Adani Ports Up, Eternal Down: Detailed Stock Market Analysis

Table of Contents

Adani Ports' Recent Performance and Growth Drivers

Analyzing Adani Ports' Financial Performance

Adani Ports has showcased impressive financial performance in recent quarters. Analyzing its financials reveals a compelling growth story.

- Revenue Growth: Consistent double-digit revenue growth year-over-year, driven by increased cargo volume and improved operational efficiency. (Include a chart showing revenue growth over the past 3-5 years).

- Profitability: Strong profit margins, indicating effective cost management and pricing strategies. (Include a chart showing profit margin trends).

- Debt Levels: While debt levels exist, they are manageable and haven't hampered the company's growth trajectory. (Include data on debt-to-equity ratio).

- Return on Equity (ROE): A high ROE demonstrates efficient utilization of shareholder equity. (Include data on ROE).

Adani Ports' success is fueled by strategic investments in infrastructure development and expansion. Key initiatives include the modernization of existing port facilities, development of new terminals, and strategic acquisitions that have enhanced its operational capacity and geographical reach. These strategic moves are reflected positively in its "Adani Ports financials".

Identifying Key Catalysts for Future Growth

Several key catalysts are poised to drive Adani Ports' future growth.

- Infrastructure Development: Ongoing investments in port infrastructure will enhance handling capacity and attract more cargo, leading to increased revenue streams.

- Government Policies: Supportive government policies focused on infrastructure development and promoting trade are boosting the company's prospects.

- Increasing Trade Volume: The growth in India's international trade is a major tailwind for Adani Ports, ensuring a consistent flow of cargo.

- Competitive Advantages: Adani Ports benefits from a strong market position, strategic locations, and efficient operations, giving it a competitive edge.

The company's proactive approach to infrastructure development, coupled with favorable government regulations, positions Adani Ports favorably within the competitive landscape for years to come.

Eternal's Current Downturn and Underlying Challenges

Deconstructing Eternal's Financial Weakness

Eternal's recent performance paints a different picture, characterized by a significant downturn. Its "Eternal financials" reveal several areas of concern:

- Revenue Decline: A consistent decline in revenue year-over-year, indicating challenges in maintaining market share and generating sales. (Include a chart showing revenue decline).

- Loss-Making Ventures: Several of Eternal's ventures are operating at a loss, putting pressure on its overall profitability.

- Operational Inefficiencies: Operational inefficiencies and high costs are further eroding profitability.

- Increased Competition: Intense competition in the market is squeezing profit margins and hindering growth.

These factors collectively contribute to Eternal's current financial weakness.

Assessing the Potential for Recovery or Restructuring

The path to recovery for Eternal is complex and requires a multifaceted approach.

- Turnaround Strategy: Implementing a robust turnaround strategy focusing on cost optimization, operational improvements, and potentially divesting non-performing assets is crucial.

- Restructuring: A potential restructuring might be necessary to alleviate debt burden and streamline operations.

- Risk Assessment: Thorough risk assessment is needed to identify and mitigate potential threats to the company's survival.

- Management Decisions: Effective management decisions are critical for navigating the current challenges and steering the company towards a more sustainable future.

The potential for a successful turnaround remains uncertain, and investors must carefully assess the risks before considering any investment.

Comparative Analysis: Adani Ports vs. Eternal

Direct Comparison of Key Financial Metrics

The following table highlights the key differences in the financial performance of Adani Ports and Eternal:

| Metric | Adani Ports | Eternal |

|---|---|---|

| Revenue Growth | +15% (YoY) | -10% (YoY) |

| Profit Margin | 25% | 5% |

| Debt-to-Equity Ratio | 0.5 | 1.8 |

| ROE | 20% | -5% |

(Note: These figures are illustrative and should be replaced with actual data)

This "comparative analysis" clearly demonstrates the contrasting financial health of the two companies.

Evaluating Investment Potential and Risk Assessment

Adani Ports presents a potentially strong investment opportunity due to its robust financial performance, strong growth drivers, and favorable market positioning. However, investors should be aware of potential risks associated with market fluctuations and geopolitical factors.

Eternal, on the other hand, carries significantly higher investment risk. While a turnaround is possible, it's not guaranteed, and investors should carefully consider the challenges and potential losses before committing capital. A thorough "risk assessment" is vital before any investment decision. The "return on investment" potential for Adani Ports is vastly different from Eternal's, showcasing the importance of a detailed "long-term outlook" for each stock.

Conclusion: Navigating the Adani Ports and Eternal Market Landscape

This analysis reveals a stark contrast between Adani Ports and Eternal. Adani Ports demonstrates impressive financial strength and growth prospects, while Eternal faces significant challenges. The key takeaway is the importance of conducting thorough due diligence and understanding the underlying factors driving stock performance before making investment decisions. Understanding the "Adani Ports Up, Eternal Down" dynamic highlights the need for a nuanced approach to stock market investment.

Before investing in either Adani Ports or Eternal, conduct your own in-depth research. Consider consulting with a financial advisor to discuss your investment goals and risk tolerance. Remember, understanding the "Adani Ports Up, Eternal Down" and similar market trends is essential for successful investing. Further resources on stock market analysis can be found [link to relevant resources].

Featured Posts

-

Dijon Et Gustave Eiffel Une Histoire Familiale Revelee

May 10, 2025

Dijon Et Gustave Eiffel Une Histoire Familiale Revelee

May 10, 2025 -

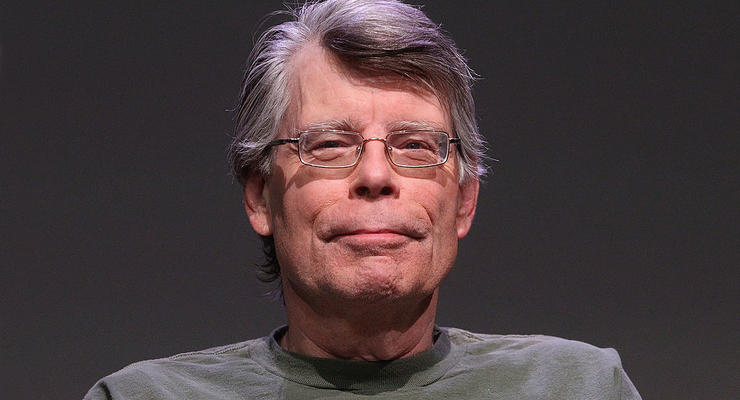

King Obrushilsya Na Trampa I Maska Podrobnosti

May 10, 2025

King Obrushilsya Na Trampa I Maska Podrobnosti

May 10, 2025 -

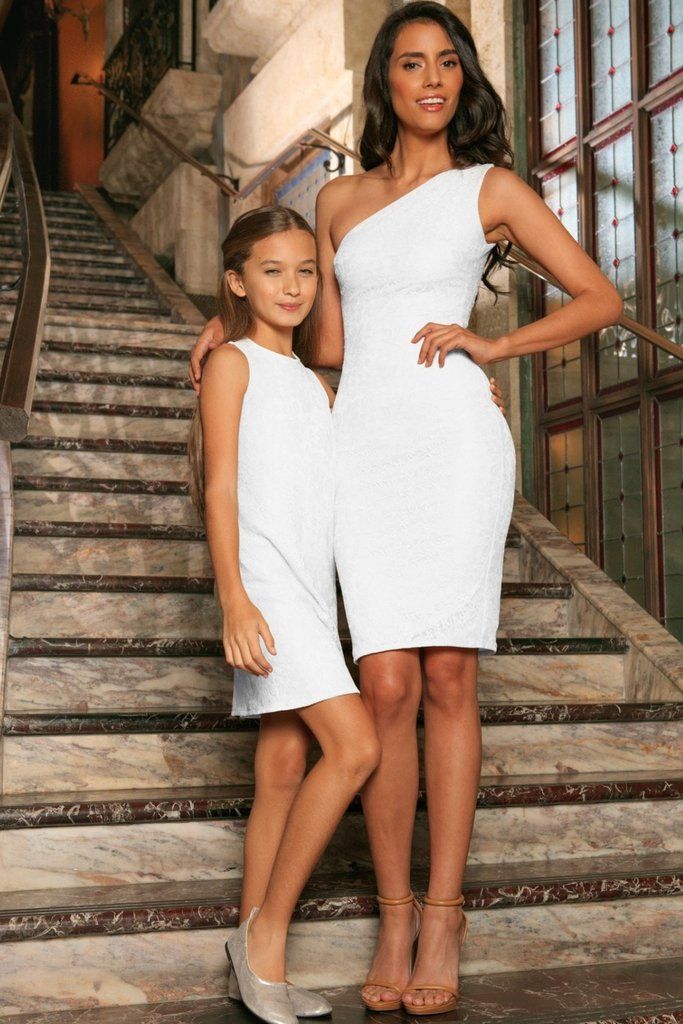

Dakota Johnsons Spring Dress A Mother Daughter Fashion Moment

May 10, 2025

Dakota Johnsons Spring Dress A Mother Daughter Fashion Moment

May 10, 2025 -

Kimbal Musk A Look At Elons Brothers Life Career And Activism

May 10, 2025

Kimbal Musk A Look At Elons Brothers Life Career And Activism

May 10, 2025 -

Hurun Global Rich List 2025 Elon Musks Net Worth Takes A Hit But He Remains On Top

May 10, 2025

Hurun Global Rich List 2025 Elon Musks Net Worth Takes A Hit But He Remains On Top

May 10, 2025