Addressing High Stock Market Valuations: BofA's View For Investors

Table of Contents

BofA's Assessment of Current Stock Market Valuations

BofA, a leading financial institution, closely monitors various economic indicators and market trends to assess the overall health of the stock market. Their analysis provides valuable insights into current valuations and their implications for investors.

Valuation Metrics and Their Implications

BofA’s assessment of current stock market valuations relies heavily on key metrics. These include:

-

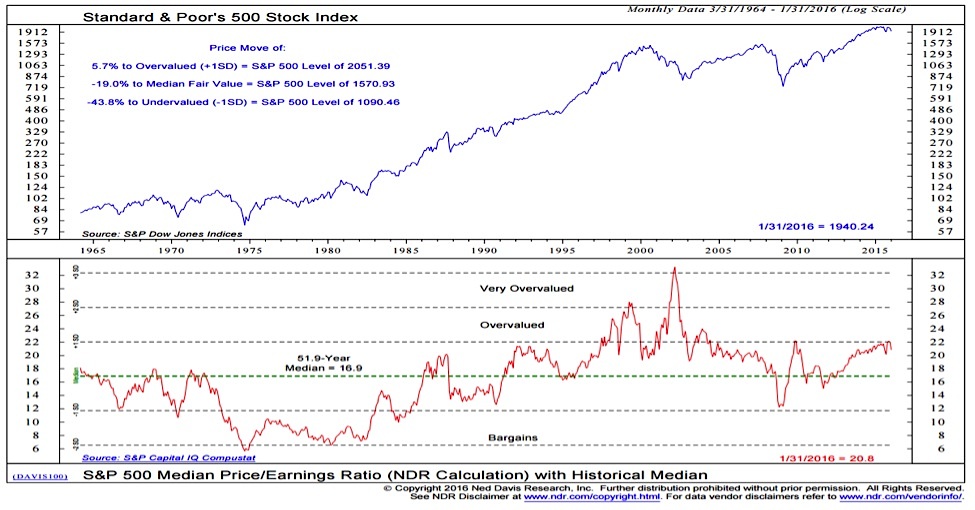

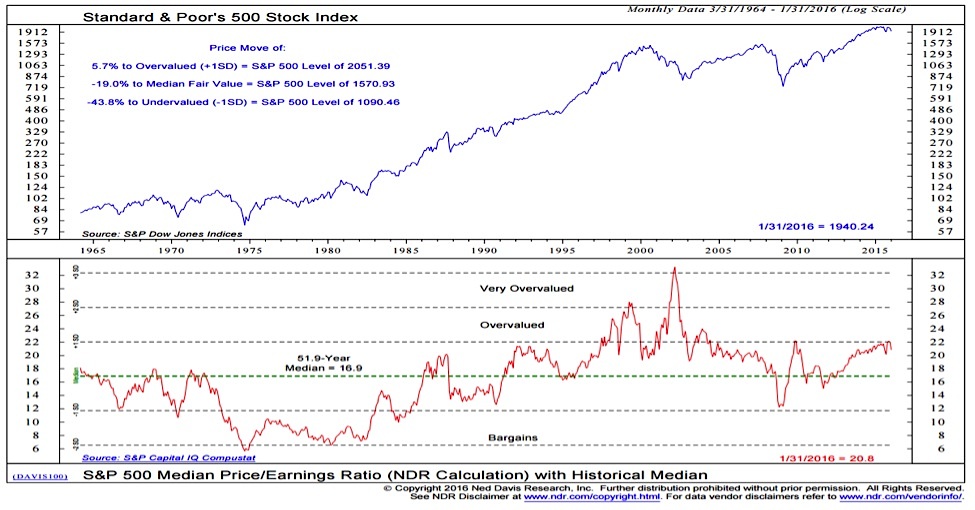

Price-to-Earnings ratio (P/E): This compares a company's stock price to its earnings per share. A high P/E ratio generally suggests that the market is anticipating strong future earnings growth, but it can also signal overvaluation. BofA's recent analyses likely show elevated P/E ratios across various sectors.

-

Shiller P/E (CAPE): This cyclically adjusted price-to-earnings ratio smooths out earnings fluctuations over a longer period (typically 10 years), providing a more stable valuation measure. BofA’s assessment of the CAPE ratio likely reveals it's significantly higher than historical averages.

-

Other Valuation Metrics: BofA likely considers other metrics like Price-to-Sales (P/S), Price-to-Book (P/B), and dividend yield to gain a comprehensive understanding of market valuations. High valuations across multiple metrics suggest a higher risk of a market correction.

BofA's interpretation of these metrics, compared to historical averages and industry benchmarks, forms the basis of their overall assessment of market valuations.

Factors Contributing to High Valuations

Several factors contribute to the currently high stock market valuations, according to BofA's analysis:

-

Low Interest Rates: Historically low interest rates have made borrowing cheaper, boosting corporate investments and encouraging investors to seek higher returns in the stock market.

-

Quantitative Easing: Central banks' quantitative easing programs have injected massive liquidity into the financial system, further driving up asset prices, including stocks.

-

Strong Corporate Earnings (and future projections): Strong corporate earnings, particularly in the technology sector, have supported higher stock prices. Further, projected future earnings growth plays a crucial role in justifying current valuations.

-

Positive Investor Sentiment: Optimistic investor sentiment fuels demand for stocks, pushing prices higher. This can create a feedback loop where rising prices further enhance positive sentiment.

-

Technological Advancements: Innovation and technological breakthroughs continue to drive significant growth in certain sectors, attracting investors and contributing to higher valuations.

-

Geopolitical Factors: Geopolitical stability (or the relative perception thereof) and government policies can significantly influence investor confidence and market valuations.

BofA's Identified Risks Associated with High Valuations

While high valuations can indicate strong economic fundamentals, they also carry significant risks. BofA likely highlights the following:

Market Corrections and Potential Downturns

BofA's analysis probably acknowledges the historical precedent of market corrections following extended periods of high valuations. Their outlook might include:

-

Potential Triggers: Triggers for a downturn could include rising interest rates, unexpected economic slowdown, geopolitical instability, or a significant shift in investor sentiment.

-

Projected Scenarios: BofA's projections might outline various scenarios, ranging from a mild correction to a more substantial downturn, based on their assessment of risk factors.

-

Historical Precedents: Analyzing historical data showing market corrections following periods of high valuations provides context and perspective on the potential magnitude and duration of any future correction.

Inflationary Pressures and Interest Rate Hikes

BofA’s analysis likely emphasizes the potential impact of rising inflation and subsequent interest rate hikes:

-

Impact on Company Profitability: Higher interest rates increase borrowing costs for companies, potentially reducing profitability and impacting stock valuations.

-

Impact on Investor Behavior: Rising interest rates may make bonds a more attractive investment, potentially diverting funds from the stock market.

-

BofA's Predictions: Their forecasts on inflation and interest rate hikes will directly influence their projections for stock market performance.

BofA's Strategic Recommendations for Investors

Navigating high stock market valuations requires a well-defined investment strategy. BofA’s recommendations likely focus on risk mitigation and strategic positioning:

Portfolio Diversification Strategies

BofA likely advocates for diversification to reduce the overall risk of your portfolio:

-

Asset Allocation: A balanced approach that spreads investments across various asset classes (stocks, bonds, real estate, etc.) is crucial to mitigate risk.

-

Sector Diversification: Avoid over-concentration in any single sector. Spreading investments across diverse sectors helps reduce the impact of sector-specific downturns.

-

Geographical Diversification: Investing in companies from different countries reduces exposure to regional economic risks.

Specific asset classes recommended by BofA will depend on their current market outlook.

Defensive Investment Approaches

In periods of high valuations, BofA may suggest adopting more defensive investment strategies:

-

Value Investing: Focusing on undervalued companies with strong fundamentals can offer better risk-adjusted returns in a potentially volatile market.

-

Dividend Investing: Investing in companies that consistently pay dividends can provide a steady stream of income and cushion against market fluctuations.

-

Hedging Strategies: Using options or other hedging techniques can help protect against potential losses during market corrections.

Active vs. Passive Management in High-Valuation Markets

BofA's view on active versus passive management will likely depend on their assessment of the current market environment. They may suggest:

-

Arguments for Active Management: Active managers can potentially outperform the market by identifying undervalued assets and exploiting market inefficiencies.

-

Arguments for Passive Management: Passive strategies (like index funds) offer diversification and lower fees, which can be advantageous in a volatile market.

BofA's recommended approach will likely depend on individual investor risk tolerance and investment goals.

Conclusion

Addressing high stock market valuations requires a careful assessment of risks and a well-defined investment strategy. BofA's analysis highlights the importance of understanding key valuation metrics, considering the factors driving high valuations, and acknowledging potential risks like market corrections and the impact of inflationary pressures. Their recommendations emphasize diversification, defensive investment approaches, and a thoughtful consideration of active versus passive management strategies. By carefully considering BofA's insights on understanding high stock market valuations and developing a personalized investment plan that aligns with your risk tolerance and financial goals, you can navigate this complex market environment effectively. Consult with a financial advisor to create a robust strategy for managing high stock market valuations and achieving your long-term investment objectives.

Featured Posts

-

Budget Friendly Buys Quality Without Compromise

May 06, 2025

Budget Friendly Buys Quality Without Compromise

May 06, 2025 -

30th Birthday Bash Gigi Hadid Makes Relationship With Bradley Cooper Instagram Official

May 06, 2025

30th Birthday Bash Gigi Hadid Makes Relationship With Bradley Cooper Instagram Official

May 06, 2025 -

Analyzing Consumer Behavior Social Media Trends And Economic Downturns

May 06, 2025

Analyzing Consumer Behavior Social Media Trends And Economic Downturns

May 06, 2025 -

Gambling On Natural Disasters The Troubling Trend Of Wildfire Betting

May 06, 2025

Gambling On Natural Disasters The Troubling Trend Of Wildfire Betting

May 06, 2025 -

Australian Asset Market Expected Changes After The Election

May 06, 2025

Australian Asset Market Expected Changes After The Election

May 06, 2025

Latest Posts

-

Celtics Vs Heat Tip Off Time Tv Channel And Live Stream February 10th

May 06, 2025

Celtics Vs Heat Tip Off Time Tv Channel And Live Stream February 10th

May 06, 2025 -

Live Stream Celtics Vs Pistons Free Online And Tv Broadcast Details

May 06, 2025

Live Stream Celtics Vs Pistons Free Online And Tv Broadcast Details

May 06, 2025 -

How To Watch Knicks Vs Celtics 2025 Nba Playoffs A Comprehensive Guide

May 06, 2025

How To Watch Knicks Vs Celtics 2025 Nba Playoffs A Comprehensive Guide

May 06, 2025 -

Celtics Vs Trail Blazers Game Time Tv Schedule And Streaming Options March 23rd

May 06, 2025

Celtics Vs Trail Blazers Game Time Tv Schedule And Streaming Options March 23rd

May 06, 2025 -

How To Watch Celtics Vs Pistons Live Stream And Tv Guide

May 06, 2025

How To Watch Celtics Vs Pistons Live Stream And Tv Guide

May 06, 2025