ABN Amro Bonus Scheme Under Scrutiny: Dutch Regulator's Potential Action

Table of Contents

The ABN Amro Bonus Scheme: A Detailed Overview

ABN Amro's bonus scheme, like many in the financial sector, is designed to incentivize strong performance and reward employees based on their contributions. However, aspects of the scheme have come under intense scrutiny. The structure utilizes a complex formula incorporating various performance metrics, aiming to align individual and organizational goals. Key elements of the scheme include:

- Bonus Eligibility Criteria: Eligibility is often tied to role, tenure, and performance level within specific departments.

- Bonus Calculation Methods: A multifaceted approach, frequently including a mix of individual, team, and company-wide performance targets.

- Performance Metrics Used: These vary but often include key performance indicators (KPIs) related to profitability, risk management, and customer satisfaction.

- Payout Frequency: Bonuses are typically paid annually, though some schemes may incorporate interim or performance-based payments.

However, critics point to a perceived disconnect between bonuses awarded and actual performance outcomes. Concerns have been raised about the lack of transparency in the calculation process and potential biases in bonus allocation, leading to accusations of excessive payouts despite subpar performance. Keywords: compensation, performance-based pay, variable compensation, executive bonuses, employee incentives.

Reasons for Regulatory Scrutiny

The AFM's investigation into ABN Amro's bonus scheme stems from several serious concerns. These include:

- Excessive Bonuses Despite Poor Performance: Allegations suggest that substantial bonuses were awarded despite the bank failing to meet certain targets or experiencing periods of poor financial results.

- Lack of Transparency: The complexity of the bonus calculation formula has raised concerns about a lack of transparency, making it difficult to understand how bonuses were determined and whether they were fairly allocated.

- Potential Conflicts of Interest: There are concerns about potential conflicts of interest in the bonus allocation process, possibly influencing the awarding of bonuses to certain individuals or teams.

- Violation of Regulatory Guidelines: The AFM may believe the scheme violates existing Dutch regulations on executive compensation, fair remuneration practices, or risk management.

These concerns highlight potential issues with regulatory compliance, ethical standards, and risk management within ABN Amro. Keywords: regulatory compliance, ethical concerns, financial misconduct, risk management, corporate governance.

Potential Actions by the Dutch Regulator (AFM)

The AFM possesses a range of powers to address its concerns about ABN Amro's bonus scheme. Potential actions include:

- Financial Penalties: Significant fines could be levied against ABN Amro for breaches of regulatory guidelines.

- Reprimands or Warnings: The AFM could issue formal reprimands or warnings to the bank, highlighting the seriousness of the shortcomings identified.

- Demand for Changes to the Bonus Scheme: The regulator might demand significant alterations to the bonus scheme, improving transparency, fairness, and alignment with regulatory requirements.

- Further Investigations: The initial investigation could lead to more extensive probes into various aspects of the bank's operations.

- Legal Action: In extreme cases, the AFM might initiate legal proceedings against the bank or individual executives.

These potential actions demonstrate the seriousness of the AFM's investigation and its commitment to enforcing regulatory compliance within the Dutch financial sector. Keywords: AFM investigation, regulatory enforcement, sanctions, fines, legal proceedings, compliance measures.

Impact on ABN Amro and its Employees

The AFM's investigation and potential actions carry substantial ramifications for ABN Amro and its employees:

- Reputational Damage: The controversy surrounding the bonus scheme could severely damage ABN Amro's reputation, potentially impacting its ability to attract and retain clients and talent.

- Financial Losses: Fines and legal costs associated with the investigation and any subsequent actions could lead to significant financial losses for the bank.

- Clawback Provisions: Employees who received bonuses might face clawback provisions, requiring them to return part or all of their bonus payments.

- Employee Morale: The uncertainty surrounding the investigation and potential actions could negatively affect employee morale and productivity.

The public perception of ABN Amro will be significantly impacted by the outcome of this investigation. Keywords: reputational risk, financial losses, clawback provisions, employee morale, public perception.

Conclusion: ABN Amro Bonus Scheme Under Scrutiny: Looking Ahead

The AFM's investigation into ABN Amro's bonus scheme highlights crucial issues surrounding transparency, fairness, and regulatory compliance in the financial sector. The potential for substantial financial penalties, reputational damage, and employee repercussions underscores the gravity of the situation. The outcome will have significant implications not only for ABN Amro but also for corporate governance and bonus schemes across the Dutch banking industry. Stay informed about developments in the ABN Amro bonus scandal, the AFM's action on ABN Amro, and the continuing scrutiny of ABN Amro compensation to understand the full ramifications of this unfolding situation.

Featured Posts

-

Tikkie En Meer Een Overzicht Van Essentiele Nederlandse Betaalmethoden

May 21, 2025

Tikkie En Meer Een Overzicht Van Essentiele Nederlandse Betaalmethoden

May 21, 2025 -

Court Upholds Sentence Against Lucy Connolly For Racial Hatred Post

May 21, 2025

Court Upholds Sentence Against Lucy Connolly For Racial Hatred Post

May 21, 2025 -

Parcourir La Loire A Velo 5 Itineraires A Decouvrir

May 21, 2025

Parcourir La Loire A Velo 5 Itineraires A Decouvrir

May 21, 2025 -

Kritichno Vazhlivi Telekanali Ukrayini Rishennya Minkulturi Schodo 1 1 Inter Stb Ta Inshikh

May 21, 2025

Kritichno Vazhlivi Telekanali Ukrayini Rishennya Minkulturi Schodo 1 1 Inter Stb Ta Inshikh

May 21, 2025 -

Dexter Ist Zurueck Lithgow Und Smits In Resurrection

May 21, 2025

Dexter Ist Zurueck Lithgow Und Smits In Resurrection

May 21, 2025

Latest Posts

-

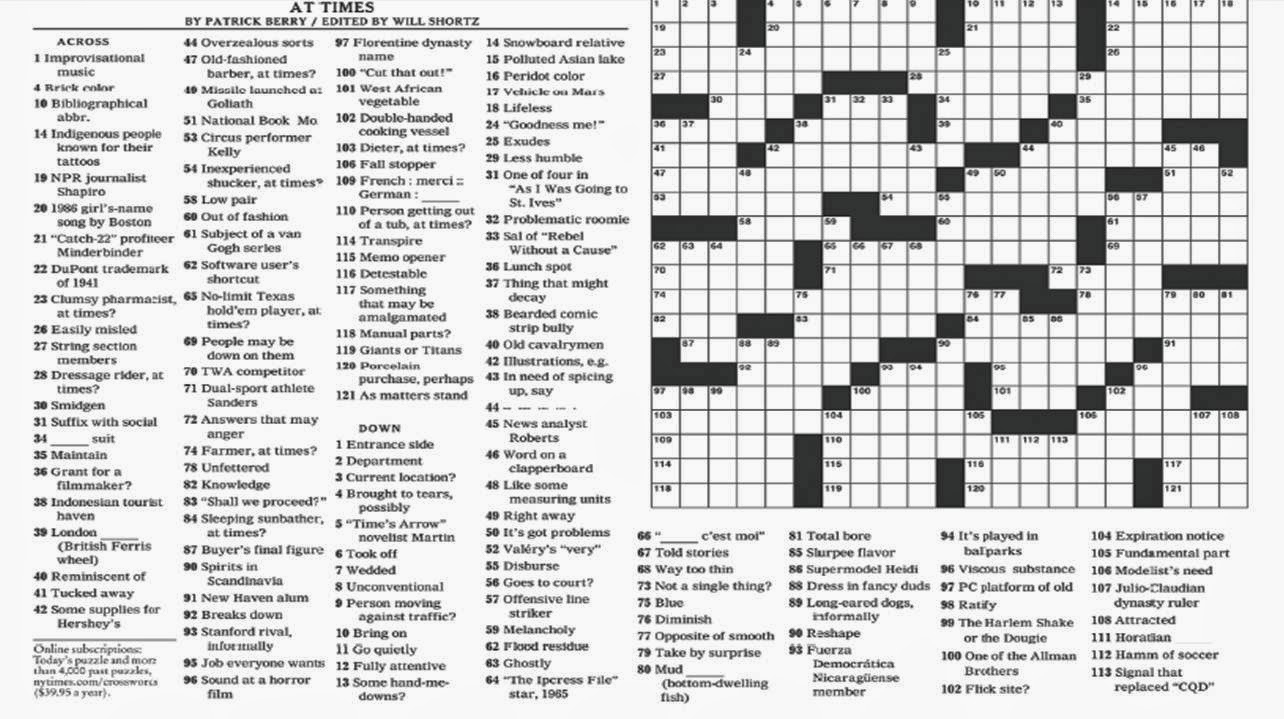

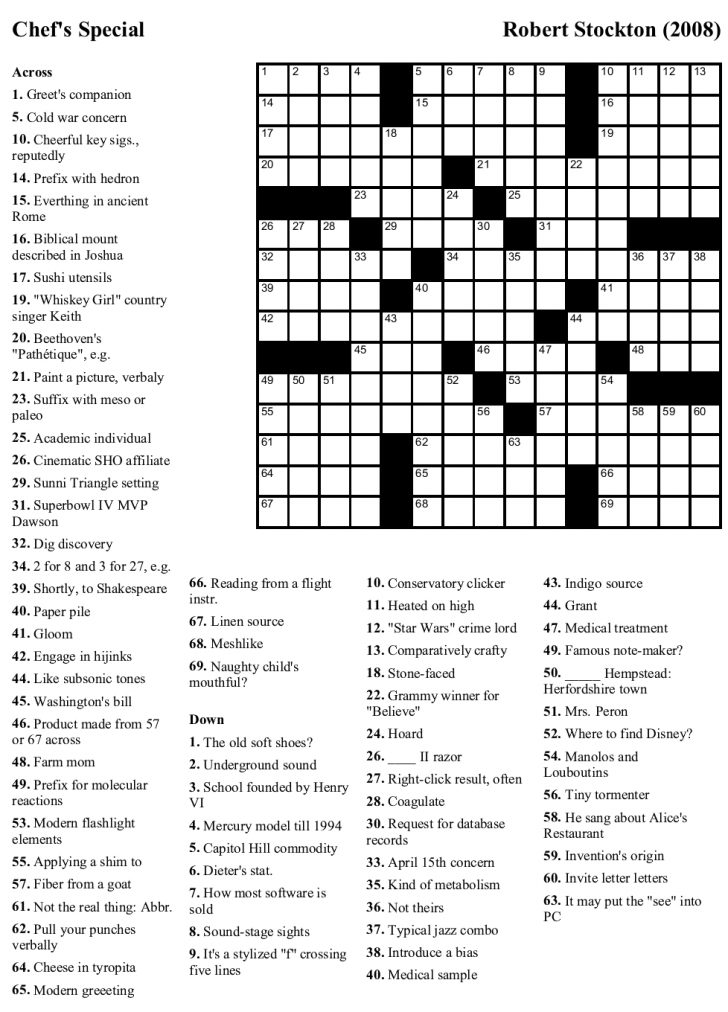

Nyt Mini Crossword Clues April 26 2025

May 21, 2025

Nyt Mini Crossword Clues April 26 2025

May 21, 2025 -

Aryna Sabalenkas Winning Start At The Madrid Open

May 21, 2025

Aryna Sabalenkas Winning Start At The Madrid Open

May 21, 2025 -

Ginger Zee Responds To Aging Criticism

May 21, 2025

Ginger Zee Responds To Aging Criticism

May 21, 2025 -

April 26 2025 Nyt Mini Crossword Puzzle Hints

May 21, 2025

April 26 2025 Nyt Mini Crossword Puzzle Hints

May 21, 2025 -

Nyt Mini Crossword April 26 2025 Hints And Solutions

May 21, 2025

Nyt Mini Crossword April 26 2025 Hints And Solutions

May 21, 2025