7-Year Prison Sentence For GPB Capital's David Gentile In Ponzi-Like Scheme

Table of Contents

The GPB Capital Ponzi-Like Scheme: Details of the Fraud

The GPB Capital Holdings LP investment fraud involved the solicitation of billions of dollars from investors through the sale of private placements in various alternative asset classes, primarily focusing on automotive dealerships and healthcare companies. The scheme operated under the guise of high-yield investment opportunities, but the reality was far different.

The Mechanics of the Fraud:

The GPB Capital Ponzi scheme employed several deceptive tactics:

- Misleading marketing materials and false promises of high returns: Investors were lured in with promises of exceptionally high returns, far exceeding typical market benchmarks. These claims were often unsubstantiated and misleading.

- Diversion of investor funds for personal use: Significant portions of investor funds were diverted for the personal enrichment of Gentile and other executives, rather than being invested as promised.

- Lack of transparency and inadequate financial reporting: GPB Capital consistently failed to provide investors with accurate and timely financial reporting, obscuring the true nature of their investments and the financial struggles of the underlying companies.

- Use of shell companies and complex financial structures to conceal the fraud: A complex web of shell companies and convoluted financial structures were used to mask the fraudulent activities and make it difficult to trace the flow of funds.

Victims of the Scheme:

The GPB Capital Ponzi scheme impacted a wide range of investors, resulting in significant financial losses and emotional distress. Thousands of investors, including retirees and high-net-worth individuals, lost substantial portions of their life savings. The exact total amount lost is still being determined, but it's estimated to be in the billions of dollars. The emotional toll on victims who lost their retirement funds or significant portions of their wealth is immeasurable.

David Gentile's Role in the GPB Capital Ponzi-Like Scheme and Conviction

David Gentile, as the former CEO of GPB Capital, played a central role in orchestrating and perpetuating the scheme. His actions directly contributed to the massive losses suffered by investors.

Gentile's Indictment and Charges:

Gentile faced a multitude of charges, including securities fraud, wire fraud, and conspiracy to commit securities fraud and wire fraud. These charges reflected the seriousness and breadth of his involvement in the fraudulent activities.

The Trial and Sentencing:

After a lengthy trial, Gentile was found guilty on multiple counts. The judge, in handing down the seven-year prison sentence, cited the significant financial harm inflicted upon investors and the deliberate nature of Gentile's fraudulent actions.

Potential Further Legal Ramifications:

While Gentile's sentencing marks a significant step, investigations into the GPB Capital Ponzi scheme are ongoing. Further legal actions against other individuals involved in the scheme are still possible. The Securities and Exchange Commission (SEC) continues to pursue civil remedies to recover funds for victims.

Lessons Learned and Investor Protections

The GPB Capital Ponzi-like scheme serves as a cautionary tale, highlighting the importance of diligent investor protection.

Due Diligence and Red Flags:

Before investing in any opportunity, thorough due diligence is paramount. Investors should be wary of the following red flags:

- Unrealistic rates of return: Promises of extraordinarily high returns with minimal risk are often indicative of fraud.

- High-pressure sales tactics: Aggressive sales techniques designed to pressure investors into making quick decisions should raise suspicion.

- Lack of transparency: Difficulty obtaining clear and accurate information about an investment should be a major red flag.

- Unlicensed or unregistered investment advisors: Always verify that your investment advisor is properly licensed and registered with relevant regulatory bodies.

Resources for Investors:

Investors can protect themselves by utilizing resources available from government agencies such as the Securities and Exchange Commission (SEC) website and the Financial Industry Regulatory Authority (FINRA) website . These websites offer valuable information on identifying and avoiding investment scams.

Conclusion

The GPB Capital Ponzi-like scheme and David Gentile's seven-year sentence underscore the devastating consequences of investment fraud. The scale of the losses and the manipulative tactics employed serve as a stark reminder of the importance of investor vigilance. The case highlights the critical need for thorough due diligence, skepticism towards unrealistic promises, and utilization of available investor protection resources. The GPB Capital Ponzi scheme should serve as a wake-up call, prompting investors to prioritize caution and informed decision-making to avoid becoming victims of similar schemes. Learn how to protect yourself from similar investment fraud by researching reputable financial advisors and resources available to investors. Don't become another victim of a GPB Capital-style scheme.

Featured Posts

-

La Fire Aftermath Increased Rent And Allegations Of Price Gouging

May 10, 2025

La Fire Aftermath Increased Rent And Allegations Of Price Gouging

May 10, 2025 -

Tech Billionaires 100 Day Pain Inauguration Donations And Billions Lost

May 10, 2025

Tech Billionaires 100 Day Pain Inauguration Donations And Billions Lost

May 10, 2025 -

Olly Murs Music Festival A Stunning Castle Setting Near Manchester

May 10, 2025

Olly Murs Music Festival A Stunning Castle Setting Near Manchester

May 10, 2025 -

Uk Visa Restrictions Report On Potential Nationality Limits

May 10, 2025

Uk Visa Restrictions Report On Potential Nationality Limits

May 10, 2025 -

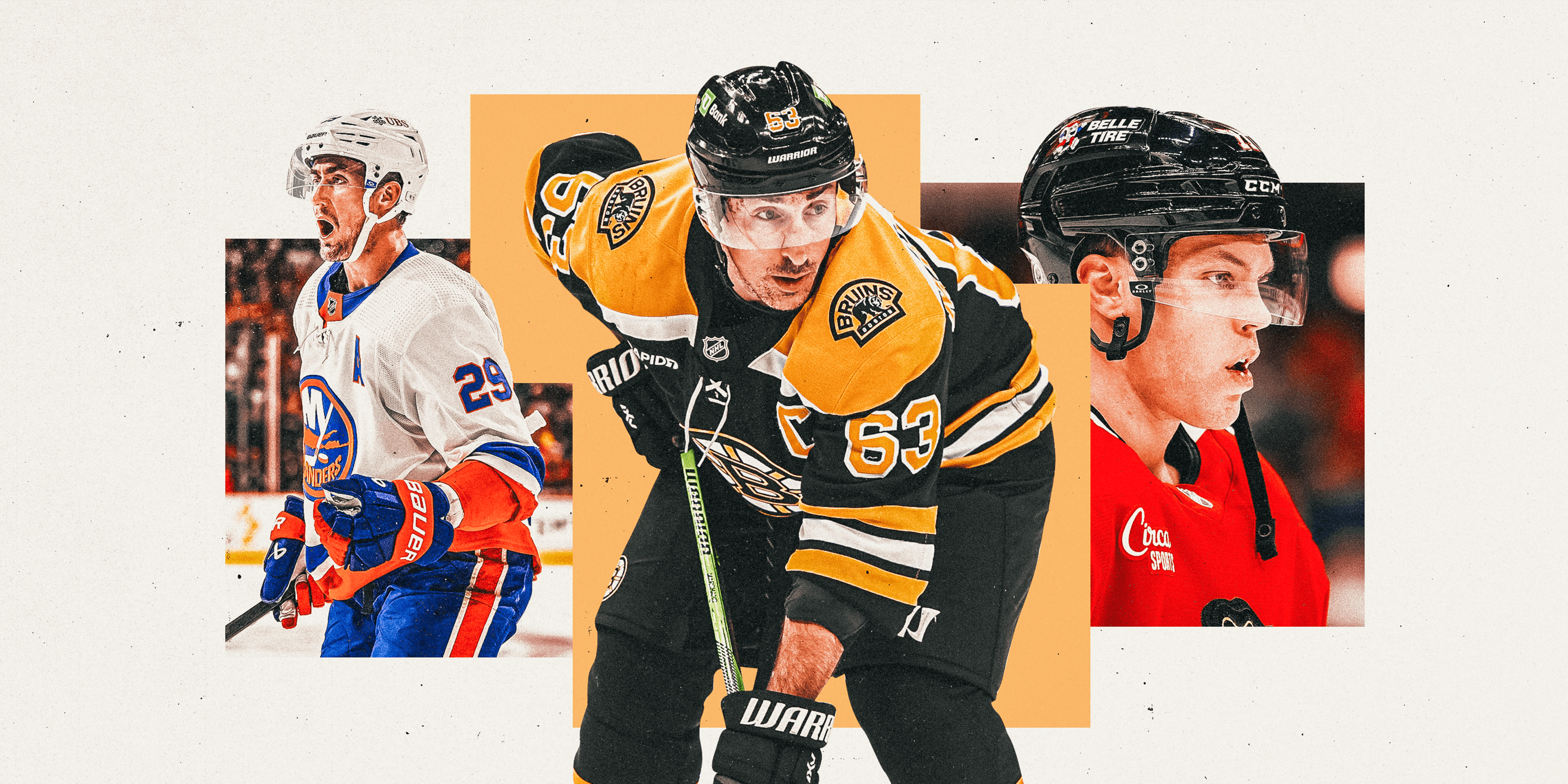

Predicting The 2025 Nhl Playoffs After The Trade Deadline

May 10, 2025

Predicting The 2025 Nhl Playoffs After The Trade Deadline

May 10, 2025