ABN AMRO: AEX-Prestaties Na Positieve Kwartaalcijfers

Table of Contents

Analyse van de Positieve Kwartaalcijfers

ABN AMRO's latest quarterly financial report showcased robust performance across several key metrics. The positive results significantly boosted investor confidence and contributed directly to the positive movement in the aandelenkoers.

-

Significant Net Profit Increase: The bank reported a substantial increase in net profit compared to the same period last year, exceeding analyst expectations. This demonstrates improved profitability and efficient cost management. Specific figures (e.g., percentage increase) should be included here if available.

-

Robust Revenue Growth: Revenue growth was driven by strong performance across various business segments, including (mention specific segments like corporate banking, retail banking, etc.). This highlights the bank's diversified revenue streams and resilience in a dynamic market. Again, insert specific data points.

-

Successful Cost-Cutting Measures: The bank implemented effective cost-cutting measures, contributing to improved margins and profitability. Details on these measures (e.g., streamlining operations, technological investments) would add context.

-

Improved Loan Performance: The quality of ABN AMRO's loan portfolio improved, indicating a reduction in non-performing loans. This is a crucial indicator of financial health and reduced risk for the bank. Include relevant data on loan default rates etc.

-

Visual Representation: A chart visually depicting the key metrics (net profit, revenue growth, cost reduction, etc.) would significantly enhance understanding and engagement. Keywords: winstgevendheid, omzetgroei, kostenbesparingen, kredietverlening, kwartaalrapportage

Impact op de AEX-Index en Aandelenkoers

The positive kwartaalcijfers immediately impacted ABN AMRO's share price, resulting in a noticeable increase. This positive beursreactie reflects investor confidence in the bank's future prospects.

-

Share Price Surge: The aandelenkoers experienced a significant upward trend following the announcement, outperforming the broader AEX index. Include specific percentage changes and data points.

-

Increased Trading Volume: The release of the results led to a surge in trading volume, indicating heightened investor interest and activity surrounding ABN AMRO shares.

-

Positive Investor Sentiment: The market reacted positively, reflecting improved investor sentiment towards the bank. This can be supported by citing news articles or analyst reports.

-

Comparative Performance: A comparison of ABN AMRO's performance against other banks within the AEX index will provide valuable context and show how the bank's performance stacked up against its peers. Keywords: aandelenkoers, AEX-index, handelsvolume, beursreactie, beleggersentiment, koersontwikkeling

Factoren die de Prestaties Beïnvloeden

Several factors, both internal and external, contributed to ABN AMRO's strong performance.

-

Macroeconomic Factors: Favorable macroeconomic conditions, such as (mention specific factors relevant to ABN AMRO's performance, e.g., low interest rates, economic growth, stable inflation), played a role in supporting the bank's results.

-

Strategic Initiatives: ABN AMRO's strategic initiatives, such as (mention specific initiatives like digital transformation, expansion into new markets, or specific product launches), positively impacted its performance.

-

Regulatory Changes: The impact of recent regulatory changes on the bank's operations and profitability should be considered.

-

Internal Efficiency: Internal improvements in efficiency and risk management likely contributed to the overall positive results. Keywords: macro-economische factoren, rentewijzigingen, inflatie, economische groei, strategische initiatieven, regelgeving

Toekomstige Verwachtingen en Outlook voor ABN AMRO

The positive kwartaalcijfers provide a solid foundation for a positive outlook for ABN AMRO. However, several factors need consideration.

-

Maintaining Momentum: The bank will need to maintain its positive momentum and continue delivering strong results in the coming quarters.

-

Potential Risks: Potential risks, such as (mention potential risks like economic downturns, increased competition, or changes in regulatory environment), need to be carefully managed.

-

Opportunities: Opportunities exist for ABN AMRO to further capitalize on its strengths and expand into new markets or product areas.

-

Analyst Forecasts: Include relevant forecasts from financial analysts to provide an external perspective on the bank's future prospects. Keywords: toekomstverwachting, risico's, kansen, analisten, voorspellingen, outlook

ABN AMRO's AEX Prestaties – Een Samenvatting en Conclusie

ABN AMRO's strong quarterly results have significantly boosted its AEX performance, driven by increased net profit, revenue growth, improved loan performance, and effective cost-cutting measures. While macroeconomic factors played a role, the bank's strategic initiatives and internal efficiency were key contributors. The outlook remains positive, although potential risks need to be carefully managed. Blijf op de hoogte van de laatste ontwikkelingen rondom ABN AMRO's AEX-prestaties door onze website regelmatig te bezoeken en let op toekomstige aankondigingen over ABN AMRO’s kwartaalcijfers en aandelenkoers.

Featured Posts

-

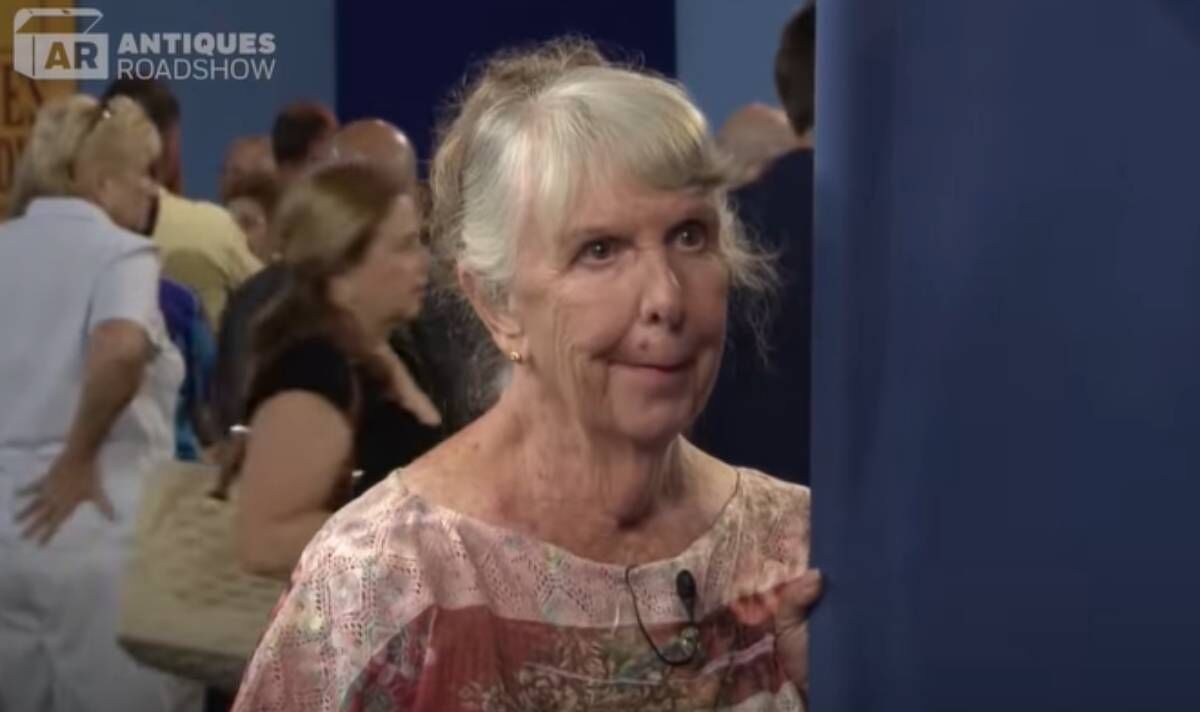

Antiques Roadshow Appearance Leads To Us Couples Arrest In The Uk

May 21, 2025

Antiques Roadshow Appearance Leads To Us Couples Arrest In The Uk

May 21, 2025 -

Peppa Pigs Mummys Baby A Gender Reveal Surprise

May 21, 2025

Peppa Pigs Mummys Baby A Gender Reveal Surprise

May 21, 2025 -

Dexter Resurrection Lithgow And Smits To Reprise Iconic Roles

May 21, 2025

Dexter Resurrection Lithgow And Smits To Reprise Iconic Roles

May 21, 2025 -

Guilty Plea Lab Owner Faked Covid 19 Test Results During Pandemic

May 21, 2025

Guilty Plea Lab Owner Faked Covid 19 Test Results During Pandemic

May 21, 2025 -

Understanding The David Walliams Britains Got Talent Situation

May 21, 2025

Understanding The David Walliams Britains Got Talent Situation

May 21, 2025

Latest Posts

-

Impact Of Abc News Layoffs On Popular Show

May 21, 2025

Impact Of Abc News Layoffs On Popular Show

May 21, 2025 -

Four Star Admiral Convicted Corruption Scandal Rocks Us Navy

May 21, 2025

Four Star Admiral Convicted Corruption Scandal Rocks Us Navy

May 21, 2025 -

The Fall Of An Admiral A Navy Bribery Case Shakes Public Trust

May 21, 2025

The Fall Of An Admiral A Navy Bribery Case Shakes Public Trust

May 21, 2025 -

Mass Layoffs At Abc News What Happens To The Show

May 21, 2025

Mass Layoffs At Abc News What Happens To The Show

May 21, 2025 -

Retired Four Star Admirals Corruption Conviction A Detailed Look

May 21, 2025

Retired Four Star Admirals Corruption Conviction A Detailed Look

May 21, 2025