ABN Amro: Dutch Central Bank Eyes Potential Fine Over Bonuses

Table of Contents

The Dutch Central Bank's Investigation into ABN Amro's Bonus Practices

De Nederlandsche Bank (DNB) has launched a formal investigation into ABN Amro's bonus structure, focusing on potential violations of banking regulations concerning executive compensation. While the specifics remain confidential, the investigation suggests concerns regarding the alignment of bonuses with risk management practices and potential breaches of supervisory review processes. The DNB's role is critical in ensuring regulatory compliance within the Netherlands' financial system, and this investigation demonstrates their commitment to maintaining stability and accountability within the sector.

- Alleged Violations: The investigation centers around concerns that ABN Amro's bonus system may not adequately incentivize responsible risk management, potentially encouraging excessive risk-taking. Specific details regarding the alleged violations remain undisclosed pending the outcome of the investigation.

- DNB's Oversight Role: The DNB actively monitors and supervises Dutch banks to ensure adherence to national and international banking regulations, including those related to executive compensation. This investigation highlights the DNB’s proactive approach to maintaining financial stability and preventing risky banking practices.

- Previous Cases: While the specifics of this case remain under wraps, previous investigations by the DNB into other Dutch banks involving similar issues have resulted in significant financial penalties and reputational damage. These past cases serve as a stark reminder of the importance of strict compliance with banking regulations.

Potential Financial Penalties and Their Impact on ABN Amro

The potential financial penalties ABN Amro faces remain uncertain. However, considering previous cases of regulatory breaches within the Dutch banking sector and the potential severity of the alleged violations, the fine could reach tens of millions of euros. This significant financial burden could negatively impact ABN Amro's profitability, requiring it to potentially cut costs or reduce investments. The impact extends beyond mere financials; reputational damage could erode investor confidence, leading to share price volatility and difficulties attracting new business.

- Estimated Fine Amount: Based on past DNB fines for similar offenses, the potential penalty could range from several million to tens of millions of euros, depending on the severity of the violations found.

- Impact on Financial Statements: A substantial fine would directly impact ABN Amro's financial statements, reducing profits and potentially affecting its credit rating. This could limit future borrowing capabilities and investment opportunities.

- Investor Confidence and Share Price: News of the investigation and potential fine has already likely influenced investor sentiment, potentially causing share price fluctuations. A significant fine could further undermine investor confidence and lead to continued downward pressure on the share price.

Implications for the Broader Dutch Banking Sector and Executive Compensation

The ABN Amro investigation carries broader implications for the Dutch banking sector and the debate surrounding executive compensation. It underscores the need for robust corporate governance and stricter adherence to regulatory requirements regarding bonuses. The outcome of this case could influence future regulations and industry best practices concerning executive pay, potentially leading to stricter oversight and more stringent guidelines.

- Stricter Regulations: This case could prompt the DNB to implement more stringent regulations on executive bonuses in the Netherlands, potentially mirroring stricter rules seen in other European countries.

- Corporate Governance and Risk Management: The investigation highlights the importance of robust corporate governance and effective risk management practices within Dutch banks. This could lead to banks reviewing and strengthening their internal controls and bonus structures.

- European Comparison: This case will be closely watched by other European banking regulators, potentially leading to a reassessment of existing regulatory frameworks and the implementation of stricter standards for executive compensation across the continent.

ABN Amro's Response and Future Outlook

ABN Amro has responded to the DNB's investigation by stating its commitment to cooperating fully with the authorities and undertaking a thorough internal review of its bonus structure. The bank has pledged to take remedial actions to address any deficiencies identified in its bonus system and strengthen its risk management framework. The long-term impact on ABN Amro’s reputation and business operations depends heavily on the outcome of the DNB’s investigation and the subsequent measures taken by the bank.

- Official Statements: ABN Amro’s official statements have emphasized its commitment to regulatory compliance and its willingness to cooperate fully with the DNB's investigation.

- Remedial Actions: The bank is likely to implement changes to its bonus system, strengthen its risk management practices, and improve its internal controls to prevent future regulatory breaches.

- Future Outlook: The outcome of this investigation will significantly influence ABN Amro's future prospects. A significant fine and reputational damage could hinder its growth and profitability in the long term.

Conclusion:

The DNB's investigation into ABN Amro's bonus practices highlights the increasing scrutiny of executive compensation within the Dutch banking sector. The potential fine carries significant implications for ABN Amro's financial health, reputation, and the broader industry. The bank's response and the DNB's actions will shape future regulations and best practices regarding executive bonuses. Stay informed about the latest developments in the ABN Amro bonus investigation; follow our updates on the impact of potential fines on ABN Amro and learn more about the evolving regulations surrounding executive compensation in the Dutch banking sector.

Featured Posts

-

Programme Musical Hellfest Au Noumatrouff Mulhouse

May 22, 2025

Programme Musical Hellfest Au Noumatrouff Mulhouse

May 22, 2025 -

5 Podcasts Imperdibles Para Amantes Del Misterio Suspenso Y Terror

May 22, 2025

5 Podcasts Imperdibles Para Amantes Del Misterio Suspenso Y Terror

May 22, 2025 -

Become A Wyoming Guided Fishing Advisory Board Volunteer

May 22, 2025

Become A Wyoming Guided Fishing Advisory Board Volunteer

May 22, 2025 -

Another Baby For Peppa Pigs Family The Gender Reveal

May 22, 2025

Another Baby For Peppa Pigs Family The Gender Reveal

May 22, 2025 -

Succession Planning For The Ultra Wealthy A Rising Trend

May 22, 2025

Succession Planning For The Ultra Wealthy A Rising Trend

May 22, 2025

Latest Posts

-

Zebra Mussel Invasion Casper Resident Uncovers Thousands

May 22, 2025

Zebra Mussel Invasion Casper Resident Uncovers Thousands

May 22, 2025 -

Casper Boat Lift Overrun With Zebra Mussels A Locals Discovery

May 22, 2025

Casper Boat Lift Overrun With Zebra Mussels A Locals Discovery

May 22, 2025 -

Massive Zebra Mussel Infestation Discovered In Casper

May 22, 2025

Massive Zebra Mussel Infestation Discovered In Casper

May 22, 2025 -

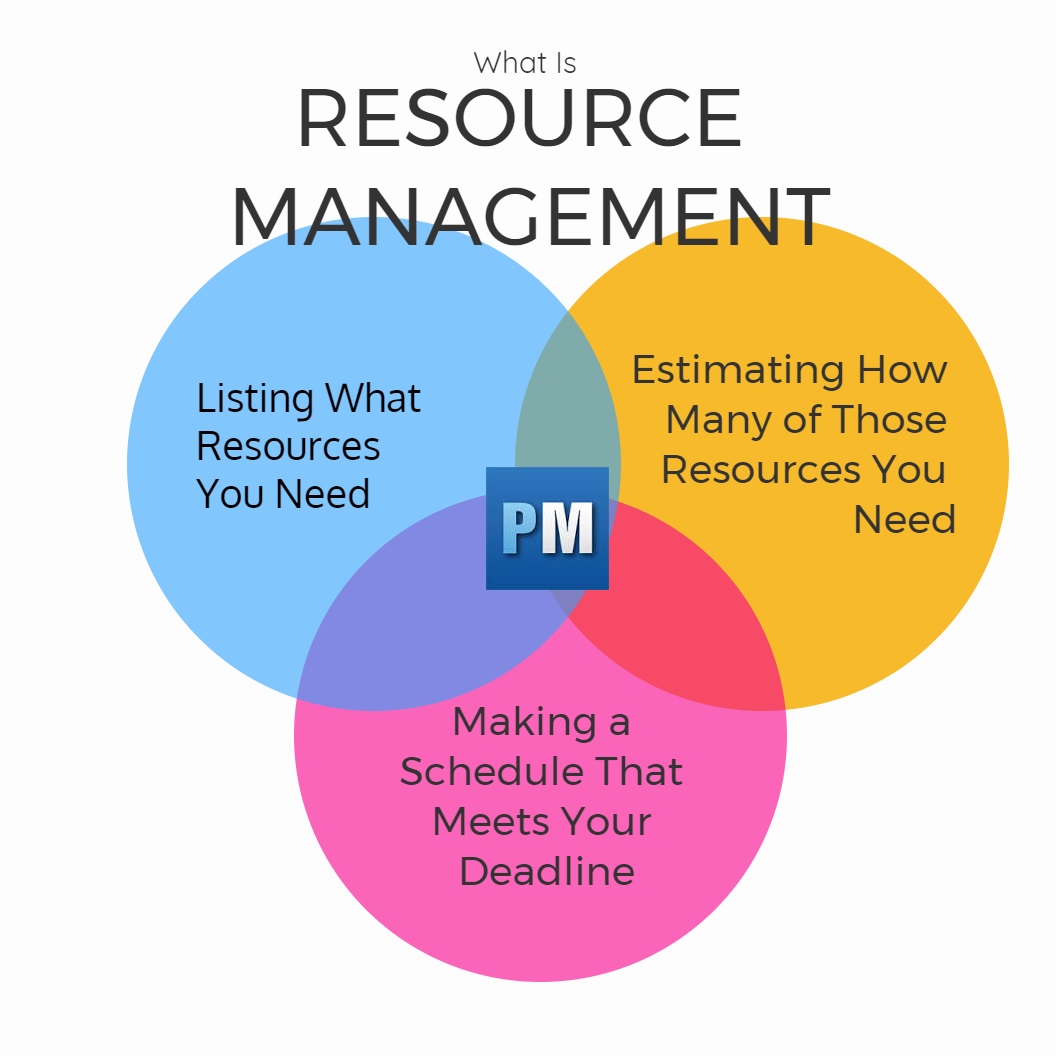

Wyoming Fishing Volunteer To Help Manage Our Resources

May 22, 2025

Wyoming Fishing Volunteer To Help Manage Our Resources

May 22, 2025 -

Become A Wyoming Guided Fishing Advisory Board Volunteer

May 22, 2025

Become A Wyoming Guided Fishing Advisory Board Volunteer

May 22, 2025