Ambani's Reliance Q[Quarter]-[Year] Earnings: A Large-Cap Market Mover?

![Ambani's Reliance Q[Quarter]-[Year] Earnings: A Large-Cap Market Mover? Ambani's Reliance Q[Quarter]-[Year] Earnings: A Large-Cap Market Mover?](https://genussprofessional.de/image/ambanis-reliance-q-quarter-year-earnings-a-large-cap-market-mover.jpeg)

Table of Contents

H2: Key Financial Highlights of Reliance Industries Q3-2023 Earnings:

H3: Revenue and Profitability:

Reliance Industries reported robust revenue growth in Q3-2023, exceeding analyst expectations. Net profit also showed a healthy increase compared to the same period last year and the previous quarter. EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) mirrored this positive trend. Visual representations of these figures (charts and graphs would be included here in a published article) clearly depict the company's financial strength.

- Revenue growth percentage: [Insert actual percentage here, e.g., 15%] showcasing strong year-on-year growth.

- Profit margin analysis: [Insert analysis here, e.g., improved profit margins due to operational efficiencies and strategic cost management.]

- Comparison to analyst estimates: [Insert comparison here, e.g., exceeded analyst consensus estimates by X%].

H3: Segment-wise Performance:

Reliance's diverse business segments contributed variably to the overall performance. Jio Platforms continued its impressive subscriber growth, solidifying its position as a leading telecom player. The retail segment demonstrated resilience, despite economic headwinds. Refining and petrochemicals experienced fluctuations influenced by global crude oil prices and production output.

- Jio subscriber growth: [Insert actual figures here, e.g., added X million subscribers.]

- Retail sales figures: [Insert actual figures here, e.g., sales growth of Y% year-on-year.]

- Refining margins: [Insert analysis here, e.g., margins were impacted by fluctuating crude oil prices but remained stable due to efficient operations.]

- Petrochemical production: [Insert details here, e.g., production output increased/decreased by Z% due to [reason]].

H3: Debt Reduction and Financial Health:

Reliance's proactive approach to debt reduction continues to yield positive results. The company's net debt levels have decreased significantly, improving its financial health and liquidity position. This improved financial strength bolsters investor confidence and allows for further investments and expansion.

- Net debt figures: [Insert actual figures here, showing a clear reduction.]

- Debt-to-equity ratio: [Insert ratio here, demonstrating improvement.]

- Credit rating implications: [Discuss any changes or maintained ratings, emphasizing positive implications.]

H2: Market Reaction and Impact on Large-Cap Stocks:

H3: Immediate Market Response:

The market reacted positively to Reliance's Q3-2023 earnings announcement. The stock price experienced a noticeable surge, accompanied by increased trading volume, indicating strong investor sentiment.

- Stock price change percentage: [Insert percentage change, e.g., increased by X%.]

- Trading volume compared to average: [Insert comparison, e.g., trading volume was Y% higher than the daily average.]

- Investor sentiment: [Describe the overall positive investor sentiment based on market reaction.]

H3: Broader Market Implications:

Reliance's strong performance had a positive ripple effect on the broader Indian stock market. Benchmark indices like the Nifty 50 and Sensex experienced gains, partly attributable to Reliance's positive results. Other large-cap stocks also showed positive correlation, reflecting a surge in overall investor confidence.

- Impact on benchmark indices (e.g., Nifty 50, Sensex): [Describe the positive impact on these indices.]

- Correlation with other large-cap stocks: [Explain the positive correlation observed.]

- Investor confidence: [Highlight the boost in investor confidence due to Reliance's performance.]

H3: Analyst Ratings and Future Outlook:

Financial analysts largely reacted positively to Reliance's Q3-2023 results, with many maintaining or upgrading their ratings. The consensus price target for Reliance shares also increased, reflecting a bullish outlook on the company's future performance.

- Consensus price target: [Insert the consensus price target among analysts.]

- Upgrade/downgrade ratings: [Summarize the analyst ratings—how many upgraded, downgraded, or maintained their rating.]

- Future growth projections: [Summarize the future growth projections by analysts.]

H2: Ambani's Strategic Initiatives and Their Impact:

H3: Key Strategic Moves:

Ambani's strategic vision continues to drive Reliance's success. Recent strategic moves, including investments in new technologies and strategic partnerships, have positively influenced the Q3-2023 earnings. [Specific examples of strategic moves and their positive impacts should be detailed here.]

- New partnerships: [List key partnerships and their contributions.]

- Investments: [Detail significant investments and their expected returns.]

- Acquisitions: [Mention any relevant acquisitions and their synergistic benefits.]

- Technological advancements: [Highlight technological improvements and their impact on efficiency and profitability.]

H3: Long-Term Vision and Growth Prospects:

Ambani's long-term vision for Reliance centers around digital transformation, sustainable growth, and continued market leadership. The company's ongoing investments in new technologies and infrastructure demonstrate a commitment to achieving these goals. Reliance's diversified business model and strong financial position position it for continued growth and success in the years to come.

- Future investment plans: [Summarize key future investment areas and strategies.]

- Expansion strategies: [Outline the company's plans for expansion into new markets or sectors.]

- Market dominance aspirations: [Discuss Reliance's aims for maintaining and expanding its market leadership position.]

3. Conclusion:

Reliance Industries' Q3-2023 earnings largely exceeded expectations, showcasing robust financial performance across its diverse business segments. This positive performance significantly impacted the broader Indian stock market, reinforcing Reliance's status as a large-cap market mover. Ambani's strategic leadership and proactive initiatives are key drivers of this success. Stay tuned for updates on Reliance's future performance and learn more about the impact of Ambani's strategies on Reliance's large-cap standing.

![Ambani's Reliance Q[Quarter]-[Year] Earnings: A Large-Cap Market Mover? Ambani's Reliance Q[Quarter]-[Year] Earnings: A Large-Cap Market Mover?](https://genussprofessional.de/image/ambanis-reliance-q-quarter-year-earnings-a-large-cap-market-mover.jpeg)

Featured Posts

-

The Growing Demand For Dysprosium And Its Impact On Ev Production

Apr 29, 2025

The Growing Demand For Dysprosium And Its Impact On Ev Production

Apr 29, 2025 -

Ftc Appeals Microsoft Activision Ruling Whats Next

Apr 29, 2025

Ftc Appeals Microsoft Activision Ruling Whats Next

Apr 29, 2025 -

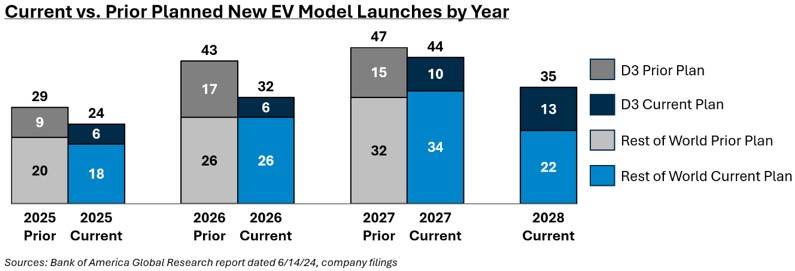

Bof A Says Dont Worry About Stretched Stock Market Valuations

Apr 29, 2025

Bof A Says Dont Worry About Stretched Stock Market Valuations

Apr 29, 2025 -

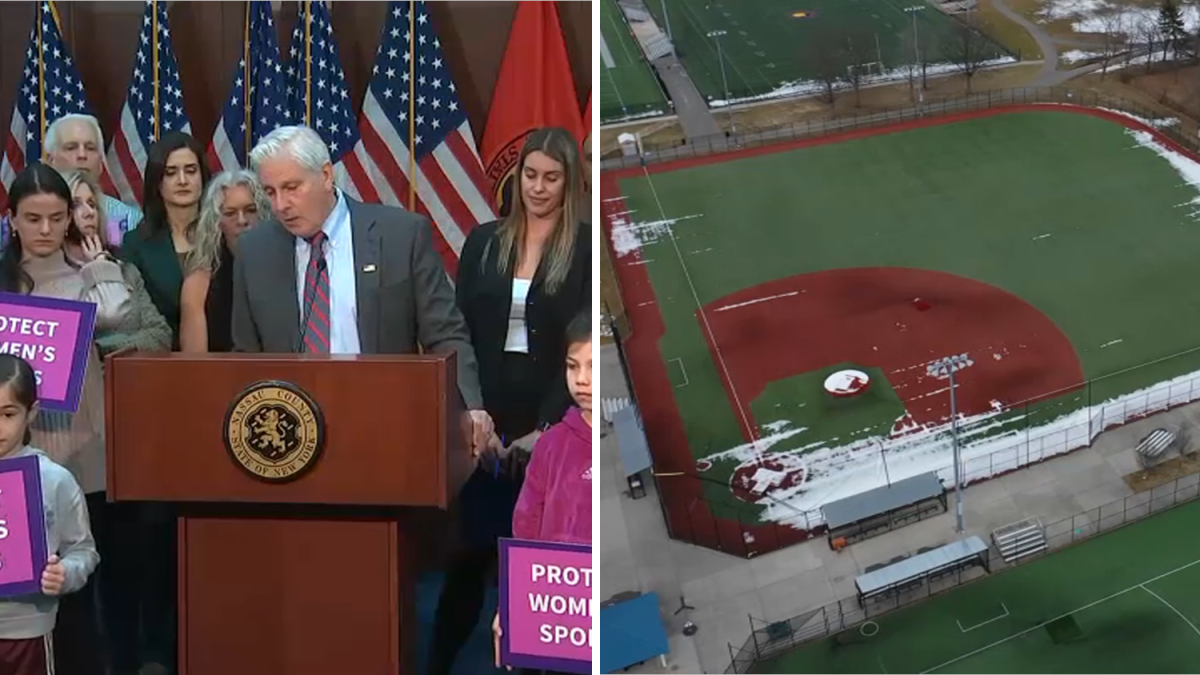

Us Attorney Generals Transgender Athlete Ban Minnesotas Response

Apr 29, 2025

Us Attorney Generals Transgender Athlete Ban Minnesotas Response

Apr 29, 2025 -

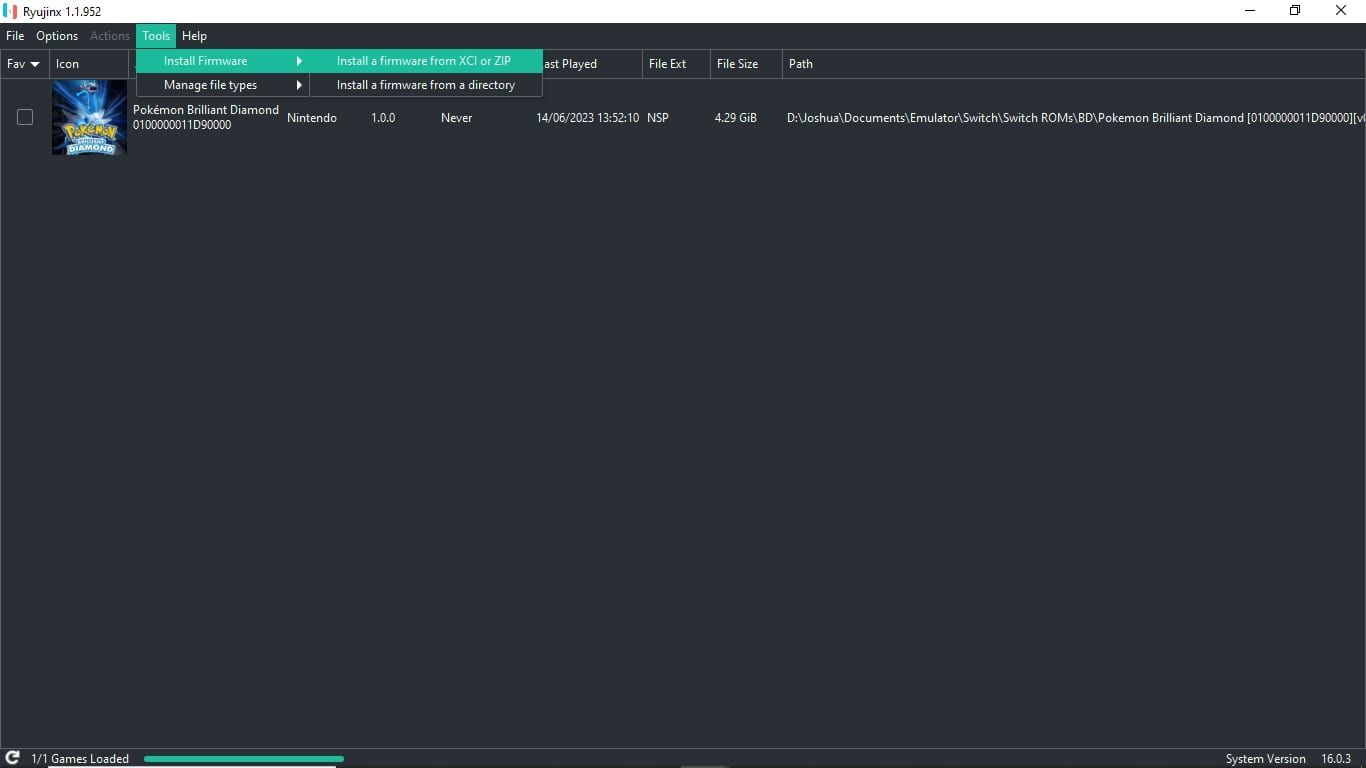

Ryujinx Emulator Project Ceases After Reported Nintendo Contact

Apr 29, 2025

Ryujinx Emulator Project Ceases After Reported Nintendo Contact

Apr 29, 2025

Latest Posts

-

Ryujinx Emulator Project Ceases After Reported Nintendo Contact

Apr 29, 2025

Ryujinx Emulator Project Ceases After Reported Nintendo Contact

Apr 29, 2025 -

Nintendos Action The End Of Ryujinx Emulator Development

Apr 29, 2025

Nintendos Action The End Of Ryujinx Emulator Development

Apr 29, 2025 -

Kuxius Revolutionary Solid State Power Bank Durability And Performance Compared

Apr 29, 2025

Kuxius Revolutionary Solid State Power Bank Durability And Performance Compared

Apr 29, 2025 -

The Future Of Search Perplexity Ceos Strategy To Beat Google In The Ai Browser Battle

Apr 29, 2025

The Future Of Search Perplexity Ceos Strategy To Beat Google In The Ai Browser Battle

Apr 29, 2025 -

Ryujinx Emulator Development Halted Nintendos Involvement Explained

Apr 29, 2025

Ryujinx Emulator Development Halted Nintendos Involvement Explained

Apr 29, 2025