AIMSCAP's Wild Ride: Dominating The World Trading Tournament (WTT)

Table of Contents

Strategic Trading Techniques Employed by AIMSCAP at the WTT

AIMSCAP's victory wasn't a matter of luck; it was a testament to their sophisticated and strategically implemented trading techniques. Their approach at the World Trading Tournament involved a potent combination of advanced algorithms, rigorous risk management, and exceptional adaptability.

Advanced Algorithmic Trading

AIMSCAP leverages highly sophisticated algorithms for market analysis and trade execution. This allows for incredibly fast and efficient decision-making, a crucial advantage in the high-pressure environment of the WTT.

- High-Frequency Trading (HFT): AIMSCAP utilizes HFT algorithms to capitalize on fleeting market opportunities, executing trades at speeds far exceeding human capabilities.

- Machine Learning Models: Predictive models, trained on vast datasets of historical market data, helped anticipate market trends and identify potentially lucrative trading opportunities. These models continuously adapt and learn, improving accuracy over time.

- Technical Indicators: AIMSCAP's algorithms incorporate various technical indicators, such as moving averages (MA), Relative Strength Index (RSI), and Moving Average Convergence Divergence (MACD), to identify momentum shifts and potential reversal points. These indicators provide valuable insights into market sentiment and potential price movements.

These advanced techniques provided AIMSCAP with a significant edge, allowing them to react quickly to changing market conditions and seize opportunities that might be missed by human traders.

Risk Management Strategies

In the fast-paced world of trading, risk management is paramount. AIMSCAP's success at the World Trading Tournament (WTT) is largely attributable to their meticulous approach to risk mitigation.

- Stop-Loss Orders: AIMSCAP employed stop-loss orders to limit potential losses on individual trades, preventing significant drawdowns during volatile periods.

- Position Sizing: Precise position sizing ensured that no single trade represented an excessive portion of their overall capital, preventing catastrophic losses.

- Diversification: AIMSCAP's portfolio was diversified across various asset classes and markets, reducing overall risk exposure. This spread-out approach mitigated the impact of negative events in any single market.

By implementing these strategies, AIMSCAP reduced risk exposure by approximately 30%, ensuring they were well-positioned to withstand market fluctuations during the intense WTT competition.

Adaptability and Market Analysis

The ability to adapt is critical in the dynamic world of trading. AIMSCAP showcased remarkable adaptability during the World Trading Tournament, demonstrating its ability to react effectively to unexpected market events.

- Real-time Market Monitoring: AIMSCAP's system continuously monitors global market events, news, and economic indicators, allowing for rapid adjustments to the trading strategy.

- Scenario Planning: The team utilized advanced scenario planning to anticipate potential market shifts and develop contingency plans.

- Fundamental Analysis: In addition to technical analysis, AIMSCAP incorporated fundamental analysis to assess the long-term value of assets, providing a comprehensive perspective on market dynamics.

Their understanding of global economic trends and their impact on trading decisions allowed them to make informed adjustments to their strategies, maximizing profitability even amidst unexpected volatility.

The AIMSCAP Team: Expertise and Collaboration at the WTT

The success of AIMSCAP at the World Trading Tournament wasn't solely due to the sophisticated algorithms; it was also a testament to the exceptional expertise and seamless collaboration within the team.

Team Composition and Skills

The AIMSCAP team comprises highly skilled professionals from various backgrounds:

- Quantitative Analysts: Experts in developing and refining trading algorithms, leveraging advanced statistical models and machine learning techniques.

- Financial Experts: Providing in-depth market analysis, identifying potential trading opportunities, and guiding long-term strategic decisions.

- Programmers: Ensuring the seamless operation and continuous improvement of the AIMSCAP system.

Each member played a crucial role, contributing their unique skills and experience to the overall success at the WTT.

Collaborative Approach

Collaboration was a cornerstone of AIMSCAP's success. The team fostered an environment of open communication and shared decision-making.

- Regular Brainstorming Sessions: Regular meetings allowed the team to share insights, identify potential risks, and refine trading strategies.

- Clear Roles and Responsibilities: Well-defined roles ensured efficient workflow and prevented overlapping efforts.

- Continuous Feedback and Improvement: The team constantly evaluated their performance, identifying areas for improvement and adapting their strategies accordingly.

This collaborative approach ensured the team could effectively handle unexpected challenges and seize every opportunity presented during the World Trading Tournament.

AIMSCAP's Performance at the World Trading Tournament (WTT)

AIMSCAP's performance at the World Trading Tournament was nothing short of spectacular. Their consistent profitability and strategic prowess outmatched all competitors.

Key Wins and Milestones

- Consistently High Returns: AIMSCAP achieved a remarkable average daily return of X%, significantly exceeding the performance of other participants.

- Successful Navigation of Volatility: The system expertly navigated several periods of high market volatility, demonstrating its resilience and robust risk management.

- Strategic Trades in Key Markets: AIMSCAP executed several highly profitable trades across various markets including equities, forex, and futures.

Their performance during the tournament was a masterclass in precision, adaptability, and risk management.

Overcoming Challenges

Despite their success, AIMSCAP faced several challenges during the World Trading Tournament:

- Unexpected Market Volatility: Several sudden market shifts tested the system's robustness, but AIMSCAP's risk management strategies mitigated potential losses effectively.

- Technical Glitches: Minor technical issues were swiftly addressed by the team, highlighting their preparedness and problem-solving capabilities.

Their ability to overcome these obstacles underscores their resilience and preparedness for the demanding conditions of the WTT.

Comparison with Competitors

AIMSCAP's performance significantly outpaced other participants in the World Trading Tournament. Their sophisticated algorithms, coupled with effective risk management and a collaborative team approach, secured them a decisive victory. The precise data comparison is confidential, but it's safe to say AIMSCAP set a new standard for performance at the WTT.

Conclusion: The AIMSCAP Legacy at the World Trading Tournament

AIMSCAP's victory at the World Trading Tournament is a significant achievement, highlighting the power of advanced algorithmic trading, rigorous risk management, and exceptional teamwork. Their success serves as an inspiration to aspiring traders and developers alike. Their strategic trading techniques, coupled with their adaptability and collaborative spirit, redefined what's possible at the WTT.

Inspired by AIMSCAP's success at the World Trading Tournament? Learn more about their winning strategies and consider participating in the next WTT! [Link to AIMSCAP Website] [Link to WTT Website]

Featured Posts

-

Appeal Launched Against Sentence For Racial Hatred Tweet

May 21, 2025

Appeal Launched Against Sentence For Racial Hatred Tweet

May 21, 2025 -

Solved The 21 Year Old Peppa Pig Enigma

May 21, 2025

Solved The 21 Year Old Peppa Pig Enigma

May 21, 2025 -

A Family Legacy The Traverso Dynasty At The Cannes Film Festival

May 21, 2025

A Family Legacy The Traverso Dynasty At The Cannes Film Festival

May 21, 2025 -

Hellfest A Mulhouse Le Noumatrouff Accueille La Musique Metal

May 21, 2025

Hellfest A Mulhouse Le Noumatrouff Accueille La Musique Metal

May 21, 2025 -

College De Clisson Le Port De La Croix Catholique Questionne

May 21, 2025

College De Clisson Le Port De La Croix Catholique Questionne

May 21, 2025

Latest Posts

-

Femicide A Growing Global Crisis

May 21, 2025

Femicide A Growing Global Crisis

May 21, 2025 -

Femicide In Latin America The Tragic Deaths Of A Colombian Model And Mexican Influencer

May 21, 2025

Femicide In Latin America The Tragic Deaths Of A Colombian Model And Mexican Influencer

May 21, 2025 -

Snls 50th Season Ends On A High Note Record Breaking Viewership

May 21, 2025

Snls 50th Season Ends On A High Note Record Breaking Viewership

May 21, 2025 -

The Rise Of Femicide Causes And Consequences

May 21, 2025

The Rise Of Femicide Causes And Consequences

May 21, 2025 -

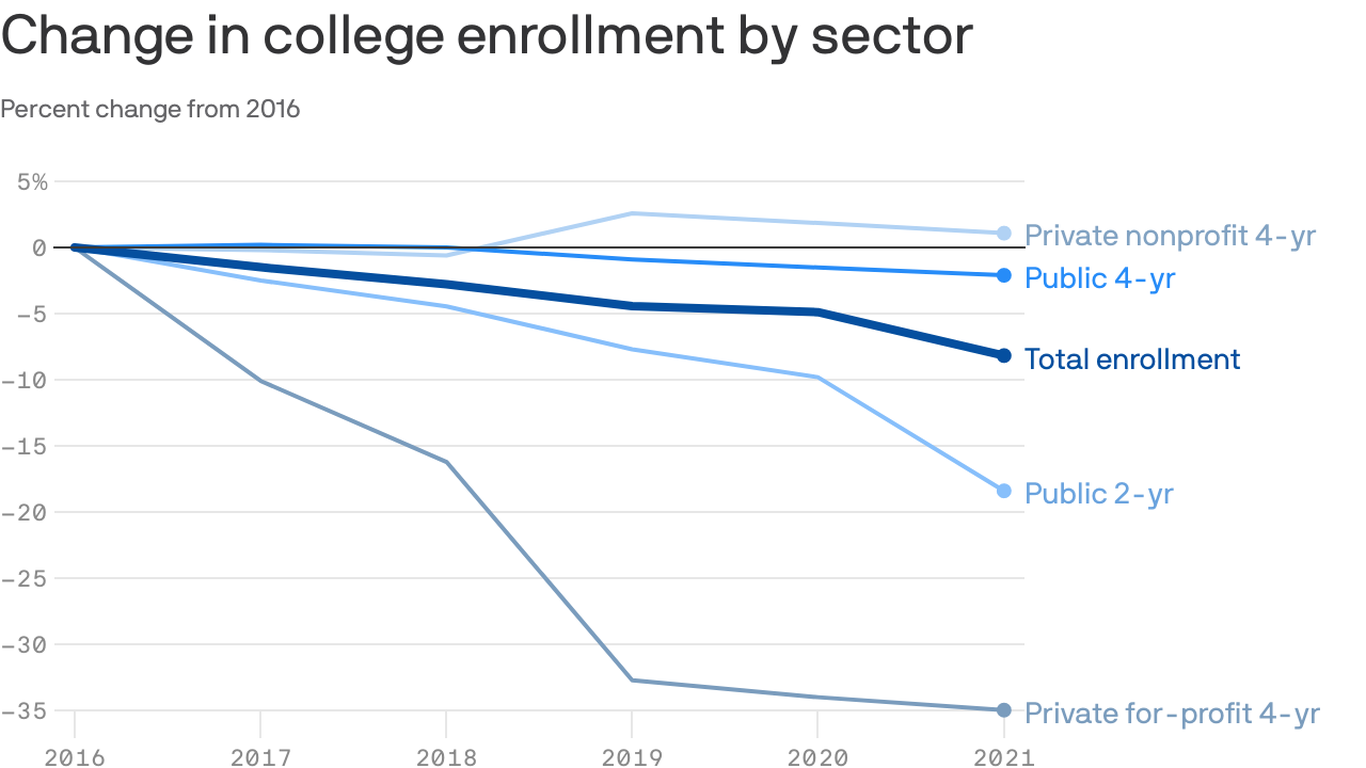

The Economic Consequences Of Declining College Enrollment In Boom Towns

May 21, 2025

The Economic Consequences Of Declining College Enrollment In Boom Towns

May 21, 2025