Airbus Passes US Airline Tariff Costs

Table of Contents

H2: The Impact of US Tariffs on Airbus

The US imposed tariffs on Airbus aircraft and parts as part of a long-running trade dispute with the European Union. These tariffs, implemented in 2019, significantly increased the cost of bringing Airbus planes to the US market. This added financial burden affects Airbus in multiple ways:

- Increased manufacturing costs: The tariffs directly increase the price of imported components and materials, pushing up the overall manufacturing cost of Airbus aircraft. This makes producing planes more expensive, impacting profitability.

- Higher transportation and logistics expenses: Shipping aircraft and parts across the Atlantic becomes more costly due to the tariffs, adding to the overall price tag. This adds complexity to already intricate supply chains.

- Potential disruption to supply chains: The uncertainty created by the tariffs can lead to disruptions in the supply chain, delaying production and potentially impacting delivery schedules to airlines. This can lead to production bottlenecks and delays in aircraft deliveries.

- Reduced profitability margins: The combined effect of higher manufacturing costs, transportation expenses, and potential supply chain disruptions directly squeezes Airbus' profit margins, forcing the company to adapt.

H2: Airbus' Strategy for Passing on Costs

Faced with increased costs from US tariffs, Airbus has implemented several strategies to offset the financial burden, ultimately passing the increased costs on to its customers:

- Price increases on new aircraft orders: The most direct approach is to increase the price of new aircraft orders to account for the added tariff expenses. This ensures Airbus maintains profitability in the face of increased costs from the tariffs.

- Revised contractual terms with existing customers: Airbus may renegotiate contracts with existing customers to reflect the added costs associated with the tariffs. This may involve adjustments to delivery schedules or other contractual terms.

- Potential delays or cancellations of orders due to cost increases: The significant price increases could lead to some airlines reconsidering or delaying their aircraft orders, impacting Airbus' order books. This uncertainty reflects the impact of tariffs on overall investment decisions.

- Exploring alternative manufacturing and sourcing strategies: To mitigate future tariff impacts, Airbus may explore alternative manufacturing locations and sourcing strategies, potentially shifting some production outside of the EU. This is a long-term strategy to reduce reliance on US-tariff impacted supply chains.

H2: The Ripple Effect on US Airlines

The cost increases passed on by Airbus directly affect the financial health of US airlines that rely on its aircraft:

- Increased operating expenses: The higher purchase prices for Airbus planes translate to increased operating expenses for US airlines, impacting their overall financial performance. This added expense directly affects their bottom line.

- Pressure to raise ticket prices for passengers: To offset the increased costs, airlines may be forced to raise ticket prices for passengers, potentially impacting demand and passenger satisfaction. This is a necessary but potentially unpopular move.

- Reduced profit margins and potential impact on expansion plans: The squeezed profit margins may force airlines to reconsider expansion plans or investments in new routes and services, impacting their competitiveness and growth trajectory. This can hinder business development in the long run.

- Competitive disadvantage against airlines using Boeing aircraft: Airlines using Boeing aircraft may have a competitive advantage as they are not directly affected by the Airbus tariffs, potentially impacting the market share of airlines purchasing Airbus aircraft. This creates an uneven playing field in the industry.

H2: Geopolitical Implications and the Broader Aviation Landscape

The trade dispute between the EU and the US, and the resulting tariffs on Airbus aircraft, has significant geopolitical implications for the global aviation industry:

- Escalation of trade tensions between the US and the EU: The tariff dispute underscores the escalating trade tensions between the US and the EU, potentially impacting other sectors and further complicating international trade relations. This highlights the significant economic and political implications of trade wars.

- Potential retaliatory tariffs from the EU: The EU might impose retaliatory tariffs on US goods, escalating the trade war and further disrupting global supply chains in various industries. This is a potential risk for all economic actors involved.

- Uncertainty and instability in the global aircraft market: The uncertainty surrounding tariffs creates instability in the global aircraft market, impacting investment decisions and long-term planning for both manufacturers and airlines. This is crucial for long-term strategic planning.

- Long-term effects on the competitiveness of European and American aircraft manufacturers: The long-term effects on the competitiveness of both Airbus and Boeing remain to be seen, but the current situation creates a complex and potentially disruptive environment for both manufacturers. The outcome will significantly shape the future of the industry.

Conclusion

The passing of US airline tariff costs by Airbus highlights the significant impact of trade disputes on the aviation industry. The increased costs, strategic responses, and ripple effects throughout the industry demonstrate the far-reaching consequences of protectionist measures. Staying informed about Airbus’ response to US airline tariffs and the evolving trade landscape is crucial for airlines, aircraft manufacturers, and industry stakeholders. Further research into the long-term effects of these tariffs on the global aviation market is essential. Understanding these Airbus US airline tariff cost implications will help navigate the complexities of the global aviation market and prepare for future challenges.

Featured Posts

-

Shh Rg Ka Almyh Ayksprys Ardw Ky Rpwrt

May 02, 2025

Shh Rg Ka Almyh Ayksprys Ardw Ky Rpwrt

May 02, 2025 -

The Allure Of Rosie Huntington Whiteleys White Lingerie Ensemble

May 02, 2025

The Allure Of Rosie Huntington Whiteleys White Lingerie Ensemble

May 02, 2025 -

Fortnite Offline Update 34 40 Brings Planned Server Maintenance

May 02, 2025

Fortnite Offline Update 34 40 Brings Planned Server Maintenance

May 02, 2025 -

Tbs Zorg Onder Druk Onacceptabel Lange Wachttijden Voor Patienten

May 02, 2025

Tbs Zorg Onder Druk Onacceptabel Lange Wachttijden Voor Patienten

May 02, 2025 -

Goedkoper Auto Opladen Met Enexis Buiten Piektijden In Noord Nederland

May 02, 2025

Goedkoper Auto Opladen Met Enexis Buiten Piektijden In Noord Nederland

May 02, 2025

Latest Posts

-

Reform Shares Ex Mp Rupert Lowe Faces Credible Harassment Allegations

May 02, 2025

Reform Shares Ex Mp Rupert Lowe Faces Credible Harassment Allegations

May 02, 2025 -

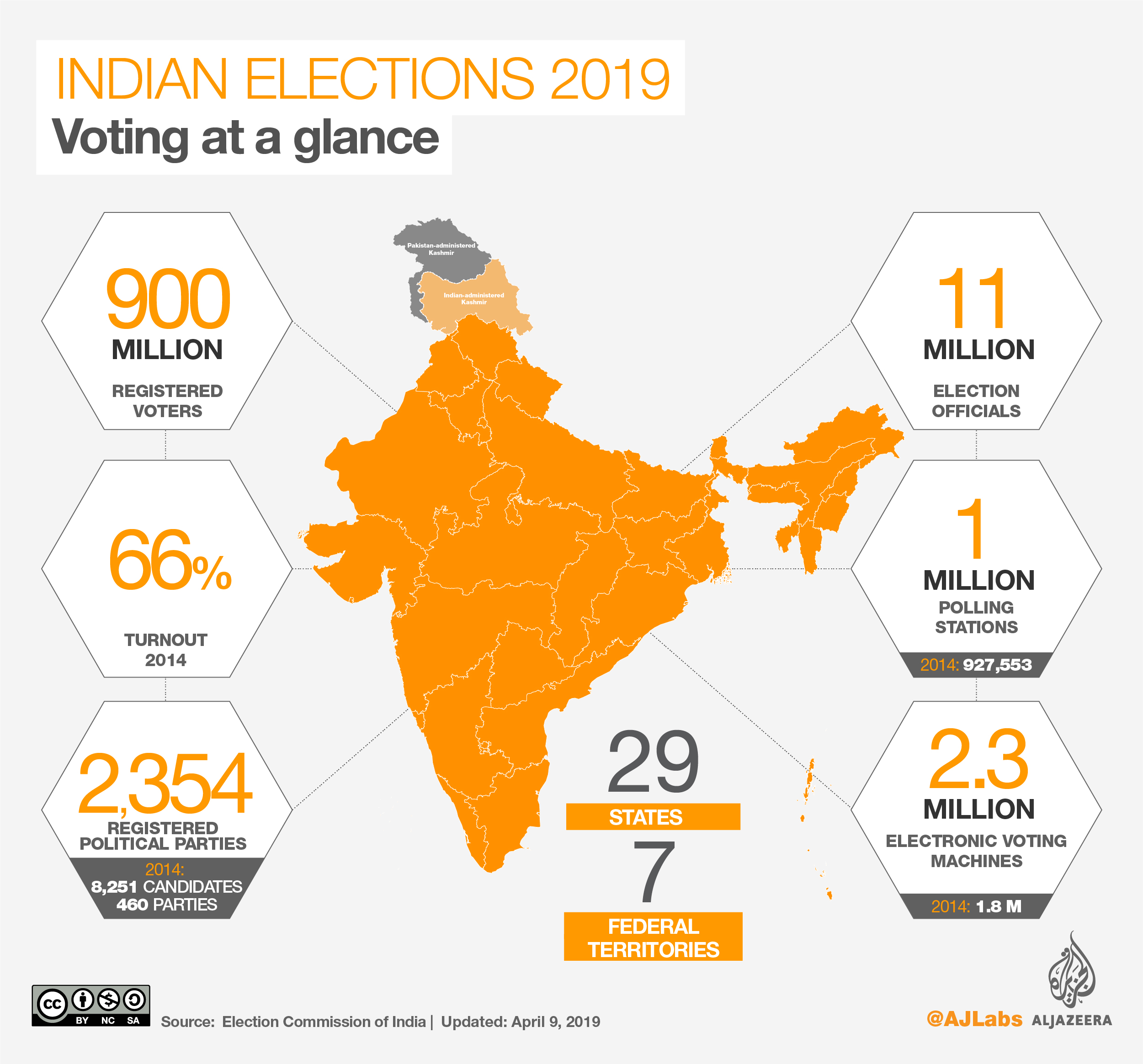

Securing Elections The Robustness Of The Poll Data System

May 02, 2025

Securing Elections The Robustness Of The Poll Data System

May 02, 2025 -

L Escalation Nucleare Di Medvedev Cause Ed Effetti Sulla Russofobia Europea

May 02, 2025

L Escalation Nucleare Di Medvedev Cause Ed Effetti Sulla Russofobia Europea

May 02, 2025 -

Robust Poll Data System Ensuring Election Integrity

May 02, 2025

Robust Poll Data System Ensuring Election Integrity

May 02, 2025 -

The Rupert Lowe Controversy Voices From Great Yarmouth

May 02, 2025

The Rupert Lowe Controversy Voices From Great Yarmouth

May 02, 2025