A Simple Path To Profitable Dividends

Table of Contents

What are Profitable Dividends? Profitable dividends represent the portion of a company's earnings paid out to its shareholders. They are a key component of passive income generation and represent a tangible return on your investment. A high dividend yield doesn't automatically mean profitable dividends; consistent dividend growth and the financial health of the underlying company are equally crucial.

Understanding Dividend Investing Basics

What are Dividends?

- Definition: Dividends are payments made by a company to its shareholders, typically from its profits. They are a form of return on investment, rewarding shareholders for their ownership.

- Sources: Dividend income primarily comes from stocks, but other assets, such as Real Estate Investment Trusts (REITs), can also provide dividend payouts.

- Tax Implications: Dividends are taxed as income, but the tax rate can vary depending on whether they are qualified (generally taxed at a lower rate) or unqualified dividends.

Example: Imagine you own 100 shares of Company X, which declares a dividend of $1 per share. You'll receive $100 (100 shares x $1/share) in dividend income.

Identifying Dividend-Paying Stocks

Choosing the right dividend-paying stocks is critical for generating profitable dividends. Key factors to consider include:

- Dividend Yield: This represents the annual dividend per share divided by the stock's price, expressed as a percentage. A higher yield may seem appealing, but it's crucial to consider other factors.

- Payout Ratio: This indicates the percentage of a company's earnings paid out as dividends. A sustainable payout ratio is generally below 70%. A very high payout ratio might suggest the dividend is unsustainable.

- Dividend Growth History: Look for companies with a history of consistently increasing their dividend payments, demonstrating their commitment to rewarding shareholders.

- Company Financial Health: Analyze key financial metrics such as the Debt-to-Equity ratio to assess the company's stability and ability to maintain its dividend payments.

Resources: You can use websites like , , and to screen for dividend stocks and access financial data.

Assessing Risk and Diversification

Diversification is paramount to mitigate risk in dividend investing. Don't put all your eggs in one basket!

- Diversification: Spread your investments across various sectors and companies to reduce the impact of any single company's underperformance. Consider investing in different industries (e.g., technology, healthcare, consumer goods) to further diversify.

- Risk Tolerance: Assess your own risk tolerance. While high-yield stocks might be tempting, they often carry higher risk. A balanced approach, combining lower-risk and higher-risk investments, often works best.

- Avoiding High-Risk, High-Yield Stocks: Be cautious of stocks with exceptionally high dividend yields, as this could indicate financial instability. Thorough research is crucial before investing in such stocks.

Example: If one company in your portfolio underperforms, the impact on your overall returns will be lessened if your portfolio is diversified across multiple companies and sectors.

Building Your Dividend Portfolio

Starting Small and Growing Steadily

Begin with a small investment that you're comfortable with, and gradually increase your contributions over time.

- Dollar-Cost Averaging: Invest a fixed amount at regular intervals (e.g., monthly), regardless of the stock price. This strategy mitigates the risk of investing a lump sum at a market high.

- Reinvesting Dividends: Reinvest your dividend payments to buy more shares, accelerating your portfolio's growth through compounding.

- Gradual Increase: As your income increases, gradually increase your investment contributions.

Tip: Even starting with a small, consistent investment is better than delaying your start. The power of compounding over the long term is remarkable.

Choosing the Right Brokerage Account

Selecting the right brokerage account is crucial for efficient dividend investing.

- Brokerage Fees: Compare fees charged by different brokerages. Some offer commission-free trades, while others charge per trade.

- Commission Structures: Understand the commission structure for buying and selling stocks.

- Research Tools: Consider the availability of research tools and resources offered by the brokerage.

- Ease of Use: Choose a platform that's user-friendly and easy to navigate.

Recommendation: Consider reputable brokerages like Fidelity, Schwab, or Vanguard, which offer various investment options and tools for beginners.

Regular Monitoring and Rebalancing

Consistent monitoring and rebalancing are essential to maintain a healthy and profitable dividend portfolio.

- Tracking Performance: Regularly track your portfolio's performance, paying close attention to dividend payments and stock price fluctuations.

- Adjusting Allocations: Rebalance your portfolio periodically (e.g., annually or quarterly) to maintain your desired asset allocation.

- Selling Underperforming Stocks: Don't hesitate to sell underperforming stocks if their outlook remains bleak.

- Reinvesting Profits: Reinvest profits from selling stocks or from dividends to further grow your portfolio.

Frequency: Aim to monitor your portfolio and rebalance at least annually, or more frequently if significant market changes occur.

Maximizing Your Profitable Dividends

Tax-Efficient Strategies

Minimizing your tax burden is key to maximizing your returns.

- Tax-Advantaged Accounts: Consider utilizing tax-advantaged retirement accounts like IRAs and 401(k)s to reduce your tax liability.

- Qualified Dividends: Understand the tax implications of qualified versus unqualified dividends to optimize your tax strategy.

- Tax Implications: Keep a record of your dividend income for tax purposes.

Disclaimer: Consult with a qualified financial advisor or tax professional for personalized tax planning advice.

Long-Term Growth and Reinvestment

The power of compounding is your best friend in dividend investing.

- The Power of Compounding: Reinvesting dividends allows your earnings to generate even more earnings over time, leading to exponential growth.

- Benefits of Reinvestment: Reinvesting maximizes your returns and accelerates the growth of your portfolio.

Example: Investing $10,000 annually with an average 7% annual return and reinvesting all dividends will grow significantly faster than investing the same amount without reinvesting.

Staying Informed and Adapting

The market is dynamic, so staying informed is critical.

- Company Performance: Regularly review the performance of the companies in your portfolio.

- Market Changes: Adapt your investment strategy as market conditions change.

- Dividend Growth Potential: Look for companies with strong potential for future dividend growth.

Resources: Stay informed by following reputable financial news sources like the Wall Street Journal, Bloomberg, and Forbes.

Your Path to Profitable Dividends Awaits

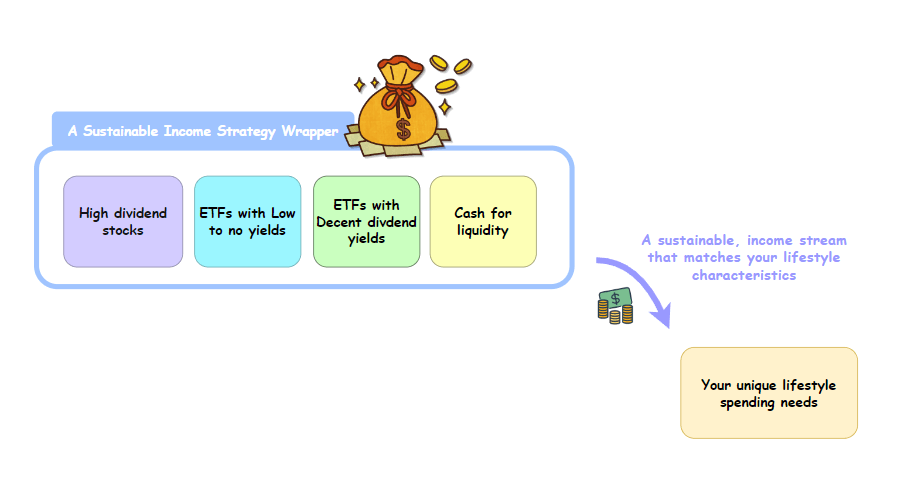

This article outlined three key steps for achieving profitable dividends: understanding the basics of dividend investing, building a well-diversified portfolio, and maximizing your returns through tax-efficient strategies and reinvestment. Remember the importance of diversification, long-term investing, and consistent monitoring. Start building your profitable dividend portfolio today! Use the tips in this article to begin your path to financial freedom and secure a steady stream of profitable dividends for years to come.

Featured Posts

-

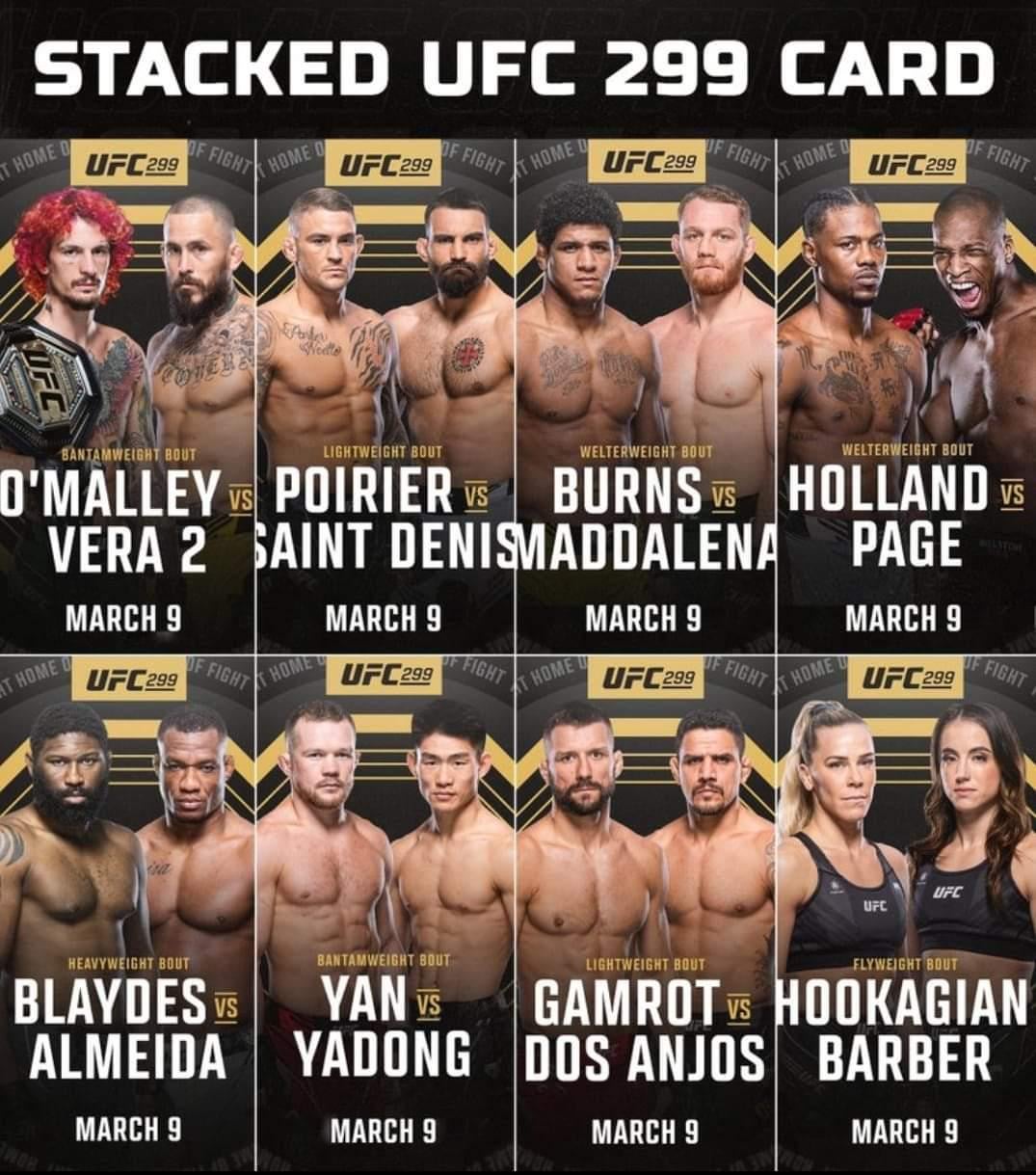

Ufc 315 Early Predictions And Key Matchup Analysis

May 11, 2025

Ufc 315 Early Predictions And Key Matchup Analysis

May 11, 2025 -

Kieran Stevenson And Ipswich Town Planning For The Next Campaign

May 11, 2025

Kieran Stevenson And Ipswich Town Planning For The Next Campaign

May 11, 2025 -

Thermal Club Warm Up Palou Fastest Dixon Close Behind

May 11, 2025

Thermal Club Warm Up Palou Fastest Dixon Close Behind

May 11, 2025 -

Lily Collins Stars In A New Calvin Klein Campaign

May 11, 2025

Lily Collins Stars In A New Calvin Klein Campaign

May 11, 2025 -

Nine Faces One Destiny The Vaticans Search For Pope Franciss Successor

May 11, 2025

Nine Faces One Destiny The Vaticans Search For Pope Franciss Successor

May 11, 2025