A-List Wife, Starving Husband: The Financial Realities Of Unequal Earning

Table of Contents

The Impact of Unequal Earning on Household Finances

Unequal earning creates a cascade of practical challenges for couples. The higher-earning spouse might feel burdened by disproportionate financial responsibility, while the lower-earning spouse may experience feelings of dependence and limited autonomy. This financial disparity significantly impacts budgeting, saving, and the ability to achieve shared financial goals.

-

Difficulty saving for long-term goals: Saving for retirement, children's education, or a down payment on a house becomes significantly more difficult when household income is concentrated in one person's hands. The lower income contributes less to savings, making it challenging to reach these milestones.

-

Increased financial stress and arguments related to money: Money is a leading cause of conflict in relationships. Unequal earning amplifies this stress, leading to increased arguments over spending, saving, and financial priorities. This constant tension can erode the relationship's foundation.

-

One partner feeling financially dependent or trapped: The lower-earning spouse might feel trapped in their current situation, unable to pursue personal goals or leave a potentially unhealthy relationship due to financial dependence. This can lead to feelings of resentment and powerlessness.

-

Inability to afford desired lifestyle: The couple's lifestyle might be dictated by the lower earner's income, leading to unmet expectations and compromises that cause frustration and resentment.

-

Challenges with shared financial responsibilities: Disagreements over budgeting, debt management, and financial decision-making are common when there's a significant income gap.

Emotional and Relational Consequences of Unequal Earning

The financial strain of unequal earning often translates into profound emotional and relational consequences. Resentment, power imbalances, and feelings of inadequacy can subtly (or not so subtly) undermine the relationship's health.

-

Resentment from the lower-earning spouse feeling undervalued: Feeling underappreciated and less significant can lead to deep-seated resentment. The lower-earning spouse might feel their contributions are overlooked, leading to emotional distance.

-

Power imbalance affecting decision-making in the relationship: The higher-earning spouse often holds more power in financial decisions, potentially leading to the lower-earning spouse feeling unheard or disregarded.

-

Lower self-esteem for the lower-earning partner: Financial dependence can negatively impact self-esteem and create feelings of insecurity and inadequacy.

-

Increased conflict and marital stress: Financial disagreements and the resulting emotional distress contribute to increased conflict and overall marital stress, potentially jeopardizing the relationship's long-term stability.

-

Feeling of lack of autonomy and control: The lower-earning spouse may feel a lack of control over their life due to their financial dependence.

Strategies for Addressing Financial Imbalance in Relationships

Addressing financial imbalance requires proactive steps and a commitment to open communication and shared responsibility. It's crucial to recognize that navigating this challenge requires teamwork and mutual understanding.

-

Open and honest communication about finances and expectations: Transparency is key. Discuss income, expenses, goals, and concerns openly and honestly.

-

Creating a joint budget and financial plan together: Collaboratively develop a budget that reflects both partners' income and expenses. This involves setting shared financial goals and outlining strategies to achieve them.

-

Utilizing budgeting apps and financial tracking tools: Technology can simplify the process of tracking expenses, managing budgets, and monitoring progress toward financial goals.

-

Seeking financial advice from a professional (financial advisor or therapist): A financial advisor can help create a sound financial plan, while a therapist can help address the emotional aspects of financial imbalance.

-

Exploring options for increasing the lower-earning spouse's income (education, career changes): Investing in education or exploring career changes can significantly improve the lower-earning spouse's financial situation.

-

Re-evaluating lifestyle expectations to align with income: Adjusting lifestyle expectations to match the household income can alleviate financial stress and foster a more realistic approach to financial management.

The Importance of Financial Transparency and Shared Decision-Making

Financial transparency and shared decision-making are paramount in addressing unequal earning in relationships. A lack of openness can exacerbate existing tensions and create a breeding ground for resentment and conflict.

-

Discussing financial goals together regularly: Regularly review financial goals, progress, and any adjustments needed to maintain alignment.

-

Sharing financial information openly and honestly: Transparency builds trust and helps both partners understand the financial landscape fully.

-

Making joint decisions about major purchases and investments: Shared decision-making ensures both partners feel heard and involved in significant financial choices.

-

Establishing clear roles and responsibilities for household finances: Assigning clear roles helps avoid confusion and ensures accountability in managing finances.

-

Creating a system for tracking expenses and income: A robust system enables effective monitoring and helps both partners understand where money is coming from and where it's going.

Conclusion

Unequal earning in marriage presents significant financial and emotional challenges. If left unaddressed, the resulting stress, resentment, and power imbalances can severely damage the relationship. Open communication, collaborative financial planning, and proactive steps to address the financial disparity are crucial for building a strong and secure future together. Don't let unequal earning destroy your relationship. Learn how to manage financial disparity effectively. Start planning your financial future together today and avoid becoming another "A-List Wife, Starving Husband" statistic. Seek professional help from a financial advisor or therapist if needed – it's an investment in your relationship's health and long-term stability. [Link to Financial Planning Website] [Link to Relationship Counseling Services]

Featured Posts

-

Gazze Ye Yardim Malzemesi Tasiyan Tirlarin Sinira Girisi Devam Ediyor

May 19, 2025

Gazze Ye Yardim Malzemesi Tasiyan Tirlarin Sinira Girisi Devam Ediyor

May 19, 2025 -

The Weeks Best Wines Il Palagios Selection At Four Seasons Firenze

May 19, 2025

The Weeks Best Wines Il Palagios Selection At Four Seasons Firenze

May 19, 2025 -

Chateau Diy Your Guide To Upcycling And Repurposing

May 19, 2025

Chateau Diy Your Guide To Upcycling And Repurposing

May 19, 2025 -

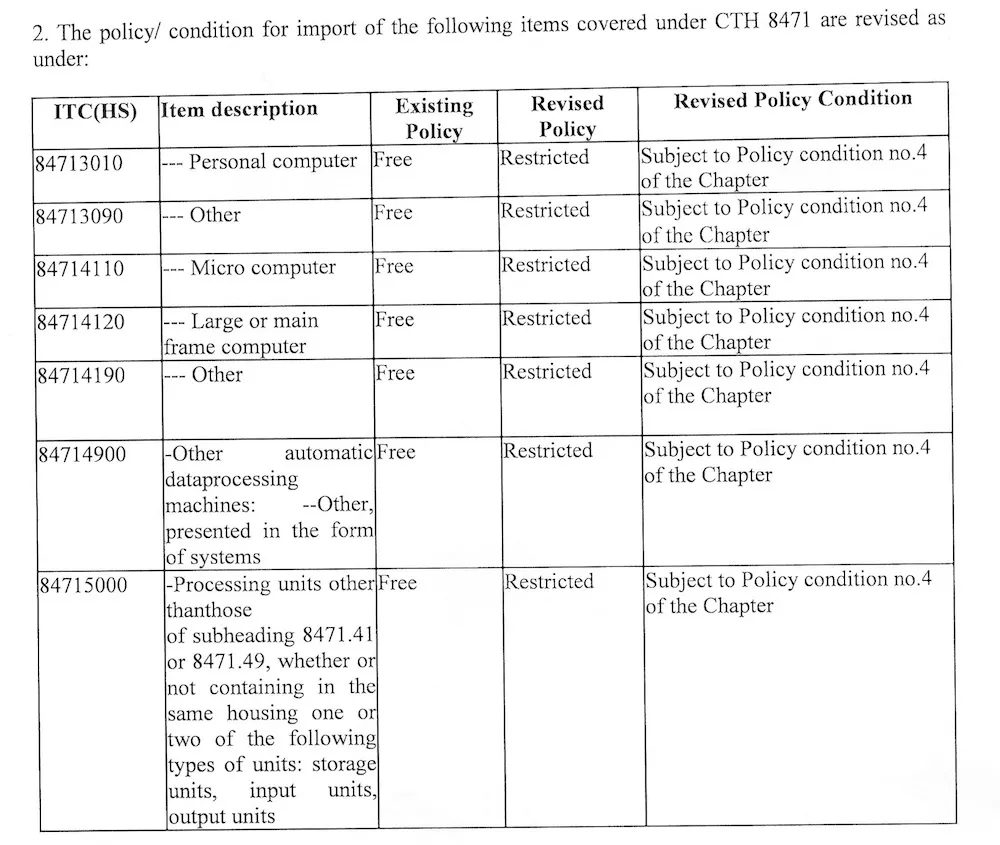

Bangladesh Facing Import Restrictions From India Analysis

May 19, 2025

Bangladesh Facing Import Restrictions From India Analysis

May 19, 2025 -

Analisis De Las Afirmaciones De Ana Paola Hall Sobre El Cne

May 19, 2025

Analisis De Las Afirmaciones De Ana Paola Hall Sobre El Cne

May 19, 2025