6,556 Bitcoin Purchase By Strategy: Investment Strategy And Market Analysis

Table of Contents

Analyzing the 6,556 Bitcoin Purchase: Understanding the Underlying Strategy

To comprehend the rationale behind a 6,556 Bitcoin purchase, we need to dissect the likely investment strategy. Several key factors would have influenced this decision, including risk tolerance, investment horizon, and the chosen acquisition method.

Risk Tolerance and Diversification

An investor committing to a 6,556 Bitcoin purchase demonstrates a high-risk tolerance. Such a significant investment in a single asset, even one as established as Bitcoin, exposes the investor to considerable volatility. To mitigate this risk, diversification would likely be a key component of their overall portfolio.

- Examples of Diversification: The investor might hold a diversified portfolio including other cryptocurrencies like Ethereum, Solana, or Cardano. They could also diversify into traditional assets such as stocks, bonds, and even real estate, using Bitcoin as a strategic part of their overall asset allocation.

- Bitcoin Portfolio Diversification: A well-structured Bitcoin portfolio isn't just about holding Bitcoin; it's about balancing Bitcoin's potential with other asset classes to reduce overall portfolio risk. Effective risk management in crypto investment necessitates diversification.

Long-Term vs. Short-Term Investment Horizon

The 6,556 Bitcoin purchase could reflect either a long-term or a short-term investment strategy, or potentially a combination of both.

- Pros of Long-Term Bitcoin Holding: Historically, Bitcoin has demonstrated significant long-term growth potential. A long-term strategy allows investors to ride out market fluctuations, potentially benefiting from substantial appreciation over time.

- Potential for Short-Term Gains: Short-term Bitcoin trading aims to capitalize on short-term price swings. While offering potential for quick profits, this approach carries substantially higher risk. A 6,556 Bitcoin purchase could incorporate both strategies, utilizing a portion for short-term trades while holding the majority for long-term growth.

- Bitcoin Price Prediction: Accurately predicting Bitcoin's price remains challenging. Long-term Bitcoin investment strategies often focus on fundamental factors rather than trying to time the market.

Dollar-Cost Averaging (DCA) vs. Lump-Sum Investment

The method used to acquire 6,556 Bitcoin is crucial. Was it a lump-sum purchase, or a gradual accumulation through dollar-cost averaging (DCA)?

- Dollar-Cost Averaging (DCA) Bitcoin: DCA involves investing a fixed amount of money at regular intervals, regardless of price. This strategy reduces the risk associated with investing a large sum at a single, potentially high price point.

- Lump-Sum Bitcoin Investment: A lump-sum investment is a single, large purchase made at a specific point in time. While potentially maximizing gains if the market rises sharply, it carries greater risk if the market declines.

- Bitcoin Market Volatility: The inherent volatility of the Bitcoin market makes choosing between DCA and a lump-sum approach a significant strategic decision. DCA mitigates volatility risk, while a lump-sum approach might be favored by those anticipating significant price increases.

Bitcoin Market Analysis: Factors Influencing the Decision

The decision to purchase 6,556 Bitcoin was undoubtedly informed by a thorough market analysis considering various macroeconomic, technological, and regulatory factors.

Macroeconomic Factors

Broader economic conditions significantly influence Bitcoin's price.

- Bitcoin and Inflation: Bitcoin is often viewed as a hedge against inflation. Periods of high inflation might drive investors towards Bitcoin as a store of value.

- Bitcoin and Interest Rates: Interest rate hikes by central banks can impact the attractiveness of riskier assets like Bitcoin.

- Geopolitical Risks and Bitcoin: Geopolitical instability and uncertainty can boost Bitcoin's appeal as a decentralized, less regulated asset.

Technological Advancements

Bitcoin's underlying technology and network upgrades play a key role in its long-term prospects.

- Bitcoin Technology: Ongoing development and improvements to Bitcoin's underlying technology continuously enhance its efficiency and security.

- Bitcoin Network Upgrades: Upgrades like the Lightning Network aim to improve scalability and transaction speed, potentially driving wider adoption and price appreciation.

Regulatory Landscape

Government regulations significantly impact the cryptocurrency market.

- Bitcoin Regulation: Regulatory clarity and acceptance can positively influence Bitcoin's price and adoption. Conversely, strict regulations or bans can negatively impact its market.

- Cryptocurrency Regulations: The evolving regulatory landscape for cryptocurrencies is a crucial factor influencing investment decisions.

Conclusion

The 6,556 Bitcoin purchase underscores the significant potential but also the inherent risks of Bitcoin investment. A successful strategy involves a deep understanding of risk tolerance, a clear investment horizon, a well-defined acquisition method (DCA or lump sum), and a comprehensive market analysis encompassing macroeconomic factors, technological advancements, and the regulatory environment. Develop your own 6,556 Bitcoin-level strategy by carefully researching market trends, assessing your risk tolerance, and diversifying your portfolio. Master your Bitcoin investment strategy and start your informed Bitcoin journey today. (Link to relevant resources, if available)

Featured Posts

-

Russian Threat Drives Global Military Spending Increase

Apr 30, 2025

Russian Threat Drives Global Military Spending Increase

Apr 30, 2025 -

Section 230 And Banned Chemicals A Landmark E Bay Case Ruling

Apr 30, 2025

Section 230 And Banned Chemicals A Landmark E Bay Case Ruling

Apr 30, 2025 -

Our Yorkshire Farm What Reuben Owen Disliked Most About The Show

Apr 30, 2025

Our Yorkshire Farm What Reuben Owen Disliked Most About The Show

Apr 30, 2025 -

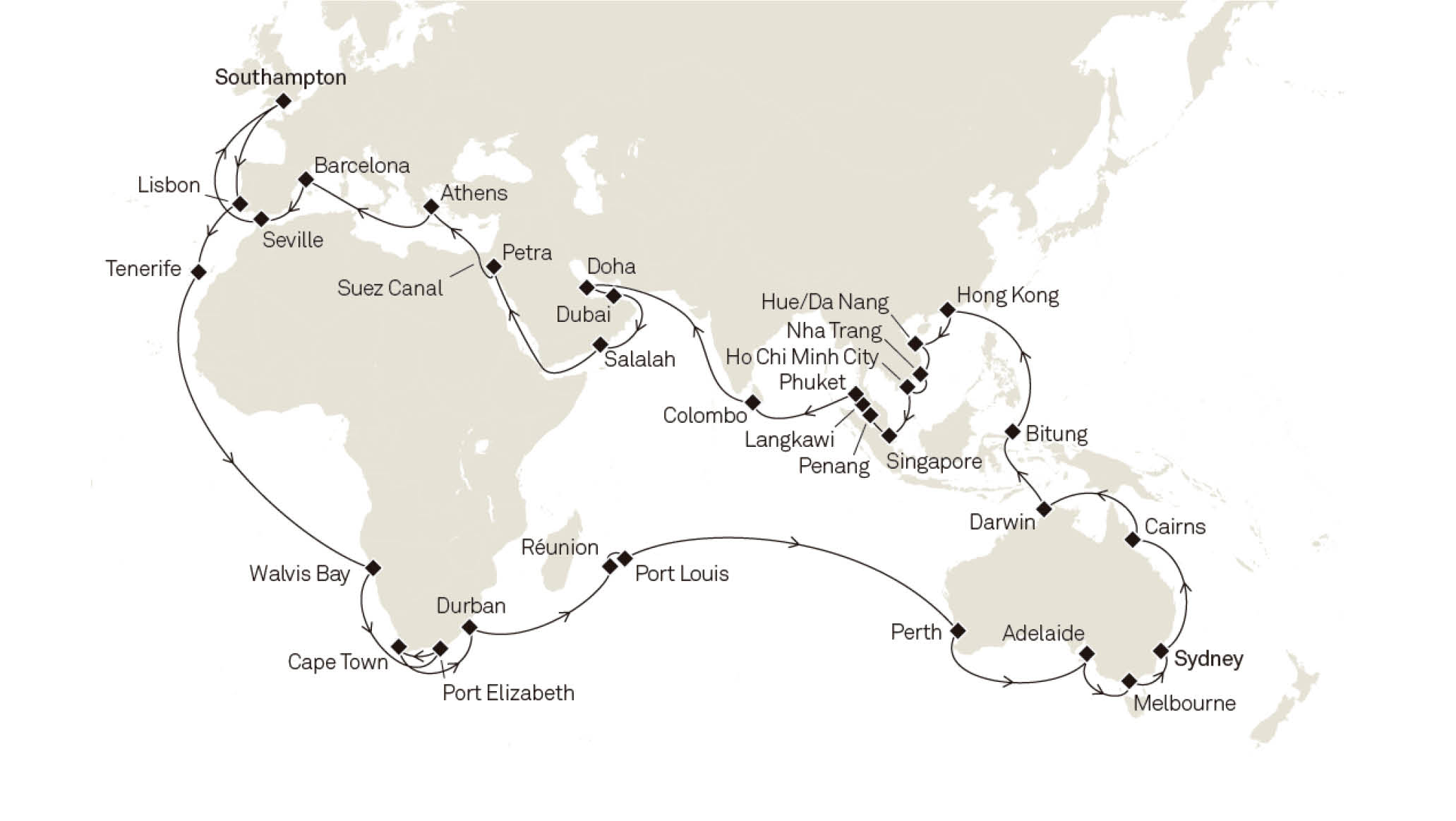

Norovirus Strikes Queen Mary 2 Cruise Ship 200 Passengers And Crew Affected

Apr 30, 2025

Norovirus Strikes Queen Mary 2 Cruise Ship 200 Passengers And Crew Affected

Apr 30, 2025 -

Eurovision Stage Restrictions On Pride Flags

Apr 30, 2025

Eurovision Stage Restrictions On Pride Flags

Apr 30, 2025