AIMSCAP And The World Trading Tournament (WTT): A Competitive Analysis

Table of Contents

AIMSCAP's Core Features and their Impact on WTT Performance

AIMSCAP's impact on WTT performance stems directly from its core functionalities. Its integrated features are specifically designed to navigate the high-pressure, fast-paced environment of the tournament.

Automated Trading Capabilities

Automated trading is paramount in the WTT. Manual trading struggles to keep up with the speed and volume of transactions. AIMSCAP's automation offers several critical advantages:

- Reduced Emotional Trading: Automated systems eliminate the emotional biases that can cloud judgment and lead to poor decisions under pressure. AIMSCAP's algorithms execute trades based on pre-defined parameters, ensuring consistent performance regardless of market volatility or personal feelings. This translates to fewer impulsive trades and better risk management in the heat of competition.

- Faster Execution Speeds: Speed is crucial in the WTT. AIMSCAP's high-speed execution capabilities allow you to capitalize on fleeting market opportunities and react swiftly to price changes, giving you a significant edge over slower manual traders. Milliseconds can make a difference between profit and loss.

- Potential for 24/7 Trading: The WTT often involves round-the-clock trading activity. AIMSCAP allows you to monitor and execute trades continuously, capitalizing on global market movements regardless of time zone.

- Backtesting Capabilities: Before deploying any strategy, rigorous testing is crucial. AIMSCAP provides robust backtesting tools to simulate trading performance across historical data, helping you optimize your settings and identify potential weaknesses before entering the high-stakes WTT environment.

Advanced Algorithmic Strategies

AIMSCAP employs sophisticated algorithms designed to outperform traditional trading methods. These algorithms provide a significant competitive edge in several key areas:

- Sophisticated Risk Management Tools: AIMSCAP incorporates advanced risk management features, including stop-loss orders and position sizing algorithms, to protect your capital and limit potential losses. This is crucial in the WTT, where a single bad trade can significantly impact your overall results.

- Adaptability to Market Changes: The market is constantly evolving. AIMSCAP's algorithms are designed to adapt to changing market conditions, automatically adjusting trading strategies as needed to maintain profitability. This dynamic adaptability is a key element in achieving long-term success.

- Optimization for Specific WTT Scenarios: AIMSCAP's algorithms can be tailored to specific WTT scenarios, allowing you to fine-tune your strategy for optimal performance within the tournament's unique parameters and rules. For example, specific algorithms can be adjusted to leverage short-term trends, volatility, or other key factors. Depending on market behavior, algorithms like mean reversion or trend following strategies can be optimized within AIMSCAP's framework.

Data Analytics and Market Insights

Data-driven decision-making is the cornerstone of successful trading. AIMSCAP provides powerful analytical tools that give you a crucial advantage:

- Real-Time Market Data Feeds: Access to real-time, high-quality market data is crucial for making informed decisions. AIMSCAP integrates seamlessly with multiple data providers, ensuring you have the information you need to make optimal trades.

- Predictive Analytics: AIMSCAP employs sophisticated predictive analytics techniques to identify potential market trends and opportunities before they become widely known. This predictive capability gives you a significant edge in anticipating market movements.

- Performance Tracking and Reporting: AIMSCAP provides detailed performance tracking and reporting, allowing you to monitor your results, identify areas for improvement, and continuously refine your trading strategy. This ongoing analysis is critical for maximizing long-term profitability.

AIMSCAP vs. Other WTT Trading Strategies: A Comparative Analysis

Understanding AIMSCAP's position within the broader WTT landscape requires a comparative analysis.

Comparison with Manual Trading

Manual trading, while offering a certain level of control, is significantly disadvantaged in the fast-paced WTT environment:

- Increased Risk of Emotional Trading: Human emotions can lead to impulsive decisions, which can be devastating in a high-stakes competition.

- Limited Time for Analysis: The sheer volume of information requires rapid analysis, something that manual traders struggle with consistently.

- Potential for Human Error: Even experienced traders are prone to errors. AIMSCAP eliminates the possibility of human error in trade execution.

Comparison with other Automated Systems

While other automated trading systems exist, AIMSCAP differentiates itself through:

- Superior Algorithms: AIMSCAP's proprietary algorithms are designed for superior performance compared to many competitors.

- Better Risk Management: AIMSCAP's risk management capabilities are more robust, protecting your capital more effectively.

- More Robust Backtesting: AIMSCAP's backtesting functionality is comprehensive and thorough, allowing for more accurate performance predictions.

Addressing Potential Weaknesses

No system is perfect. AIMSCAP's potential limitations include dependency on reliable data feeds and potential vulnerabilities to unforeseen market events. However, these can be mitigated through:

- Diversification: Spreading your investments across multiple assets reduces the impact of any single market event.

- Regular Monitoring: Continuous system monitoring ensures prompt responses to any unforeseen circumstances.

- Adaptive Strategies: Utilizing AIMSCAP's adaptive capabilities allows for dynamic adjustments to the changing market environment.

Optimizing AIMSCAP for WTT Success: Practical Tips and Strategies

To fully leverage AIMSCAP's capabilities in the WTT, optimization is crucial.

Parameter Tuning and Optimization

Fine-tuning AIMSCAP's parameters is vital for achieving optimal performance. This involves:

- Importance of Backtesting: Extensive backtesting is crucial to identify optimal parameter settings before deploying your strategy in the WTT.

- Adjusting Risk Parameters: Carefully adjust risk parameters such as stop-loss levels and position sizes based on your risk tolerance and market conditions.

- Adapting Strategies based on Market Conditions: Continuously adapt your trading strategies based on prevailing market trends and volatility.

Risk Management Techniques

Effective risk management is non-negotiable in the WTT. Implement these measures:

- Stop-loss Orders: Always use stop-loss orders to limit potential losses on individual trades.

- Position Sizing: Carefully determine the size of your positions to manage overall risk.

- Diversification: Spread your investments across different assets to mitigate risk.

- Capital Preservation: Prioritize capital preservation above all else.

Continuous Monitoring and Improvement

Ongoing monitoring and adjustments are key to long-term success:

- Regular Performance Reviews: Regularly review your performance to identify strengths and weaknesses.

- Adapting to Changing Market Dynamics: Continuously adapt your strategy to reflect changing market conditions.

- Learning from Past Trades: Analyze past trades to identify patterns and improve your future performance.

Conclusion: Unlocking Your WTT Potential with AIMSCAP

AIMSCAP offers a significant competitive advantage in the World Trading Tournament. Its automated trading capabilities, advanced algorithms, data analytics, and robust risk management tools can significantly enhance your trading performance. By understanding its core features, optimizing its parameters, and implementing effective risk management techniques, you can unlock your full potential within the WTT. Ready to dominate the World Trading Tournament? Explore the power of AIMSCAP today! [Link to AIMSCAP Website]

Featured Posts

-

Coldplays Number One Show A Review Of Music Lighting And Positive Messaging

May 21, 2025

Coldplays Number One Show A Review Of Music Lighting And Positive Messaging

May 21, 2025 -

Reyting Finansovikh Kompaniy Ukrayini 2024 Credit Kasa Finako Ukrfinzhitlo Atlana Ta Credit Plus Lidiruyut

May 21, 2025

Reyting Finansovikh Kompaniy Ukrayini 2024 Credit Kasa Finako Ukrfinzhitlo Atlana Ta Credit Plus Lidiruyut

May 21, 2025 -

Alissons Performance Slot And Enrique Offer Insights After Liverpool Match

May 21, 2025

Alissons Performance Slot And Enrique Offer Insights After Liverpool Match

May 21, 2025 -

Uncovering The Truth A 21 Year Old Peppa Pig Mystery Solved

May 21, 2025

Uncovering The Truth A 21 Year Old Peppa Pig Mystery Solved

May 21, 2025 -

Self Image And Skin Bleaching Insights From Vybz Kartels Experience

May 21, 2025

Self Image And Skin Bleaching Insights From Vybz Kartels Experience

May 21, 2025

Latest Posts

-

Los Angeles Wildfires A Troubling New Market For Gamblers

May 21, 2025

Los Angeles Wildfires A Troubling New Market For Gamblers

May 21, 2025 -

30 Year Treasury Yield At 5 Implications For The Sell America Narrative

May 21, 2025

30 Year Treasury Yield At 5 Implications For The Sell America Narrative

May 21, 2025 -

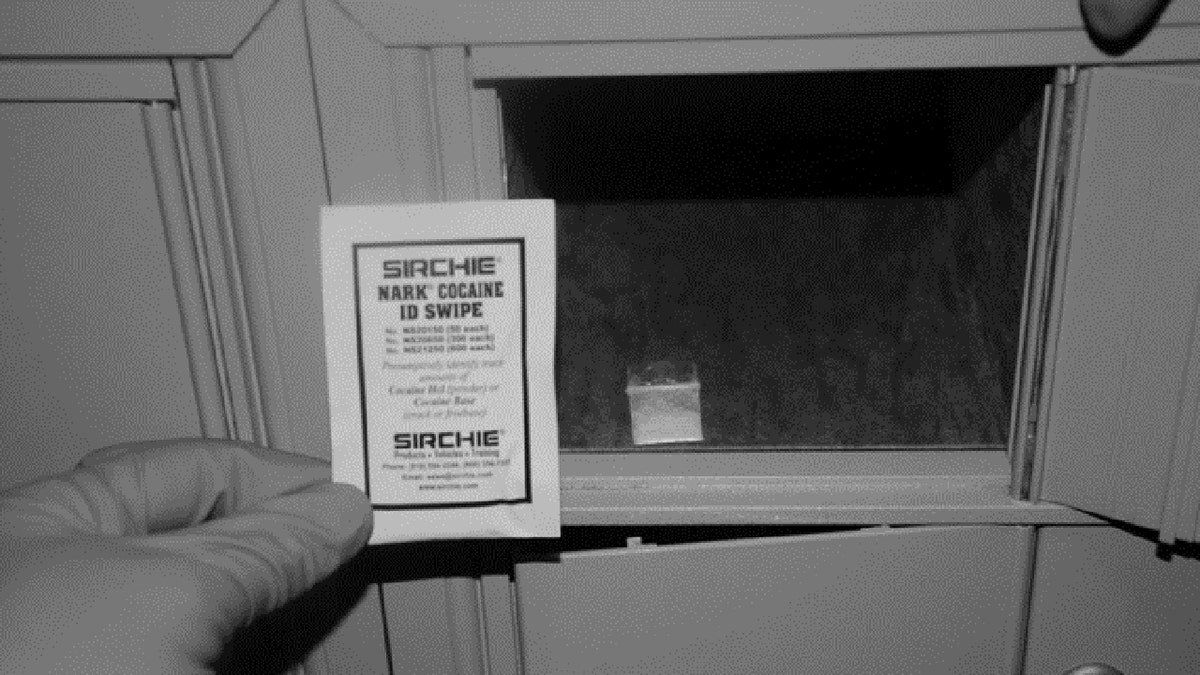

Cocaine At White House Secret Service Ends Investigation

May 21, 2025

Cocaine At White House Secret Service Ends Investigation

May 21, 2025 -

Zuckerbergs New Chapter Navigating The Trump Presidency

May 21, 2025

Zuckerbergs New Chapter Navigating The Trump Presidency

May 21, 2025 -

Trump Supporter Ray Epps Defamation Lawsuit Against Fox News Key Details

May 21, 2025

Trump Supporter Ray Epps Defamation Lawsuit Against Fox News Key Details

May 21, 2025