Airlines Face Headwinds: Rising Fuel Costs And Oil Supply Disruptions

Table of Contents

Soaring Fuel Costs: A Major Threat to Airline Profitability

Jet fuel costs represent a substantial portion of an airline's operating expenses. Fluctuations in crude oil prices directly translate to changes in jet fuel prices, significantly impacting airline profitability.

The Impact of Crude Oil Prices on Jet Fuel

Crude oil prices are the primary driver of jet fuel costs. A direct correlation exists: when crude oil prices rise, so do jet fuel prices, squeezing airline margins.

- Recent Price Spikes: In the past year alone, we've witnessed several significant spikes in crude oil prices, leading to a 30-40% increase in jet fuel costs for many airlines.

- Impact on Operating Margins: This dramatic increase has severely eroded airline operating margins, forcing many to re-evaluate their business strategies. Some airlines are reporting losses where they previously saw profits.

- Percentage Increase: The percentage increase in jet fuel costs varies depending on the airline and its hedging strategies, but the overall trend is undeniably upward.

Hedging Strategies and Their Limitations

Airlines employ various hedging strategies to mitigate the risk of volatile fuel prices. However, even the most sophisticated hedging techniques have limitations in a highly unpredictable market.

- Futures Contracts: Airlines purchase futures contracts to lock in a price for future jet fuel purchases. However, unforeseen price surges can still negatively impact profitability.

- Options Contracts: These offer more flexibility than futures but are also more complex and require expertise to manage effectively.

- Effectiveness Challenges: The effectiveness of hedging depends on accurate market predictions. Unexpected geopolitical events or supply chain disruptions can render even the most carefully planned hedging strategies inadequate.

Passing Increased Costs to Consumers

To maintain profitability, airlines are forced to pass on increased fuel costs to consumers through higher ticket prices.

- Reduced Demand: Higher fares can lead to reduced demand, particularly impacting price-sensitive leisure travelers.

- Business vs. Leisure Travel: Business travelers, often less sensitive to price fluctuations, may absorb the increased costs more readily than leisure travelers.

- Ancillary Revenue: Airlines are increasingly relying on ancillary revenue streams (baggage fees, seat selection, in-flight meals) to partially offset rising fuel costs.

Oil Supply Disruptions: A Source of Uncertainty and Volatility

Geopolitical instability and supply chain disruptions contribute significantly to the volatility of oil prices, creating considerable uncertainty for the airline industry.

Geopolitical Factors and Their Influence

Geopolitical events, such as wars, sanctions, and political instability in oil-producing regions, directly impact oil production and global supply.

- Impact of Conflicts: Recent conflicts and political tensions have significantly impacted global oil supply, leading to price volatility and uncertainty for airlines.

- Sanctions and Embargoes: Sanctions imposed on oil-producing nations can further restrict supply, driving up prices.

- Political Instability: Unrest in major oil-producing regions can disrupt production and transportation, creating supply shortages.

OPEC's Role in Price Determination

The Organization of the Petroleum Exporting Countries (OPEC) plays a crucial role in determining global oil prices through its production decisions.

- OPEC Production Cuts: OPEC's decisions to cut or increase oil production directly influence global supply and, consequently, jet fuel prices.

- Predicting OPEC Actions: Predicting OPEC's future actions is challenging, adding to the uncertainty airlines face when planning budgets and fuel purchases.

- Impact on Airline Planning: This uncertainty makes long-term planning and hedging extremely difficult for airlines.

Supply Chain Issues and Their Effect on Jet Fuel Availability

Disruptions in the oil supply chain, from production to refining and distribution, can further exacerbate the problem.

- Refining Capacity: Limitations in refining capacity can constrain the availability of jet fuel, even when crude oil supplies are adequate.

- Transportation Bottlenecks: Delays or disruptions in transportation networks can lead to shortages and price spikes in specific regions.

- Pipeline Issues: Damage to pipelines or disruptions in pipeline operations can severely impact fuel availability.

Strategies for Airlines to Navigate These Challenges

Airlines are actively exploring various strategies to mitigate the impact of rising fuel costs and oil supply disruptions.

Fuel Efficiency Initiatives

Improving fuel efficiency is crucial for reducing operating costs and enhancing profitability.

- Fuel-Efficient Aircraft: Investing in newer, more fuel-efficient aircraft models significantly reduces fuel consumption per passenger mile.

- Route Optimization: Airlines are constantly optimizing flight routes to minimize fuel consumption, considering factors such as wind patterns and flight altitudes.

- Technological Innovations: Advanced technologies, such as improved flight management systems, help to reduce fuel burn.

Ancillary Revenue Streams

Diversifying revenue streams beyond ticket sales is essential for absorbing increased fuel costs.

- Baggage Fees: Airlines generate significant revenue from baggage fees, which are relatively insensitive to fluctuations in fuel prices.

- Seat Upgrades: Offering seat upgrades for a premium price increases revenue and enhances the passenger experience.

- In-flight Purchases: Sales of food, beverages, and other goods contribute to profitability and offset fuel costs.

Cost-Cutting Measures

Airlines are also implementing cost-cutting measures to maintain profitability in the face of rising fuel costs.

- Staffing Reductions: In some cases, airlines may resort to reducing staff to control labor costs.

- Route Optimization: Consolidating or eliminating underperforming routes can reduce overall operational costs.

- Fleet Modernization: Replacing older, less fuel-efficient aircraft with newer models can significantly reduce fuel consumption.

Conclusion

Rising fuel costs and unpredictable oil supply disruptions represent significant challenges for the airline industry. These headwinds are severely impacting airline profitability, forcing them to adapt and implement various strategies to survive. Fuel efficiency initiatives, diversified revenue streams, and cost-cutting measures are crucial for maintaining profitability and navigating this challenging environment. Stay informed about the latest developments impacting the airline industry and understand how "Airlines Face Headwinds: Rising Fuel Costs and Oil Supply Disruptions" affect air travel costs and availability. Further research into fuel hedging strategies and airline financial reports can provide a deeper understanding of this evolving situation.

Featured Posts

-

Ufc 314 Co Main Event Betting Preview And Predictions For Chandler Vs Pimblett

May 04, 2025

Ufc 314 Co Main Event Betting Preview And Predictions For Chandler Vs Pimblett

May 04, 2025 -

Is Stefano Domenicali The Driving Force Behind Formula 1s Explosive Popularity

May 04, 2025

Is Stefano Domenicali The Driving Force Behind Formula 1s Explosive Popularity

May 04, 2025 -

Fox And Espns 2025 Streaming Service Launch What We Know

May 04, 2025

Fox And Espns 2025 Streaming Service Launch What We Know

May 04, 2025 -

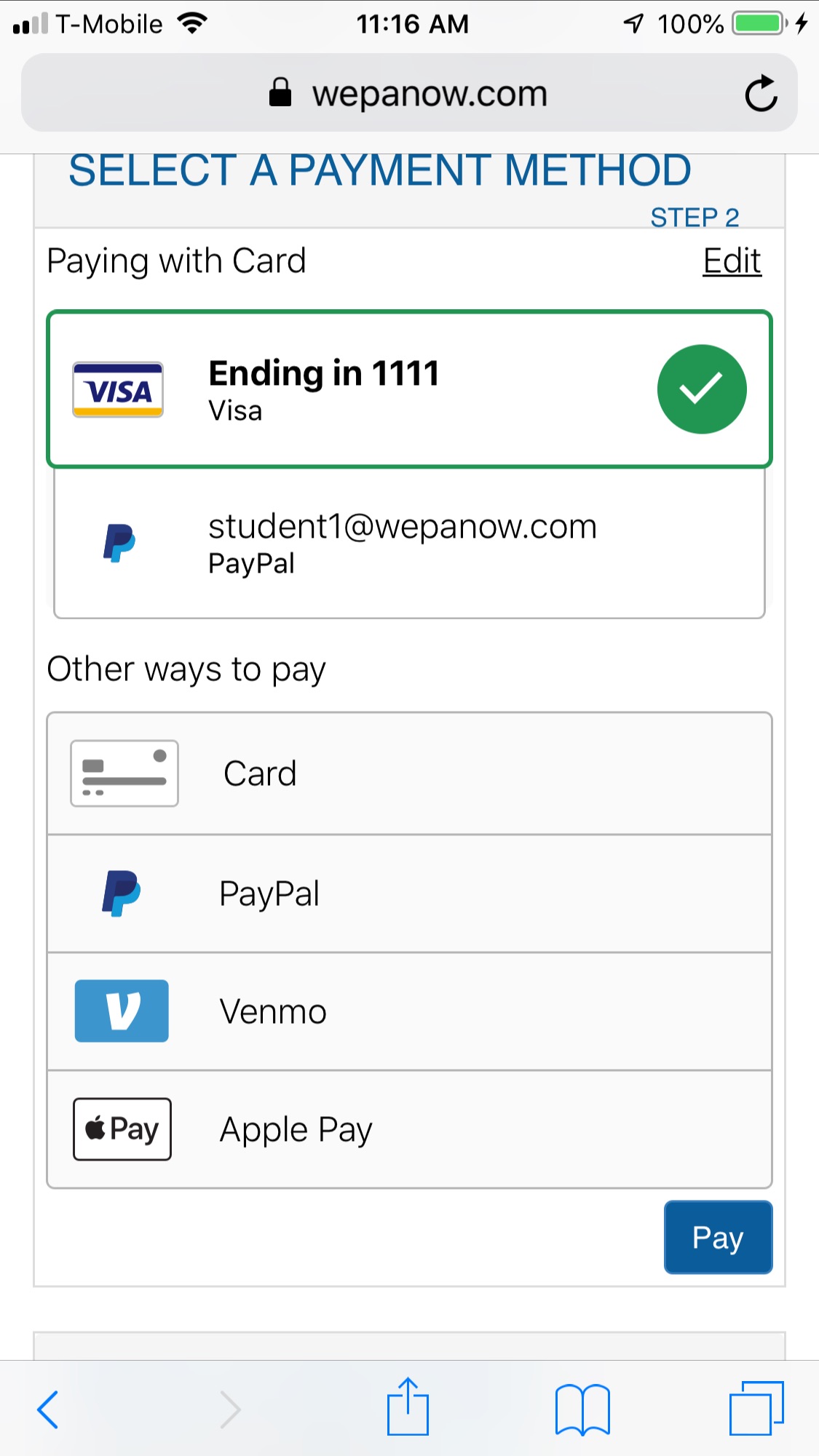

Spotify I Phone App Flexible Payment Options Now Available

May 04, 2025

Spotify I Phone App Flexible Payment Options Now Available

May 04, 2025 -

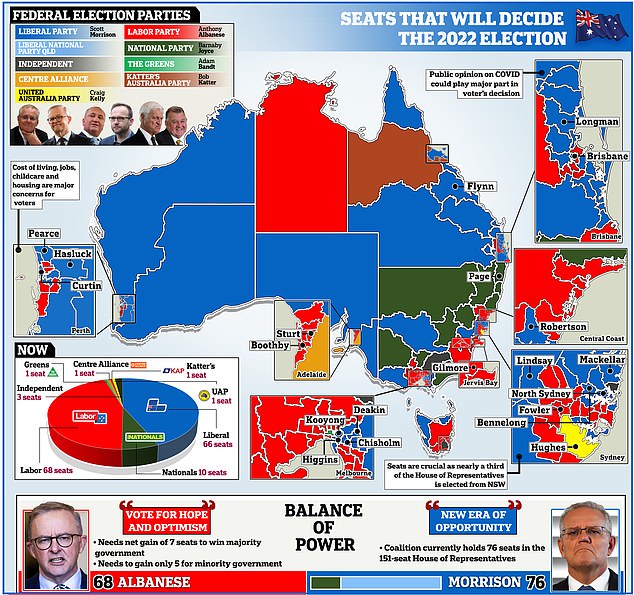

Australia Votes Election 2023 Update Labor In Front

May 04, 2025

Australia Votes Election 2023 Update Labor In Front

May 04, 2025

Latest Posts

-

Internet Buzz Over Emma Stones Popcorn Butt Lift Dress At Snl

May 04, 2025

Internet Buzz Over Emma Stones Popcorn Butt Lift Dress At Snl

May 04, 2025 -

Fox And Espn New Streaming Platforms Launching Later This Year 2025

May 04, 2025

Fox And Espn New Streaming Platforms Launching Later This Year 2025

May 04, 2025 -

Emma Stones Quirky Snl Dress A Popcorn Butt Lift Moment

May 04, 2025

Emma Stones Quirky Snl Dress A Popcorn Butt Lift Moment

May 04, 2025 -

Standalone Streaming Services From Fox And Espn Coming In 2025

May 04, 2025

Standalone Streaming Services From Fox And Espn Coming In 2025

May 04, 2025 -

Indy Cars 2024 Season Full Coverage On Fox

May 04, 2025

Indy Cars 2024 Season Full Coverage On Fox

May 04, 2025