A$3.7 Billion Deal: Gold Fields' Purchase Of Gold Road Resources

Table of Contents

Deal Details and Financial Implications

Acquisition Price and Structure

Gold Fields agreed to acquire all outstanding shares of Gold Road Resources for a total consideration of A$3.7 billion. This translates to A$1.85 per share, representing a significant premium to Gold Road's pre-announcement share price. The transaction is expected to be funded through a combination of cash and Gold Fields' existing equity. The precise allocation of cash versus equity will be finalized closer to the completion date, subject to market conditions and regulatory approvals. No contingent payments are anticipated.

Synergies and Expected Returns

The acquisition is anticipated to yield substantial synergies for Gold Fields. The combination of Gold Road's high-quality assets with Gold Fields' operational expertise is projected to generate significant returns. Specifically:

- Improved operational efficiency: Gold Fields' established operational infrastructure and best practices will be implemented across Gold Road's assets, leading to cost savings and enhanced productivity.

- Access to new gold reserves and exploration opportunities: Gold Road Resources boasts a substantial portfolio of gold assets, including the Gruyere gold mine, which significantly expands Gold Fields' resource base and exploration potential. This provides opportunities for future growth and production increases.

- Enhanced market position and increased production capacity: The combined entity will be a dominant player in the Australian gold mining sector, enjoying greater market influence and significantly increased production capacity.

Regulatory Approvals and Timeline

The successful completion of the acquisition is contingent upon receiving the necessary regulatory approvals from relevant Australian and potentially international authorities. This includes obtaining clearance from the Australian Competition and Consumer Commission (ACCC), which scrutinizes mergers and acquisitions to prevent anti-competitive behavior. The anticipated timeline for the completion of the deal is within the next [Insert expected timeframe based on current news].

Impact on Gold Fields and Gold Road Resources

Gold Fields' Strategic Objectives

This acquisition is a strategic masterstroke for Gold Fields, aligning perfectly with its stated objectives of expanding its footprint in tier-one jurisdictions and bolstering its gold production capacity. Gold Road's assets provide a significant boost to Gold Fields' geographic diversification, reducing reliance on individual operating regions. The acquisition further supports Gold Fields' growth strategy, enhancing shareholder value in the long term.

Impact on Gold Road Resources Shareholders

The offer price of A$1.85 per share represents a substantial premium for Gold Road Resources shareholders, providing immediate and significant returns. This acquisition provides an attractive exit opportunity for shareholders, while potentially unlocking greater long-term value within the larger Gold Fields structure.

Future of Gold Road's Operations

Post-acquisition, Gold Road Resources' operations will be integrated into Gold Fields' existing framework. While some operational changes are expected, Gold Fields has indicated a commitment to retaining much of the existing talent and expertise within Gold Road Resources to ensure a smooth transition and maintain operational excellence.

Market Reaction and Industry Analysis

Stock Market Response

The announcement of the acquisition was met with largely positive reactions from the stock market. Both Gold Fields and Gold Road Resources experienced positive share price movements in the immediate aftermath of the news, reflecting investor confidence in the strategic rationale and anticipated synergies of the deal. [Insert specific data on share price movements if available].

Industry Experts' Opinions

Leading industry analysts have largely praised the acquisition, citing its potential to reshape the Australian gold mining landscape. [Insert quotes from relevant industry experts]. Many view the deal as a testament to the attractiveness of Australian gold assets and the continued strength of the global gold market.

Competitive Landscape

The acquisition significantly alters the competitive landscape of the Australian gold mining sector. The combined entity will emerge as a major player, potentially influencing pricing dynamics and strategic decisions within the industry. This could lead to increased consolidation in the sector, with other companies potentially exploring similar acquisition opportunities.

The A$3.7 Billion Gold Fields Acquisition: A New Chapter in Australian Gold Mining

The Gold Fields acquisition of Gold Road Resources marks a pivotal moment in the Australian gold mining industry. The A$3.7 billion deal signifies a substantial consolidation of assets, enhancing Gold Fields’ global position and offering significant growth potential. While regulatory approvals and integration challenges remain, the potential synergies and returns promise a lucrative future for Gold Fields. The deal's impact on the competitive landscape and the overall gold market will be closely watched in the coming months and years. Stay tuned for updates on this landmark A$3.7 billion gold mining deal and its impact on the global market.

Featured Posts

-

Black Women Athletes Leading The Fashion Game

May 06, 2025

Black Women Athletes Leading The Fashion Game

May 06, 2025 -

Black Female Athletes Impact On Fashion Trends

May 06, 2025

Black Female Athletes Impact On Fashion Trends

May 06, 2025 -

Why Did Patrick Schwarzenegger Delay His Wedding To Abby Champion

May 06, 2025

Why Did Patrick Schwarzenegger Delay His Wedding To Abby Champion

May 06, 2025 -

Hawaiis Kilauea A Unique Eruption Pattern Unseen In 40 Years

May 06, 2025

Hawaiis Kilauea A Unique Eruption Pattern Unseen In 40 Years

May 06, 2025 -

Kontrowersyjny Kontrakt Polska Eksportuje Trotyl

May 06, 2025

Kontrowersyjny Kontrakt Polska Eksportuje Trotyl

May 06, 2025

Latest Posts

-

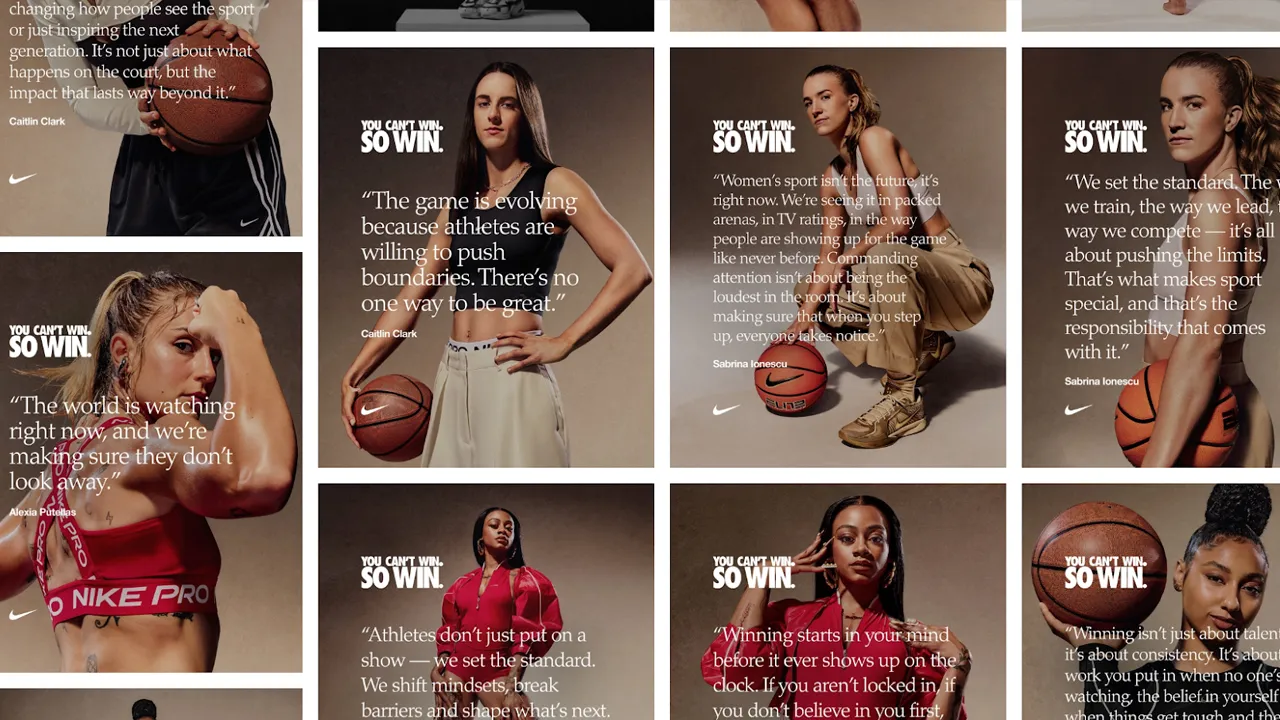

New Nike Shirts Celebrate Jordan Chiles And Sha Carri Richardsons Success

May 06, 2025

New Nike Shirts Celebrate Jordan Chiles And Sha Carri Richardsons Success

May 06, 2025 -

Doechiis Nike Super Bowl Ad A Historic Return After Three Decades

May 06, 2025

Doechiis Nike Super Bowl Ad A Historic Return After Three Decades

May 06, 2025 -

Nikes New Jordan Chiles And Sha Carri Richardson So Win Shirts A Closer Look

May 06, 2025

Nikes New Jordan Chiles And Sha Carri Richardson So Win Shirts A Closer Look

May 06, 2025 -

Bill Mahers Take Dissecting Nikes Super Bowl 2025 Ad And Its Patriarchy Messaging

May 06, 2025

Bill Mahers Take Dissecting Nikes Super Bowl 2025 Ad And Its Patriarchy Messaging

May 06, 2025 -

Nikes Super Bowl 2025 So Win Ad Faces Backlash Bill Mahers Strong Criticism

May 06, 2025

Nikes Super Bowl 2025 So Win Ad Faces Backlash Bill Mahers Strong Criticism

May 06, 2025