Activision Blizzard Acquisition: FTC's Appeal And The Future Of Gaming Mergers

Table of Contents

The FTC's Case Against the Activision Blizzard Acquisition

The Federal Trade Commission (FTC) launched an antitrust lawsuit to block the Activision Blizzard acquisition, arguing that the deal would substantially lessen competition in the video game market.

Antitrust Concerns

The FTC's primary argument centers on the potential for Microsoft to leverage its control over key gaming franchises like Call of Duty, World of Warcraft, and Candy Crush to stifle competition across various gaming platforms—consoles, PCs, and cloud gaming services. Their concerns include:

- Reduced competition in the console market: Microsoft's acquisition could give them an unfair advantage over competitors like Sony's PlayStation, potentially leading to reduced innovation and higher prices. The dominance of Call of Duty, for example, is a major point of contention.

- Potential for higher game prices: With less competition, Microsoft could potentially increase the prices of Activision Blizzard games, harming consumers. This is a significant concern for gamers, especially those on a budget.

- Limited consumer choice and innovation: A lack of competition can lead to a reduced selection of games and slower innovation within the industry. The fear is that Microsoft might prioritize its own platforms, potentially neglecting other platforms or even discontinuing certain titles.

- Stifled development of competing games: Microsoft's control over popular franchises could dissuade smaller developers from creating competing titles, thus reducing diversity in the gaming market. This could lead to a less dynamic and innovative gaming landscape.

Microsoft's Response and Proposed Solutions

Microsoft countered the FTC's claims by offering various concessions aimed at mitigating competition concerns. These include:

- Long-term licensing agreements for Call of Duty: Microsoft pledged to license Call of Duty to competitors like Nintendo and PlayStation for a period of ten years, ensuring continued availability on these platforms. This was a key component of their defense strategy.

- Commitment to maintain Call of Duty on PlayStation: This commitment aims to address concerns about Microsoft making Call of Duty exclusive to Xbox, thereby harming PlayStation users.

- Investment in cloud gaming infrastructure: Microsoft committed significant investments to its cloud gaming infrastructure, aiming to promote greater competition in this burgeoning market.

The Appeal Process and its Potential Outcomes

The FTC's appeal against a judge's ruling in favor of the acquisition is currently underway. The outcome will profoundly impact the future of gaming mergers.

Legal Arguments and Precedents

The legal arguments will center on several key points:

- Analysis of relevant markets: The court will need to define the relevant markets (console gaming, PC gaming, cloud gaming) to assess Microsoft's market power accurately. This is a crucial aspect of the case.

- Evaluation of Microsoft's market power: The court will analyze the extent of Microsoft's market power and whether the acquisition would significantly increase this power, leading to anti-competitive behavior.

- Consideration of past merger rulings and their implications: Past merger cases, especially those involving large tech companies, will be examined to establish legal precedents and guide the court's decision. This legal precedent setting is significant.

Potential Impact on the Gaming Industry

The appeal's outcome will have significant ramifications:

- Increased regulatory scrutiny of large gaming mergers: A ruling against Microsoft could set a precedent for increased scrutiny of future mergers and acquisitions within the gaming industry.

- Potential for stricter antitrust enforcement: The case may lead to stricter antitrust enforcement, making it more difficult for large companies to merge or acquire other businesses. This could reshape the M&A landscape significantly.

- Influence on pricing and availability of gaming titles: The decision could affect the pricing and availability of popular games, potentially impacting consumers directly.

- Impact on game development and innovation: The outcome could significantly affect the pace of game development and the innovation we see within the industry.

The Broader Implications for Mergers and Acquisitions

The Activision Blizzard case has implications far beyond the gaming industry.

Setting a Precedent

This case could set a significant precedent for future mergers and acquisitions:

- Impact on tech industry mergers: The ruling will impact future mergers and acquisitions within the broader technology sector, influencing how regulators approach such deals.

- Implications for other media and entertainment mergers: The case will have implications for mergers and acquisitions in other media and entertainment industries as well.

- Increased focus on consumer welfare in merger reviews: The case emphasizes the importance of considering consumer welfare in merger reviews, highlighting the potential negative impacts of monopolies.

Future of Cloud Gaming

The acquisition's outcome will significantly impact the rapidly developing cloud gaming market:

- Impact on cloud gaming competition and innovation: The ruling will influence the competitive dynamics and innovation within the cloud gaming sector.

- Influence on cloud gaming subscription services: The decision could affect the structure and pricing of cloud gaming subscription services.

- Regulatory hurdles for cloud gaming platforms: The case could create increased regulatory hurdles for cloud gaming platforms moving forward.

Conclusion

The FTC's appeal against the Activision Blizzard acquisition represents a pivotal moment for the gaming industry and broader mergers and acquisitions landscape. The outcome will have far-reaching implications for competition, innovation, and regulatory oversight. Understanding the intricacies of this case is crucial for stakeholders across the industry. Stay informed about the developments in the Activision Blizzard Acquisition case and its effect on the future of gaming mergers. This landmark case will undoubtedly shape the future of the gaming industry and how regulators view large-scale acquisitions in the tech sector.

Featured Posts

-

Auto Dealers Intensify Fight Against Mandatory Ev Sales

May 06, 2025

Auto Dealers Intensify Fight Against Mandatory Ev Sales

May 06, 2025 -

Seeing Patrick Schwarzenegger In His Classic Bronco In Los Angeles

May 06, 2025

Seeing Patrick Schwarzenegger In His Classic Bronco In Los Angeles

May 06, 2025 -

Latest On Romanias Election Runoff Results And Analysis

May 06, 2025

Latest On Romanias Election Runoff Results And Analysis

May 06, 2025 -

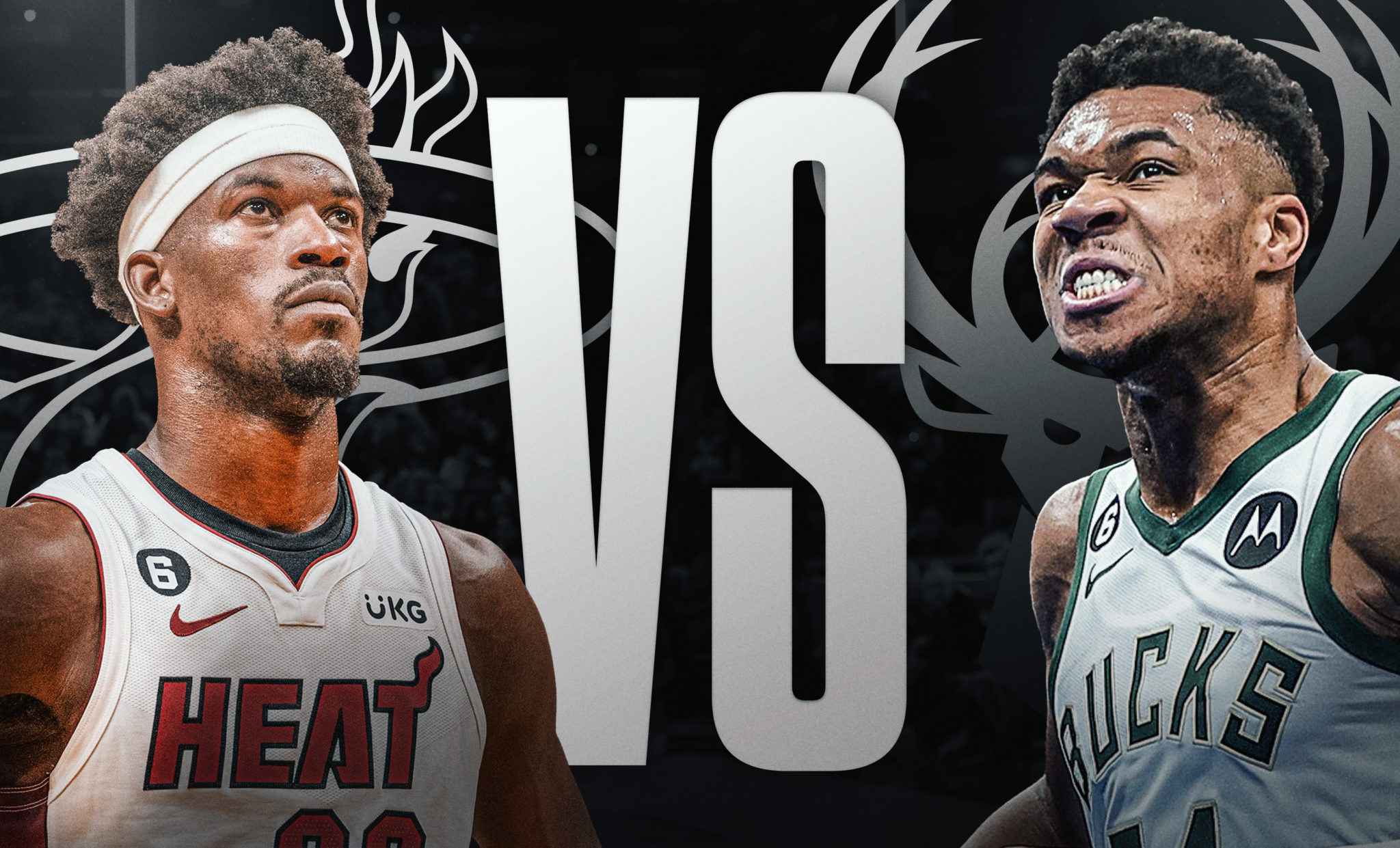

Celtics Vs 76ers Expert Nba Predictions Betting Odds And Analysis Feb 20 2025

May 06, 2025

Celtics Vs 76ers Expert Nba Predictions Betting Odds And Analysis Feb 20 2025

May 06, 2025 -

Analysts Forecast Australian Asset Growth Following Election

May 06, 2025

Analysts Forecast Australian Asset Growth Following Election

May 06, 2025

Latest Posts

-

Nba Playoffs Game 1 Knicks Vs Celtics Predictions And Best Bets

May 06, 2025

Nba Playoffs Game 1 Knicks Vs Celtics Predictions And Best Bets

May 06, 2025 -

Celtics Playoff Schedule Dates And Times For Magic Series Announced

May 06, 2025

Celtics Playoff Schedule Dates And Times For Magic Series Announced

May 06, 2025 -

Celtics Vs Heat Game Time Tv Channel And Live Stream Info February 10

May 06, 2025

Celtics Vs Heat Game Time Tv Channel And Live Stream Info February 10

May 06, 2025 -

Celtics Vs Knicks Game 1 Playoff Predictions And Betting Analysis

May 06, 2025

Celtics Vs Knicks Game 1 Playoff Predictions And Betting Analysis

May 06, 2025 -

Knicks Vs Celtics Game 1 Expert Predictions And Betting Picks For Nba Playoffs

May 06, 2025

Knicks Vs Celtics Game 1 Expert Predictions And Betting Picks For Nba Playoffs

May 06, 2025