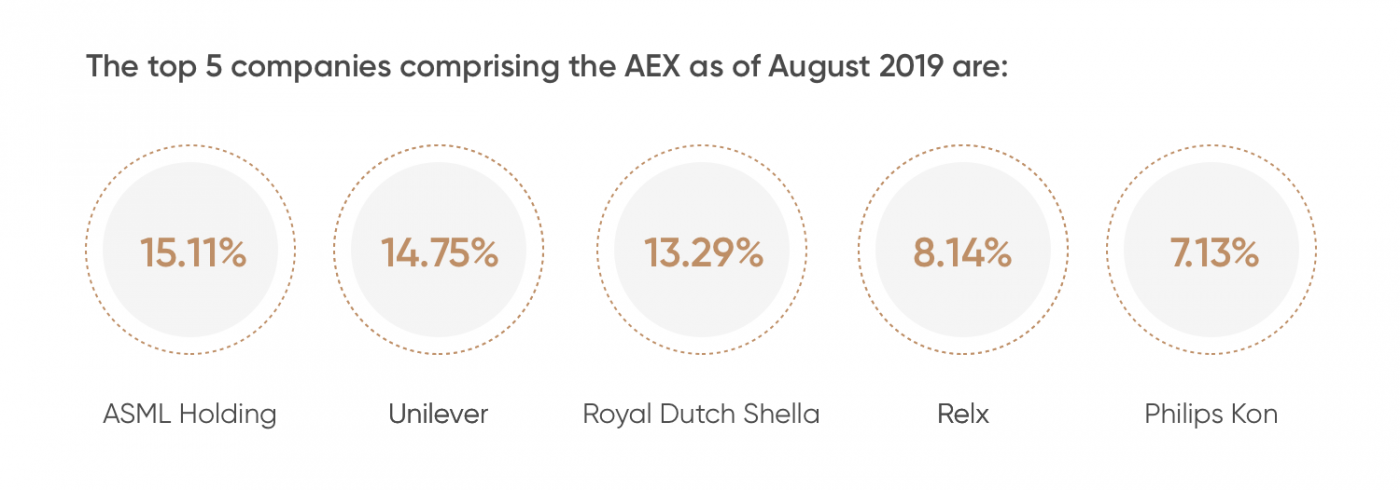

Philips Announces 2025 Annual General Meeting Agenda What Shareholders Need To Know

May 25, 2025

Philips Announces 2025 Annual General Meeting Agenda What Shareholders Need To Know

May 25, 2025 -

Amsterdam Stock Exchange Plunges 11 Drop Since Wednesday

May 25, 2025

Amsterdam Stock Exchange Plunges 11 Drop Since Wednesday

May 25, 2025 -

Escape To The Country Top Locations For A Tranquil Getaway

May 25, 2025

Escape To The Country Top Locations For A Tranquil Getaway

May 25, 2025 -

Forgotten Highway The Bury M62 Relief Road Project

May 25, 2025

Forgotten Highway The Bury M62 Relief Road Project

May 25, 2025 -

Amerikaanse Beurs Daalt Aex Blijft Stijgen Experts Geven Hun Voorspellingen

May 25, 2025

Amerikaanse Beurs Daalt Aex Blijft Stijgen Experts Geven Hun Voorspellingen

May 25, 2025

Latest Posts

-

Farrows Plea Hold Trump Accountable For Deporting Venezuelan Gang Members

May 25, 2025

Farrows Plea Hold Trump Accountable For Deporting Venezuelan Gang Members

May 25, 2025 -

Mia Farrows Plea Jail Trump For Handling Of Venezuelan Deportations

May 25, 2025

Mia Farrows Plea Jail Trump For Handling Of Venezuelan Deportations

May 25, 2025 -

Actress Mia Farrow Seeks Legal Action Against Trump Regarding Venezuelan Deportations

May 25, 2025

Actress Mia Farrow Seeks Legal Action Against Trump Regarding Venezuelan Deportations

May 25, 2025 -

Actress Mia Farrow Trump Should Face Charges For Venezuelan Deportation Actions

May 25, 2025

Actress Mia Farrow Trump Should Face Charges For Venezuelan Deportation Actions

May 25, 2025 -

The Fall From Grace 17 Celebrities Who Lost Everything Instantly

May 25, 2025

The Fall From Grace 17 Celebrities Who Lost Everything Instantly

May 25, 2025