Access To Capital: Funding For Sustainable Practices In SMEs

Table of Contents

Understanding the Need for Sustainable Finance in SMEs

Investor interest in ESG (Environmental, Social, and Governance) factors is booming. Consumers are increasingly demanding sustainable products and services, pushing businesses to adopt eco-friendly practices. This shift creates a significant competitive advantage for SMEs that embrace sustainability. Beyond the ethical considerations, sustainable operations often lead to long-term cost savings. Energy efficiency measures, waste reduction strategies, and responsible sourcing can dramatically reduce operational expenses.

- Increased consumer demand for sustainable products and services: Consumers are actively seeking out businesses with strong ethical and environmental commitments.

- Improved brand reputation and customer loyalty: A commitment to sustainability enhances brand image, attracting customers who value responsible practices and fostering long-term loyalty.

- Reduced operational costs through resource efficiency: Implementing sustainable practices often leads to lower energy bills, reduced waste disposal fees, and decreased raw material costs.

- Access to new markets and opportunities: Sustainable businesses can tap into niche markets seeking eco-friendly products and services, opening doors to new growth opportunities.

Identifying Funding Sources for Sustainable Projects

Several funding sources cater specifically to SMEs focused on sustainable practices. Let's explore some key options:

Grants and Subsidies

Governments worldwide recognize the importance of sustainable business practices and offer various grants and subsidies to support SMEs. These programs often target specific green technologies or sustainable development initiatives. For example, in the UK, the Green Business Fund provides grants for energy efficiency improvements, while similar programs exist in the US (e.g., the Small Business Administration's loan programs) and the EU (various regional funding initiatives).

- Research national and regional grant databases: Utilize online resources to identify relevant grant opportunities tailored to your industry and location.

- Network with relevant government agencies and organizations: Building relationships with government agencies can provide valuable insights into funding opportunities and application processes.

- Prepare a strong grant proposal highlighting the project's sustainability impact: Clearly articulate the environmental and social benefits of your project and demonstrate its feasibility.

Green Loans and Bonds

Many banks and financial institutions offer green loans and bonds designed specifically for sustainable projects. Green loans often come with preferential interest rates, encouraging the adoption of sustainable practices. Green bonds, suitable for larger investments, allow SMEs to raise capital by issuing debt securities specifically earmarked for environmentally friendly projects.

- Compare interest rates and loan terms offered by different lenders: Shop around to find the most competitive financing options for your sustainable initiatives.

- Understand the criteria for qualifying for a green loan or bond: Familiarize yourself with the eligibility requirements and ensure your project meets the lender's sustainability criteria.

- Prepare a comprehensive business plan highlighting the environmental benefits: Demonstrate the positive environmental impact of your project and how it aligns with the lender's sustainability goals.

Impact Investing and Venture Capital

Impact investors and venture capitalists are increasingly interested in businesses with a strong social and environmental impact. These investors prioritize both financial returns and positive social and environmental outcomes. They look for SMEs with innovative sustainable solutions and a clear path to profitability.

- Research impact investment firms specializing in sustainable businesses: Identify firms aligned with your company's mission and investment stage.

- Develop a compelling investment pitch that showcases your company’s social and environmental impact: Highlight the positive impact of your business model and its potential for growth.

- Prepare detailed financial projections demonstrating strong returns: Convince investors of the financial viability of your sustainable business model.

Crowdfunding Platforms

Crowdfunding platforms provide an alternative funding source for SMEs with sustainable projects. These platforms allow you to raise capital from a large number of individuals who support your mission. While crowdfunding can be effective, it requires a strong marketing strategy and a compelling narrative.

- Develop a compelling crowdfunding campaign highlighting the social and environmental impact of the project: Engage potential investors with a clear and concise explanation of your project's benefits.

- Build a strong online presence to attract potential investors: Utilize social media and other online channels to reach a wider audience.

- Manage investor communications effectively throughout the funding process: Keep your backers informed of your progress and thank them for their support.

Strategies for Securing Funding

Securing funding for sustainable initiatives requires a well-defined strategy. A strong business plan is paramount, emphasizing both financial projections and the environmental benefits of your project. A clear and concise sustainability report demonstrates your commitment to ESG principles. Networking is vital – building relationships with potential investors and lenders increases your chances of success.

- Develop a comprehensive sustainability strategy: Clearly define your sustainability goals, targets, and implementation plan.

- Obtain relevant certifications (e.g., B Corp, LEED): Certifications enhance your credibility and demonstrate your commitment to sustainability.

- Track and report on key sustainability metrics: Regularly monitor your progress and communicate your achievements transparently.

- Seek mentorship from experienced entrepreneurs and investors: Learn from those who have successfully secured funding for sustainable initiatives.

Conclusion

Accessing capital for sustainable practices in SMEs can be challenging, but it's crucial for long-term success and environmental responsibility. By exploring diverse funding options like grants, green loans, impact investing, and crowdfunding, and by crafting a compelling business plan that highlights both financial returns and environmental benefits, SMEs can secure the necessary resources to implement their sustainable initiatives. Don't hesitate to explore all available avenues for accessing capital for your sustainable practices. Start your journey towards sustainable growth and secure the funding you need today! Remember, access to capital for sustainable practices in your SME is achievable with the right planning and approach.

Featured Posts

-

The Man Who Saved The Jersey Battle Of Flowers

May 19, 2025

The Man Who Saved The Jersey Battle Of Flowers

May 19, 2025 -

Melodifestivalen Zelmerloew Odpada Powrotu Na Eurowizje Nie Bedzie

May 19, 2025

Melodifestivalen Zelmerloew Odpada Powrotu Na Eurowizje Nie Bedzie

May 19, 2025 -

Sodiq Yusuff Fight Could Decide Mairon Santos Weight Class Future

May 19, 2025

Sodiq Yusuff Fight Could Decide Mairon Santos Weight Class Future

May 19, 2025 -

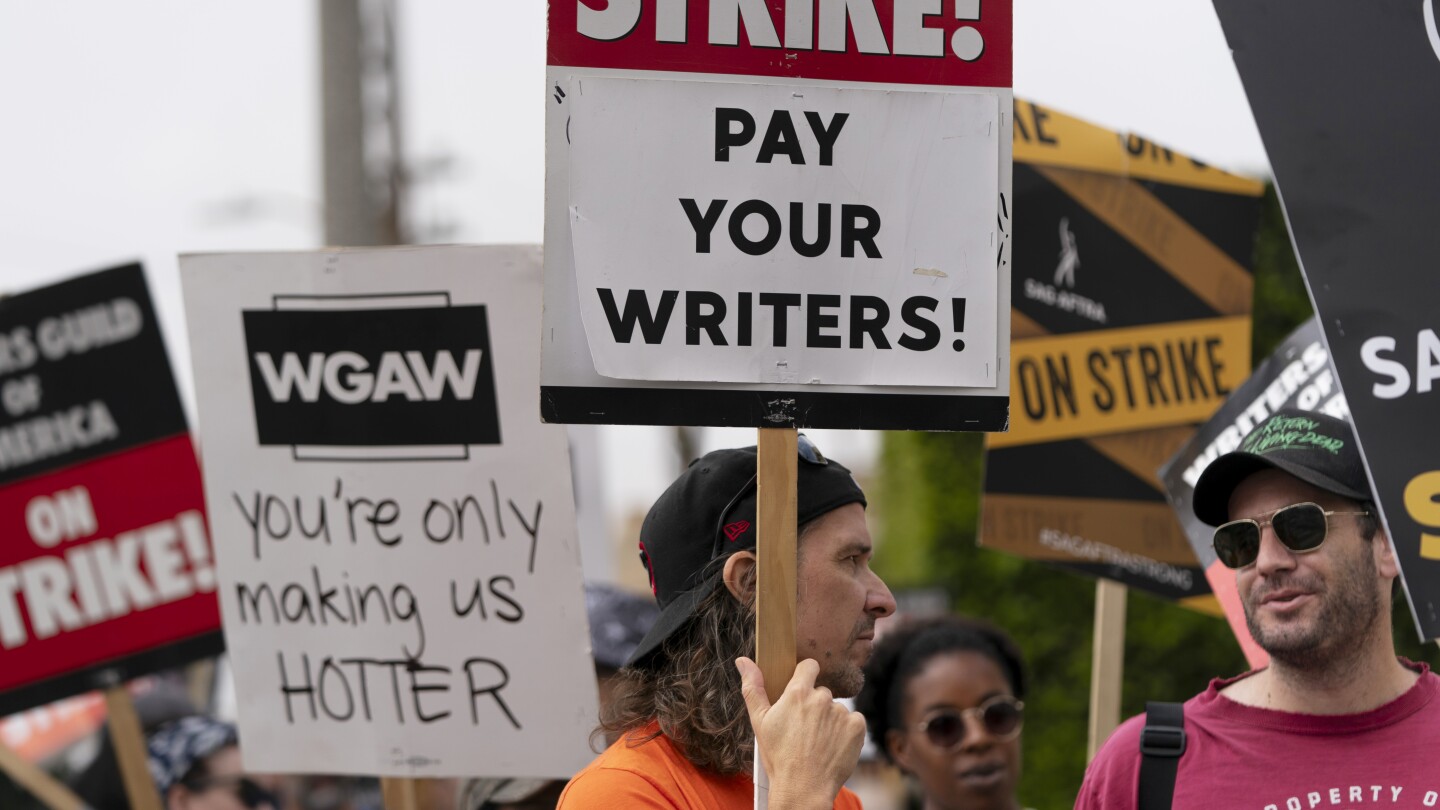

Hollywood Production Grinds To Halt Amidst Joint Actors And Writers Strike

May 19, 2025

Hollywood Production Grinds To Halt Amidst Joint Actors And Writers Strike

May 19, 2025 -

Final Destination Bloodlines Review A Franchise Resurrection

May 19, 2025

Final Destination Bloodlines Review A Franchise Resurrection

May 19, 2025