7% Stock Market Plunge In Amsterdam: Trade War Uncertainty Creates Volatility

Table of Contents

Understanding the 7% Drop in the Amsterdam Stock Exchange (AEX)

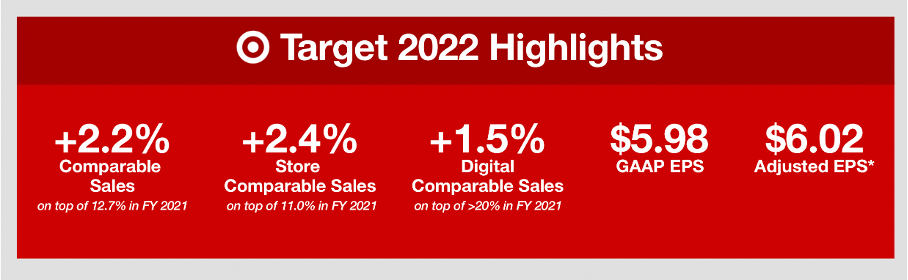

The Amsterdam Stock Exchange (Euronext Amsterdam), home to the AEX index, is a crucial part of the Dutch and European economy. The AEX, representing the 25 largest companies listed on Euronext Amsterdam, serves as a key barometer of the Dutch economy's health. The recent 7% plunge represents a significant event, impacting the Amsterdam stock market severely. This sharp decline occurred within a short timeframe – [Insert specific date and timeframe here, e.g., "between 10:00 AM and 12:00 PM on October 26th, 2024"].

[Insert chart or graph visually representing the drop. Clearly label axes and highlight the 7% drop.]

This drop disproportionately affected specific sectors. Export-oriented industries, heavily reliant on global trade, suffered the most significant losses. Technology companies, sensitive to global economic shifts, also experienced considerable declines.

- Magnitude of the drop compared to historical averages: The 7% drop is significantly larger than the average daily fluctuation observed in recent years, indicating an unusually volatile market event. The Amsterdam stock market plunge is unprecedented in recent times.

- Number of companies significantly impacted: [Insert number] companies experienced double-digit percentage losses, highlighting the widespread impact of the plunge.

- Investor sentiment immediately following the event: Investor sentiment was extremely negative, characterized by widespread fear and uncertainty. This is evident in the increased trading volume and sharp drops in individual stock prices.

Trade War Uncertainty: The Primary Catalyst

The current global trade war, characterized by escalating tariffs and protectionist measures, is the primary catalyst for the Amsterdam stock market plunge. The impact of this trade war on Amsterdam is considerable. European economies, including the Netherlands, are significantly vulnerable to global trade fluctuations. The Dutch economy relies heavily on exports, making it particularly susceptible to trade disruptions.

Specific trade policies, such as [Insert specific example of a recent trade policy or event that triggered the reaction, e.g., "the imposition of new tariffs on Dutch agricultural products by the US"], directly contributed to the market's negative reaction.

- Specific examples of trade disputes directly affecting Dutch businesses: [Provide concrete examples of Dutch companies impacted by specific trade disputes.]

- Analysis of how investor confidence was eroded by trade war anxieties: The ongoing uncertainty surrounding future trade policies has created significant anxiety amongst investors, leading to a sell-off and the Amsterdam stock market plunge.

- Mention expert opinions and analyses on the trade war's impact: [Quote relevant expert opinions and analyses on the trade war's impact on the Dutch economy and the Amsterdam stock market.]

Other Contributing Factors to Market Volatility

While trade war uncertainty was the primary driver, other factors contributed to the market's volatility. Brexit-related uncertainties and a slowing global economic growth created a climate of heightened risk aversion.

- Specific economic indicators showing weakness: [Cite specific economic indicators, such as slowing GDP growth or declining consumer confidence.]

- Political events affecting market confidence: [Mention any political events, both domestic and international, that may have negatively impacted market confidence.]

- Any unforeseen events that may have exacerbated the situation: [Mention any unexpected events that might have worsened the situation.] These factors, in conjunction with the trade war, amplified the negative impact on the Amsterdam stock market, leading to the dramatic plunge.

Consequences of the Amsterdam Stock Market Plunge

The Amsterdam stock market plunge has short-term and long-term consequences for Dutch businesses and investors. Reduced investor confidence can lead to decreased business investment and hiring freezes. The ripple effect on the broader European economy could be significant, given the Netherlands' role in the EU. The government's response will be crucial in mitigating the impact.

- Impact on employment and business investment: The decline in business confidence could lead to job losses and reduced capital investment.

- Changes in consumer spending: Uncertainty can lead to reduced consumer spending, further dampening economic growth.

- Government's economic response strategies: The Dutch government may implement fiscal or monetary policies to stabilize the economy and boost investor confidence. The government response to the Amsterdam stock market plunge is crucial.

Navigating Future Volatility in the Amsterdam Stock Market

Navigating future volatility requires a proactive approach to risk management. Investors should diversify their portfolios to reduce exposure to specific sectors or geographic regions. A long-term investment perspective is crucial, avoiding impulsive reactions to short-term market fluctuations.

- Recommended investment strategies for navigating volatility: Diversification, hedging strategies, and careful asset allocation are crucial.

- Importance of long-term investment perspectives: Short-term market fluctuations should not dictate long-term investment strategies.

- Resources for investors seeking further information: [Provide links to relevant financial news sources, investment advice websites, etc.]

Conclusion

The 7% Amsterdam stock market plunge serves as a stark reminder of the significant impact of trade war uncertainty on global markets. Understanding the contributing factors, consequences, and potential future implications is crucial for investors and businesses alike. By carefully analyzing the interplay of global trade dynamics and local economic conditions, investors can better navigate future volatility in the Amsterdam stock market and make informed decisions. Stay informed about the latest developments concerning the Amsterdam stock market plunge and global trade relations to protect your investments. Understanding the nuances of the Amsterdam stock market plunge is essential for navigating future challenges.

Featured Posts

-

Punished For Seeking Change Understanding The Repercussions

May 25, 2025

Punished For Seeking Change Understanding The Repercussions

May 25, 2025 -

Actors And Writers Strike What It Means For Hollywood And Beyond

May 25, 2025

Actors And Writers Strike What It Means For Hollywood And Beyond

May 25, 2025 -

Marylands Aubrey Wurst Stars In 11 1 Win Against Delaware Softball

May 25, 2025

Marylands Aubrey Wurst Stars In 11 1 Win Against Delaware Softball

May 25, 2025 -

Apple Price Target Lowered But Wedbush Stays Bullish Is It Right For You

May 25, 2025

Apple Price Target Lowered But Wedbush Stays Bullish Is It Right For You

May 25, 2025 -

High Speed Refueling Police Pursuit Ends With Text Messages At 90mph

May 25, 2025

High Speed Refueling Police Pursuit Ends With Text Messages At 90mph

May 25, 2025

Latest Posts

-

Canli Mac Izle Atletico Madrid Barcelona Muecadelesi Fanatik Gazetesi Nde

May 25, 2025

Canli Mac Izle Atletico Madrid Barcelona Muecadelesi Fanatik Gazetesi Nde

May 25, 2025 -

Atletico Madrid Barcelona Macini Canli Yayinla Izleyin Fanatik Gazetesi Nden Anlik Guencellemeler

May 25, 2025

Atletico Madrid Barcelona Macini Canli Yayinla Izleyin Fanatik Gazetesi Nden Anlik Guencellemeler

May 25, 2025 -

Atletico Madrid Barcelona Maci Canli Izle Fanatik Gazetesi Ile Macin Keyfini Cikarin

May 25, 2025

Atletico Madrid Barcelona Maci Canli Izle Fanatik Gazetesi Ile Macin Keyfini Cikarin

May 25, 2025 -

Zaferle Doenues Atletico Madrid 3 Maclik Hasreti Sonlandirdi

May 25, 2025

Zaferle Doenues Atletico Madrid 3 Maclik Hasreti Sonlandirdi

May 25, 2025 -

Atletico Madrid 3 Maclik Durgunluk Kirildi

May 25, 2025

Atletico Madrid 3 Maclik Durgunluk Kirildi

May 25, 2025