Airbus Passes Tariff Burden Onto US Airlines: Implications For The Aviation Industry

Table of Contents

The Details of the Airbus Tariffs

The tariffs imposed on Airbus aircraft stem from a long-running WTO dispute centering around illegal government subsidies. The US government, finding Airbus to have received unlawful state aid, levied retaliatory tariffs on Airbus aircraft imported into the US. These tariffs represent a significant percentage of the aircraft's value, impacting various models and significantly increasing their cost. Airbus's decision to pass these increased costs directly to US airlines places a considerable strain on their already-thin profit margins.

- Specific tariff amounts: The tariffs currently range from 10% to 15%, depending on the aircraft model.

- Aircraft models affected: A wide range of Airbus aircraft, including popular models like the A320 family and the larger A350, are subject to these tariffs.

- Examples of increased costs for airlines: The added tariff expense translates to millions of dollars in increased costs per aircraft, significantly impacting the overall operational budget for airlines purchasing these planes.

Impact on US Airlines

The financial implications of these Airbus tariffs are substantial and vary depending on the airline's size. Major US airlines, with their larger fleets and higher purchasing power, might absorb some of the cost, but it will still severely impact their profitability. Regional airlines, however, face a more significant challenge, as the added expense represents a larger percentage of their overall operational budget.

- Projected increases in operating costs: Airlines face millions of dollars in additional costs, potentially leading to reduced profitability and squeezed margins.

- Possible strategies airlines may employ to mitigate the impact: Airlines might explore options such as increasing ticket prices, adjusting flight routes to less costly destinations, or delaying new aircraft purchases. They may also negotiate better terms with suppliers and explore more fuel-efficient aircraft to offset the added expense.

- Examples of potential route cancellations or adjustments: Less profitable routes might be cut to offset increased operating costs, potentially impacting air connectivity and access in certain regions.

Wider Implications for the Aviation Industry

The Airbus tariffs and their transfer to US airlines have far-reaching consequences for the global aviation market. The impact extends beyond the US, affecting aircraft manufacturing, international supply chains, and passenger travel. The situation creates uncertainty and could trigger further retaliatory measures, potentially escalating the trade dispute.

- Impact on the competitiveness of US airlines globally: The increased costs put US airlines at a disadvantage against their international competitors who are not subject to the same tariffs.

- Potential for ripple effects across the supply chain: The added costs could impact suppliers and manufacturers involved in the production and maintenance of Airbus aircraft.

- Potential for further escalation of trade tensions: The situation could trigger further retaliatory measures from the EU or other countries, creating greater uncertainty and instability in the global aviation industry.

Potential Solutions and Mitigation Strategies

Resolving the US-EU trade dispute is crucial to mitigating the negative impacts of these tariffs. Negotiations and diplomatic solutions are essential to finding a long-term solution that benefits both sides. Meanwhile, airlines can explore various strategies to manage the increased costs.

- Negotiation and diplomatic solutions: Open dialogue and collaborative efforts between the US and EU governments are vital to resolving the underlying trade dispute.

- Cost-cutting initiatives for airlines: Airlines need to actively seek opportunities for cost reduction, including fuel efficiency improvements, streamlining operations, and optimizing maintenance schedules.

- Government support or financial aid for airlines: Government intervention, potentially in the form of subsidies or financial assistance, might be considered to help airlines cope with the added burden of these tariffs.

Conclusion

The impact of Airbus passing tariff burdens onto US airlines is undeniable. The financial pressures, potential route adjustments, and wider implications for the global aviation industry highlight the seriousness of this situation. From increased operating costs and potential route cancellations to broader global trade tensions, the ramifications are far-reaching. The situation regarding Airbus tariffs on US airlines demands close monitoring. Stay informed about developments in this ongoing trade dispute and its impact on the aviation industry by regularly checking reputable news sources and industry publications. Understanding the intricacies of Airbus tariffs and their effects on US airlines is crucial for stakeholders across the aviation sector.

Featured Posts

-

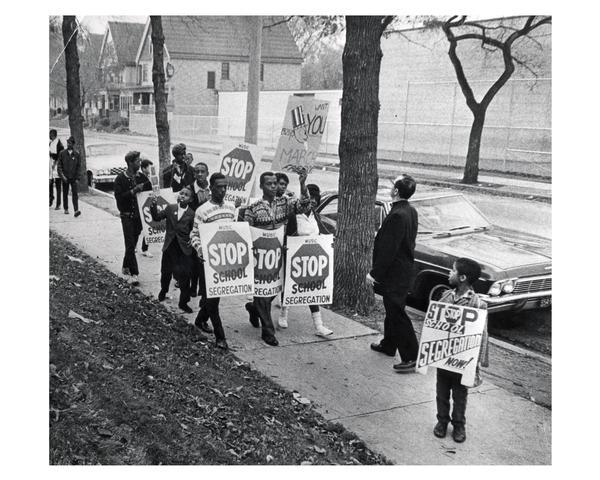

The End Of A School Desegregation Order A Turning Point In Education

May 03, 2025

The End Of A School Desegregation Order A Turning Point In Education

May 03, 2025 -

Mwqe Bkra Alkrh Fy Krt Alqdm 30 Shkhsyt Athart Ghdb Aljmahyr

May 03, 2025

Mwqe Bkra Alkrh Fy Krt Alqdm 30 Shkhsyt Athart Ghdb Aljmahyr

May 03, 2025 -

Googles Future At Stake Sundar Pichai On The Dojs Antitrust Plan

May 03, 2025

Googles Future At Stake Sundar Pichai On The Dojs Antitrust Plan

May 03, 2025 -

Fortnite Cowboy Bebop Collaboration Freebies Available For A Limited Time

May 03, 2025

Fortnite Cowboy Bebop Collaboration Freebies Available For A Limited Time

May 03, 2025 -

Will David Tennant Reprise His Role In The Max Harry Potter Series Unlikely

May 03, 2025

Will David Tennant Reprise His Role In The Max Harry Potter Series Unlikely

May 03, 2025